Oakland Ca Sales Tax

When it comes to understanding sales tax in Oakland, California, there are a few key factors to consider. Sales tax rates can vary not only between states but also within different jurisdictions, making it essential for businesses and consumers alike to be well-informed about the tax landscape in their area. This article aims to provide an in-depth exploration of the sales tax system in Oakland, shedding light on its intricacies and implications.

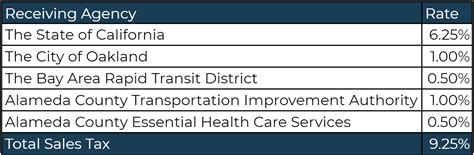

Understanding Oakland’s Sales Tax Structure

Sales tax in Oakland is a combination of state, county, and city taxes, with each level of government imposing its own rate. The state sales tax rate in California currently stands at 7.25%, one of the higher rates among U.S. states. On top of this, Oakland residents and businesses contribute to the Alameda County sales tax, which adds 1.125% to the total, bringing the county rate to 8.375%. But that’s not all – Oakland itself levies an additional 1.50% sales tax, resulting in a combined rate of 9.875% for all purchases made within city limits.

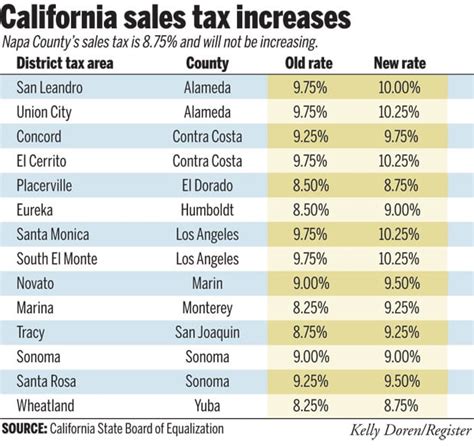

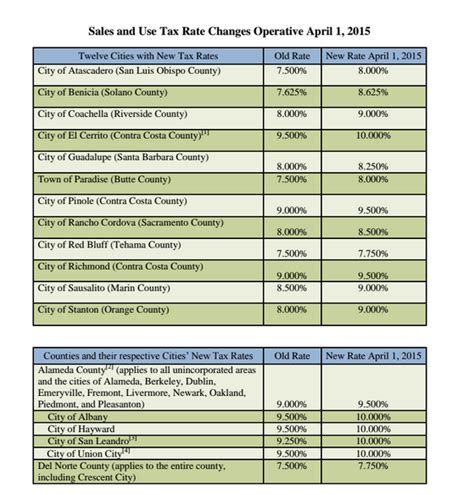

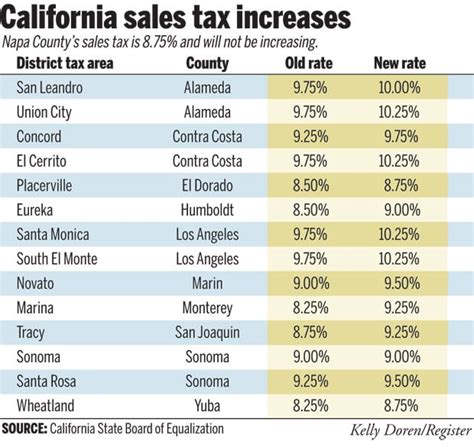

Comparison with Surrounding Areas

When compared to other cities in the San Francisco Bay Area, Oakland’s sales tax rate is relatively high. For instance, neighboring cities like Berkeley and Emeryville have a combined rate of 9.50%, while San Francisco stands at 8.50%. This disparity in rates can have a significant impact on consumer behavior and business operations, especially when considering the competitive nature of the retail industry.

| City | Sales Tax Rate |

|---|---|

| Oakland | 9.875% |

| Berkeley | 9.50% |

| Emeryville | 9.50% |

| San Francisco | 8.50% |

Impact on Businesses and Consumers

For businesses operating in Oakland, the high sales tax rate can pose challenges. It increases the overall cost of doing business, potentially affecting profit margins. Moreover, it can influence consumer purchasing decisions, as shoppers may opt to make larger purchases in areas with lower tax rates. This dynamic can lead to a loss of sales and revenue for Oakland-based businesses.

On the consumer side, the added tax burden can be a significant factor in shopping choices. Residents may choose to shop online or in nearby cities to avoid the higher tax rate, particularly for big-ticket items. This behavior can further exacerbate the impact on local businesses, creating a cycle that may be difficult to break.

Tax Exemptions and Special Considerations

While the sales tax rate in Oakland is substantial, there are certain exemptions and special cases that can provide relief to businesses and consumers alike. Understanding these nuances is crucial for navigating the tax landscape effectively.

Exemptions for Specific Goods and Services

California, and by extension Oakland, offers sales tax exemptions for a range of goods and services. These exemptions can provide significant savings for businesses and consumers, especially when purchasing items that are frequently used or have high price tags.

- Groceries and Food Products: Many staple food items, including produce, dairy, and bakery goods, are exempt from sales tax in California. This exemption can provide substantial savings for households and food-related businesses.

- Prescription Drugs: Sales tax is not applicable to prescription medications, offering a crucial relief for individuals with chronic health conditions and high medication costs.

- Clothing and Shoes: Clothing and footwear items priced under $100 are exempt from sales tax, providing a significant benefit for families and individuals on a budget.

- Educational Materials: Books, magazines, and other educational materials are generally exempt from sales tax, supporting the educational sector and making learning resources more affordable.

- Energy-Efficient Products: To encourage energy conservation, California offers sales tax exemptions for certain energy-efficient appliances and products, making sustainable living more accessible.

Special Considerations for Online Sales

With the rise of e-commerce, the sales tax landscape has become more complex, especially for online retailers. In Oakland, as in many other jurisdictions, there are specific rules and regulations governing online sales tax collection. Businesses selling goods online must comply with these rules, which can vary based on factors like the type of goods sold, the location of the buyer, and the seller’s physical presence in the state.

For instance, if an Oakland-based business sells goods online to a customer in another state, the sales tax rate applied may be different from Oakland's rate. This is because the tax rate is typically based on the location of the buyer, not the seller. As such, online retailers must be well-versed in the sales tax laws of various states to ensure compliance and avoid penalties.

Compliance and Reporting

Navigating the sales tax system in Oakland requires a deep understanding of the city’s tax laws and regulations. Businesses operating in the city must adhere to strict compliance and reporting guidelines to avoid penalties and maintain good standing with the tax authorities.

Sales Tax Registration and Permits

To collect and remit sales tax in Oakland, businesses must first obtain a Seller’s Permit from the California Department of Tax and Fee Administration (CDTFA). This permit allows businesses to legally collect and remit sales tax on behalf of the state and local governments. The application process typically involves providing detailed information about the business, including its legal structure, location, and expected sales volume.

In addition to the Seller's Permit, businesses may need to obtain other permits or licenses specific to their industry or the products they sell. For instance, alcohol and tobacco retailers require additional permits, while certain professional services may require licenses or certifications. Staying compliant with these requirements is essential to avoid legal issues and maintain a positive business reputation.

Sales Tax Calculation and Remittance

Calculating sales tax accurately is a critical aspect of compliance. Businesses must apply the correct tax rate to each sale, taking into account any applicable exemptions or special considerations. In Oakland, this involves applying the combined state, county, and city tax rates, which can be a complex task, especially for businesses with diverse product lines or services.

Once the sales tax has been calculated, businesses must remit the collected tax to the appropriate tax authorities within a specified timeframe. In California, sales tax returns are typically due monthly, quarterly, or annually, depending on the business's expected sales volume. Late or incorrect filings can result in penalties and interest charges, so it's crucial for businesses to stay on top of their reporting obligations.

Future Implications and Potential Changes

The sales tax landscape is dynamic, and Oakland, like many other cities, may see changes in its tax rates or regulations in the future. These changes can be influenced by a variety of factors, including economic conditions, political decisions, and shifts in consumer behavior.

Potential Rate Adjustments

While the current sales tax rate in Oakland is relatively stable, there is always the possibility of rate adjustments in the future. Rate increases or decreases can be proposed by local government bodies to address budgetary concerns or to incentivize certain behaviors, such as promoting local businesses or encouraging energy-efficient practices.

For instance, if the city of Oakland faces a budget shortfall, it may consider raising the sales tax rate to generate additional revenue. Conversely, if the city wants to stimulate economic growth, it might propose a temporary tax reduction to encourage consumer spending and business investment.

Technological Advancements and Tax Collection

Advancements in technology are also shaping the future of sales tax collection. With the increasing popularity of e-commerce and digital platforms, tax authorities are exploring new ways to track and collect sales tax from online transactions. This includes the use of data analytics and AI to identify and target non-compliant businesses, as well as the development of user-friendly tax collection systems for online retailers.

In Oakland, as in many other cities, the integration of technology into tax collection processes could streamline compliance for businesses and ensure a more equitable tax system. However, it also raises questions about privacy and the potential for overreach, highlighting the need for careful implementation and ongoing dialogue between tax authorities and stakeholders.

Conclusion

Understanding the sales tax system in Oakland is crucial for both businesses and consumers. The city’s relatively high sales tax rate, combined with a range of exemptions and special considerations, creates a complex tax landscape. Navigating this landscape effectively requires a deep understanding of the rules and regulations, as well as a commitment to compliance.

As Oakland and the surrounding Bay Area continue to evolve, the sales tax system will likely see changes and adaptations. Staying informed about these changes and their potential implications is essential for businesses and consumers to make informed decisions and navigate the tax landscape successfully.

Are there any sales tax holidays in Oakland, California?

+Yes, California occasionally offers sales tax holidays, during which certain purchases are exempt from sales tax. These holidays typically occur around major shopping events like back-to-school season or Black Friday. However, it’s important to note that not all cities in California participate, and Oakland’s participation may vary from year to year.

How often do sales tax rates change in Oakland?

+Sales tax rates can change annually or even more frequently, depending on various factors. These changes are typically proposed by local government bodies and are subject to approval. While major rate changes are relatively rare, small adjustments to account for inflation or other economic factors can occur more frequently.

What happens if a business fails to collect or remit sales tax in Oakland?

+Failure to collect or remit sales tax can result in significant penalties and interest charges. Businesses found to be non-compliant may also face legal consequences, including fines, revocation of business licenses, and even criminal charges in severe cases. It’s crucial for businesses to stay informed about their sales tax obligations and comply with all reporting requirements.

Are there any online resources for businesses to stay updated on Oakland’s sales tax laws and regulations?

+Yes, the California Department of Tax and Fee Administration (CDTFA) provides a wealth of resources and guidance for businesses on its website. This includes information on sales tax rates, registration requirements, reporting deadlines, and more. It’s a valuable resource for businesses to stay informed and compliant with Oakland’s sales tax laws.