Property Tax Dakota County

Understanding property taxes is crucial for homeowners and investors alike, as these taxes significantly impact one's financial obligations and planning. This comprehensive guide will delve into the intricacies of property taxes in Dakota County, Minnesota, offering a detailed analysis and practical insights.

Property Tax Landscape in Dakota County

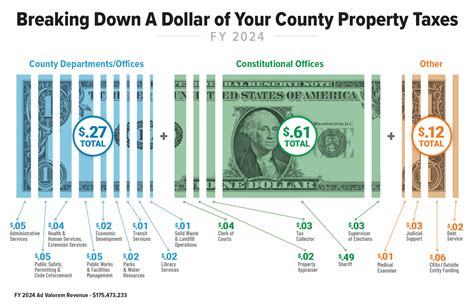

Dakota County, nestled in the southern part of Minnesota, boasts a diverse range of residential and commercial properties. The county’s property tax system is designed to fund essential services, including education, infrastructure, and public safety. Let’s explore the key aspects of property taxation in this region.

Tax Assessment Process

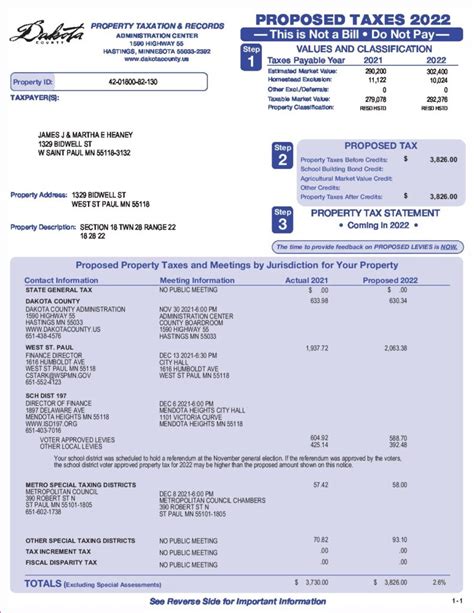

The property tax journey in Dakota County begins with a thorough assessment process. County assessors are responsible for evaluating each property’s value, considering factors such as location, size, improvements, and market conditions. This valuation determines the property’s taxable value, which serves as the basis for tax calculations.

The assessment process typically occurs every year, with property owners receiving a notification of their assessed value. It's important for homeowners to review these assessments carefully, as they have the right to appeal if they believe the valuation is inaccurate or unfair.

Tax Rates and Calculations

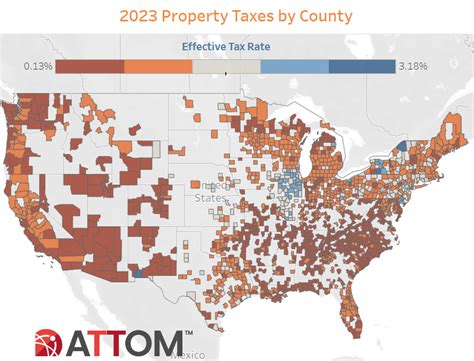

Dakota County utilizes a complex tax rate structure, which varies depending on the property’s location and classification. Residential properties, commercial spaces, and agricultural lands are subject to different tax rates. These rates are expressed as a percentage of the property’s taxable value.

To calculate the actual property tax amount, the assessed value is multiplied by the applicable tax rate. For instance, if a residential property has an assessed value of $300,000 and the tax rate is 1.5%, the annual property tax would be $4,500.

| Property Type | Tax Rate (%) |

|---|---|

| Residential | 1.25 - 1.75 |

| Commercial | 1.5 - 2.0 |

| Agricultural | 0.75 - 1.25 |

Tax Due Dates and Payment Options

Property taxes in Dakota County are typically due twice a year. The first installment is due by the end of February, and the second installment is due by the end of May. However, taxpayers have the flexibility to pay their taxes in full by the first due date, often receiving a small discount for early payment.

The county offers various payment methods, including online payment portals, mail-in checks, and in-person payments at designated locations. It's crucial to note that late payments may incur penalties and interest, so timely payment is essential to avoid additional financial burdens.

Property Tax Relief Programs

Recognizing the financial strain property taxes can impose, Dakota County provides several relief programs to assist eligible homeowners. These programs aim to ease the tax burden, especially for senior citizens, veterans, and low-income individuals.

- Homestead Credit: This program offers a direct refund based on the property's value and the homeowner's income. Eligible homeowners can receive a refund of up to $500 to offset their property tax liability.

- Deferred Property Tax Program: Designed for low-income seniors and disabled individuals, this program allows eligible homeowners to defer their property taxes until the property is sold or ownership changes. This provides much-needed financial relief for those on fixed incomes.

- Property Tax Refund: Residents who rent or own their homes may qualify for a state-level property tax refund, providing additional financial assistance.

Factors Influencing Property Taxes

Property taxes in Dakota County are influenced by a myriad of factors, each playing a unique role in determining the final tax amount. Understanding these factors can help homeowners anticipate and plan for their tax obligations effectively.

Property Value and Appreciation

The assessed value of a property is a primary determinant of its tax liability. As property values rise due to market conditions, improvements, or renovations, the taxable value increases, leading to higher property taxes.

For instance, if a homeowner invests in a significant renovation project, such as adding a new wing to their house, the property's assessed value is likely to increase. This increase in value will be reflected in the subsequent tax assessment, resulting in higher taxes.

Tax Rate Changes

Tax rates are subject to change annually, influenced by factors such as county budgets, state legislation, and economic conditions. Increases in tax rates can directly impact the property tax burden, even if the property’s assessed value remains constant.

For example, if the county experiences a budget shortfall, the tax rate may be increased to generate additional revenue. This rate increase would affect all property owners in the county, regardless of their property's value.

Local Initiatives and Bonds

Dakota County, like many other localities, often undertakes various initiatives and projects to enhance infrastructure, education, or public services. These initiatives are typically funded through bonds, which are repaid using property tax revenue.

When a bond measure is approved by voters, it can lead to a temporary increase in property taxes to cover the bond repayment. These tax increases are usually outlined in the bond proposal, providing transparency to taxpayers.

Assessment Appeals and Challenges

Property owners have the right to appeal their assessed value if they believe it is inaccurate or too high. The appeal process allows homeowners to present evidence and arguments to support their case for a lower assessment.

Successful appeals can result in a reduced taxable value, leading to lower property taxes. However, it's important to note that the appeal process can be complex and time-consuming, requiring thorough preparation and a solid understanding of the assessment criteria.

Property Tax Analysis and Strategies

Analyzing property taxes is crucial for effective financial planning and budgeting. By understanding the tax landscape and employing strategic approaches, homeowners can optimize their tax obligations and potentially reduce their overall tax burden.

Tax Planning and Budgeting

Property tax planning involves forecasting tax liabilities and budgeting accordingly. Homeowners should aim to set aside funds specifically for property taxes to ensure timely payments and avoid financial surprises.

By tracking tax due dates, tax rates, and potential changes in assessment values, homeowners can accurately estimate their tax obligations. This proactive approach helps in financial planning and ensures that property taxes are not a sudden financial burden.

Maximizing Tax Deductions and Credits

Dakota County, along with federal and state tax systems, offers various tax deductions and credits that can reduce a homeowner’s tax liability. It’s essential to explore these options and understand how to qualify for them.

- Mortgage Interest Deduction: Homeowners can deduct the interest paid on their mortgage loans, which can significantly reduce their taxable income and, consequently, their property tax burden.

- Property Tax Deduction: Property taxes paid are often deductible when filing federal and state taxes, providing an additional layer of tax relief.

- Energy Efficiency Credits: Homeowners who invest in energy-efficient improvements may qualify for tax credits, reducing their overall tax liability.

Strategic Property Improvements

While property improvements can increase a home’s value and tax assessment, strategic improvements can offer a balance between enhancing the property and managing tax implications.

For instance, homeowners can focus on improvements that increase the property's functionality and comfort without significantly impacting its assessed value. This strategic approach allows homeowners to enjoy the benefits of improvements without a substantial increase in property taxes.

Long-Term Property Ownership Strategies

For long-term homeowners, understanding the potential for property value appreciation and its impact on taxes is crucial. Over time, as property values increase, so do tax obligations. However, there are strategies to mitigate this impact.

One approach is to explore tax-efficient investment options, such as real estate investment trusts (REITs) or property funds, which can provide exposure to the real estate market without the direct ownership and tax implications.

Future Implications and Trends

The property tax landscape in Dakota County is dynamic, influenced by economic, demographic, and political factors. Understanding these trends and their potential impact is essential for homeowners and investors.

Economic Factors

Economic conditions, such as inflation, interest rates, and market fluctuations, can significantly affect property values and, consequently, property taxes. During economic downturns, property values may decrease, leading to lower tax assessments. Conversely, during economic booms, property values may surge, resulting in higher taxes.

Homeowners should stay informed about economic trends and their potential impact on property values to anticipate tax changes effectively.

Demographic Shifts

Changes in the county’s demographic profile, such as population growth, aging populations, or shifts in household sizes, can influence property tax policies and rates. For instance, a growing population may lead to increased demand for services, potentially resulting in higher tax rates to fund these services.

Understanding demographic trends can help homeowners and investors anticipate tax changes and make informed decisions about property ownership and investment.

Political and Legislative Changes

Property tax policies are subject to political and legislative influences. Changes in local, state, or federal legislation can impact tax rates, assessment processes, and relief programs. It’s crucial for taxpayers to stay informed about these changes to understand their rights and potential benefits.

For instance, recent legislative efforts in Dakota County aimed to streamline the assessment process and provide additional tax relief for seniors and veterans. These changes reflect the county's commitment to fair and equitable taxation.

Technological Advancements

Technological advancements are transforming the property tax landscape. Online tax payment portals, digital assessment tools, and data analytics are enhancing the efficiency and transparency of the tax system.

For instance, Dakota County's online tax portal allows taxpayers to access their tax information, make payments, and track their tax history securely. This digital transformation improves taxpayer convenience and reduces administrative burdens.

Conclusion

Understanding the intricacies of property taxes in Dakota County is essential for effective financial planning and responsible property ownership. From the assessment process to tax relief programs, each aspect of the property tax system plays a vital role in determining a homeowner’s tax obligations.

By staying informed about tax rates, assessment values, and potential changes, homeowners can navigate the property tax landscape with confidence. Strategic planning, coupled with an understanding of available tax deductions and credits, can help optimize tax obligations and ensure a stable financial future.

As the property tax landscape evolves, staying abreast of economic, demographic, and legislative trends is crucial. By adapting to these changes, homeowners can continue to thrive in the dynamic world of property ownership and taxation.

How often are property taxes assessed in Dakota County?

+Property taxes in Dakota County are assessed annually. This means that property owners receive a new tax assessment each year, reflecting the current value of their property.

Are there any tax relief programs for seniors in Dakota County?

+Yes, Dakota County offers several tax relief programs specifically designed for senior citizens. These programs provide financial assistance to eligible seniors, helping them manage their property tax obligations. Some programs allow for deferred property taxes, while others offer direct refunds based on income and property value.

Can property owners appeal their tax assessments in Dakota County?

+Absolutely! Property owners have the right to appeal their tax assessments if they believe the valuation is inaccurate or unfair. The appeal process in Dakota County is designed to ensure fairness and transparency. Property owners can present evidence and arguments to support their case for a lower assessment.