Property Tax Riverside County

Property taxes are an essential aspect of local government revenue, playing a significant role in funding public services and infrastructure. In Riverside County, California, property taxes contribute to the economic health and well-being of the community. This comprehensive guide aims to provide an in-depth analysis of property taxes in Riverside County, exploring the assessment process, tax rates, exemptions, and their impact on residents and the local economy.

Understanding Property Tax Assessments in Riverside County

The property tax assessment process in Riverside County is overseen by the Assessor’s Office, an independent government agency responsible for appraising and evaluating real property within the county. This office ensures fair and accurate assessments, which form the basis for property tax calculations.

The assessment process in Riverside County is governed by the California Revenue and Taxation Code, specifically Sections 401-407. These sections outline the duties and responsibilities of the Assessor, ensuring compliance with state laws and regulations.

Assessment Process and Timeline

Property assessments in Riverside County occur annually. The Assessor’s Office mails assessment notices to property owners by May 1st, detailing the assessed value of their property. This value is crucial as it determines the property tax bill for the upcoming fiscal year.

Property owners have the right to appeal their assessed value if they believe it is inaccurate. The deadline for filing an appeal is typically within 60 days of receiving the assessment notice. The Assessment Appeals Department reviews these appeals and makes adjustments if necessary, ensuring fairness in the assessment process.

| Assessment Timeline | Key Dates |

|---|---|

| Assessment Notices Mailed | May 1st |

| Appeal Deadline | 60 Days after Notice |

| Assessment Appeals Hearings | July - September |

Factors Affecting Property Assessments

Several factors influence the assessment of property values in Riverside County:

- Market Conditions: The real estate market plays a significant role. The Assessor's Office analyzes recent sales data and market trends to determine fair market value.

- Property Improvements: Any additions or improvements made to a property can impact its assessed value. This includes renovations, new construction, or even significant landscaping changes.

- Economic Factors: The local economy and job market can affect property values. A thriving economy may lead to increased property values, while economic downturns can have the opposite effect.

- Environmental Factors: Natural disasters, such as wildfires or floods, can impact property values. The Assessor's Office considers these events when assessing properties in affected areas.

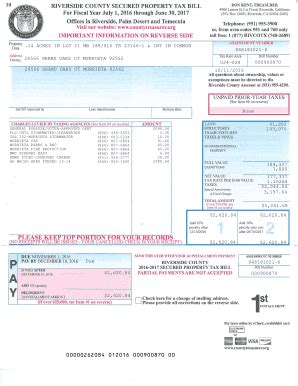

Property Tax Rates and Calculations

Property tax rates in Riverside County are determined by a combination of state and local factors. The primary rate is set by the California State Board of Equalization, which establishes a base rate for all counties in the state. However, local governments, including cities, school districts, and special districts, can also levy additional taxes to fund specific services and projects.

Understanding the Tax Rate Structure

The property tax rate in Riverside County is expressed as a percentage of the assessed value of the property. The rate is composed of two main components:

- Statewide Property Tax Rate: This rate is set by the State Board of Equalization and applies uniformly across California. As of 2023, the statewide rate is 1% of the assessed value.

- Local Tax Rates: These rates are determined by local governments and can vary significantly between different areas within Riverside County. Local tax rates are typically lower than the statewide rate, but they can add up, especially in areas with multiple special districts.

The total tax rate for a property is the sum of the statewide rate and all applicable local rates. This rate is then multiplied by the assessed value of the property to calculate the annual property tax bill.

Example Calculation

Let’s consider an example to illustrate the property tax calculation process. Suppose a residential property in Riverside County has an assessed value of $500,000. The statewide property tax rate is 1%, and the local tax rates for this property are as follows:

- City: 0.5%

- School District: 0.75%

- Special District: 0.25%

The total tax rate for this property would be: 1% (statewide) + 0.5% (city) + 0.75% (school district) + 0.25% (special district) = 2.5%.

To calculate the annual property tax bill, we multiply the assessed value by the total tax rate:

Property Tax Bill = Assessed Value x Total Tax Rate

Property Tax Bill = $500,000 x 0.025 = $12,500

So, the annual property tax bill for this property would be $12,500.

Property Tax Exemptions and Relief Programs

Riverside County offers various property tax exemptions and relief programs to eligible homeowners and property owners. These programs aim to reduce the financial burden of property taxes for certain individuals and provide incentives for specific types of properties.

Homestead Exemption

The Homestead Exemption is one of the most common property tax relief programs in Riverside County. This exemption reduces the assessed value of a property for tax purposes if it is the primary residence of the owner. The exemption amount varies depending on the county and can provide significant savings on property taxes.

To qualify for the Homestead Exemption, the property owner must meet certain criteria, including being a legal resident of the property and using it as their primary residence. The exemption is applied automatically once the homeowner registers for it with the Assessor's Office.

Veterans and Disabled Persons Exemption

Riverside County offers special property tax exemptions for veterans and disabled persons. These exemptions can reduce the assessed value of a property or provide a complete exemption from property taxes, depending on the eligibility criteria.

To qualify for the Veterans Exemption, a veteran must have served in the U.S. Armed Forces and meet specific service requirements. The exemption amount varies based on the veteran's disability status and length of service.

Disabled persons who meet certain criteria, such as having a service-connected disability, may also be eligible for property tax exemptions. These exemptions aim to support veterans and disabled individuals by reducing their financial burden.

Senior Citizen Exemption

Riverside County provides property tax relief for senior citizens through the Senior Citizen Exemption program. This exemption reduces the assessed value of a property for tax purposes if the owner is a senior citizen and meets specific income and residency requirements.

To qualify for this exemption, a senior citizen must be at least 62 years old, own and reside in the property, and have a total household income below a certain threshold. The exemption amount is based on the assessed value of the property and can provide substantial savings on property taxes for eligible seniors.

Impact of Property Taxes on Residents and the Local Economy

Property taxes play a crucial role in shaping the financial landscape of Riverside County. They provide a significant source of revenue for local governments, funding essential services such as education, public safety, infrastructure development, and social programs.

Funding Local Services

Property taxes are a primary funding source for schools, police and fire departments, roads and infrastructure, and other vital public services. The revenue generated from property taxes ensures that these services are adequately funded and can meet the needs of the community.

Economic Development and Job Creation

Property taxes also contribute to economic development initiatives in Riverside County. The revenue from taxes can be used to fund infrastructure projects, attract new businesses, and support job creation. This, in turn, stimulates economic growth and enhances the overall prosperity of the region.

Residential Real Estate Market

Property taxes can influence the real estate market in Riverside County. Prospective homebuyers often consider property tax rates when deciding on a location. Competitive tax rates can make an area more attractive to buyers, leading to increased demand and potentially higher property values.

Tax Incentives for Business and Development

Riverside County offers various tax incentives and abatements to attract businesses and promote economic development. These incentives can include reduced property tax rates for a specified period, providing a financial advantage to businesses that choose to locate in the county.

Future Implications and Outlook

The future of property taxes in Riverside County is closely tied to the economic health and development of the region. As the county continues to grow and evolve, property taxes will play a pivotal role in funding public services and infrastructure improvements.

Potential Challenges

Rising property values can lead to increased property tax bills, potentially impacting affordability for homeowners. The county may need to carefully manage tax rates to ensure that the burden on taxpayers remains reasonable.

Additionally, as the population continues to grow, the demand for public services and infrastructure will increase. The county will need to balance the need for funding with the financial capabilities of its residents.

Opportunities for Growth

Riverside County has the opportunity to leverage its strategic location and economic advantages to attract new businesses and residents. By offering competitive tax rates and incentives, the county can stimulate economic growth and create a thriving business environment.

Furthermore, the county can explore innovative financing mechanisms and partnerships to fund infrastructure projects, ensuring that the community has the necessary resources to support its growing population.

Frequently Asked Questions

How often are property assessments conducted in Riverside County?

+Property assessments in Riverside County are conducted annually. The Assessor’s Office mails assessment notices to property owners by May 1st each year, detailing the assessed value of their property for the upcoming fiscal year.

What factors determine the assessed value of a property in Riverside County?

+The assessed value of a property in Riverside County is determined by various factors, including market conditions, property improvements, economic factors, and environmental factors. The Assessor’s Office analyzes these factors to ensure fair and accurate assessments.

Are there any property tax relief programs available in Riverside County for seniors or veterans?

+Yes, Riverside County offers several property tax relief programs for seniors and veterans. These include the Senior Citizen Exemption, which reduces the assessed value of a property for seniors who meet specific income and residency requirements, and the Veterans Exemption, which provides tax relief for eligible veterans based on their service and disability status.

How can I appeal my property assessment in Riverside County if I believe it is inaccurate?

+If you believe your property assessment in Riverside County is inaccurate, you have the right to appeal. The deadline for filing an appeal is typically within 60 days of receiving the assessment notice. You can contact the Assessment Appeals Department to initiate the appeal process and provide evidence supporting your claim.

What is the impact of property taxes on the local economy and community in Riverside County?

+Property taxes in Riverside County have a significant impact on the local economy and community. They provide funding for essential public services, infrastructure development, and social programs. The revenue generated from property taxes ensures the financial stability of the county and contributes to the overall well-being of its residents.