Sales Tax In Huntington Beach Ca

Sales tax in Huntington Beach, California, is an important aspect of doing business and understanding the local economy. The city, often referred to as Surf City USA, attracts tourists and residents alike with its beautiful beaches and vibrant culture. As such, the sales tax system plays a crucial role in generating revenue for the city and its various services and initiatives.

Understanding Sales Tax in Huntington Beach

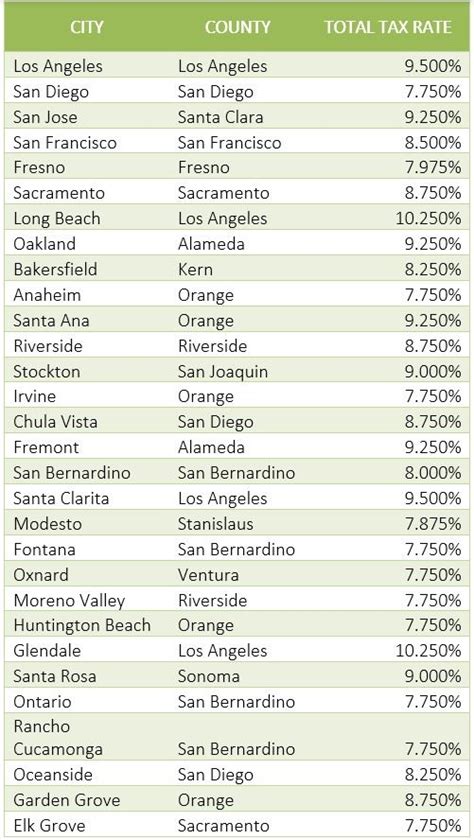

The sales tax in Huntington Beach is a combination of state, county, and city taxes, each with its own rate. As of my last update in January 2023, the sales tax rate in Huntington Beach consists of the following components:

| Tax Type | Rate |

|---|---|

| California State Sales Tax | 7.25% |

| Orange County Sales Tax | 1.00% |

| Huntington Beach City Sales Tax | 0.50% |

| Total Sales Tax Rate | 8.75% |

The state sales tax rate is applied uniformly across California and is set by the state government. The county and city sales tax rates, on the other hand, are additional taxes that are unique to Orange County and Huntington Beach, respectively. These local taxes contribute to the overall tax burden and are used to fund specific initiatives and services in the city.

How Sales Tax is Calculated

Sales tax is typically calculated as a percentage of the total sale price of goods or services. For example, if you purchase an item priced at $100 in Huntington Beach, the sales tax would be calculated as follows:

Total Sales Tax = ($100 * 0.0725) + ($100 * 0.01) + ($100 * 0.005)

Total Sales Tax = $7.25 + $1.00 + $0.50

Total Sales Tax = $8.75

So, the total sales tax on a $100 purchase in Huntington Beach would amount to $8.75, bringing the final cost of the item to $108.75.

Exemptions and Special Considerations

It’s important to note that not all goods and services are subject to sales tax. California, like many other states, exempts certain items from sales tax, such as most groceries, prescription drugs, and certain medical devices. Additionally, there are specific industries and transactions that may be subject to different tax rates or exemptions. For instance, certain manufacturing businesses in California may qualify for a reduced sales tax rate on purchases of manufacturing equipment.

The Impact of Sales Tax on Businesses and Consumers

Sales tax can significantly influence both businesses and consumers in Huntington Beach. For businesses, it is a cost of doing business that must be factored into their pricing strategies and financial planning. The sales tax rate can impact a business’s competitiveness, especially when compared to neighboring cities or states with different tax structures. Businesses must also ensure compliance with tax regulations to avoid penalties and legal issues.

For consumers, sales tax adds to the cost of goods and services. While it may seem like a small percentage, it can add up, especially for higher-priced items or frequent purchases. Consumers in Huntington Beach may also compare prices across different cities or opt for online shopping to avoid sales tax, which can impact local businesses.

Strategies for Businesses

To mitigate the impact of sales tax, businesses in Huntington Beach can employ various strategies. One approach is to build the sales tax into the product pricing, ensuring that the tax is covered by the customer without affecting the perceived value of the product. Alternatively, businesses can offer promotions or discounts to offset the tax, making their products more competitive.

Another strategy is to emphasize the unique aspects of shopping locally, such as customer service, product expertise, or the local economy's support. By educating consumers about the impact of their purchases on the community, businesses can foster a sense of loyalty and encourage shoppers to support local businesses despite the sales tax.

Consumer Behavior and Preferences

Consumer behavior in relation to sales tax can be complex. Some consumers may be price-sensitive and actively seek out lower tax rates, especially for larger purchases. Others may prioritize convenience or the shopping experience, accepting the sales tax as a necessary cost. Understanding consumer preferences and behaviors can help businesses tailor their strategies and marketing efforts effectively.

Future Outlook and Potential Changes

The sales tax landscape is subject to change, and businesses and consumers in Huntington Beach should stay informed about potential shifts. Tax rates can be adjusted by the state, county, or city government, often to address budget concerns or fund specific projects. For instance, there have been discussions in California about implementing a value-added tax (VAT) or increasing sales tax rates to support infrastructure projects.

Additionally, the rise of e-commerce and online shopping has prompted discussions about taxing online sales and ensuring a level playing field for brick-and-mortar businesses. The ongoing debate around state and local tax policies, especially in relation to online sales, could significantly impact the sales tax system in Huntington Beach and across California.

Staying Informed and Adapting

For businesses in Huntington Beach, staying informed about tax policies and potential changes is crucial. This allows them to plan and adjust their strategies accordingly. It may involve working with tax professionals or staying updated through industry associations and local business networks. By being proactive, businesses can ensure compliance, manage their tax obligations effectively, and adapt to any changes in the sales tax landscape.

Conclusion

Understanding the sales tax system in Huntington Beach, California, is vital for both businesses and consumers. It influences pricing strategies, consumer behavior, and the local economy. By staying informed and adapting to potential changes, businesses can navigate the sales tax landscape effectively, while consumers can make informed purchasing decisions. As the city continues to evolve, the sales tax system will remain a critical component of its economic ecosystem.

What is the current sales tax rate in Huntington Beach, CA?

+As of January 2023, the total sales tax rate in Huntington Beach, CA, is 8.75%. This includes the California state sales tax of 7.25%, the Orange County sales tax of 1%, and the Huntington Beach city sales tax of 0.5%.

Are there any items exempt from sales tax in Huntington Beach?

+Yes, certain items are exempt from sales tax in California, including most groceries, prescription drugs, and some medical devices. It’s important to check the specific exemptions and rules for your business or industry to ensure compliance.

How can businesses in Huntington Beach mitigate the impact of sales tax on their operations?

+Businesses can employ various strategies, such as building the sales tax into their pricing, offering discounts or promotions to offset the tax, or emphasizing the benefits of shopping locally. Understanding consumer preferences and behaviors can also help businesses tailor their approaches effectively.

What potential changes to the sales tax system should businesses in Huntington Beach be aware of?

+Businesses should stay informed about discussions and potential changes at the state, county, and city levels. This includes potential adjustments to tax rates, the implementation of new taxes, or changes in regulations related to online sales. Being proactive and adaptable is key to navigating these potential shifts.