Investing In The World's Largest Submarine: Costs, Roi, And Risks

Investing In The World’s Largest Submarine: Costs, ROI, And Risks

The decision to pursue the World’s Largest Submarine as a flagship asset combines frontier engineering with long-horizon capital allocation. This article outlines the major cost drivers, the potential return on investment (ROI), and the principal risks involved. By unpacking capital outlays, operating expenses, and strategic value, readers can form a grounded view of whether such a program fits their portfolio or organizational mission.

Key Points

- Estimating construction costs for the World's Largest Submarine involves multipliers for hull complexity, propulsion systems, and stealth features, often placing the project in the multi-billion-dollar range.

- ROI hinges on a mix of defense contracts, long-term maintenance partnerships, and technology licensing, rather than simple sales revenue alone.

- Technical risk is high due to unprecedented scale, integration challenges, and the need for reliable underwater endurance in demanding environments.

- Regulatory and export-control considerations can affect suppliers, collaboration, and timeline; governance structures should mitigate bottlenecks.

- Lifecycle costs—crewing, overhauls, parts supply, and upgrades—can erode returns if not calibrated with phased funding and predictable budgets.

Costs And Investment Horizon

The upfront outlays for the World’s Largest Submarine encompass design validation, specialized fabrication, propulsion systems, and launch testing. Planning must account for potential supply-chain volatility, inflation, and currency exposure when sourcing from multiple regions. Beyond capex, ongoing operating expenses cover crew salaries, maintenance cycles, software updates, and periodic system overhauls that extend the asset’s life and capabilities.

Capital Costs

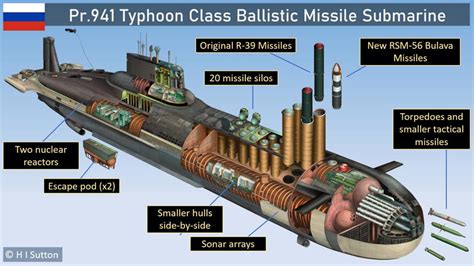

Capital expenditure typically dominates early-stage budgeting. Factors driving these costs include large-scale hull fabrication, advanced propulsion and energy storage, quieting and sensor suites, and deep-water testing facilities. Financing strategies often combine public funding, public-private partnerships, and long-duration debt instruments designed to align with the asset’s multi-decade service life.

Lifecycle And Operating Costs

Operating costs span crew training, routine maintenance, spare parts, and mission support logistics. Projections should incorporate contingency reserves for major overhauls, software refresh cycles, and potential retrofits to address evolving threat environments and regulatory changes.

ROI And Strategic Value

ROI for such a high-value asset blends tangible financial returns with strategic influence. While direct revenue from deployments or licenses may be limited, the asset can generate worth through deterrence, allied interoperability, and access to cutting-edge research. A rigorous ROI model weighs anticipated contracts, technology licensing opportunities, and the value of long-term partnerships that enhance force readiness and regional influence.

Financial Return Scenarios

Best-case scenarios assume stable defense budgets, predictable contract pipelines, and timely license revenue. Moderate scenarios model delays or cost overruns, while worst-case scenarios consider significant regulatory hurdles or reduced demand. Sensitivity analysis on discount rates, contract timing, and maintenance costs helps stakeholders understand potential outcomes.

Risks And Mitigation

Investing in the World’s Largest Submarine carries substantial risk across technical, regulatory, and market dimensions. Effective mitigation relies on staged development, independent reviews, and flexible procurement strategies that accommodate design changes without derailing overall budgets.

Technical Risks

Unprecedented scale can introduce hull integrity concerns, propulsion integration challenges, and sensor-system compatibility issues. Early prototyping, accelerated test programs, and modular design approaches help identify and address issues before full-scale production.

Regulatory And Geopolitical Risks

Export controls, international sanctions, and treaty constraints may constrain collaboration and technology sharing. A diversified supplier network and clear governance frameworks reduce exposure to single-point failures.

Market And Demand Risks

Shifts in defense priorities, budget reallocations, or changing geopolitical risk assessments can affect anticipated revenue streams and partnerships. Scenario planning supports investment pacing aligned with risk tolerance and strategic objectives.

What is the estimated cost range for building the World's Largest Submarine?

+

Estimates for a project of this scale typically fall in the multi-billion-dollar territory, with the final figure highly sensitive to hull design, propulsion architecture, weapons and sensor suites, testing infrastructure, and timeline-driven cost escalations.

How is ROI measured for a submarine program of this nature?

+ROI combines direct contract value and licensing potential with strategic benefits like deterrence, interoperability with allies, and accelerated access to advanced technologies. A robust model uses scenario analysis, long-term cost of ownership, and probabilistic outcomes to capture both financial and strategic returns.

What are the top risks, and how can they be mitigated?

+Top risks include technical feasibility challenges, schedule delays, and regulatory hurdles. Mitigation focuses on staged development, independent design reviews, modular construction, and diversified partnerships to prevent single-point failures.

What is the typical timeline from concept to deployment?

+Timelines for flagship naval platforms can span a decade or more from concept to initial operations, with extended periods of testing, certification, and integration into fleets. Delays are common due to engineering challenges and regulatory reviews.

Which financing options are typically used for such a project?

+Financing often combines public funding, sovereign guarantees, and long-term debt arrangements. Public-private partnerships and joint ventures may also play a role, with repayment and risk-sharing aligned to the asset’s lifecycle and contractually defined milestones.