Tax Colorado Sales

Colorado's sales tax system is an intricate framework that governs the collection and management of taxes on various goods and services sold within the state. With a diverse range of tax rates and rules, understanding this system is crucial for businesses and individuals alike. In this comprehensive guide, we delve into the specifics of tax collection in Colorado, exploring its unique features, variations across jurisdictions, and the implications for businesses and consumers.

Understanding the Colorado Sales Tax Landscape

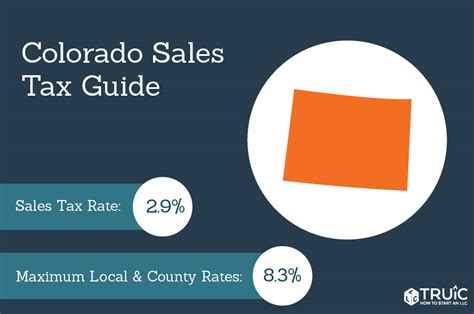

The sales tax landscape in Colorado is a complex network of rates and regulations. At its core, the state levies a 2.9% sales and use tax on most tangible personal property and certain services. This base rate is then subject to modification by local jurisdictions, resulting in a wide range of tax rates across the state.

Colorado's sales tax system is notable for its local control, with individual counties, cities, and special districts having the authority to impose additional sales taxes. This local autonomy leads to significant variations in tax rates, with some areas having rates as low as the base 2.9%, while others can reach upwards of 10% or more.

Sales Tax Rates by Jurisdiction

To illustrate the diversity of sales tax rates in Colorado, let’s consider a few examples. The city of Denver, for instance, has a sales tax rate of 8.312%, which includes the state base tax and additional city and regional taxes. In contrast, the town of Cripple Creek has a much lower rate of 3.9%, consisting only of the state tax and a small local tax.

These variations are even more pronounced in certain areas. For example, the Sales Tax Rate in Denver's Art District on Santa Fe is set at 5.1%, benefiting from a special tax district aimed at supporting local arts and culture. On the other hand, the Residential Sales Tax Rate in Douglas County can be as high as 7.5%, reflecting the county's higher tax rate.

| Jurisdiction | Sales Tax Rate |

|---|---|

| Denver | 8.312% |

| Cripple Creek | 3.9% |

| Denver Art District on Santa Fe | 5.1% |

| Douglas County (Residential) | 7.5% |

Such variations make it essential for businesses operating in multiple jurisdictions within Colorado to have a comprehensive understanding of the specific tax rates applicable to their operations.

Sales Tax Exemptions and Special Considerations

Colorado’s sales tax system is not a one-size-fits-all approach. It features a variety of exemptions and special considerations that can significantly impact the tax burden for certain goods, services, and entities.

Food and Grocery Sales Tax Exemptions

One notable exemption in Colorado’s sales tax system is for unprepared food and groceries. Under Colorado Revised Statutes § 39-26-203(1)(aa), sales of food for home consumption are exempt from sales tax. This exemption extends to a wide range of items, including fresh produce, meats, dairy products, and other staple foods.

However, it's important to note that this exemption does not apply to all food items. For instance, prepared foods, such as hot meals from restaurants or delis, are subject to sales tax. The distinction between unprepared and prepared foods is crucial for businesses in the food industry, as it directly affects their tax obligations.

Other Exemptions and Special Cases

Colorado also provides sales tax exemptions for various other goods and services, including:

- Prescription medications are exempt under § 39-26-203(1)(l)(II), reducing the tax burden for individuals with medical needs.

- Certain agricultural machinery and equipment are exempt, as per § 39-26-203(1)(cc), supporting Colorado’s agricultural industry.

- The state offers a sales tax holiday for certain items, such as school supplies and clothing, during specified periods, providing temporary tax relief for consumers.

Additionally, there are special considerations for specific industries and entities. For instance, remote sellers may be subject to economic nexus rules, requiring them to collect and remit sales tax if their sales into Colorado exceed certain thresholds. This rule has significant implications for online retailers and other out-of-state businesses.

Compliance and Filing Requirements

Navigating Colorado’s sales tax system requires careful compliance and timely filing. Businesses are responsible for collecting and remitting the appropriate sales tax to the Colorado Department of Revenue (DOR) based on the applicable tax rates and exemptions.

Sales Tax Registration and Permits

To begin collecting sales tax in Colorado, businesses must first register with the DOR. This process involves obtaining a sales and use tax license, which authorizes the business to collect and remit sales tax. The license is specific to each business location, meaning a business with multiple locations in Colorado may need multiple licenses.

Once registered, businesses are provided with a sales tax permit, which serves as proof of their authority to collect sales tax. This permit should be displayed prominently at each business location, making it easily accessible for customers and tax authorities.

Sales Tax Return Filing and Payment

Businesses in Colorado are typically required to file sales tax returns on a monthly, quarterly, or annual basis, depending on their sales volume. These returns must be filed with the DOR by the 20th day of the month following the reporting period. For example, if a business’s reporting period ends on March 31st, the sales tax return for that period would be due on April 20th.

Along with the return, businesses must remit the collected sales tax to the DOR. Late filing or non-compliance can result in penalties and interest, underscoring the importance of timely and accurate filing.

Sales Tax Audits and Penalties

The DOR conducts regular sales tax audits to ensure compliance. These audits can be triggered by various factors, including random selection, high sales volumes, or specific audit criteria. During an audit, the DOR may review a business’s sales records, tax returns, and other financial documents to verify the accuracy of sales tax collections and remittances.

If an audit reveals underreported or unreported sales tax, businesses may face penalties and interest charges. These penalties can be significant, making it crucial for businesses to maintain accurate records and ensure compliance with Colorado's sales tax laws.

Conclusion: Navigating Colorado’s Sales Tax Landscape

Colorado’s sales tax system is a complex network of rates, exemptions, and regulations. From the diverse tax rates across jurisdictions to the various exemptions and special considerations, understanding this system is essential for businesses and individuals alike.

By providing a comprehensive overview of Colorado's sales tax landscape, this guide aims to empower businesses to navigate the complexities of tax collection and compliance. From registration and permit requirements to filing deadlines and potential audits, each aspect of the sales tax system is crucial for maintaining compliance and avoiding penalties.

As the sales tax landscape in Colorado continues to evolve, staying informed and proactive is key. Whether you're a business owner, tax professional, or consumer, understanding these intricacies can help you make informed decisions and ensure compliance with Colorado's sales tax laws.

What is the sales tax rate in Colorado Springs, Colorado?

+The sales tax rate in Colorado Springs is currently set at 8.25%, which includes the state sales tax rate of 2.9% and additional local taxes. This rate is subject to change, so it’s important to stay updated with the latest tax rates for accurate compliance.

Are there any sales tax exemptions for online sales in Colorado?

+Yes, Colorado has specific rules regarding online sales and sales tax collection. Out-of-state sellers with significant sales into Colorado may be required to collect and remit sales tax based on economic nexus rules. These rules define the threshold for when online sellers must start collecting sales tax in the state.

How often do sales tax rates change in Colorado?

+Sales tax rates in Colorado can change periodically, typically as a result of legislative changes or local ballot initiatives. While the state sales tax rate remains stable, local jurisdictions may propose and implement changes to their sales tax rates more frequently. It’s important for businesses to stay updated with any changes to ensure accurate tax collection.