Biblical Tax Collector

In the biblical narrative, the role of tax collectors is an intriguing one, offering a unique perspective on societal dynamics during the time of Jesus. These individuals played a pivotal part in the economic and political landscape of the ancient world, yet their representation in the Bible is often complex and multifaceted.

The Biblical Context of Tax Collectors

Tax collectors, or publicans as they were known, were individuals responsible for collecting taxes on behalf of the Roman Empire, which occupied much of the Holy Land during the time of Jesus. They were often vilified in the biblical accounts, yet their presence provides a fascinating insight into the social and economic conditions of the time.

The Bible frequently portrays tax collectors as greedy, corrupt, and disreputable figures, who exploited their position to extort excessive taxes from their fellow citizens. This negative portrayal, however, should be understood within the broader context of the occupation's inherent challenges and the political tensions of the era.

The Role of Tax Collectors in the Roman Empire

In the Roman Empire, tax collection was a crucial source of revenue, funding military campaigns, infrastructure projects, and administrative costs. The system relied on a network of individuals, often locals, who were granted the right to collect taxes within a specific region. These tax collectors, or publicani, were essentially entrepreneurs, bidding for the right to collect taxes and keeping any surplus as profit.

The system was not without its flaws. Tax collectors often faced the challenge of recouping their investment, leading to instances of extortion and corruption. Additionally, the Roman Empire's heavy tax burden and the absence of a formal currency in some regions created further complexities. Despite these challenges, tax collectors played a vital role in funding the empire's expansion and maintenance.

Biblical Accounts of Tax Collectors

The Bible provides several notable instances of tax collectors, each offering a unique glimpse into their role and societal perception.

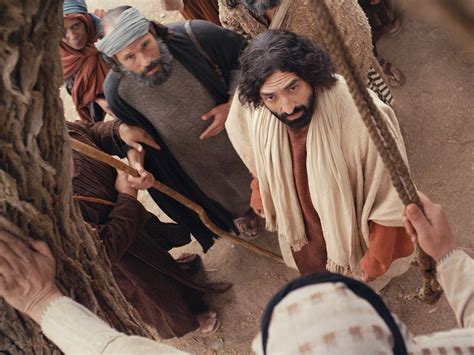

- Matthew the Tax Collector: One of the most famous biblical tax collectors is Matthew, also known as Levi. Matthew, a tax collector in Capernaum, is called by Jesus to become one of his disciples (Matthew 9:9). This account is significant as it shows Jesus' willingness to associate with individuals considered social outcasts, challenging the societal norms of the time.

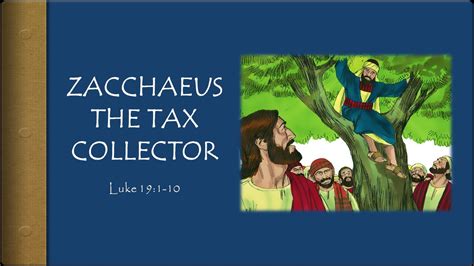

- Zacchaeus the Tax Collector: Another notable tax collector is Zacchaeus, who climbed a sycamore tree to catch a glimpse of Jesus as he passed through Jericho (Luke 19:1-10). This story is often cited as an example of Jesus' compassion and his ability to bring about transformation in individuals, regardless of their past actions or societal status.

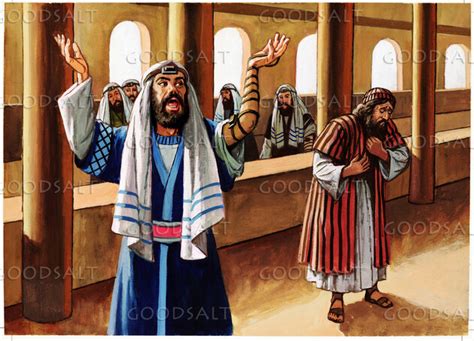

- The Parable of the Pharisee and the Tax Collector: In this parable, Jesus contrasts the prayer of a self-righteous Pharisee with that of a humble tax collector, highlighting the importance of humility and repentance (Luke 18:9-14). This story underscores the theme of Jesus' ministry, which was often directed towards those society considered "sinners."

| Biblical Tax Collector | Notable Appearance |

|---|---|

| Matthew (Levi) | Called by Jesus to become a disciple (Matthew 9:9) |

| Zacchaeus | Climbed a tree to see Jesus in Jericho (Luke 19:1-10) |

The Impact and Legacy of Biblical Tax Collectors

The portrayal of tax collectors in the Bible has had a lasting impact on the perception of taxation and societal justice. It highlights the challenges of power, corruption, and social inequality, themes that continue to resonate in modern society.

Taxation and Social Justice

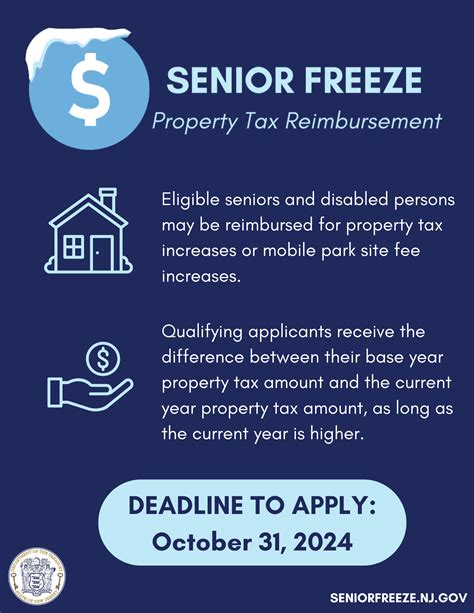

The biblical accounts of tax collectors often emphasize the unfairness of taxation systems and the exploitation of the poor. This narrative has influenced modern discussions on tax justice and has been a driving force behind movements advocating for more equitable tax systems.

Redemption and Transformation

Despite their negative portrayal, the stories of Matthew and Zacchaeus demonstrate the potential for redemption and transformation. These accounts offer a message of hope, suggesting that even individuals considered social outcasts can find a place in the kingdom of God and undergo profound personal changes.

Challenging Societal Norms

Jesus’ association with tax collectors challenged the societal norms and prejudices of his time. This aspect of his ministry underscores the importance of inclusivity and the value of every individual, regardless of their background or occupation. It is a powerful reminder of the potential for positive change and the power of love and acceptance.

What was the primary role of tax collectors in the Roman Empire?

+Tax collectors, or publicani, were responsible for collecting taxes on behalf of the Roman Empire. They played a crucial role in funding the empire’s expansion and maintenance.

Why were tax collectors often viewed negatively in the Bible?

+Tax collectors were often portrayed negatively due to the perception that they exploited their position to extort excessive taxes. This negative portrayal reflects the societal tensions and challenges of the time.

What is the significance of Jesus’ association with tax collectors?

+Jesus’ willingness to associate with tax collectors, who were considered social outcasts, challenged societal norms. It demonstrates the inclusive nature of his ministry and the potential for redemption and transformation in all individuals.