Union Dues Tax Deductible

In the realm of financial planning and tax optimization, one often-discussed topic is the deductibility of union dues. Union members, particularly those in the United States, frequently inquire about the tax implications of their union fees. This article aims to delve into the intricacies of union dues and their tax status, offering a comprehensive guide to help individuals understand their financial obligations and potential deductions.

Understanding Union Dues and Their Purpose

Union dues are financial contributions paid by members to their respective labor unions. These dues serve as the primary source of funding for unions, enabling them to advocate for workers’ rights, negotiate better working conditions, and provide various member benefits. The amount of dues varies across unions and is typically calculated as a percentage of an individual’s earnings or a flat rate.

Unions play a crucial role in promoting collective bargaining, ensuring fair wages, and protecting the interests of their members. By contributing to these organizations, workers gain access to a range of services, including legal support, healthcare benefits, education programs, and retirement planning assistance.

The Tax Treatment of Union Dues

The tax deductibility of union dues is a subject that has undergone significant evolution over the years. Historically, union dues were considered tax-deductible business expenses for individuals working in certain professions, such as teachers, government employees, and skilled tradespeople. However, the Internal Revenue Service (IRS) has revised its guidelines, leading to a more nuanced understanding of the tax status of these contributions.

According to the IRS, union dues are now classified as miscellaneous itemized deductions, which means they are only deductible if they exceed a certain threshold. This threshold, known as the 2% adjusted gross income (AGI) floor, represents the minimum amount of eligible expenses an individual must have before they can claim a deduction. In simpler terms, an individual's total miscellaneous deductions must exceed 2% of their AGI to qualify for a tax deduction.

To illustrate this, consider an example. If an individual's AGI is $50,000, their miscellaneous deductions, including union dues, must exceed $1,000 ($50,000 x 0.02) to be eligible for a tax deduction. Any expenses below this threshold are not tax-deductible.

Calculating Union Dues Deduction

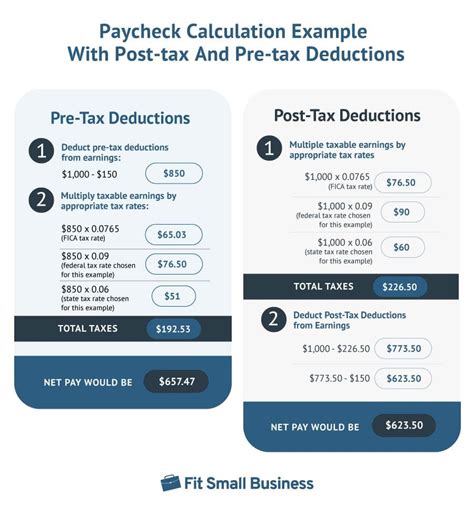

To determine the exact amount of union dues that can be deducted, individuals must first calculate their total miscellaneous deductions. This includes not only union dues but also other eligible expenses such as investment fees, tax preparation fees, and certain unreimbursed employee expenses.

Once the total miscellaneous deductions are calculated, they are compared to the 2% AGI threshold. If the total deductions exceed the threshold, the excess amount can be deducted on the individual's tax return. For instance, if an individual's total miscellaneous deductions amount to $1,500, and their AGI is $50,000, they can deduct $500 ($1,500 - $1,000) on their taxes.

Impact of the Tax Reform

It is important to note that the Tax Cuts and Jobs Act of 2017 brought significant changes to the deductibility of union dues and other miscellaneous itemized deductions. This reform eliminated the deduction for most miscellaneous itemized deductions, including union dues, for tax years 2018 through 2025. However, this provision is set to expire after 2025, potentially restoring the deductibility of union dues and other expenses.

Eligibility for Union Dues Deduction

Not all individuals are eligible to claim a deduction for their union dues. The eligibility criteria are tied to the individual’s tax filing status and their level of involvement with the union.

To be eligible for a union dues deduction, individuals must meet the following conditions:

- File their taxes using Form 1040 or Form 1040-SR (for seniors)

- Itemize their deductions on Schedule A

- Be a member of a recognized labor union

- Have paid their union dues during the tax year

It is crucial to note that individuals who claim the standard deduction, which is a fixed amount based on filing status and other factors, are not eligible to deduct union dues. The standard deduction is intended for individuals who have relatively low deductions and provides a simpler alternative to itemizing.

Filing for Union Dues Deduction

To claim the union dues deduction, individuals must carefully gather and organize their documentation. This includes:

- Receipts or statements showing the amount of union dues paid

- Information about the union, such as its name and address

- Details of any other miscellaneous deductions

- Calculation of the total miscellaneous deductions

Once the necessary information is gathered, individuals can proceed to fill out Schedule A of Form 1040. They will need to report their total miscellaneous deductions and compare them to the 2% AGI threshold. If the deductions exceed the threshold, the excess amount can be entered on Line 23 of Schedule A as an itemized deduction.

| Deduction Type | Eligible Expenses |

|---|---|

| Union Dues | Contributions to labor unions, including membership fees and assessments. |

| Investment Fees | Fees paid to financial advisors, brokerage commissions, and management fees. |

| Tax Preparation Fees | Costs associated with tax return preparation and filing. |

| Employee Expenses | Unreimbursed expenses related to employment, such as job search costs and work-related education. |

Alternatives to Union Dues Deduction

For individuals who are not eligible for the union dues deduction or prefer not to itemize their deductions, there are alternative strategies to consider. One option is to contribute to a Health Savings Account (HSA) or a Flexible Spending Account (FSA), which offer tax advantages for healthcare-related expenses.

Additionally, individuals can explore other tax-deductible expenses, such as contributions to charitable organizations, student loan interest, or mortgage interest. These deductions can help offset taxable income and potentially reduce an individual's tax liability.

Conclusion: Navigating Union Dues and Taxes

Understanding the tax implications of union dues is crucial for individuals to optimize their financial planning and maximize their tax benefits. While the deductibility of union dues has become more complex, it is still possible to claim a deduction under certain conditions. By carefully tracking their expenses and staying informed about tax regulations, individuals can make the most of their union dues and take advantage of potential tax savings.

As with any tax-related matter, it is advisable to consult with a tax professional or financial advisor to ensure compliance with the latest regulations and to receive personalized guidance based on individual circumstances.

Can I deduct union dues even if I’m not a union member?

+No, you must be a member of a recognized labor union to deduct union dues. Dues paid to other organizations or associations are not eligible for this deduction.

What if my union dues are deducted automatically from my paycheck?

+If your union dues are automatically deducted, you can still claim a deduction as long as you meet the eligibility criteria. Keep records of the deductions to support your claim.

Are there any limitations on the amount of union dues I can deduct?

+The amount of union dues you can deduct is subject to the 2% AGI floor. Any expenses exceeding this threshold can be deducted. It’s important to calculate your total miscellaneous deductions to determine the exact amount.