Elon Musk Tax

The concept of the "Elon Musk Tax" has sparked significant discussion and controversy, especially in the context of the tech industry and wealth distribution. This term, often used colloquially, refers to the idea of imposing a higher tax rate on individuals with exceptionally high incomes, particularly those in the tech sector. As we delve into the world of high-income taxation and its potential impact, it's crucial to examine the specifics of such a proposal and its potential implications.

Understanding the Elon Musk Tax Proposal

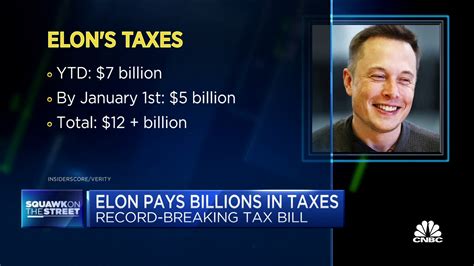

The Elon Musk Tax, though an informal term, is a concept that has gained traction in recent years as a potential solution to address wealth inequality and fund public initiatives. The core idea is to implement a progressive tax system that targets the ultra-wealthy, with a particular focus on individuals like Elon Musk, who have amassed vast fortunes through their business ventures, often in the tech and innovation sectors.

The proposal suggests a graduated tax rate, where the higher the income, the higher the tax percentage. This concept is not entirely novel, as many countries already have progressive tax systems in place. However, the Elon Musk Tax takes this idea a step further by aiming to capture a larger share of the wealth accumulated by the top earners.

Key Features of the Proposed Tax

- Progressive Income Tax: The tax rate would increase as income rises, with the highest earners paying a significantly higher percentage.

- Focus on Tech and Innovation: Given Elon Musk’s status as a tech billionaire, the tax would likely target income generated from tech-related ventures and innovations.

- Potential Wealth Redistribution: Proponents argue that the tax could help redistribute wealth, potentially funding social programs, infrastructure, or other public goods.

The proposal has gained attention not only due to the public fascination with Elon Musk's success but also because it addresses a growing concern about income inequality, particularly in the tech industry, where a few individuals hold a substantial portion of the wealth.

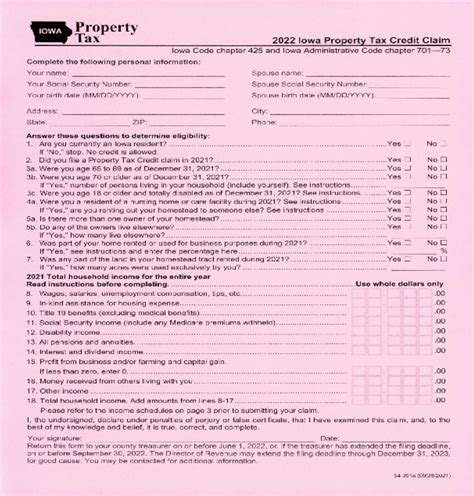

| Income Bracket | Proposed Tax Rate |

|---|---|

| Up to $100,000 | 15% |

| $100,001 - $500,000 | 25% |

| $500,001 - $1,000,000 | 35% |

| Over $1,000,000 | 50% |

This table provides a simplified example of how the Elon Musk Tax might be structured, with tax rates increasing as income brackets rise. However, it's important to note that in reality, the tax structure would likely be more complex and tailored to individual countries' economic and social policies.

The Impact on Tech Entrepreneurs and Innovation

Implementing a tax policy specifically targeting high-income earners in the tech industry could have both positive and negative repercussions. On one hand, it might encourage a more equitable distribution of wealth, ensuring that the benefits of technological advancements are shared more broadly across society. On the other hand, it could potentially discourage innovation and entrepreneurship, as high tax rates might deter individuals from pursuing high-risk, high-reward ventures.

Potential Benefits for Society

- Wealth Redistribution: The tax revenue could be utilized to fund public services, education, healthcare, and other social programs, improving the overall quality of life for a larger segment of the population.

- Addressing Income Inequality: By targeting the ultra-wealthy, the tax could help reduce the gap between the richest and the rest of society, fostering a more cohesive and stable social fabric.

Concerns for the Tech Industry

- Innovation Deterrence: High tax rates might discourage individuals from taking entrepreneurial risks, especially in the early stages of a business when profits are uncertain.

- Talent Migration: Tech talent might be incentivized to move to countries with more favorable tax policies, potentially leading to a brain drain in certain regions.

Finding the right balance between encouraging innovation and addressing income inequality is a complex task. While the Elon Musk Tax concept offers a potential solution, it's essential to consider the broader economic and social implications.

Global Perspectives and Tax Policies

The idea of the Elon Musk Tax resonates differently across the globe, as each country has its own unique economic and social landscape. Let’s explore how this concept might play out in various regions.

United States

In the US, the proposal could be a divisive topic. While it might find support among those advocating for progressive taxation and wealth redistribution, it could face opposition from those who believe in a more laissez-faire approach to taxation. The US already has a progressive tax system, but the top marginal tax rate is significantly lower than what the Elon Musk Tax proposes.

European Countries

Europe has a history of more progressive tax policies, with several countries already imposing high tax rates on the wealthy. However, the specifics of the Elon Musk Tax might still face scrutiny, particularly regarding its potential impact on business growth and competition.

Developing Nations

In developing countries, the tax could be seen as a means to rapidly boost public funds for essential services and infrastructure development. However, the feasibility and potential consequences would need careful consideration to avoid detrimental effects on local economies.

| Country | Top Marginal Tax Rate |

|---|---|

| United States | 37% |

| United Kingdom | 45% |

| France | 45% |

| India | 30% |

This table showcases the top marginal tax rates in various countries, providing a glimpse into the global variation in tax policies. The Elon Musk Tax proposal, if implemented, would likely surpass these rates, making it a significant shift in taxation philosophy.

Ethical and Economic Considerations

Beyond the practical implications, the Elon Musk Tax raises several ethical and economic questions that deserve careful scrutiny.

Ethical Dimensions

- Fairness: Is it fair to single out specific industries or individuals for higher taxation? Or should the tax system be based on a broader principle of fairness, independent of industry or personal wealth?

- Social Responsibility: Do ultra-wealthy individuals have a responsibility to contribute more to society through taxation, especially given the societal benefits of their business ventures?

Economic Impact Analysis

- Revenue Potential: How much revenue could the Elon Musk Tax generate, and what would be the most efficient way to allocate these funds to maximize social impact?

- Economic Growth: Would the tax hinder economic growth by discouraging investment and entrepreneurship? Or could it stimulate growth by funding essential public goods and services?

These considerations are complex and multifaceted, requiring a nuanced approach to taxation policy. The Elon Musk Tax, while a compelling idea, needs to be thoroughly evaluated in the context of each country's unique circumstances.

Conclusion: A Thought-Provoking Proposal

The Elon Musk Tax is a thought-provoking concept that challenges traditional tax policies and sparks debate about wealth distribution and social responsibility. While it may not be a universal solution, it highlights the ongoing conversation about how societies should approach economic inequality and the role of taxation in fostering a more equitable future.

As we navigate the complexities of modern taxation, it's essential to consider the potential benefits and drawbacks of such proposals, ensuring that any policy changes are grounded in sound economic principles and social justice.

How does the Elon Musk Tax differ from existing progressive tax systems?

+The Elon Musk Tax proposes a more aggressive progressive tax rate, targeting the highest income brackets with significantly higher tax percentages. This is in contrast to some existing progressive tax systems that have lower top marginal rates.

What are the potential benefits of the Elon Musk Tax for society?

+The tax could lead to more equitable wealth distribution, potentially funding essential public services and addressing income inequality. It may also encourage a more sustainable and inclusive approach to economic growth.

How might the Elon Musk Tax impact the tech industry’s innovation and growth?

+High tax rates might deter risk-taking and entrepreneurship, potentially slowing down innovation. However, if properly managed, the tax revenue could also be reinvested into the tech sector, fostering growth and development.

What are some potential challenges in implementing the Elon Musk Tax globally?

+The global implementation would face challenges in harmonizing tax policies across diverse economic and social landscapes. Additionally, ensuring compliance and preventing tax evasion would be crucial.