City Of Cincinnati Income Tax

The City of Cincinnati, Ohio, is known for its vibrant culture, diverse economy, and a unique municipal tax system that sets it apart from many other cities. The Cincinnati Income Tax is a significant component of the city's revenue generation and has been a subject of interest and curiosity for both residents and businesses. This article delves into the intricacies of the Cincinnati Income Tax, exploring its history, impact on the local economy, and the experiences of those who navigate this tax system.

A Brief History of the Cincinnati Income Tax

The roots of the Cincinnati Income Tax can be traced back to the 1930s, a period marked by the Great Depression and its profound economic challenges. The city, like many others, faced significant financial strains and sought innovative ways to generate revenue. In 1932, Cincinnati implemented a municipal income tax as a means to bolster its finances and provide a more stable source of income for essential city services.

This tax system, initially designed as a temporary measure, proved to be remarkably resilient. Over the decades, it evolved and adapted to the changing economic landscape, becoming a permanent fixture in Cincinnati's fiscal framework. Today, the Cincinnati Income Tax is a well-established and integral part of the city's financial strategy, contributing significantly to its overall revenue stream.

The tax has not only been a source of financial stability but has also influenced the city's economic policies and development strategies. It has played a pivotal role in shaping Cincinnati's economic landscape, impacting business growth, job creation, and the overall financial health of the community.

Evolution of Tax Rates

Since its inception, the Cincinnati Income Tax has undergone several revisions and adjustments to its tax rates. The initial rate, implemented in the 1930s, was 1% for both individuals and businesses. Over the years, these rates have fluctuated based on the city’s budgetary needs and economic conditions.

| Year | Individual Rate | Business Rate |

|---|---|---|

| 1932 | 1% | 1% |

| 1970 | 1.8% | 1.8% |

| 2004 | 2.1% | 1.4% |

| Current | 2.1% | 1.8% |

The table above highlights the evolution of tax rates over the years, showing the increase in individual rates while keeping business rates relatively stable. These changes have been a result of careful consideration by the city's leadership, aiming to strike a balance between generating revenue and maintaining a competitive business environment.

Understanding the Cincinnati Income Tax System

The Cincinnati Income Tax operates under a progressive tax structure, meaning that higher income earners are taxed at a higher rate. This approach aims to ensure fairness and equity in the tax system, where those with greater financial means contribute proportionally more to the city’s revenue.

Taxable Income and Exemptions

The tax is levied on all income earned within the city limits, including wages, salaries, commissions, bonuses, and other forms of compensation. However, certain types of income are exempt from taxation, such as Social Security benefits, some types of pension income, and certain types of investment income.

Cincinnati also offers a personal exemption of $100 for each taxpayer, which reduces the taxable income for individuals. Additionally, residents who work outside the city limits can claim a credit for taxes paid to other municipalities, ensuring that they are not double-taxed on their income.

Registration and Compliance

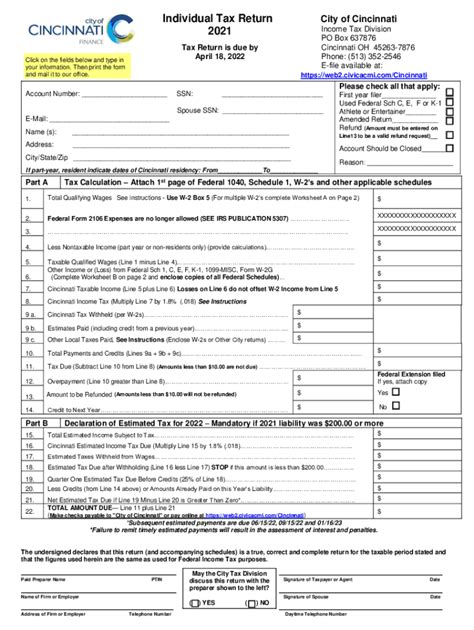

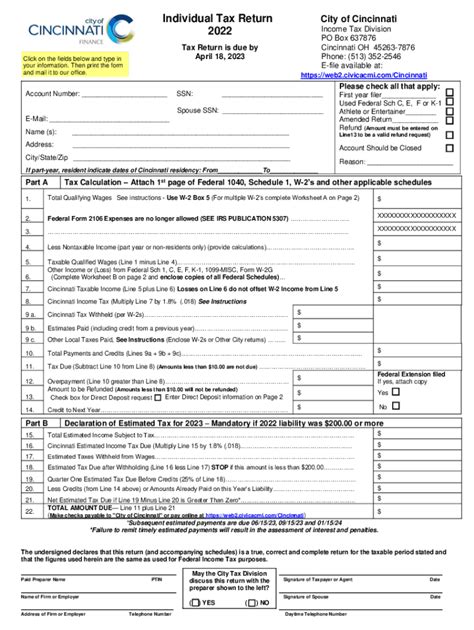

Businesses and individuals operating within Cincinnati are required to register with the city’s tax department and obtain a tax identification number. This process ensures that the city has accurate records of all taxable entities and can effectively administer the tax system.

Compliance with the Cincinnati Income Tax is monitored through a combination of self-reporting and audits. Taxpayers are responsible for accurately reporting their income and calculating their tax liability. The city's tax department conducts periodic audits to ensure compliance and may impose penalties for non-compliance or underreporting.

Impact on Cincinnati’s Economy

The Cincinnati Income Tax has a profound impact on the city’s economy, influencing business decisions, job creation, and the overall financial health of the community.

Attracting and Retaining Businesses

The tax system plays a crucial role in attracting and retaining businesses within the city limits. While the tax rates are a consideration for businesses, Cincinnati’s overall business environment, including its skilled workforce, infrastructure, and access to markets, often outweighs the tax burden.

The city has implemented various incentives and tax abatements to encourage business growth and job creation. These measures, combined with a well-managed tax system, have contributed to Cincinnati's reputation as a desirable location for businesses, fostering economic development and innovation.

Supporting Essential City Services

A significant portion of the revenue generated from the Cincinnati Income Tax is allocated towards funding essential city services. These include public safety, education, infrastructure maintenance, and social services, which are vital for the well-being and prosperity of the community.

By providing a stable and reliable source of income, the tax system ensures that the city can effectively plan and deliver these critical services, contributing to the overall quality of life for residents.

Economic Equity and Social Justice

The progressive nature of the Cincinnati Income Tax aligns with principles of economic equity and social justice. By taxing higher-income earners at a higher rate, the system helps to redistribute wealth and resources, supporting initiatives that benefit the entire community, including those who may be economically disadvantaged.

This approach has been instrumental in addressing income inequality and ensuring that the benefits of economic growth are shared more equitably across the city.

Resident and Business Experiences

The Cincinnati Income Tax system impacts the lives of residents and businesses in various ways, shaping their financial decisions and interactions with the city’s tax department.

Resident Perspectives

For residents, the Cincinnati Income Tax is a reality that they navigate annually. While some may view it as a necessary contribution to the city’s prosperity, others may perceive it as a financial burden, especially for those with lower incomes.

However, the tax system also offers benefits to residents. For instance, the city's investment in public services, such as improved infrastructure and enhanced public safety, directly impacts the quality of life for residents. Additionally, the progressive nature of the tax means that those with higher incomes contribute more, potentially alleviating some of the financial strain on lower-income earners.

Business Insights

Businesses operating within Cincinnati have a unique perspective on the city’s tax system. While the tax may add to their operational costs, many businesses appreciate the stability and predictability it brings to the city’s fiscal landscape.

The tax system's progressive nature and the availability of tax incentives and abatements can make Cincinnati an attractive location for businesses, especially those looking to expand or relocate. These factors contribute to a business-friendly environment, fostering growth and innovation within the city's economy.

Navigating the Tax System

Both residents and businesses have access to resources and support to help them navigate the Cincinnati Income Tax system. The city’s tax department provides comprehensive guidelines, forms, and online tools to assist with tax filing and compliance.

Additionally, tax professionals and accounting firms in the city specialize in helping individuals and businesses manage their tax obligations, offering guidance on tax planning, deductions, and credits. These resources ensure that taxpayers can effectively manage their tax liabilities and maximize the benefits of the system.

Future Implications and Potential Reforms

As Cincinnati continues to evolve and adapt to changing economic conditions, the future of its income tax system is a topic of ongoing discussion and consideration.

Economic Growth and Development

The city’s economic growth and development strategies will significantly impact the future of the Cincinnati Income Tax. As the city attracts new businesses and fosters innovation, the tax system will need to adapt to support these changes while maintaining a stable revenue stream.

Potential reforms could include adjustments to tax rates, the introduction of new tax incentives, or the exploration of alternative revenue streams to complement the income tax. These measures aim to ensure that the tax system remains competitive, equitable, and responsive to the city's evolving needs.

Equity and Social Justice Considerations

The progressive nature of the Cincinnati Income Tax has been a key driver in addressing income inequality and promoting social justice. However, as the city’s demographics and economic landscape shift, ongoing evaluations of the tax system’s effectiveness in achieving these goals are necessary.

Future reforms may involve re-evaluating tax rates, exploring new approaches to tax relief for low-income earners, or implementing initiatives to further enhance economic equity. These considerations aim to ensure that the tax system remains a tool for promoting fairness and social justice within the community.

Technological Advancements and Tax Administration

Advancements in technology are likely to shape the future of tax administration in Cincinnati. The city can leverage digital tools and platforms to enhance tax compliance, streamline the filing process, and improve overall efficiency.

By embracing technological innovations, the city's tax department can provide more accessible and user-friendly services, reducing the administrative burden on taxpayers and potentially improving overall compliance rates.

What is the current tax rate for individuals and businesses in Cincinnati?

+

The current tax rate for individuals is 2.1%, while the rate for businesses is 1.8%. These rates are set by the city and may be subject to change based on budgetary needs and economic conditions.

How does Cincinnati’s income tax compare to other cities in Ohio?

+

Cincinnati’s income tax rates are relatively competitive compared to other major cities in Ohio. While rates may vary across municipalities, Cincinnati’s rates are generally in line with or slightly higher than its peers. However, it’s important to note that tax systems and rates can differ significantly between cities, so it’s beneficial to research and compare tax structures when considering a move or business expansion.

Are there any tax incentives or abatements available for businesses in Cincinnati?

+

Yes, Cincinnati offers a range of tax incentives and abatements to encourage business growth and development. These incentives can include tax credits, abatements on property taxes, and grants for specific industries or projects. Businesses should consult with the city’s economic development office or tax department to explore the available options and determine their eligibility.

How can residents and businesses stay updated on changes to the Cincinnati Income Tax system?

+

The City of Cincinnati provides regular updates and notifications regarding changes to the income tax system. Residents and businesses can stay informed by visiting the city’s official website, subscribing to email updates from the tax department, or following relevant news sources that cover local tax matters. Additionally, attending community meetings or workshops hosted by the city can provide valuable insights into ongoing tax-related discussions and initiatives.

What resources are available for taxpayers who need assistance with their Cincinnati Income Tax obligations?

+

The City of Cincinnati offers various resources to assist taxpayers with their income tax obligations. This includes detailed guidelines and forms available on the city’s website, as well as a dedicated helpline for tax-related inquiries. Additionally, tax professionals and accounting firms in the city can provide personalized assistance and support to ensure compliance and optimize tax strategies.