Free Military Tax Filing

Tax season is a critical time for many individuals, and it becomes even more significant for those serving in the military. The complexities of military life, with unique pay structures, deployment scenarios, and tax benefits, often require specialized knowledge. Fortunately, there are resources available to simplify the tax filing process for service members, offering free and efficient services. This comprehensive guide will delve into the world of free military tax filing, exploring the benefits, processes, and tools that make tax season less daunting for our armed forces.

Understanding the Importance of Free Military Tax Filing

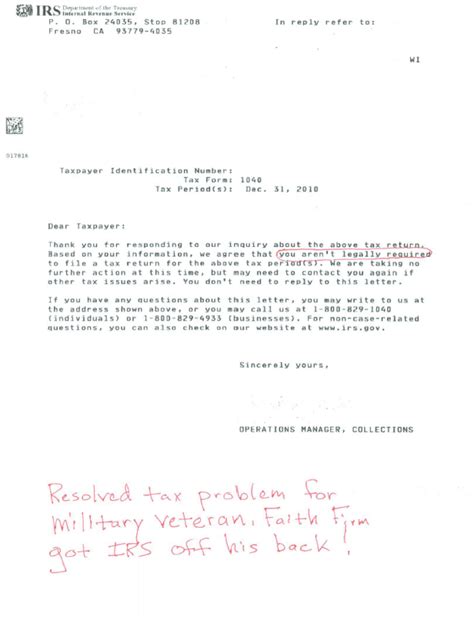

Military tax filing can be intricate, especially for those who are frequently on the move, experience varied income streams, or have unique allowances and deductions. Free tax filing services tailored for military personnel aim to ease this complexity, ensuring service members can navigate their tax obligations smoothly.

The primary benefit of these services is their accessibility. They are often designed with user-friendly interfaces, ensuring that even those with limited tax knowledge can confidently file their returns. Furthermore, these services are typically offered at no cost, a significant advantage for those who may be managing their finances on a tight budget.

Another critical aspect is the expertise these services provide. Many platforms offering free military tax filing are backed by experienced tax professionals who understand the intricacies of military tax laws. This ensures that service members can access accurate and up-to-date information, maximizing their potential deductions and credits.

Exploring Popular Free Military Tax Filing Services

Several reputable platforms offer free tax filing services specifically for military personnel. Here’s a detailed look at some of the most prominent ones:

Military OneSource

Military OneSource is a Department of Defense program offering a range of support services for active duty, Guard, Reserve, and their families. Their tax filing service is designed to simplify the process for service members, providing step-by-step guidance and expert support. The platform ensures secure filing and offers a user-friendly interface, making it an excellent choice for those seeking simplicity and security.

TaxSlayer Military

TaxSlayer Military is a dedicated platform that provides free federal and state tax filing services for active-duty military, veterans, and their families. Their software is intuitive and easy to navigate, offering a straightforward approach to tax filing. Additionally, TaxSlayer Military provides access to tax professionals who can offer guidance and support throughout the process.

TurboTax Military Edition

TurboTax Military Edition is another popular choice among service members. This platform offers a dedicated military filing option, providing tailored guidance and resources to navigate military-specific tax situations. With its simple interface and robust support, TurboTax ensures a seamless tax filing experience for military personnel.

H&R Block Military Discount

While not entirely free, H&R Block offers significant discounts for military personnel, making it an affordable option for those seeking professional tax support. Their military discount program ensures that service members can access quality tax services at reduced rates, benefiting from the expertise of their tax professionals.

The Process: Step-by-Step Guide to Free Military Tax Filing

Filing taxes can seem daunting, but with the right guidance and tools, the process can be streamlined and efficient. Here’s a detailed step-by-step guide to help military personnel navigate their tax obligations:

- Choose a Reputable Service: Select a trusted platform like Military OneSource, TaxSlayer Military, or TurboTax Military Edition. These platforms are designed specifically for military personnel, ensuring they understand your unique tax situation.

- Gather Necessary Documents: Collect all relevant documents, including your W-2, 1099 forms, and any other income or expense records. Ensure you have your military ID and necessary contact information.

- Create an Account: Register on the chosen platform, providing your personal and military details. This step ensures the software can tailor its guidance to your specific situation.

- Enter Your Information: Input your income, deductions, and credits accurately. The platform will guide you through this process, ensuring you don't miss out on any applicable benefits.

- Review and Submit: Carefully review your tax return for accuracy. Once satisfied, submit your return electronically. The platform will handle the rest, ensuring a secure and efficient filing process.

- Track Your Refund: After submission, you can track the status of your refund. Most platforms provide real-time updates, ensuring you stay informed throughout the process.

It's essential to note that while these steps provide a general guide, each platform may have unique features and processes. Always refer to the platform's instructions and support resources for a more detailed and personalized experience.

Maximizing Your Tax Benefits: Expert Tips for Military Personnel

Tax season presents an opportunity for military personnel to maximize their financial benefits. Here are some expert tips to ensure you’re making the most of your tax filing:

- Understand Military-Specific Deductions: Military life offers unique deductions and credits, such as the Combat Zone Tax Exclusion or the Moving Expense Deduction. Ensure you're aware of these benefits and how they apply to your situation.

- Keep Detailed Records: Maintain a well-organized record of your expenses and income throughout the year. This simplifies the tax filing process and ensures you don't miss out on any deductions.

- Seek Professional Advice: If your tax situation is complex, consider seeking advice from a military tax professional. They can provide personalized guidance, ensuring you navigate your tax obligations effectively.

- Stay Informed: Keep up-to-date with the latest tax laws and changes. This ensures you're aware of any new benefits or adjustments that may impact your tax filing.

- Take Advantage of Free Services: As mentioned, several reputable platforms offer free tax filing services for military personnel. These services are designed to simplify the process and ensure you receive all applicable benefits.

Future Trends: The Evolution of Military Tax Filing

The landscape of military tax filing is continually evolving, driven by advancements in technology and a growing understanding of military-specific tax scenarios. Here’s a glimpse into the future of military tax filing:

- AI-Assisted Tax Filing: Artificial Intelligence is set to play a more significant role in tax filing. AI-powered platforms can offer personalized recommendations and guidance, ensuring military personnel receive the most accurate and efficient tax services.

- Mobile Tax Filing Apps: With the increasing use of smartphones, mobile tax filing apps are becoming more prevalent. These apps offer a convenient and accessible way for service members to file their taxes, regardless of their location.

- Integrated Financial Platforms: The future may see the integration of tax filing services with broader financial management platforms. This would provide a comprehensive view of a service member's financial situation, offering more holistic financial planning and tax strategies.

- Enhanced Security Measures: As tax filing moves increasingly online, ensuring the security of personal information is crucial. Future tax filing platforms will likely prioritize advanced security measures to protect service members' data.

In conclusion, free military tax filing services offer a vital support system for service members, ensuring they can navigate their tax obligations with ease and confidence. With the right tools and guidance, tax season can be a stress-free experience, allowing military personnel to focus on their primary duties and missions.

Can I file my taxes for free if I’m a veteran?

+Yes, several platforms offer free tax filing services for veterans, ensuring they can access the same benefits as active-duty personnel. These platforms provide tailored guidance and support, making tax filing a seamless process.

What documents do I need to file my taxes as a military member?

+You’ll need documents such as your W-2, 1099 forms, and any other income or expense records. Additionally, your military ID and necessary contact information will be required during the filing process.

Are there any specific tax benefits for military personnel?

+Yes, military personnel are eligible for several unique tax benefits, including the Combat Zone Tax Exclusion, Moving Expense Deduction, and more. These benefits can significantly impact your tax obligations, so it’s essential to be aware of them.

Can I file my taxes online if I’m deployed overseas?

+Absolutely! Many free military tax filing services are designed with deployment scenarios in mind. They offer secure online filing, ensuring you can complete your tax obligations regardless of your location.