Sales Tax Milwaukee Wi

Sales tax in Milwaukee, Wisconsin, is an important aspect of doing business and understanding the local economy. It plays a significant role in shaping consumer behavior and the financial landscape of the city. This comprehensive guide will delve into the intricacies of sales tax in Milwaukee, providing valuable insights for businesses and consumers alike.

Understanding Milwaukee’s Sales Tax Landscape

Milwaukee, like many other cities in the United States, has a unique sales tax structure that combines state, county, and city taxes. This multi-tiered system can be complex, but it is essential for businesses to navigate accurately to comply with tax laws and ensure fair pricing for consumers.

The sales tax in Milwaukee consists of three main components: the state sales tax, the county sales tax, and the city sales tax. Each of these taxes contributes to the overall tax rate, which can vary depending on the type of goods or services being purchased.

State Sales Tax

The state of Wisconsin imposes a 5% sales tax on most tangible personal property and certain services. This tax is applied uniformly across the state and is a significant source of revenue for the state government. It is used to fund various public services and infrastructure projects.

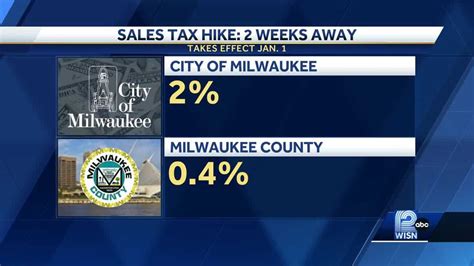

County Sales Tax

Milwaukee County, where Milwaukee city is located, levies an additional 0.5% sales tax on top of the state tax. This county tax helps support local initiatives and infrastructure specific to the county’s needs. It ensures that the community’s unique requirements are addressed effectively.

| State Sales Tax | County Sales Tax |

|---|---|

| 5% | 0.5% |

City Sales Tax

The city of Milwaukee imposes a 0.5% sales tax, bringing the total sales tax rate for the city to 6% for most items. This city tax is a critical revenue stream for the city government, helping fund essential services such as public safety, education, and urban development projects.

However, it's important to note that there are certain exemptions and special provisions within the city sales tax. For instance, some items like food for home consumption, prescription drugs, and certain medical devices are exempt from the city sales tax, making the effective rate 5.5% for these specific items.

| City Sales Tax | Effective Rate for Most Items | Effective Rate for Exempt Items |

|---|---|---|

| 0.5% | 6% | 5.5% |

Sales Tax Compliance and Reporting

Ensuring compliance with sales tax regulations is a critical aspect of running a business in Milwaukee. The Wisconsin Department of Revenue is responsible for overseeing sales tax collection and compliance, and businesses are required to register for a sales tax permit if they meet certain criteria.

Sales Tax Registration

Businesses that sell taxable goods or services in Milwaukee must register with the Wisconsin Department of Revenue to obtain a Sales and Use Tax Permit. This permit allows businesses to legally collect and remit sales tax on behalf of the state, county, and city.

The registration process typically involves providing basic business information, such as the business's legal name, physical address, and contact details. The Department of Revenue will then issue a unique permit number, which businesses must display prominently at their place of business.

Sales Tax Collection and Remittance

Once registered, businesses are responsible for collecting the appropriate sales tax from customers at the point of sale. This tax is then held in trust until it is remitted to the relevant taxing authorities.

The frequency of sales tax remittance depends on the business's sales volume and the regulations set by the Wisconsin Department of Revenue. Most businesses are required to remit sales tax on a monthly or quarterly basis. Failure to remit sales tax on time can result in penalties and interest charges.

Sales Tax Reporting

In addition to collecting and remitting sales tax, businesses must also file regular sales tax returns. These returns provide a detailed breakdown of the sales tax collected during a specific period. The information on these returns helps the Department of Revenue track tax collections and identify any discrepancies.

Sales tax returns are typically due at the same time as the remittance. The specific due dates and filing requirements can be obtained from the Wisconsin Department of Revenue's website or by consulting a tax professional.

Sales Tax Exemptions and Special Provisions

While most goods and services are subject to sales tax in Milwaukee, there are certain exemptions and special provisions that businesses and consumers should be aware of. These exemptions can significantly impact the overall sales tax burden.

Exempt Items

As mentioned earlier, certain items are exempt from the city sales tax in Milwaukee. These exempt items include:

- Food for home consumption

- Prescription drugs

- Certain medical devices

- Some agricultural products

- Select educational materials

It's important for businesses to clearly understand which items fall under these exemptions to avoid overcharging customers and to ensure compliance with tax regulations.

Special Provisions for Specific Industries

Certain industries or sectors may have unique sales tax provisions or rates. For instance, businesses engaged in manufacturing, agriculture, or wholesale trade may be subject to different tax rates or exemptions. It is crucial for businesses in these sectors to consult the specific guidelines provided by the Wisconsin Department of Revenue.

Sales Tax Holidays

In some cases, the state or local government may declare specific sales tax holidays. During these periods, certain items are exempt from sales tax, providing a boost to consumer spending. Sales tax holidays are often targeted towards back-to-school or holiday shopping seasons.

Businesses should stay informed about any upcoming sales tax holidays to take advantage of increased consumer demand and promote their products effectively.

Impact of Sales Tax on Businesses and Consumers

Sales tax in Milwaukee has a significant impact on both businesses and consumers. Understanding this impact can help businesses develop effective pricing strategies and consumers make informed purchasing decisions.

Impact on Businesses

For businesses, sales tax can be a significant factor in their overall financial planning and pricing strategy. Here are some key considerations:

- Pricing Strategy: Businesses must incorporate sales tax into their pricing to ensure they remain competitive while still covering their costs and making a profit. This can be a delicate balance, especially for small businesses.

- Compliance Costs: The cost of complying with sales tax regulations, including registration, reporting, and remittance, can be a burden for small businesses. These costs must be factored into the overall business plan.

- Sales Tax Registration and Management: Businesses need to dedicate time and resources to manage their sales tax obligations effectively. This includes staying updated on tax rates, exemptions, and filing requirements.

Impact on Consumers

Consumers in Milwaukee are directly impacted by sales tax in several ways:

- Price Transparency: Sales tax adds to the overall cost of goods and services, making it essential for consumers to understand the final price they will pay, including tax.

- Budgeting and Spending Decisions: Sales tax can influence consumers' purchasing decisions and budgeting. Higher sales tax rates may encourage consumers to seek out tax-free alternatives or shop in areas with lower tax rates.

- Sales Tax Awareness: Being aware of sales tax rates and exemptions can help consumers make more informed choices, especially when shopping for tax-exempt items or during sales tax holidays.

Future Implications and Trends

The sales tax landscape in Milwaukee, like any other city, is subject to change and evolution. Here are some potential future implications and trends to consider:

Potential Rate Changes

Sales tax rates can be adjusted by the state, county, or city to accommodate changing economic conditions or to fund specific initiatives. While the current rates are stable, businesses and consumers should stay informed about any proposed changes that could impact their operations or purchasing power.

Technology and Sales Tax

Advancements in technology, such as e-commerce and online sales, have introduced new challenges and opportunities for sales tax collection and compliance. Businesses that operate in the digital space must navigate complex tax regulations, especially when selling across state lines.

Consumer Behavior and Trends

Consumer behavior and preferences can influence the effectiveness of sales tax policies. For instance, the rise of online shopping and the preference for tax-free alternatives may impact the overall sales tax revenue and the city’s ability to fund public services.

Local Initiatives and Exemptions

Milwaukee may introduce new local initiatives or exemptions to support specific industries or promote economic development. These initiatives can provide tax incentives or reduced tax rates to attract businesses and stimulate the local economy.

Sales Tax Simplification

There is a growing movement towards simplifying sales tax regulations and making them more uniform across states. While this could provide some relief to businesses operating in multiple jurisdictions, it may also result in changes to the current sales tax structure in Milwaukee.

Conclusion

Understanding the sales tax landscape in Milwaukee is crucial for both businesses and consumers. It ensures compliance with tax regulations, helps businesses develop effective pricing strategies, and enables consumers to make informed purchasing decisions. By staying informed about sales tax rates, exemptions, and future trends, businesses and consumers can navigate the Milwaukee market with confidence.

What is the current sales tax rate in Milwaukee, Wisconsin?

+The current sales tax rate in Milwaukee is 6% for most items. However, certain items like food for home consumption, prescription drugs, and specific medical devices are exempt from the city sales tax, making the effective rate 5.5% for these items.

Are there any special provisions for businesses in Milwaukee regarding sales tax?

+Yes, certain industries or sectors may have unique sales tax provisions or rates. For example, businesses engaged in manufacturing, agriculture, or wholesale trade may be subject to different tax rates or exemptions. It is important for businesses to consult the specific guidelines provided by the Wisconsin Department of Revenue.

How often do businesses need to remit sales tax in Milwaukee?

+The frequency of sales tax remittance depends on the business’s sales volume and the regulations set by the Wisconsin Department of Revenue. Most businesses are required to remit sales tax on a monthly or quarterly basis. It is crucial to stay updated on the specific due dates and filing requirements.