Oregon Tax Refund

Welcome to our comprehensive guide on the Oregon Tax Refund, a topic of interest to many residents and taxpayers in the Beaver State. This article aims to provide an in-depth analysis of the tax refund process in Oregon, offering valuable insights and information to help you navigate this often-complex financial matter. With its unique tax structure and a range of credits and deductions, understanding the Oregon tax refund system is crucial for optimizing your financial planning.

Understanding the Oregon Tax System

Oregon operates under a unique tax system compared to many other states in the US. It is one of only a handful of states that does not levy a sales tax, instead relying heavily on income tax and corporate tax for revenue generation. This makes the state’s tax landscape quite distinct and often more advantageous for certain types of taxpayers.

The state's income tax system is notable for its progressive structure, with higher income brackets facing higher tax rates. This means that as your income increases, the tax rate you pay also increases. This progressive system aims to ensure that higher-income earners contribute a larger share of their income to state revenues.

For individuals and families, Oregon offers a standard deduction that can reduce the amount of income subject to tax. Additionally, the state provides a variety of tax credits that can further reduce your tax liability. These credits cover a wide range of areas, from child and dependent care to energy efficiency improvements in your home.

Eligibility and Process for Oregon Tax Refunds

To be eligible for an Oregon tax refund, you must first file your state income tax return accurately and on time. The state’s tax year runs concurrently with the federal tax year, from January 1st to December 31st. Tax returns are typically due by April 15th of the following year, but this deadline may be extended under certain circumstances.

When filing your Oregon tax return, you will calculate your tax liability based on your income, deductions, and credits. If the total tax you owe is less than the amount you've already paid through payroll deductions or estimated tax payments, you will be eligible for a refund. This refund represents the excess amount you've paid, which the state will return to you.

The Oregon Department of Revenue provides various methods for filing your tax return, including online filing through their website, paper filing, or using a tax preparer. Each method has its advantages and considerations, and it's important to choose the one that best suits your comfort level and situation.

Online Filing: A Convenient Option

Online filing has become increasingly popular due to its convenience and speed. The Oregon Department of Revenue’s website offers a user-friendly interface for taxpayers to file their returns. This method typically provides faster processing times and allows for easy tracking of your refund status.

To file online, you'll need to create an account on the Department's website and have your tax documents readily available. The process is generally straightforward, but it's advisable to have a basic understanding of tax terminology and concepts to ensure accuracy.

| Online Filing Benefits | Considerations |

|---|---|

| Faster processing and refund times | Requires internet access and some familiarity with online tax filing |

| Easy tracking of refund status | May not be suitable for complex tax situations |

| User-friendly interface | Potential for errors if not careful |

Paper Filing: A Traditional Approach

For those who prefer a more traditional approach or have complex tax situations, paper filing is an option. The Department of Revenue provides paper forms that you can complete and mail in. This method may take longer to process and you’ll need to keep a record of your return and any supporting documents.

Paper filing can be more time-consuming, but it allows for a more meticulous approach to tax preparation, especially for those with unique circumstances or a large number of deductions and credits.

Using a Tax Preparer: Expert Guidance

Engaging the services of a tax preparer can be beneficial, especially if you’re unsure about the tax refund process or have a complex financial situation. Tax preparers are trained professionals who can help you navigate the intricacies of the Oregon tax system, ensuring you take advantage of all applicable deductions and credits.

While there is a cost associated with using a tax preparer, the potential for larger refunds and peace of mind can often outweigh this expense. Tax preparers can also provide valuable advice on tax planning strategies for the upcoming year.

Maximizing Your Oregon Tax Refund

While the primary goal of filing your tax return is to ensure compliance with state law, maximizing your refund is a welcome bonus. Here are some strategies to consider when preparing your Oregon tax return to potentially increase the amount of your refund.

Claim All Applicable Deductions and Credits

Oregon offers a variety of deductions and credits that can significantly reduce your tax liability. Some of these include the Standard Deduction, Personal Exemptions, and various Tax Credits such as the Child and Dependent Care Credit, Low-Income Credit, and Energy Tax Credit.

Make sure you understand all the deductions and credits you're eligible for and claim them on your return. Failing to claim these could result in leaving money on the table that rightfully belongs in your pocket.

Keep Good Records

Accurate record-keeping is essential for claiming deductions and credits, and for ensuring the accuracy of your tax return. Keep track of all your income, expenses, and any other relevant financial information throughout the year. This includes receipts, bank statements, and any other documentation that can support your tax claims.

Good record-keeping not only helps with the preparation of your tax return but also facilitates any potential audits. It demonstrates your commitment to tax compliance and can help resolve any issues that may arise.

Consider Tax Planning Strategies

Tax planning is an important aspect of financial management. By understanding your financial situation and goals, you can employ strategies to minimize your tax liability and maximize your refund. This may include adjusting your payroll deductions, contributing to retirement accounts, or taking advantage of tax-efficient investment strategies.

Consulting with a tax professional or financial advisor can provide valuable insights into tax planning strategies that are tailored to your unique circumstances. They can help you understand the potential benefits and trade-offs of different strategies, ensuring you make informed decisions.

Oregon Tax Refund Timeline

Understanding the timeline for your Oregon tax refund is essential for effective financial planning. The Department of Revenue processes refunds as quickly as possible, but the exact timeline can vary depending on several factors.

Processing Times

For tax returns filed electronically, the Department of Revenue aims to process refunds within 21 days of receipt. However, this timeline can be affected by various factors, including the complexity of the return, errors or omissions, and the overall volume of tax returns being processed.

Paper returns generally take longer to process, with a typical timeframe of 6–8 weeks. Again, this can be influenced by the factors mentioned above.

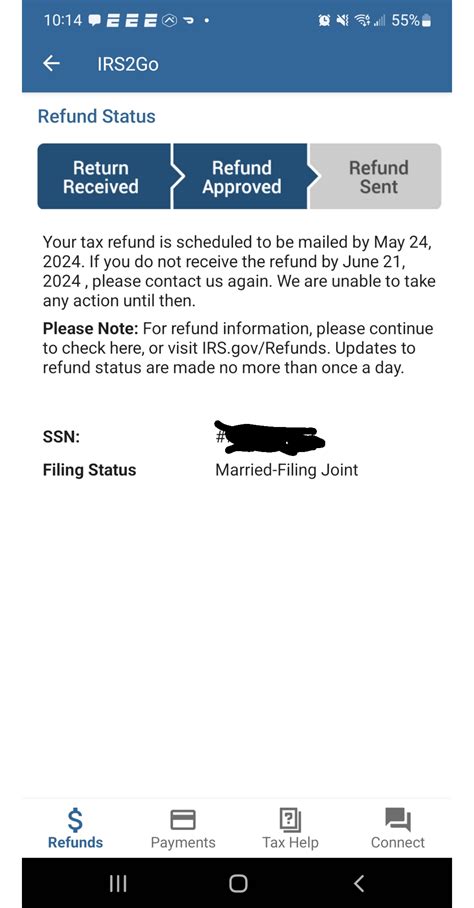

Tracking Your Refund

The Department of Revenue provides a refund status tool on its website, which allows you to track the progress of your refund. This tool is updated regularly, and you can check the status of your refund by entering your Social Security Number and the amount of your expected refund.

Additionally, the Department of Revenue offers a refund hotline where you can speak to a representative for updates on your refund status. This service is particularly useful if you have not received your refund within the expected timeframe and want to confirm the status of your return.

Common Issues and Resolutions

Despite your best efforts, there may be instances where your Oregon tax refund is delayed or you encounter other issues. Here are some common problems and potential resolutions.

Refund Delays

Refund delays can occur for a variety of reasons. Common causes include errors or omissions on your tax return, missing or incorrect information, or the need for additional documentation. In some cases, the Department of Revenue may also delay refunds due to fraud prevention measures.

If you have not received your refund within the expected timeframe, the first step is to check the status of your refund using the Department's online tool or refund hotline. If the status indicates that your refund is being processed, it's best to wait a little longer as the Department may just be taking additional time to ensure the accuracy of your return.

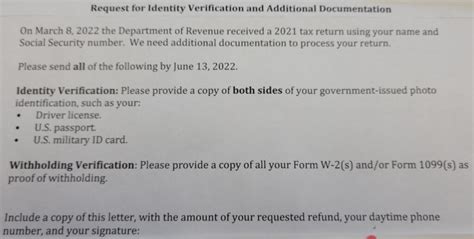

If the status indicates that there is an issue with your return, you will need to contact the Department of Revenue directly to resolve the problem. This may involve providing additional documentation or clarifying certain aspects of your return.

Errors and Omissions

Errors and omissions on your tax return can lead to a range of issues, from delayed refunds to additional tax liabilities. Common errors include incorrect personal information, miscalculations of tax liability, and failing to claim eligible deductions or credits.

To avoid errors, it's crucial to carefully review your tax return before submitting it. Use tax preparation software or engage the services of a tax professional to help ensure accuracy. If you do discover an error after filing, contact the Department of Revenue as soon as possible to correct the issue.

Identity Theft and Fraud

Identity theft and tax fraud are serious issues that can affect your tax refund. Criminals may use your personal information to file a fraudulent tax return in your name, claiming a refund that they then pocket. This not only delays your legitimate refund but also requires significant effort to resolve.

To protect yourself, be vigilant about safeguarding your personal information, especially your Social Security Number and financial details. Be cautious about sharing this information online or over the phone, and regularly monitor your credit report for any unusual activity.

If you suspect that your identity has been used fraudulently for tax purposes, contact the Department of Revenue and the relevant law enforcement agencies immediately. They can provide guidance on how to resolve the issue and protect your rights.

Future Outlook for Oregon Tax Refunds

The landscape of tax refunds in Oregon is subject to change, influenced by various factors such as economic conditions, legislative decisions, and technological advancements. Here’s a look at some potential future developments.

Economic Factors

Economic conditions play a significant role in the state’s tax revenue and, consequently, the amount of refunds issued. During periods of economic growth, the state may experience higher tax revenues, potentially leading to larger refunds for taxpayers. Conversely, economic downturns can result in reduced tax revenues and, therefore, smaller refunds.

Legislative Changes

The Oregon legislature regularly reviews and makes amendments to the state’s tax laws. These changes can impact the tax refund process, from the eligibility criteria for certain deductions and credits to the overall structure of the tax system. Staying informed about these legislative changes is essential for effective tax planning.

Technological Advancements

The Department of Revenue is continuously improving its technological infrastructure to enhance the tax refund process. This includes upgrades to its online filing system, refund tracking tools, and data security measures. These advancements aim to provide a more efficient, secure, and user-friendly experience for taxpayers.

Conclusion

Navigating the Oregon tax refund process can be complex, but with the right knowledge and strategies, it can be a straightforward and potentially rewarding experience. By understanding the state’s unique tax system, staying informed about eligibility criteria, and employing effective tax planning strategies, you can optimize your refund and make the most of your financial situation.

Whether you choose to file online, on paper, or with the assistance of a tax professional, remember that accurate record-keeping and a proactive approach to tax planning are key to a successful outcome. Stay informed, seek professional advice when needed, and take advantage of the resources provided by the Oregon Department of Revenue to ensure a smooth and beneficial tax refund process.

When is the Oregon tax filing deadline for the current year?

+For the current tax year, the deadline to file your Oregon state income tax return is typically April 15th. However, this deadline may be extended in certain circumstances, such as during periods of widespread disaster or if the federal tax filing deadline is extended.

How can I check the status of my Oregon tax refund?

+You can check the status of your Oregon tax refund by using the refund status tool on the Department of Revenue’s website. You’ll need your Social Security Number and the amount of your expected refund to access this tool. Alternatively, you can call the Department’s refund hotline for updates on your refund status.

What are some common tax credits available in Oregon?

+Oregon offers a variety of tax credits, including the Child and Dependent Care Credit, which provides a credit for the cost of caring for a qualifying child or dependent, and the Low-Income Credit, which provides a refund for low-income taxpayers. Other credits include the Energy Tax Credit for energy-efficient home improvements and the Research and Development Credit for businesses engaging in research and development activities.

What should I do if I receive a notice from the Oregon Department of Revenue regarding my tax refund?

+If you receive a notice from the Oregon Department of Revenue regarding your tax refund, it’s important to carefully review the notice and respond promptly. The notice may provide important information about the status of your refund, request additional documentation, or inform you of potential issues with your tax return. Contact the Department directly if you have questions or need further clarification.