California Tax Rate San Francisco

The state of California, known for its diverse landscapes, vibrant cities, and thriving industries, is home to one of the most dynamic economies in the world. Among its many cities, San Francisco stands out as a global hub for technology, finance, and innovation. As such, understanding the tax landscape in San Francisco is crucial for individuals and businesses alike.

Exploring the Tax Structure in San Francisco

The tax system in San Francisco operates within the broader framework of California’s tax regulations, but it also has its unique aspects that set it apart from other cities in the state. This section will delve into the specifics of the tax rate in San Francisco, providing a comprehensive understanding of how it affects residents and businesses.

Statewide Sales and Use Tax

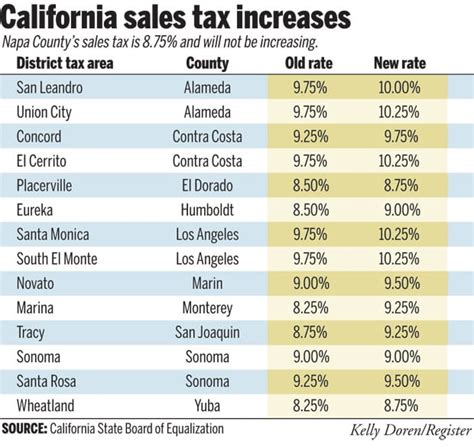

California imposes a statewide sales and use tax on retail transactions and the storage, use, or other consumption of tangible personal property. As of my last update in January 2023, the statewide sales and use tax rate stands at 7.25%. This rate is applicable across the state, including San Francisco.

However, it's important to note that local jurisdictions in California, such as cities and counties, have the authority to levy additional sales and use taxes. These local additions can significantly impact the overall tax burden for residents and businesses.

| Statewide Sales and Use Tax Rate | Local Additions |

|---|---|

| 7.25% | Varies by County |

San Francisco’s Local Sales and Use Tax

San Francisco, like many other cities in California, imposes its own local sales and use tax on top of the statewide rate. This additional tax is used to fund various city initiatives and services. As of my knowledge cutoff, the city of San Francisco levied a local sales and use tax of 1.25%, bringing the total sales and use tax rate in San Francisco to 8.50%.

It's worth mentioning that local sales and use tax rates can change over time as cities adjust their budgets and priorities. It's essential to stay updated with the latest tax rates to ensure accurate tax planning and compliance.

Income Tax in San Francisco

California’s income tax system is progressive, with tax rates ranging from 1% to 12.3% based on income brackets. San Francisco residents, like all California residents, are subject to this state income tax.

Additionally, San Francisco imposes its own Local Income Tax, which is added to the state income tax. As of my knowledge cutoff, San Francisco's local income tax rate was 1.5%, making it one of the highest local income tax rates in the state. This local tax is used to fund specific city services and programs.

Property Tax in San Francisco

Property taxes in California are determined by the assessed value of the property and the tax rate set by the local jurisdiction. The state of California has a Proposition 13 tax assessment limitation, which limits the annual increase in assessed value to 2% or the inflation rate, whichever is lower.

In San Francisco, the effective property tax rate varies depending on the property's location and characteristics. The city's property tax rate is influenced by various factors, including the city's budget needs and the services provided to residents and businesses.

| Effective Property Tax Rate | Tax Rate as % of Assessed Value |

|---|---|

| Varies by Neighborhood | Typically 1-1.5% |

Other Taxes and Fees

In addition to the taxes mentioned above, San Francisco, like many other cities, imposes various other taxes and fees to fund specific services and initiatives. These can include:

- Hotel Tax: San Francisco imposes a hotel tax on the rent or use of hotel rooms, which can vary depending on the type of accommodation.

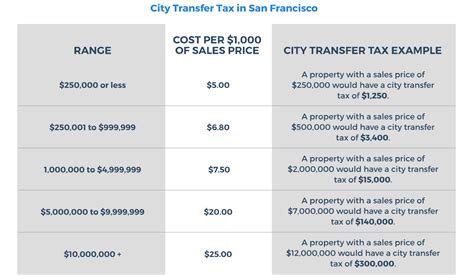

- Transfer Tax: A tax on the sale or transfer of real property within the city.

- Business Taxes: San Francisco levies taxes on businesses, including a Gross Receipts Tax and a Payroll Expense Tax.

- Parking Taxes: Fees and taxes related to parking, including parking meter fees and parking lot taxes.

Tax Planning and Compliance in San Francisco

Navigating the tax landscape in San Francisco requires careful planning and compliance with both state and local regulations. Here are some key considerations for individuals and businesses operating in San Francisco:

Understanding Tax Obligations

Businesses, in particular, must be aware of their tax obligations, which can include sales tax collection, use tax reporting, income tax withholding, and various other taxes and fees. Staying informed about the latest tax rates and regulations is crucial for accurate tax planning.

Tax Registration and Filing

Both individuals and businesses are required to register for applicable taxes and file tax returns with the appropriate agencies. This includes registering with the California Department of Tax and Fee Administration (CDTFA) for sales and use tax purposes and the Franchise Tax Board (FTB) for income tax purposes.

Tax Incentives and Exemptions

San Francisco, like other cities and counties in California, may offer tax incentives or exemptions to certain businesses or industries. These incentives can be in the form of tax credits, abatements, or deferrals. Staying updated on these incentives can provide opportunities for businesses to reduce their tax burden.

Tax Compliance and Audits

Compliance with tax regulations is essential to avoid penalties and legal issues. Businesses and individuals should maintain accurate records and file tax returns on time. In the event of an audit, it’s important to cooperate with the taxing authorities and provide the necessary documentation.

The Impact of San Francisco’s Tax Structure

San Francisco’s tax structure plays a significant role in shaping the city’s economic landscape. The city’s high tax rates, particularly in income and local sales taxes, can influence business decisions, such as where to locate operations or how to structure transactions.

For individuals, the tax burden can affect their cost of living and financial planning. Understanding the tax implications of living and working in San Francisco is crucial for making informed decisions about personal finances.

Economic Impact and Growth

The city’s tax revenue is used to fund a wide range of services and initiatives, including infrastructure development, public transportation, education, and social programs. These investments contribute to the overall economic growth and quality of life in San Francisco.

However, high tax rates can also be a double-edged sword, as they may impact the city's competitiveness in attracting and retaining businesses. Balancing the need for revenue with the cost of doing business is a delicate task for city policymakers.

Future Implications and Trends

The tax landscape in San Francisco is dynamic and subject to change. As the city continues to evolve and adapt to economic and social trends, tax rates and regulations may also undergo adjustments.

For instance, the COVID-19 pandemic has had a significant impact on San Francisco's economy, leading to budget constraints and potential changes in tax policies. Additionally, the ongoing debate over remote work and its tax implications may further influence the city's tax structure.

Staying informed about these trends and potential changes is essential for both individuals and businesses to make strategic decisions and plan for the future.

Conclusion

Understanding the tax rate in San Francisco is a critical aspect of financial planning and business strategy. With its unique tax structure, including high local income and sales taxes, San Francisco presents both opportunities and challenges for residents and businesses.

By staying updated with the latest tax rates, regulations, and incentives, individuals and businesses can navigate the city's tax landscape effectively and contribute to the vibrant economic ecosystem of San Francisco.

How often do sales and use tax rates change in San Francisco?

+Sales and use tax rates in San Francisco, and California in general, can change periodically. Local governments may adjust tax rates based on budget needs and other factors. It’s essential to stay updated with the latest rates to ensure accurate tax planning and compliance.

Are there any tax incentives for businesses in San Francisco?

+Yes, San Francisco, like many other cities, offers tax incentives to attract and support businesses. These incentives can include tax credits, abatements, or deferrals for specific industries or businesses that meet certain criteria. It’s advisable to consult with a tax professional or the city’s economic development agency for more information on available incentives.

How does San Francisco’s tax structure compare to other major cities in California?

+San Francisco’s tax structure, particularly its local sales and income tax rates, is relatively high compared to some other major cities in California. However, it’s important to consider the specific needs and services funded by these taxes. Each city has its unique tax landscape, so comparing tax rates alone may not provide a complete picture.