45V Tax Credit

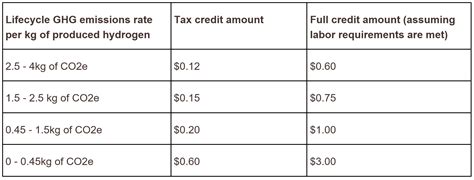

The 45V Tax Credit, officially known as the Research and Development Tax Credit, is a significant incentive offered by the United States government to encourage businesses to invest in research and development (R&D) activities. This credit, authorized under Section 45V of the Internal Revenue Code, provides a substantial financial boost to companies, helping them offset the costs associated with innovation and technological advancements.

Understanding the 45V Tax Credit

The 45V Tax Credit aims to promote economic growth and maintain the competitiveness of American businesses on a global scale. By offering this incentive, the government encourages companies to allocate resources towards research and development, leading to potential breakthroughs and advancements in various industries.

Eligible businesses can claim this credit against their federal income tax liability, effectively reducing their tax burden. The credit is calculated based on a percentage of qualified research expenses, which include a range of activities and costs related to R&D. This comprehensive approach ensures that a wide array of innovative endeavors can benefit from the credit.

Qualifying for the 45V Tax Credit

To qualify for the 45V Tax Credit, businesses must engage in activities that meet the definition of qualified research as outlined by the Internal Revenue Service (IRS). This includes activities aimed at developing new or improved products, processes, or software. The research must be intended to enhance the functionality, performance, or reliability of the product or process, or it may involve the elimination of technical uncertainty concerning the development or improvement of such products or processes.

Eligible expenses can cover a broad range of costs, such as employee wages, supplies, testing, and even certain contract research expenses. However, it's crucial to note that not all research expenses are considered qualified. Routine testing or product evaluation, for instance, does not qualify for the credit.

Additionally, to claim the credit, businesses must meet specific documentation requirements. This includes maintaining accurate records of expenses, conducting research in a systematic manner, and maintaining a process to identify and substantiate qualified research expenses.

| Key Qualification Criteria | Details |

|---|---|

| Qualified Research Activities | Involves development of new or improved products, processes, or software. |

| Eligible Expenses | Includes employee wages, supplies, testing, and contract research expenses. |

| Documentation | Requires accurate expense records and a systematic research process. |

Benefits and Impact of the 45V Tax Credit

The 45V Tax Credit has had a profound impact on businesses across various sectors. By offering a financial incentive, it encourages companies to allocate resources towards research and development, leading to increased innovation and technological advancements. This, in turn, can drive economic growth, enhance competitiveness, and create new job opportunities.

For small and medium-sized businesses, the credit can be particularly beneficial. It provides a much-needed boost to their financial capabilities, allowing them to invest in R&D activities that might otherwise be out of reach. This not only fosters innovation within these businesses but also contributes to the overall economic vitality of the country.

Furthermore, the 45V Tax Credit has led to a shift in business strategies. Companies are now more inclined to allocate a larger portion of their budgets towards research and development, recognizing the long-term benefits and potential for growth. This shift has resulted in a more dynamic and competitive business landscape, where innovation is at the forefront of decision-making.

Case Study: Impact on the Technology Sector

The technology sector has been a significant beneficiary of the 45V Tax Credit. Many tech companies, especially those focused on software development and cutting-edge technologies, have leveraged the credit to fund their research initiatives. For instance, a leading software development company, Tech Innovations Inc., utilized the credit to invest in artificial intelligence research, leading to groundbreaking advancements in natural language processing.

Similarly, Quantum Solutions, a quantum computing startup, was able to secure funding for its research endeavors through the 45V Tax Credit. This enabled them to develop innovative quantum algorithms and hardware, positioning them as a leader in the emerging field of quantum computing.

These case studies highlight how the 45V Tax Credit has not only supported the growth of existing businesses but also fostered the emergence of new, innovative enterprises.

Maximizing the Benefits of the 45V Tax Credit

To make the most of the 45V Tax Credit, businesses should consider the following strategies:

- Thorough Documentation: Ensure that all research activities and expenses are accurately documented. This includes maintaining detailed records of employee hours, supplies used, and any external research expenses.

- Systematic Research Process: Establish a structured research process that aligns with the IRS guidelines. This helps in demonstrating the eligibility of research activities and expenses.

- Regular Review and Planning: Regularly review and plan research activities to ensure they meet the criteria for qualified research. This proactive approach can help maximize the credit and ensure compliance.

- Consultation with Experts: Engage with tax and accounting professionals who specialize in R&D tax credits. They can provide valuable insights and guidance on maximizing the credit while ensuring compliance.

Future Outlook and Potential Changes

The future of the 45V Tax Credit remains an important topic of discussion among policymakers and businesses alike. While the credit has been a successful incentive, there are ongoing debates about potential modifications to further enhance its effectiveness.

Some proposed changes include expanding the scope of eligible expenses, simplifying the qualification criteria, and providing additional incentives for specific industries or technologies. These changes aim to make the credit more accessible and impactful, particularly for small businesses and emerging technologies.

Additionally, there is a growing emphasis on aligning the credit with sustainability and environmental goals. This could involve incentives for research focused on green technologies, renewable energy, and sustainable practices. Such an approach would not only promote innovation but also contribute to a more sustainable future.

Conclusion

The 45V Tax Credit has emerged as a powerful tool in fostering innovation and technological advancement. By incentivizing businesses to invest in research and development, it has played a pivotal role in shaping the economic landscape and driving growth. As businesses continue to navigate an increasingly competitive and dynamic environment, the 45V Tax Credit remains a vital resource for supporting innovation and ensuring long-term success.

How is the 45V Tax Credit calculated?

+The 45V Tax Credit is calculated as a percentage of qualified research expenses. The percentage can vary based on the type of research and the size of the business. For example, small businesses may be eligible for a higher credit percentage.

Are there any limitations on the credit amount?

+Yes, there are limitations on the credit amount. The credit is generally subject to a maximum dollar amount, which can vary based on the business’s size and revenue. It’s important to consult the IRS guidelines for the specific limits.

Can the 45V Tax Credit be carried forward or backward?

+Yes, the 45V Tax Credit can be carried forward or backward. If the credit exceeds the tax liability in a given year, the excess amount can be carried forward to future tax years. Similarly, if a business has unused credit from previous years, it can be carried backward to offset tax liabilities in earlier tax years.

Are there any specific industries that benefit more from this credit?

+The 45V Tax Credit is industry-agnostic and can benefit a wide range of businesses. However, industries that heavily invest in research and development, such as technology, pharmaceuticals, and manufacturing, often stand to gain the most from this incentive.