Washington State Retail Tax

The Washington State Retail Tax is a critical component of the state's revenue system, playing a significant role in funding essential public services and infrastructure. This tax, often referred to as the Sales and Use Tax, is levied on the retail sale or rental of tangible personal property and certain services within the state. With a unique tax structure and some interesting exemptions, understanding the Washington State Retail Tax is crucial for both businesses and consumers alike.

Understanding the Washington State Retail Tax

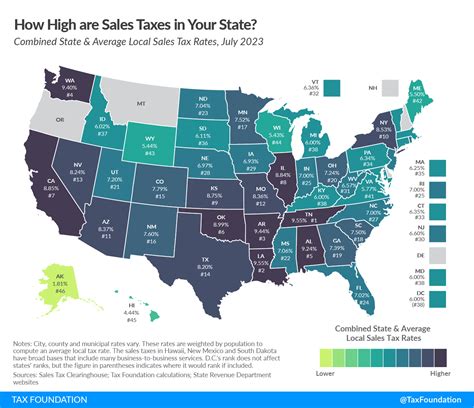

The retail tax in Washington operates on a multi-jurisdictional basis, with taxes collected at the state, county, and municipal levels. The tax rate varies depending on the location of the transaction, with some areas having additional local taxes. For instance, the combined state and local sales tax rates can range from 7.50% to 10.40% across the state.

One of the distinctive features of Washington's retail tax is its "privilege tax" nature. This means that it is levied on the privilege of engaging in business activities within the state, rather than on the goods or services themselves. As such, the tax is often seen as a cost of doing business in Washington.

Washington's retail tax is administered by the Washington State Department of Revenue, which provides guidelines and resources to help businesses and consumers understand their tax obligations. The department offers a range of tools, including tax rate look-up services and tax calculators, to assist with compliance.

Taxable Goods and Services

In Washington, the retail tax generally applies to the sale or rental of tangible personal property, such as clothing, electronics, and furniture. It also covers certain services, including admission to entertainment events, amusement park tickets, and lodging. Additionally, some professional services, like accounting and legal services, are subject to the retail tax.

However, it's important to note that Washington has a broad range of exemptions and exclusions from the retail tax. These exemptions are designed to support specific industries, promote economic development, and encourage certain behaviors. For example, certain food products, prescription medications, and manufacturing machinery are exempt from the retail tax.

| Taxable Item | Tax Rate |

|---|---|

| Clothing and Accessories | 7.50% - 10.40% |

| Electronics | 7.50% - 10.40% |

| Admission to Events | 7.50% - 10.40% |

| Legal Services | 7.50% - 10.40% |

Retail Tax Exemptions and Refunds

Washington offers a variety of retail tax exemptions and refunds to eligible entities. These include exemptions for certain nonprofit organizations, manufacturers, and farmers, as well as refunds for sales tax paid on purchases made outside the state and brought into Washington.

For instance, nonprofit organizations that qualify as charitable, religious, or educational entities may be exempt from paying retail tax on certain purchases. This exemption helps these organizations reduce their operating costs and focus more on their core missions.

Similarly, manufacturers and farmers often qualify for exemptions or refunds on certain purchases, such as machinery and equipment used in production. These exemptions are designed to support these industries, which are vital to Washington's economy.

| Exemption Type | Eligible Entities |

|---|---|

| Nonprofit Exemption | Charitable, Religious, Educational Organizations |

| Manufacturer's Exemption | Manufacturing Businesses |

| Farmers' Exemption | Agricultural Producers |

Compliance and Reporting

Ensuring compliance with Washington’s retail tax laws is a critical responsibility for businesses operating in the state. The Washington State Department of Revenue provides comprehensive guidelines and resources to assist businesses in understanding their tax obligations.

Businesses are required to register with the Department of Revenue to obtain a Business License and a Sales and Use Tax Permit. These permits enable businesses to collect and remit the appropriate taxes on their sales.

Sales Tax Collection and Remittance

Businesses are responsible for collecting the applicable retail tax at the point of sale and remitting these taxes to the Department of Revenue. The frequency of remittance varies depending on the business’s tax liability, with options ranging from monthly to annually.

To assist businesses in managing their tax obligations, the Department of Revenue offers a range of resources, including online filing and payment systems, tax rate lookup tools, and guidance on tax exemptions and credits.

Record-Keeping and Audits

Proper record-keeping is essential for businesses to demonstrate compliance with Washington’s retail tax laws. Businesses must maintain records of sales, purchases, and tax payments for at least four years. These records should include invoices, receipts, and tax returns.

The Department of Revenue conducts audits to ensure compliance with tax laws. Audits may be triggered by a variety of factors, including random selection, a history of non-compliance, or a specific complaint. During an audit, businesses must provide access to their records and cooperate with the auditors.

Impact on Businesses and Consumers

Washington’s retail tax has a significant impact on both businesses and consumers within the state. For businesses, the tax is a cost of doing business, and proper management of these obligations is crucial for financial health and compliance.

From a consumer perspective, the retail tax adds to the cost of goods and services. However, the varying tax rates across the state can provide opportunities for strategic shopping, with some areas offering lower tax rates than others.

Strategies for Businesses

Businesses operating in Washington can employ several strategies to manage their retail tax obligations effectively. These include leveraging tax exemptions and credits, implementing robust record-keeping systems, and staying informed about changes to tax laws and rates.

For example, a business that manufactures products may be able to reduce its tax liability by taking advantage of the manufacturer's exemption. Similarly, a business that sells products online and in-store may need to consider the varying tax rates across the state and ensure they are collecting the correct amount of tax for each transaction.

Consumer Considerations

For consumers, understanding the retail tax landscape in Washington can help them make informed purchasing decisions. While the tax adds to the cost of goods and services, consumers can take advantage of the varying tax rates across the state by shopping in areas with lower rates.

Additionally, consumers can explore opportunities to reduce their tax burden, such as by purchasing tax-exempt items or taking advantage of sales tax holidays, which are occasional periods when certain types of purchases are exempt from the retail tax.

Future Implications and Changes

As with any tax system, Washington’s retail tax is subject to potential changes and updates. These changes can be driven by a variety of factors, including shifts in the state’s economic landscape, changes in consumer behavior, and legislative actions.

Potential Future Changes

One potential area of change is the expansion of retail tax exemptions. As the state’s economy evolves, there may be calls to support certain industries or behaviors through additional exemptions or credits. For instance, the state could consider expanding exemptions for green energy products or services to encourage environmental sustainability.

Another area of potential change is the implementation of new technologies for tax collection and compliance. As digital commerce continues to grow, the state may explore options for automating tax collection and reporting, which could simplify compliance for businesses and improve tax revenue collection.

Impact on Businesses and Consumers

Changes to Washington’s retail tax system can have significant implications for both businesses and consumers. For businesses, changes in tax rates or exemptions can impact their cost structures and financial planning. Additionally, new compliance requirements or technological implementations may require businesses to adapt their systems and processes.

Consumers, on the other hand, may see changes in the prices of goods and services as a result of tax rate adjustments or the introduction of new taxes. However, they may also benefit from expanded exemptions or tax holidays, which can reduce their overall tax burden.

What is the current retail tax rate in Washington State?

+The current retail tax rate in Washington State varies depending on the location of the transaction, with state and local tax rates combined ranging from 7.50% to 10.40%.

Are there any exemptions from the retail tax in Washington?

+Yes, Washington offers a range of exemptions, including for nonprofit organizations, manufacturers, and farmers. These exemptions are designed to support specific industries and behaviors.

How often do businesses need to remit retail taxes in Washington?

+The frequency of remittance varies depending on the business’s tax liability. Businesses can remit taxes monthly, quarterly, semi-annually, or annually, depending on their sales volume and tax obligations.

What happens if a business fails to collect or remit retail taxes in Washington?

+Businesses that fail to collect or remit retail taxes in Washington may face penalties, interest charges, and potential legal consequences. It is crucial for businesses to understand and comply with their tax obligations to avoid these issues.