Galveston Tax Office

The Galveston Tax Office, located in the heart of Galveston, Texas, plays a crucial role in the city's administration and financial management. This office is responsible for the assessment and collection of various taxes, ensuring the smooth functioning of the local government and the provision of essential services to the community. In this article, we will delve into the workings of the Galveston Tax Office, exploring its history, services, and impact on the city's residents and businesses.

A Historical Perspective

The roots of the Galveston Tax Office can be traced back to the late 19th century when Galveston, known as the “Queen City of the Gulf,” was a thriving port and commercial center. As the city grew, so did its need for a robust taxation system to fund public projects and maintain infrastructure. The establishment of a dedicated tax office became essential to manage the city’s financial affairs effectively.

Over the years, the Galveston Tax Office has evolved to meet the changing needs of the community. It has adapted to various economic shifts, from the post-war boom to the challenges brought by natural disasters, ensuring the city's financial stability and resilience.

Today, the office stands as a vital component of the city's administrative framework, with a team of professionals dedicated to delivering efficient and fair taxation services to the residents and businesses of Galveston.

Services and Responsibilities

The Galveston Tax Office is responsible for a wide range of taxation-related services, each playing a critical role in the city’s financial ecosystem.

Property Tax Assessment

One of the primary functions of the tax office is the assessment of property taxes. Real estate, both residential and commercial, forms a significant portion of the city’s tax base. The office employs a team of assessors who evaluate property values based on market trends, location, and other relevant factors. This process ensures that property owners pay their fair share of taxes, contributing to the city’s revenue.

The office also handles appeals and provides assistance to property owners who may have concerns about their assessments. Open communication and transparency are key aspects of their approach, fostering trust and understanding among taxpayers.

Business Tax Administration

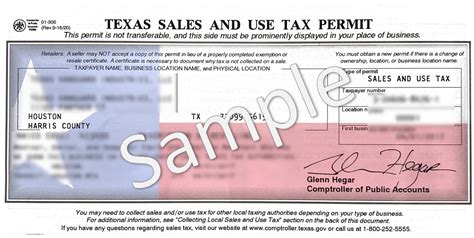

Galveston is home to a diverse range of businesses, from small startups to established enterprises. The tax office ensures that these businesses comply with local tax regulations. They provide guidance and support to business owners, helping them navigate the complex world of taxation.

The office offers online resources and personalized assistance to make the tax filing process more accessible and less daunting. This proactive approach encourages compliance and fosters a positive relationship between the city and its business community.

Vehicle Registration and Titling

The Galveston Tax Office is also responsible for the registration and titling of vehicles. This includes cars, trucks, motorcycles, and even watercraft. The office ensures that vehicle owners meet their legal obligations and pay the necessary fees and taxes associated with vehicle ownership.

The process is streamlined, with online options available for convenience. The office's efficient management of vehicle-related taxes contributes to the overall efficiency of the city's transportation infrastructure.

Other Tax-Related Services

In addition to the above, the tax office offers a range of other services, including:

- Collection of hotel occupancy taxes for the tourism industry.

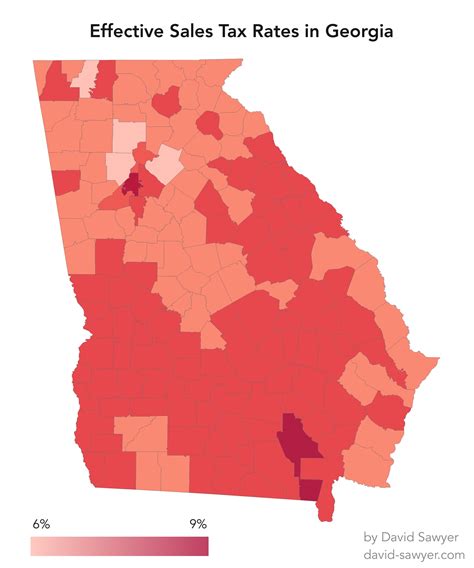

- Administration of local sales taxes, ensuring compliance across various retail sectors.

- Management of special taxes, such as those related to environmental initiatives or specific community projects.

- Provision of tax information and resources to the public, including educational materials and workshops.

Impact on the Community

The Galveston Tax Office’s work has a profound impact on the city’s residents and businesses. By effectively managing the city’s tax system, the office ensures the provision of essential services, such as public safety, infrastructure maintenance, and social programs.

For residents, the tax office's services translate to reliable access to public facilities, well-maintained roads and parks, and efficient emergency response systems. The office's commitment to fair and transparent taxation fosters a sense of trust and engagement within the community.

For businesses, the tax office's support and guidance contribute to a positive business environment. Clear tax regulations and accessible resources encourage entrepreneurship and economic growth, benefiting the city's overall prosperity.

Community Engagement

Beyond its administrative duties, the Galveston Tax Office actively engages with the community. They organize educational workshops and seminars, helping residents understand their tax obligations and rights. This empowers individuals to make informed financial decisions and actively participate in the city’s governance.

The office also collaborates with local businesses and organizations to promote economic development and social welfare initiatives. Their involvement in community projects strengthens the bond between the city and its residents, fostering a sense of shared responsibility and progress.

Performance and Recognition

The Galveston Tax Office’s dedication to excellence has not gone unnoticed. The office has received numerous accolades and certifications for its outstanding performance and customer service.

In recent years, the office has been recognized for its innovative use of technology, streamlining processes and enhancing efficiency. This has not only improved the taxpayer experience but has also reduced administrative costs, allowing for more resources to be allocated to community projects and initiatives.

| Award | Year |

|---|---|

| Excellence in Customer Service Award | 2021 |

| Innovative Technology Implementation Award | 2020 |

| Best Practice in Tax Administration Award | 2019 |

These accolades reflect the office's commitment to continuous improvement and its role as a leader in the field of municipal taxation.

Looking Ahead

As Galveston continues to grow and evolve, the Galveston Tax Office will play a pivotal role in shaping the city’s future. With a focus on technological advancements, community engagement, and sustainable practices, the office is well-positioned to meet the challenges of the coming years.

The office's commitment to transparency and fairness in taxation will ensure that Galveston remains a vibrant and prosperous city, offering its residents and businesses a high quality of life. The future looks bright for the Galveston Tax Office, as they continue to innovate and adapt, ensuring the city's financial health and resilience.

How can I contact the Galveston Tax Office for assistance or inquiries?

+The Galveston Tax Office can be reached through various channels. You can visit their official website for online services and resources. Additionally, they provide a dedicated phone line and email address for inquiries and support. For more complex matters, you can schedule an appointment to meet with a tax advisor in person.

What are the tax deadlines for property owners in Galveston?

+Property tax deadlines in Galveston typically fall around May to July each year. However, it’s essential to stay updated with the specific dates, as they may vary slightly from year to year. The Galveston Tax Office provides regular updates and reminders through their website and community notices.

Are there any tax relief programs available for seniors or low-income residents in Galveston?

+Yes, the Galveston Tax Office, in collaboration with the city government, offers various tax relief programs to support seniors and low-income residents. These programs provide reduced tax rates or exemptions based on certain criteria. The office provides detailed information and application processes on their website, making it accessible for those in need.

How does the Galveston Tax Office handle tax disputes or appeals?

+The Galveston Tax Office has a dedicated team to handle tax disputes and appeals. If you have concerns about your tax assessment or believe there has been an error, you can initiate the appeal process. The office provides clear guidelines and support to ensure a fair and transparent resolution.

What are the payment options available for taxes in Galveston?

+The Galveston Tax Office offers a variety of payment options to accommodate different preferences and needs. These include online payments through their secure portal, traditional mail-in payments, and walk-in payments at their office. Additionally, they provide information on payment plans and options for those facing financial difficulties.