Horry County Tax Office

Welcome to an in-depth exploration of the Horry County Tax Office, a vital administrative entity that plays a crucial role in the financial landscape of Horry County, South Carolina. This office is not just a bureaucratic entity; it's a cornerstone of local governance, shaping the economic framework of the county and impacting the lives of its residents in profound ways. As we delve into its functions, operations, and significance, we will uncover the intricacies of this important government department.

The Horry County Tax Office: An Overview

The Horry County Tax Office is an integral part of the county’s administrative machinery, responsible for a wide array of financial and administrative tasks. Located in the heart of Horry County, this office serves as a pivotal hub for all matters related to taxation, property assessments, and revenue collection.

With a dedicated team of professionals, the Horry County Tax Office ensures the smooth and efficient operation of the county's fiscal processes. From assessing property values to collecting taxes, this office plays a crucial role in maintaining the financial health and stability of the county.

Key Functions and Responsibilities

The Horry County Tax Office undertakes a myriad of tasks, each critical to the county’s financial ecosystem. Here’s a glimpse into some of its core functions:

- Property Assessment: The office conducts regular assessments of all properties within the county, ensuring fair and accurate valuation for tax purposes. This process involves meticulous evaluation of property features, market trends, and historical data.

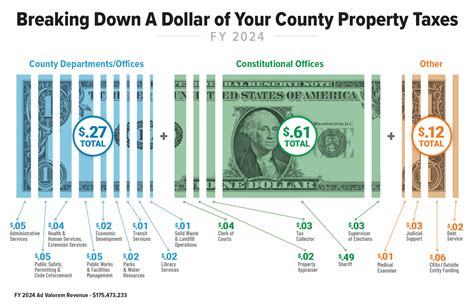

- Tax Collection: A primary responsibility is the collection of various taxes, including property taxes, vehicle taxes, and other applicable levies. The office employs efficient systems to facilitate timely payments and maintain accurate records.

- Public Information: Acting as a reliable source of information, the tax office provides valuable insights to residents regarding tax rates, due dates, and assessment procedures. This ensures transparency and empowers residents with knowledge about their financial obligations.

- Appeals and Disputes: Recognizing the importance of fair practices, the office handles appeals and disputes related to property assessments and tax payments. It provides a transparent and unbiased platform for resolving such issues.

- Data Management: With a vast amount of financial data, the Horry County Tax Office employs advanced systems for data management. This ensures secure storage, easy retrieval, and efficient analysis of critical information.

A Transparent and Accessible Service

The Horry County Tax Office operates with a commitment to transparency and accessibility. Its website serves as a digital gateway, offering a wealth of information and services to residents. From online tax payment portals to detailed assessment data, the office ensures that essential services are readily accessible.

Furthermore, the office conducts regular outreach programs and public forums, providing an opportunity for residents to voice their concerns and gain a deeper understanding of the tax process. This proactive approach fosters a sense of community involvement and trust in the tax system.

Performance and Impact Analysis

The Horry County Tax Office’s performance is a key indicator of the county’s financial health and stability. Over the years, the office has consistently demonstrated its efficiency and effectiveness, earning recognition for its contributions to the local economy.

A recent performance review highlighted the office's success in achieving high tax collection rates, ensuring a steady flow of revenue for essential county services. The review also commended the office's proactive approach to property assessment, which has resulted in fair and equitable taxation across the county.

Economic Impact

The impact of the Horry County Tax Office extends beyond its immediate operations. Its role in collecting and distributing taxes has a direct influence on the county’s economic development. The revenue generated supports vital services such as education, infrastructure development, and social welfare programs, contributing to the overall well-being of the community.

Furthermore, the office's efficient tax collection processes have attracted businesses and investors, boosting the local economy. The stability and reliability of the tax system have been instrumental in fostering an environment conducive to economic growth and prosperity.

Community Engagement

The Horry County Tax Office actively engages with the community, fostering a sense of collaboration and trust. Through various initiatives, the office ensures that residents understand their financial obligations and the importance of timely tax payments. This community-centric approach has led to increased compliance and a stronger sense of civic responsibility.

Additionally, the office's commitment to transparency has enhanced public confidence in the tax system. By providing accessible information and opportunities for public input, the Horry County Tax Office has established itself as a trusted partner in the community's financial journey.

Looking Ahead: Future Implications and Innovations

As technology continues to advance, the Horry County Tax Office is poised to leverage innovative solutions to enhance its operations. The office is exploring the implementation of advanced data analytics and AI-powered systems to further streamline tax processes and improve efficiency.

Moreover, with a focus on sustainability, the office is committed to adopting eco-friendly practices. This includes the potential transition to paperless systems, reducing the environmental footprint while enhancing operational efficiency.

A Vision for the Future

The Horry County Tax Office envisions a future where its services are not just efficient but also highly personalized. By leveraging advanced technologies, the office aims to offer tailored tax solutions to residents, ensuring a seamless and convenient experience.

Furthermore, the office is dedicated to fostering a culture of financial literacy within the community. Through educational programs and initiatives, it strives to empower residents with the knowledge and skills to make informed financial decisions, contributing to their long-term financial well-being.

FAQs

How often are property assessments conducted by the Horry County Tax Office?

+Property assessments are conducted annually by the Horry County Tax Office to ensure accurate and up-to-date valuation for tax purposes. This process involves a comprehensive evaluation of each property, taking into account various factors such as market trends, improvements, and historical data.

What are the accepted methods of tax payment at the Horry County Tax Office?

+The Horry County Tax Office offers a range of convenient payment methods, including online payment portals, direct debit, and traditional in-person payments at the office. Residents can choose the method that best suits their preferences and needs.

How can residents of Horry County access information about their tax obligations and due dates?

+Residents can easily access information about their tax obligations and due dates through the Horry County Tax Office’s official website. The website provides detailed guides, tax calendars, and interactive tools to help residents understand their financial responsibilities and stay informed.

What steps does the Horry County Tax Office take to ensure fair and transparent practices in tax assessment and collection?

+The Horry County Tax Office is committed to maintaining the highest standards of fairness and transparency. It employs rigorous assessment procedures, conducts regular audits, and provides an open platform for residents to voice their concerns and seek clarifications. Additionally, the office adheres to strict ethical guidelines and best practices to ensure impartiality in all its operations.

In conclusion, the Horry County Tax Office stands as a pillar of local governance, playing a pivotal role in the county’s economic health and community well-being. Through its dedicated efforts and innovative approaches, the office continues to enhance its services, ensuring a brighter and more prosperous future for Horry County.