Maryland Pay Taxes

Paying taxes is an essential part of being a responsible citizen, and understanding the tax system in your state can help individuals and businesses navigate their financial obligations effectively. Maryland, with its rich history and diverse economy, has a unique tax landscape that impacts its residents and businesses. In this comprehensive guide, we will delve into the intricacies of Maryland's tax system, providing an in-depth analysis and practical insights for individuals and entities subject to Maryland's tax jurisdiction.

The Maryland Tax Landscape: An Overview

Maryland, officially known as the Free State, boasts a vibrant economy fueled by a diverse range of industries, including biotechnology, healthcare, cybersecurity, and government services. With a population of over 6 million people and a robust GDP, Maryland’s tax system plays a crucial role in funding public services, infrastructure, and state initiatives.

The Maryland Department of Assessments and Taxation (SDAT) is the primary governmental body responsible for assessing and collecting various taxes, including property taxes, income taxes, and sales and use taxes. SDAT’s comprehensive tax structure ensures that Marylanders contribute to the state’s economic stability and development.

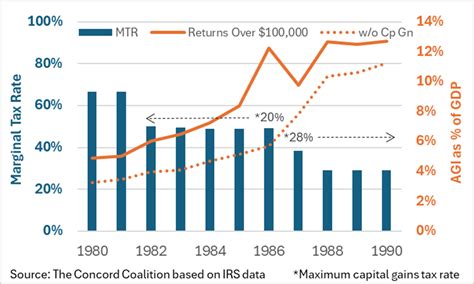

Maryland Income Tax: A Progressive System

Maryland’s income tax system is progressive, meaning that individuals with higher incomes are subject to higher tax rates. As of 2023, Maryland has five income tax brackets, ranging from 2% to 5.75%, with the highest bracket applicable to incomes over 250,000 for single filers and 300,000 for joint filers.

The income tax rates in Maryland are as follows:

| Income Bracket | Tax Rate |

|---|---|

| Up to 1,000</td> <td>2%</td> </tr> <tr> <td>1,001 to 3,000</td> <td>3%</td> </tr> <tr> <td>3,001 to 4,000</td> <td>4%</td> </tr> <tr> <td>4,001 to 150,000</td> <td>4.75%</td> </tr> <tr> <td>Over 150,000 (Single) / $170,000 (Joint) | 5.75% |

Maryland also offers various tax credits and deductions to help reduce the tax burden for eligible individuals and families. These include the Maryland Earned Income Tax Credit (EITC), which provides a refundable credit for low- to moderate-income workers, and the Maryland Personal Income Tax Credit, which is available to residents who meet certain criteria.

Maryland Tax Filing and Due Dates

The tax year in Maryland aligns with the federal tax year, running from January 1st to December 31st. Maryland residents and businesses must file their income tax returns by April 15th, in line with the federal deadline. However, it’s essential to note that Maryland offers an automatic filing extension until October 15th, providing additional time for tax preparation.

Property Taxes in Maryland: A Local Affair

Property taxes in Maryland are primarily assessed and collected at the local level, with rates varying significantly across the state’s 24 counties and Baltimore City. These taxes are used to fund local services, such as schools, fire departments, and infrastructure projects.

The property tax rates in Maryland are determined by the individual jurisdictions and are typically expressed as a percentage of the assessed value of the property. For example, in Montgomery County, the residential property tax rate for Fiscal Year 2023 is 0.953 per 100 of assessed value, while in Baltimore City, the rate is 0.934 per 100 of assessed value.

Property Tax Assessment Process

Property tax assessments in Maryland are conducted by the local jurisdictions, and the process typically involves the following steps:

- Property Valuation: The local tax assessor’s office determines the fair market value of the property.

- Assessment Notice: Property owners receive an assessment notice, which includes the assessed value and the applicable tax rate.

- Appeal Process: If a property owner disagrees with the assessed value, they have the right to appeal the assessment.

- Tax Bill: Once the assessment is finalized, property owners receive a tax bill detailing the amount due and the payment deadline.

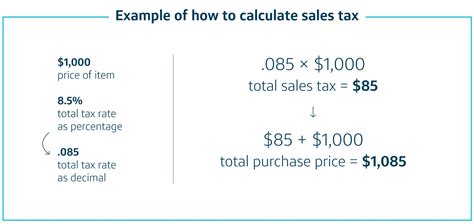

Sales and Use Taxes: A Statewide Contribution

Maryland imposes a statewide sales and use tax on the retail sale, lease, or rental of tangible personal property and certain services. The base sales tax rate in Maryland is 6%, with additional local taxes applied in certain jurisdictions. For example, Baltimore City imposes an additional 1.5% tax, bringing the total sales tax rate to 7.5% within the city limits.

Sales and use taxes are collected by businesses and remitted to the state, with the revenue generated used to fund various state programs and initiatives. Maryland also offers tax exemptions for specific items, such as certain food products, prescription drugs, and clothing.

Maryland Tax Exemptions and Special Programs

Maryland provides various tax exemptions and special programs to promote economic development and support specific industries or initiatives. These include:

- Homestead Tax Credit: A credit available to homeowners who meet certain income requirements, providing a reduction in property taxes.

- Enterprise Zones: Designated areas where businesses may be eligible for tax credits and other incentives to encourage investment and job creation.

- Historic Tax Credit: A credit available to owners of historic properties to encourage their preservation and rehabilitation.

- Film Production Tax Credit: Maryland offers a tax credit to encourage film and television production within the state.

Maryland Tax Compliance and Enforcement

The Maryland Comptroller’s Office is responsible for enforcing tax compliance and collecting delinquent taxes. Failure to comply with tax obligations can result in penalties, interest, and legal consequences. Maryland has a robust system in place to ensure tax compliance, including audits, investigations, and outreach programs to educate taxpayers on their responsibilities.

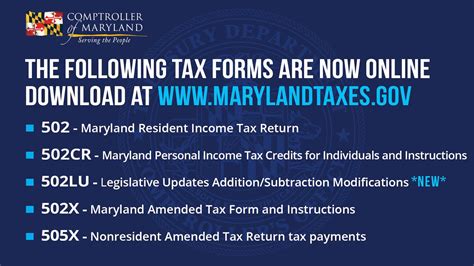

Maryland also offers taxpayer assistance programs and resources to help individuals and businesses understand their tax obligations and navigate the tax system. These resources include online tax guides, tax forms, and dedicated help lines.

Common Tax Compliance Issues

Some common tax compliance issues that Maryland taxpayers may encounter include:

- Underreporting of income: Failure to report all sources of income accurately can lead to penalties and audits.

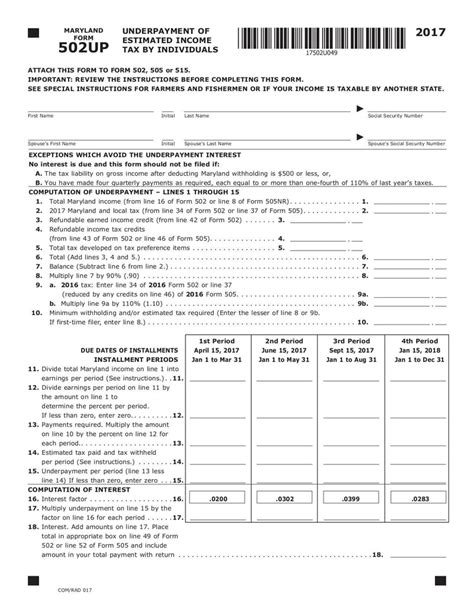

- Late filing or non-filing of tax returns: Delayed or missed tax filings can result in penalties and interest charges.

- Incorrect tax calculations: Mistakes in calculating tax liabilities can lead to overpayment or underpayment, both of which can have financial implications.

- Failure to pay estimated taxes: Self-employed individuals and businesses with fluctuating income may be required to make estimated tax payments to avoid penalties.

The Future of Maryland’s Tax System

As Maryland’s economy continues to evolve, the state’s tax system will likely undergo changes and adaptations to meet the needs of its residents and businesses. The ongoing debate surrounding tax policy, including proposals for tax reform and modernization, is a testament to the state’s commitment to maintaining a fair and efficient tax system.

Key areas of focus for future tax policy discussions in Maryland may include:

- Simplifying the tax code: Streamlining tax laws and regulations to make them more accessible and understandable for taxpayers.

- Tax reform for businesses: Exploring ways to reduce the tax burden on businesses, particularly small businesses, to encourage economic growth and job creation.

- Addressing tax disparities: Examining tax policies that may disproportionately affect certain demographic groups or industries.

- Tax incentives for innovation: Providing tax incentives to promote innovation, technology, and sustainable practices.

Conclusion

In conclusion, Maryland’s tax system is a complex yet essential framework that underpins the state’s economic vitality. By providing an in-depth analysis of Maryland’s income tax, property tax, sales tax, and various tax programs, this guide aims to empower individuals and businesses with the knowledge needed to navigate the state’s tax landscape confidently. Stay tuned for future updates and insights as Maryland continues to shape its tax policies to meet the evolving needs of its residents and businesses.

How can I estimate my Maryland income tax liability?

+To estimate your Maryland income tax liability, you can use the state’s online tax estimator tool. This tool considers your income, deductions, and credits to provide an estimate of your tax liability. Alternatively, you can consult a tax professional or use tax preparation software to calculate your taxes accurately.

Are there any tax breaks or incentives for seniors in Maryland?

+Yes, Maryland offers several tax breaks and incentives for seniors. The state provides a Homestead Tax Credit, which reduces property taxes for eligible homeowners aged 65 and older. Additionally, certain retirement income, such as pension income, may be exempt from state income tax under specific circumstances.

How can I determine the sales tax rate in my jurisdiction in Maryland?

+Maryland’s sales tax rates vary by jurisdiction. To find the sales tax rate in your area, you can visit the Maryland Comptroller’s website, which provides a comprehensive list of sales tax rates by county and municipality. Alternatively, you can contact your local tax office for specific information.

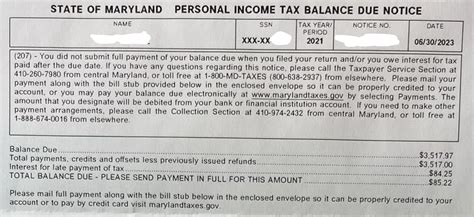

What happens if I fail to pay my Maryland taxes on time?

+Failing to pay your Maryland taxes on time can result in penalties, interest charges, and potential legal consequences. The Maryland Comptroller’s Office may impose penalties of up to 5% of the unpaid tax amount for each month the tax remains unpaid, along with interest accruing at a rate of 0.75% per month. It’s crucial to stay current with your tax obligations to avoid these penalties.

Are there any tax credits or deductions available for homeowners in Maryland?

+Yes, Maryland offers several tax credits and deductions for homeowners. These include the Homestead Tax Credit, which provides a reduction in property taxes for eligible homeowners, and the Property Tax Credit for Low-Income Homeowners, which offers a credit to homeowners with limited incomes. Additionally, homeowners may be eligible for deductions for certain home improvements or energy-efficient upgrades.