Hcad Harris County Property Taxes

Property taxes are an essential component of the revenue system for local governments and school districts in Texas. Harris County, being the most populous county in the state, faces a unique challenge in managing property tax assessments and collections. The Harris County Appraisal District (HCAD) plays a pivotal role in this process, determining the appraised value of properties within the county.

This comprehensive guide aims to delve into the intricacies of Harris County property taxes, exploring the assessment process, tax rates, payment options, and the appeals procedure. By understanding these aspects, property owners in Harris County can navigate the tax system with greater clarity and confidence.

Understanding the HCAD Appraisal Process

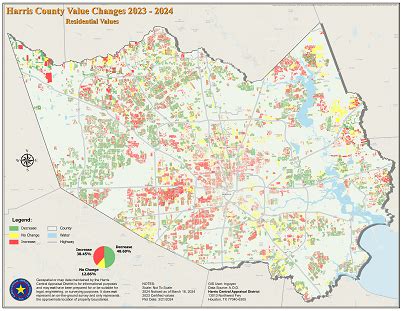

The Harris County Appraisal District is responsible for appraising all real and business personal properties within the county. This process involves assigning a value to each property, which forms the basis for calculating property taxes. HCAD utilizes a variety of methods to determine property values, including market comparisons, cost approaches, and income approaches.

Market comparisons involve analyzing recent sales of similar properties to determine the fair market value of a subject property. The cost approach considers the cost of replacing or reproducing the property, while the income approach estimates the net income potential of the property and discounts it to arrive at a present value.

Data Collection and Accuracy

HCAD maintains a vast database of property information, including property characteristics, ownership details, and sales data. The accuracy of this data is crucial for fair and equitable property tax assessments. HCAD employs a team of appraisers who conduct on-site inspections, verify property details, and update records to ensure the database remains current.

| Key Data Points | Description |

|---|---|

| Property Type | Residential, commercial, industrial, or agricultural. |

| Size | Square footage of improvements and land area. |

| Age | Construction date and any significant renovations. |

| Market Trends | Analysis of recent sales and market fluctuations. |

Tax Rates and Calculations

Property taxes in Harris County are determined by multiplying the appraised value of a property by the applicable tax rate. These tax rates are set by various taxing entities, including the county government, city governments, school districts, and special districts.

Tax Rate Components

The tax rate, often referred to as the tax roll, is a combination of different tax rates imposed by each taxing entity. It is expressed in dollars per 100 of assessed value. For instance, a tax rate of 0.50 per 100 means that for every 100 of assessed property value, the owner will pay $0.50 in taxes.

| Taxing Entity | Tax Rate ($/100) |

|---|---|

| Harris County | $0.3740 |

| Houston ISD | $1.4133 |

| City of Houston | $0.3877 |

| Flood Control District | $0.0120 |

| Community College District | $0.1396 |

| Total Tax Rate | $2.3266 |

In the above example, a property with an appraised value of $200,000 would have a total tax liability of $4,653.20 ($200,000 x $2.3266/100). This calculation illustrates how the cumulative tax rates of different entities contribute to the overall property tax bill.

Payment Options and Deadlines

Harris County offers property owners several convenient payment options to settle their tax liabilities. Understanding these options and adhering to payment deadlines is crucial to avoid penalties and interest charges.

Online Payment Platforms

The Harris County Tax Office provides an online payment portal where property owners can make secure payments using credit cards, debit cards, or electronic checks. This platform offers real-time payment confirmation and allows taxpayers to access their payment history.

Traditional Payment Methods

Property owners can also pay their taxes through traditional methods, such as mailing a check or money order to the Harris County Tax Office. Additionally, payments can be made in person at the Tax Office or at authorized payment locations, including certain banks and retail stores.

| Payment Method | Description |

|---|---|

| Online Portal | Secure payment with instant confirmation. |

| Send check or money order to the Tax Office. | |

| In-Person | Visit the Tax Office or authorized payment locations. |

It is important to note that payment deadlines vary based on the method chosen. Online payments typically have a cutoff time, after which payments may be considered late. Mailing payments should allow sufficient time for delivery, and in-person payments should be made during regular business hours to avoid penalties.

Property Tax Appeals and Challenges

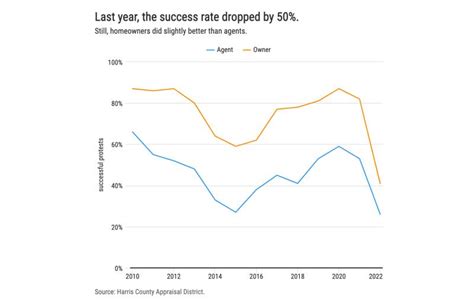

Property owners in Harris County have the right to appeal their property’s appraised value if they believe it is inaccurate or unfair. The appeal process is designed to ensure that property values are determined equitably and in accordance with the law.

Steps to Appeal

- Review your Notice of Appraised Value carefully. This notice provides details about your property’s appraised value and includes important deadlines.

- Identify the basis for your appeal. Common reasons include discrepancies in property characteristics, recent changes to the property, or a belief that the appraised value is significantly higher than similar properties in the area.

- Gather supporting documentation, such as recent property appraisals, photographs, or repair estimates.

- Submit your appeal to HCAD by the protest deadline, which is typically in late May or early June.

- Attend a hearing, if necessary, to present your case before an Appraisal Review Board (ARB) panel.

- If you are not satisfied with the ARB’s decision, you may appeal further to district court or binding arbitration.

Conclusion

Understanding the intricacies of Harris County property taxes is essential for property owners to effectively manage their tax obligations. From the appraisal process to payment options and appeals, each step requires careful consideration and timely action. By staying informed and proactive, property owners can ensure they are treated fairly and equitably under the tax system.

Frequently Asked Questions

How often does HCAD appraise properties in Harris County?

+

HCAD conducts mass appraisals annually to update property values based on market trends and other factors. This ensures that property taxes remain fair and equitable.

What happens if I miss the payment deadline for my property taxes?

+

Late payments may incur penalties and interest charges. It’s crucial to stay informed about payment deadlines to avoid additional costs.

Can I appeal my property’s appraised value if I disagree with it?

+

Yes, property owners have the right to appeal their appraised values. The process involves submitting a protest, attending a hearing, and potentially appealing further if needed.

Are there any exemptions or reductions available for property taxes in Harris County?

+

Harris County offers various exemptions, such as the Homestead Exemption, Over-65 Exemption, and Disability Exemption. These can reduce the taxable value of your property, lowering your tax liability.

How can I stay updated on changes to property tax laws and regulations in Harris County?

+

You can subscribe to updates from the Harris County Tax Office and HCAD to receive notifications about any changes or important deadlines.