What Is Fit Tax

In the realm of fitness and wellness, the concept of "Fit Tax" has emerged as a intriguing and somewhat controversial topic. This term, which may sound like a tax levied on fitness enthusiasts, is actually a metaphorical representation of the costs and challenges associated with maintaining an active and healthy lifestyle.

As the global population becomes increasingly health-conscious, the idea of Fit Tax has gained traction, prompting a deeper exploration of its implications and its role in the fitness industry.

Unraveling the Fit Tax Phenomenon

The term “Fit Tax” encapsulates the various expenses and sacrifices individuals make to stay fit and healthy. These costs go beyond monetary considerations and encompass time, energy, and even social aspects of one’s life.

Financial Implications

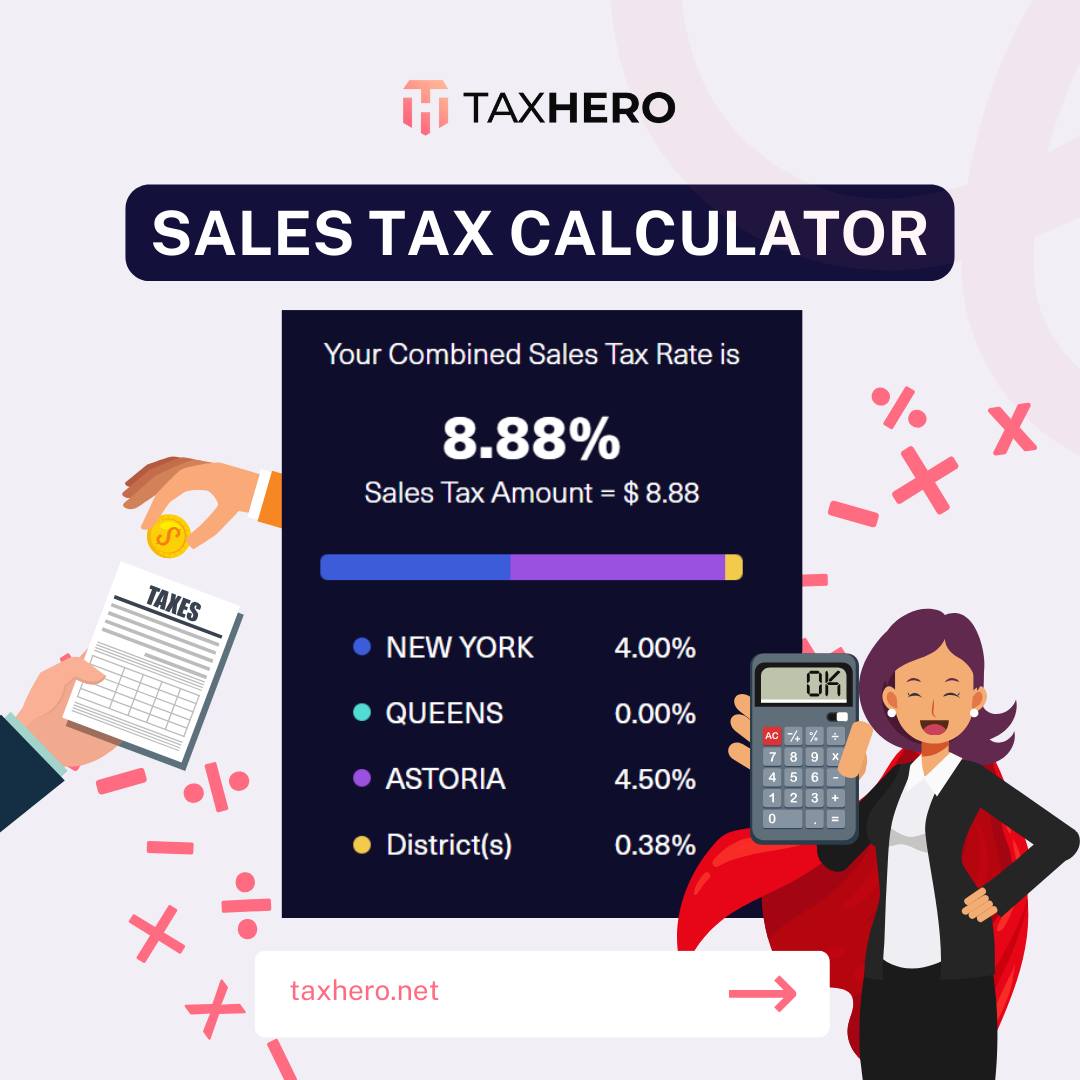

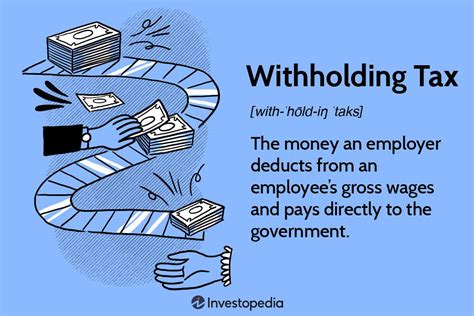

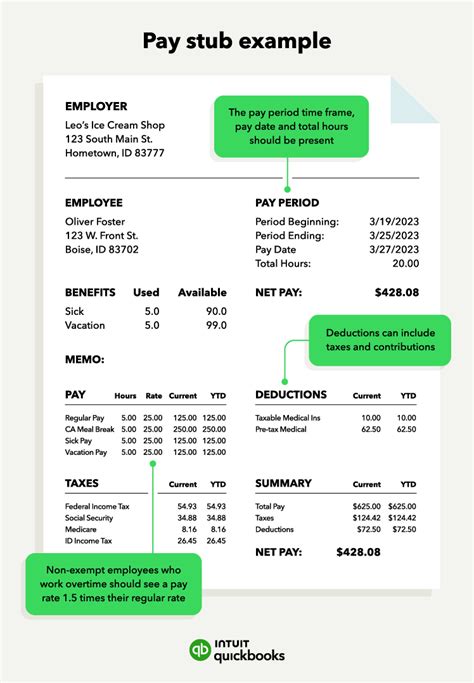

Let’s begin with the financial aspect. Engaging in regular fitness activities often requires investments in gym memberships, specialized equipment, healthy foods, and sometimes, even personal trainers or wellness programs. These expenses can quickly add up, especially for those who are committed to their fitness journey.

A quick glance at the numbers reveals the scale of this expenditure. For instance, a basic gym membership can range from $20 to $100 per month, depending on the location and facilities offered. Add to that the cost of nutritional supplements, organic foods, and fitness apparel, and the annual expenses can reach several thousand dollars.

| Expense Category | Average Annual Cost |

|---|---|

| Gym Membership | $300 - $1,200 |

| Nutritional Supplements | $500 - $1,500 |

| Healthy Food | $1,500 - $3,000 |

| Fitness Gear | $200 - $800 |

| Personal Training | $1,000 - $5,000 |

Time and Energy Commitment

Beyond financial costs, Fit Tax also involves a substantial time commitment. Regular workouts, meal prep, and recovery periods demand a dedicated schedule. For many, this means sacrificing leisure time or other hobbies to prioritize fitness.

A typical workout routine might involve 3-5 sessions per week, each lasting 45 minutes to an hour. This equates to a weekly time investment of 3-5 hours, not including the time spent on meal planning and preparation. For those with busy schedules, this can be a significant challenge.

Social and Lifestyle Adjustments

The Fit Tax extends beyond personal sacrifices. It also involves social and lifestyle adjustments. For instance, choosing a healthy meal at a restaurant over a decadent dessert, or opting for an active weekend activity instead of a sedentary one, are decisions that contribute to the Fit Tax.

Additionally, social events and gatherings can present challenges for those committed to their fitness goals. Navigating social situations while maintaining a healthy diet and avoiding temptations can be a constant battle, adding another layer of complexity to the Fit Tax concept.

The Benefits of Paying the Fit Tax

Despite the costs and challenges, there are undeniable benefits to paying the Fit Tax. The rewards of a healthy lifestyle are multifaceted and can improve overall quality of life.

Physical Health Benefits

Regular exercise and a balanced diet contribute to improved physical health. This includes increased strength and endurance, reduced risk of chronic diseases, and better overall fitness. For many, the physical benefits are a significant motivator to continue paying the Fit Tax.

Mental and Emotional Well-being

The impact of fitness extends beyond the physical realm. Regular exercise is known to boost mood, reduce stress, and improve cognitive function. It can also enhance self-esteem and confidence, providing a sense of accomplishment and satisfaction.

Social and Community Benefits

Engaging in fitness activities often leads to social connections and a sense of community. Whether it’s through group workouts, sports teams, or simply sharing fitness goals with like-minded individuals, the social aspect of fitness can be a powerful motivator and source of support.

The Future of Fit Tax

As the understanding of health and fitness evolves, so too will the concept of Fit Tax. With advancements in technology and a growing emphasis on wellness, the fitness industry is likely to see further innovation and accessibility.

Technology and Fitness

The integration of technology into fitness is already evident with the rise of fitness apps, wearable devices, and online workout platforms. These innovations offer new ways to track progress, customize workouts, and access expert guidance, potentially reducing some of the costs and challenges associated with the Fit Tax.

Accessibility and Inclusion

The fitness industry is also making strides towards inclusivity and accessibility. This includes offering a wider range of fitness options, catering to different abilities and preferences, and promoting body positivity. By making fitness more inclusive, the barriers to entry can be lowered, reducing the burden of the Fit Tax for many individuals.

Personalized Wellness Approaches

The future of fitness is likely to see a shift towards personalized wellness plans. With advancements in genetic testing and data analytics, individuals will be able to tailor their fitness and nutrition strategies to their unique needs and goals. This level of customization can enhance the efficiency and effectiveness of fitness routines, potentially mitigating some of the Fit Tax costs.

Conclusion

The concept of Fit Tax is a multifaceted aspect of the fitness journey, encompassing financial, time, and social considerations. While it presents challenges, the benefits of a healthy lifestyle are undeniable. As the fitness industry continues to evolve, the costs and rewards of fitness will likely be reshaped, offering new opportunities for individuals to pursue their health and wellness goals.

How can I minimize the financial impact of the Fit Tax?

+There are several strategies to reduce the financial burden of fitness. Consider joining community gyms or utilizing free outdoor fitness spaces. Also, explore cost-effective meal prep options and look for discounts or deals on fitness gear. Finally, prioritize your expenses to ensure fitness-related costs align with your budget.

Are there ways to save time while still maintaining an active lifestyle?

+Absolutely! Incorporating high-intensity interval training (HIIT) into your routine can reduce workout time while still providing an effective workout. Additionally, meal prepping in bulk and planning your workouts in advance can help optimize your time.

How can I stay motivated when faced with social challenges related to fitness?

+Finding a supportive fitness community or a workout buddy can provide the motivation and accountability you need. Additionally, setting clear fitness goals and tracking your progress can help maintain motivation, even when faced with social challenges.