Wi Tax Refund

Welcome to this comprehensive guide on the Wi Tax Refund, a valuable initiative that offers a financial respite to eligible residents of the state of Wisconsin. In this article, we will delve into the intricacies of this tax refund program, exploring its benefits, eligibility criteria, and the process of claiming your refund. Whether you're a seasoned taxpayer or new to the state, understanding the Wi Tax Refund can help you maximize your financial returns and navigate the complexities of state taxation with ease.

Understanding the Wi Tax Refund Program

The Wi Tax Refund is an annual initiative launched by the Wisconsin Department of Revenue to provide tax relief to its residents. This program aims to support individuals and families by offering a refund on certain taxes paid throughout the year. The refund amounts can vary depending on various factors, including income level, family size, and specific tax credits available.

This program plays a crucial role in the state's tax system, promoting financial equity and ensuring that taxpayers receive a portion of their contributions back. It serves as a vital tool for Wisconsin's residents to manage their finances effectively and plan for the future.

Key Benefits of the Wi Tax Refund

- Financial Relief: The primary benefit of the Wi Tax Refund is the opportunity to receive a substantial refund, providing much-needed financial relief to taxpayers. This refund can be a significant boost to household budgets, helping individuals and families cover essential expenses or save for future goals.

- Tax Credit Accessibility: The program incorporates various tax credits, such as the Earned Income Tax Credit and the Child and Dependent Care Credit, which can significantly reduce tax liabilities. These credits are particularly beneficial for low- to moderate-income earners, making the tax system more equitable.

- Encouraging Tax Compliance: By offering refunds, the Wi Tax Refund program incentivizes taxpayers to comply with state tax regulations. This initiative ensures that residents understand the importance of accurate tax reporting and encourages timely filing, contributing to a more efficient tax system.

Eligibility Criteria

Not all Wisconsin residents are eligible for the Wi Tax Refund. The program has specific criteria that determine who can benefit from this initiative. Understanding these criteria is essential to determine your eligibility and plan your tax strategy accordingly.

To be eligible for the Wi Tax Refund, individuals must meet the following requirements:

- Residency: Applicants must be legal residents of the state of Wisconsin for the entire tax year. Temporary residents or those with a primary residence in another state may not qualify.

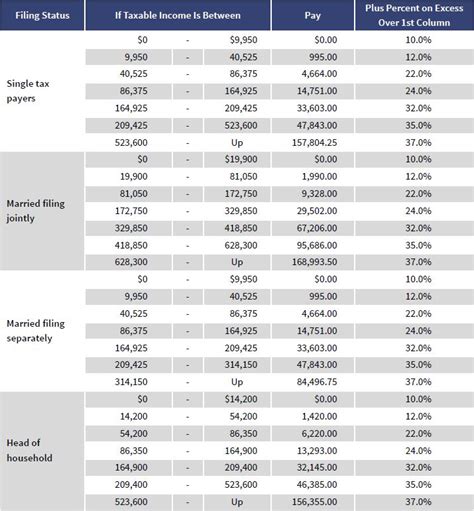

- Income Level: The income level is a critical factor in determining eligibility. Generally, the program is designed to benefit low- and moderate-income earners. Specific income thresholds are set annually, and individuals must fall within these limits to qualify.

- Tax Filing Status: The tax filing status, whether single, married filing jointly, or head of household, can impact eligibility. Different thresholds apply to each filing status, so it's crucial to understand which category you fall into.

- Dependents: The number of dependents claimed on your tax return can also affect your eligibility. The Wi Tax Refund program considers the number of qualifying children or other dependents you support.

How to Claim Your Wi Tax Refund

Claiming your Wi Tax Refund is a straightforward process, but it requires attention to detail to ensure you receive the maximum benefit. Here’s a step-by-step guide to help you navigate the process:

- Gather Necessary Documents: Before you begin, collect all relevant documents, including your social security number, proof of Wisconsin residency, and financial records. These documents will be crucial for accurate tax filing.

- Choose Your Filing Method: Wisconsin taxpayers have the option to file their taxes electronically or by mail. Electronic filing is often the preferred method, as it's faster and more secure. Ensure you have the necessary software or access to online filing platforms.

- Complete Your Tax Return: Carefully fill out your tax return, ensuring accuracy in reporting your income, deductions, and credits. Take advantage of the available tax credits, such as the Earned Income Tax Credit and the Child and Dependent Care Credit, to maximize your refund.

- Submit Your Return: Once your tax return is complete, submit it through the chosen filing method. Electronic filing provides instant confirmation of receipt, while mailed returns may take longer to process.

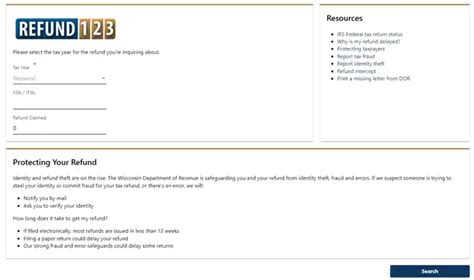

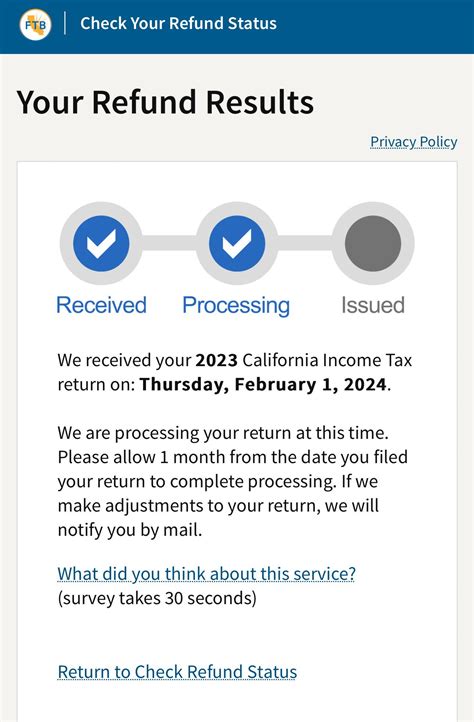

- Track Your Refund: After submitting your return, you can track the status of your Wi Tax Refund using the Wisconsin Department of Revenue's online tools. This feature provides real-time updates on the progress of your refund.

- Receive Your Refund: Once your tax return is processed, and your eligibility is confirmed, you will receive your refund. The method of payment may vary, including direct deposit, check, or a state-issued debit card.

Maximizing Your Wi Tax Refund

Maximizing your Wi Tax Refund involves careful tax planning and an understanding of the available tax credits and deductions. Here are some strategies to consider:

- Claim All Applicable Credits: Review the list of available tax credits, such as the Earned Income Tax Credit, Child Tax Credit, and Child and Dependent Care Credit. Ensure you meet the eligibility criteria and claim these credits to reduce your tax liability.

- Optimize Your Deductions: Take advantage of deductions to lower your taxable income. Common deductions include student loan interest, medical expenses, and charitable contributions. Consult a tax professional to explore all available deductions.

- File on Time: Timely filing is crucial to avoid penalties and ensure prompt processing of your refund. Set a reminder to file your taxes before the deadline to avoid any delays.

- Consider Professional Help: If you have a complex tax situation or are unsure about claiming certain credits or deductions, consider seeking assistance from a tax professional. They can provide personalized advice to maximize your refund.

Real-Life Success Stories

The impact of the Wi Tax Refund program is best understood through the stories of those who have benefited from it. Here are a few real-life success stories from Wisconsin residents:

| Name | Refund Amount | Impact |

|---|---|---|

| Sarah Miller | $1,200 | Sarah, a single mother of two, used her refund to pay for her children's summer camp and cover unexpected medical expenses. |

| John Wilson | $850 | John, a recent college graduate, utilized his refund to make a down payment on his first car, enabling him to commute to his new job. |

| Emily Johnson | $600 | Emily, a small business owner, invested her refund in new equipment for her bakery, helping her business grow and serve more customers. |

These stories illustrate the tangible impact of the Wi Tax Refund program, showcasing how it empowers individuals to achieve their financial goals and support their communities.

Future Implications and Developments

The Wi Tax Refund program is an evolving initiative, and its future holds potential for further enhancements. As the state’s tax system adapts to changing economic landscapes and emerging challenges, the program may see adjustments to eligibility criteria, refund amounts, and the inclusion of new tax credits.

The Wisconsin Department of Revenue continuously evaluates the program's effectiveness and considers feedback from taxpayers and stakeholders. This ongoing review process ensures that the Wi Tax Refund remains a valuable tool for financial relief, fostering a more equitable and prosperous Wisconsin.

Conclusion

The Wi Tax Refund is a vital component of Wisconsin’s tax system, offering financial relief and promoting tax equity. By understanding the program’s benefits, eligibility criteria, and the process of claiming your refund, you can navigate the state’s tax landscape with confidence. Remember, this program is designed to support you, so take advantage of the available tax credits and deductions to maximize your refund and plan for a brighter financial future.

FAQ

How often can I receive the Wi Tax Refund?

+

The Wi Tax Refund is an annual program, meaning you can claim a refund once per tax year. However, the amount of your refund may vary annually based on your income, tax credits, and other factors.

Are there any income restrictions for the Wi Tax Refund?

+

Yes, there are income restrictions. The program is designed to benefit low- and moderate-income earners. The specific income thresholds are set annually and vary based on your filing status and the number of dependents you claim.

Can I file my taxes electronically for the Wi Tax Refund?

+

Absolutely! Wisconsin taxpayers have the option to file their taxes electronically, which is often faster and more secure than traditional mail filing. Ensure you have the necessary software or access to online filing platforms.

What if I miss the filing deadline for the Wi Tax Refund?

+

Missing the filing deadline may result in penalties and delays in receiving your refund. It’s essential to file your taxes on time to avoid any complications. If you cannot meet the deadline, consider requesting an extension to buy yourself some time.

How can I track the status of my Wi Tax Refund?

+

You can track the status of your Wi Tax Refund using the Wisconsin Department of Revenue’s online tools. These tools provide real-time updates on the progress of your refund, helping you stay informed and manage your expectations.