Chime Taxes

Chime, a leading mobile banking platform, has been making waves in the financial industry with its innovative approach to banking services. With its user-friendly interface and convenient features, Chime has gained popularity among consumers, especially those seeking an alternative to traditional banking. However, as with any financial institution, the question of taxes arises. In this comprehensive article, we will delve into the world of Chime and explore the intricacies of taxes associated with this digital banking platform.

Understanding Chime and its Banking Services

Chime is a fintech company that offers a range of banking and financial services through its mobile app. It provides a seamless banking experience, allowing users to manage their finances, make transactions, and access various benefits directly from their smartphones. Chime has gained traction for its no-fee policy on many services, making it an attractive option for those looking to avoid traditional banking fees.

The platform offers a suite of services, including a spending account, a savings account, and a Visa debit card. Chime's spending account, known as the Chime Spending Account, comes with features like early direct deposit, no overdraft fees, and access to a nationwide ATM network. The savings account, called the Chime Savings Account, encourages users to save by offering a competitive interest rate and automatic savings tools. Additionally, Chime's Visa debit card, the Chime Visa Debit Card, provides users with a secure and convenient way to make purchases and access cash.

One of the unique aspects of Chime is its focus on financial health and transparency. The platform offers real-time transaction notifications, budgeting tools, and even automatic savings features that help users stay on top of their finances. Chime's commitment to transparency is evident in its clear and concise fee structure, where users can easily understand the costs associated with their accounts.

Tax Implications and Chime

When it comes to taxes, Chime, like any financial institution, has certain responsibilities and obligations. While Chime itself is not a tax authority or advisor, it does play a role in facilitating tax-related processes for its users.

Reporting Income and Tax Forms

For individuals who receive their income through direct deposit into their Chime spending account, it is important to note that Chime does not issue W-2 forms. W-2 forms are typically issued by employers and contain information about an individual’s earnings and tax withholdings. In the case of Chime, users should receive their W-2 forms directly from their employers, as Chime acts as a banking platform and does not have access to employment-related tax information.

However, Chime does provide users with the necessary tax documentation for their accounts. For instance, if you have a Chime Spending Account, you may receive a 1099-INT form if you've earned any interest on your balance during the tax year. This form provides details about the interest income, which should be included in your tax return. Chime ensures that users are informed about their tax obligations and provides the relevant documentation to assist in the tax filing process.

Withholding and Reporting Taxes

Chime’s role in tax withholding and reporting depends on the specific services and features utilized by its users. For example, if a user has set up their Chime account to automatically save a portion of their paycheck, Chime may facilitate the withholding and reporting of taxes on those savings. This process ensures that the appropriate tax amounts are deducted and reported to the relevant tax authorities.

Furthermore, Chime's partnership with various financial institutions and employers allows for efficient tax reporting. For instance, when an employer chooses to partner with Chime to offer its employees direct deposit services, Chime can work closely with the employer to ensure accurate tax withholding and reporting. This streamlined process benefits both employers and employees, providing a seamless experience when it comes to managing taxes.

Tax Benefits and Incentives

Chime, through its innovative financial services, offers users potential tax benefits and incentives. For example, the Chime Savings Account provides users with the opportunity to earn interest on their savings, which can be advantageous when it comes to tax time. The interest earned may be eligible for certain tax deductions or credits, depending on the user’s financial situation and applicable tax laws.

Additionally, Chime's focus on financial health and budgeting can help users maximize their tax returns. By utilizing Chime's budgeting tools and savings features, users can optimize their spending and savings strategies, potentially reducing their taxable income and increasing their tax refunds. Chime's platform enables users to take control of their finances and make informed decisions that can positively impact their tax situation.

Chime’s Tax Resources and Support

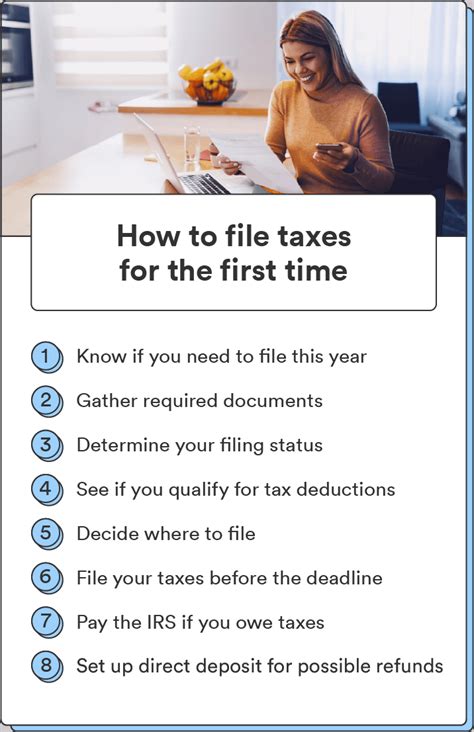

Chime understands the importance of tax-related matters and provides users with resources and support to navigate the tax landscape. The Chime website offers a dedicated section with informative articles and guides on various tax-related topics. Users can find valuable information on topics such as understanding tax forms, calculating tax deductions, and maximizing their tax refunds.

Furthermore, Chime's customer support team is trained to assist users with tax-related inquiries. Whether it's understanding the tax implications of a specific Chime service or seeking guidance on tax documentation, the support team is equipped to provide accurate and helpful information. Chime aims to empower its users with the knowledge and tools they need to manage their taxes effectively.

Integration with Tax Preparation Services

To further enhance the tax experience for its users, Chime has integrated with popular tax preparation services. By partnering with these services, Chime ensures that users have access to expert tax advice and preparation assistance. This integration allows users to seamlessly import their Chime account information into tax preparation software, making the process more efficient and accurate.

Through these partnerships, Chime users can receive personalized tax advice, identify potential tax credits and deductions, and ensure they are maximizing their tax benefits. The integration of tax preparation services with Chime's platform demonstrates the company's commitment to providing a holistic financial experience, including support during tax season.

Case Studies: Chime and Taxes in Practice

To illustrate the practical application of Chime’s tax-related services, let’s explore a few case studies:

Case Study 1: Freelancer’s Tax Savings

Meet Sarah, a freelance graphic designer who recently started using Chime for her business finances. As a freelancer, Sarah receives her income through various direct deposits into her Chime Spending Account. With Chime’s transparent fee structure and budgeting tools, Sarah is able to easily manage her finances and ensure she sets aside funds for tax payments.

Chime's integration with popular tax preparation software allows Sarah to seamlessly import her transaction history and account information into her tax return. This integration saves Sarah time and effort, as she no longer needs to manually enter each transaction. Additionally, Chime's real-time transaction notifications help Sarah keep track of her income throughout the year, making it easier to estimate her tax obligations.

By utilizing Chime's financial services, Sarah is able to maximize her tax savings. The platform's automatic savings feature allows her to set aside a portion of her income for taxes, ensuring she has sufficient funds when tax season arrives. Chime's focus on financial transparency and budgeting tools empowers Sarah to make informed financial decisions, leading to a more efficient tax process.

Case Study 2: Small Business Owner’s Tax Efficiency

John, a small business owner, has been using Chime to manage his business finances for the past year. With Chime’s business account features, John is able to easily track his business expenses and income. Chime’s real-time transaction notifications and budgeting tools provide him with a clear overview of his financial situation, helping him stay on top of his tax obligations.

Chime's integration with accounting software specifically designed for small businesses enables John to streamline his tax preparation process. He can easily categorize and organize his business transactions, ensuring accurate tax reporting. Additionally, Chime's automatic savings feature allows John to set aside funds for tax payments, providing him with the financial stability needed to manage his business taxes efficiently.

By leveraging Chime's financial services, John is able to focus more on growing his business and less on the administrative burden of taxes. Chime's platform simplifies the tax process, allowing John to make informed decisions and take advantage of potential tax benefits available to small business owners.

Future Implications and Industry Insights

As Chime continues to grow and innovate, its impact on the tax landscape is likely to evolve. Here are some potential future implications and industry insights to consider:

Enhanced Tax Integration

Chime may explore deeper integrations with tax authorities and government agencies to streamline the tax process even further. By establishing direct connections, Chime could facilitate automatic tax filing and reporting, reducing the burden on users and improving efficiency.

Personalized Tax Advice

With advancements in artificial intelligence and machine learning, Chime could develop personalized tax advice features. These features could analyze a user’s financial data and provide tailored recommendations for tax deductions, credits, and savings strategies, helping users optimize their tax positions.

Community and Knowledge Sharing

Chime could create a community platform where users can share their tax experiences, ask questions, and receive support from fellow users and tax experts. This community-driven approach could foster a collaborative environment, benefiting users by providing real-world insights and solutions to tax-related challenges.

Expansion of Tax-Related Services

Chime may consider expanding its tax-related services by offering additional features such as tax planning tools, investment advice, or even tax-loss harvesting strategies. By diversifying its offerings, Chime could become a one-stop shop for users’ financial and tax needs, further solidifying its position in the industry.

Conclusion: Chime and Taxes

Chime has revolutionized the banking industry with its innovative approach to financial services. While taxes are an important aspect of personal finance, Chime ensures that its users are well-informed and supported throughout the tax process. Through its transparent fee structure, integration with tax preparation services, and dedication to financial health, Chime empowers its users to navigate the tax landscape with confidence.

As Chime continues to grow and adapt, its impact on the tax industry is set to expand. With its focus on innovation and user experience, Chime is well-positioned to continue providing valuable tax-related services and resources to its users, ensuring a seamless and efficient tax journey.

How does Chime handle tax reporting for direct deposits?

+Chime does not issue W-2 forms for direct deposits. Users should receive their W-2 forms directly from their employers. However, Chime provides tax documentation for accounts, such as the 1099-INT form for interest earnings.

Can Chime assist with tax preparation and filing?

+While Chime does not provide tax preparation or filing services, it has integrated with popular tax preparation software to assist users. Users can seamlessly import their Chime account information into tax preparation software for a more efficient process.

What tax benefits can I expect from using Chime’s financial services?

+Chime’s financial services, such as the Chime Savings Account, offer potential tax benefits. The interest earned on savings may be eligible for tax deductions or credits, depending on individual financial situations and applicable tax laws. Additionally, Chime’s budgeting tools can help users optimize their tax positions.