Minnesota Tax Rates

Understanding the tax landscape of any state is crucial for both residents and businesses. Minnesota, like many other states, has a complex tax system that encompasses various types of taxes, each with its own rates and regulations. This article aims to provide a comprehensive guide to Minnesota's tax rates, offering insights into the different taxes levied by the state and their implications.

A single filer with an income of 50,000 would fall into the 7.85% tax bracket in Minnesota. This means that the income tax rate for this income level is 7.85%.">What is the tax bracket for a single filer with an income of 50,000 in Minnesota? +

Income Tax Rates in Minnesota

Minnesota imposes an income tax on its residents and nonresidents who earn income within the state. The income tax is a progressive tax, meaning that higher income brackets are subject to higher tax rates. As of 2023, Minnesota has six tax brackets with the following marginal tax rates:

| Tax Bracket | Tax Rate |

|---|---|

| 0 to $13,050 (single filers) / 0 to $19,500 (joint filers) | 5.35% |

| $13,051 to $34,500 (single) / $19,501 to $49,500 (joint) | 7.05% |

| $34,501 to $86,250 (single) / $49,501 to $129,000 (joint) | 7.85% |

| $86,251 to $172,500 (single) / $129,001 to $246,000 (joint) | 8.89% |

| $172,501 to $345,000 (single) / $246,001 to $495,000 (joint) | 9.85% |

| Above $345,000 (single) / Above $495,000 (joint) | 9.85% |

It's important to note that these tax rates are subject to change annually, so it's advisable to refer to the latest tax tables published by the Minnesota Department of Revenue for the most accurate information.

Special Income Tax Considerations

Minnesota also imposes a surcharge on certain high-income taxpayers. The surcharge is an additional tax of 3.2% on income exceeding 250,000 for single filers and 350,000 for joint filers. This surcharge is designed to generate revenue for specific state programs and initiatives.

Additionally, Minnesota has a working family credit, which is a refundable tax credit for low- and moderate-income working families. This credit can reduce the amount of income tax owed or even result in a refund if the credit amount exceeds the tax liability.

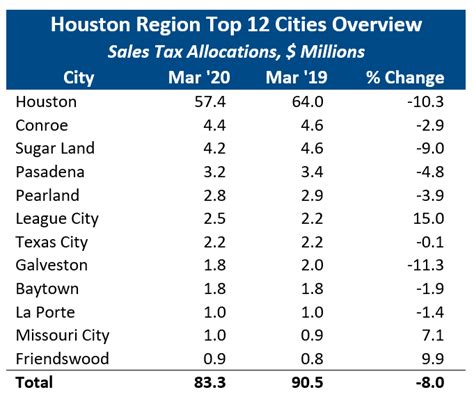

Sales and Use Tax Rates

Minnesota has a statewide sales and use tax rate of 6.875%, which applies to most retail sales, leases, and rentals of tangible personal property, as well as certain services. However, the state allows local jurisdictions to impose additional sales taxes, resulting in a combined sales tax rate that can vary depending on the location.

| County | Local Sales Tax Rate | Total Sales Tax Rate |

|---|---|---|

| Hennepin County | 0.75% | 7.625% |

| Ramsey County | 0.5% | 7.375% |

| Dakota County | 0.5% | 7.375% |

| Washington County | 0.5% | 7.375% |

| Most other counties | 0.5% | 7.375% |

It's crucial for businesses operating in Minnesota to be aware of these varying local sales tax rates, as they can significantly impact pricing strategies and tax compliance.

Sales Tax Exemptions

Minnesota offers several sales tax exemptions, including exemptions for:

- Prescription drugs

- Most non-prepared food items

- Clothing and footwear (up to a certain value)

- Certain manufacturing and agricultural inputs

- Services, such as professional services, repairs, and entertainment

These exemptions can provide significant savings for both businesses and consumers, but it's essential to understand the specific conditions and qualifications for each exemption.

Property Tax Rates

Property taxes in Minnesota are primarily assessed and collected at the local level, with rates varying significantly across the state. The Minnesota Department of Revenue provides a historical property tax rate table that showcases the statewide median property tax rates for different types of properties.

As of 2022, the statewide median property tax rates are as follows:

| Property Type | Median Property Tax Rate |

|---|---|

| Residential | 1.06% |

| Agricultural | 1.12% |

| Commercial/Industrial | 2.02% |

These rates represent the median effective tax rate, which is the total property tax bill divided by the property's market value. It's important to note that these rates can vary greatly between counties and even within cities, as local taxing authorities have the power to set their own property tax rates.

Property Tax Classification and Assessments

Minnesota classifies properties into different categories, such as homesteads (owner-occupied residences), agricultural land, and commercial properties. Each category has its own assessment and valuation rules. For instance, homesteads are typically assessed at a lower value than other property types.

The state also offers property tax relief programs, such as the Homestead Credit Refund, which provides a refund to eligible homeowners based on their income and property taxes paid. This program aims to reduce the tax burden on low- and moderate-income homeowners.

Corporate Tax Rates

Minnesota imposes a corporate income tax on businesses operating within the state. As of 2023, the corporate income tax rate is 9.8% for most businesses. However, certain types of corporations, such as S corporations and limited liability companies (LLCs), may be subject to different tax rates or classifications.

Minnesota’s Combined Reporting Rules

Minnesota employs a combined reporting system for certain types of businesses. Under this system, affiliated corporations are required to file a consolidated tax return, combining their income and losses for tax purposes. This can impact the effective tax rate for businesses with multiple entities in the state.

Additionally, Minnesota has a minimum corporate income tax of $300, which applies to corporations with income below a certain threshold. This ensures that all corporations contribute to the state's tax revenue, even if their income is relatively low.

Other Minnesota Taxes

In addition to the taxes mentioned above, Minnesota levies various other taxes, including:

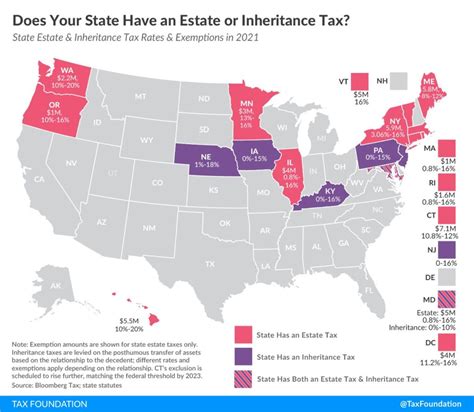

- Estate and Inheritance Taxes: Minnesota imposes an estate tax on the transfer of property at death, with rates ranging from 11% to 16% for estates valued over $2.7 million (as of 2023). Inheritance taxes are also applicable for certain beneficiaries receiving property from an estate.

- Motor Vehicle Taxes: Minnesota has a registration fee for motor vehicles, which varies depending on the vehicle type and weight. Additionally, the state imposes a sales tax on the purchase of vehicles, as well as a use tax on vehicles purchased out of state but registered in Minnesota.

- Gasoline Tax: Minnesota has a gasoline tax of 28.5 cents per gallon, which is used to fund transportation infrastructure projects.

- Tobacco Taxes: The state imposes excise taxes on cigarettes, tobacco products, and vaping devices, with rates varying based on the type of product.

Conclusion: Navigating Minnesota’s Tax Landscape

Minnesota’s tax system is multifaceted, with various taxes impacting individuals, businesses, and property owners. Understanding these tax rates and their implications is crucial for making informed financial decisions. Whether you’re a resident, a business owner, or an investor, staying up-to-date with Minnesota’s tax laws and regulations can help ensure compliance and optimize your financial strategies.

What is the tax bracket for a single filer with an income of 50,000 in Minnesota?</h3> <span class="faq-toggle">+</span> </div> <div class="faq-answer"> <p>A single filer with an income of 50,000 would fall into the 7.85% tax bracket in Minnesota. This means that the income tax rate for this income level is 7.85%.

Are there any sales tax exemptions for online purchases in Minnesota?

+Yes, Minnesota offers a sales tax exemption for certain online purchases, such as those made through remote sellers without a physical presence in the state. However, this exemption only applies if the total purchase amount is below a certain threshold, which can vary based on the type of item purchased.

How does Minnesota’s corporate tax rate compare to other states in the region?

+Minnesota’s corporate tax rate of 9.8% is relatively higher compared to some neighboring states, such as Wisconsin (7.9%) and Iowa (8.5%). However, it’s important to consider the overall business climate and incentives offered by each state when comparing corporate tax rates.

Are there any property tax relief programs for senior citizens in Minnesota?

+Yes, Minnesota offers the Senior Citizen Property Tax Deferral Program, which allows eligible senior citizens to defer a portion of their property taxes until after their death or until they move out of their home. This program provides financial relief for senior homeowners.

What is the threshold for the high-income surcharge in Minnesota’s income tax system?

+The high-income surcharge in Minnesota’s income tax system applies to income exceeding 250,000 for single filers and 350,000 for joint filers. This surcharge is an additional 3.2% tax on the income above these thresholds.