Sales Tax In Houston Tx

In the vibrant city of Houston, Texas, understanding the intricacies of sales tax is crucial for both businesses and consumers alike. This comprehensive guide will delve into the specifics of sales tax regulations in Houston, offering a detailed analysis of rates, exemptions, and collection processes. By exploring real-world examples and providing expert insights, we aim to demystify the complexities of sales tax in this bustling metropolis.

Sales Tax Essentials in Houston, TX

Sales tax in Houston is a critical component of the city’s revenue stream, impacting a wide range of goods and services. The state of Texas imposes a base sales tax rate, which is then subject to additional local taxes, creating a unique tax landscape for businesses operating in Houston.

The Texas Sales Tax Structure

Texas has a robust sales tax system, with a state-wide base rate that serves as the foundation for local variations. As of [insert date], the state sales tax rate stands at [insert percentage]%, a figure that remains consistent across the state. However, it is the local add-on taxes that create a distinct tax environment in Houston.

| Tax Type | Rate |

|---|---|

| State Sales Tax | [insert percentage]% |

| Houston Local Sales Tax | [insert percentage]% |

| Total Sales Tax in Houston | [insert total percentage]% |

The Houston local sales tax is a critical component, often used to fund specific initiatives or services within the city. This local tax rate is determined by the city government and can vary based on the type of business and the location of the sale.

Sales Tax Exemptions in Houston

Understanding the exemptions is crucial for businesses to navigate the tax landscape effectively. Texas, and by extension Houston, offers a range of sales tax exemptions that cater to specific industries and products. These exemptions can significantly impact a business’s tax liability, so it’s essential to stay informed about the latest regulations.

- Groceries and Food Products: Many staple food items are exempt from sales tax, offering a significant relief for both consumers and businesses in the food industry.

- Prescription Medications: Sales tax does not apply to prescription drugs, ensuring that healthcare costs remain more affordable for Houston residents.

- Manufacturing Equipment: Certain machinery and equipment used in manufacturing processes are exempt, encouraging industrial growth in the city.

- Educational Materials: Books, school supplies, and other educational resources are often exempt, supporting the city's commitment to education.

It's important to note that these exemptions are subject to change, and businesses should regularly consult official sources for the most up-to-date information.

Sales Tax Collection and Remittance

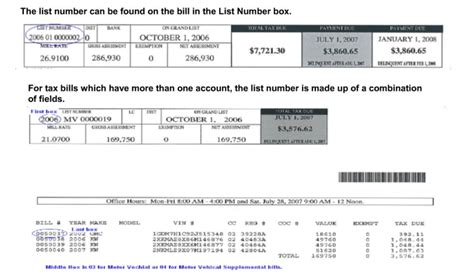

For businesses, the process of collecting and remitting sales tax is a critical responsibility. In Houston, the Texas Comptroller of Public Accounts oversees the collection and distribution of sales tax revenue. Businesses are required to register with the Comptroller’s office and obtain a sales tax permit, which authorizes them to collect tax from customers.

The frequency of sales tax remittance depends on the business's tax liability. Larger businesses with higher tax obligations may be required to remit taxes monthly, while smaller businesses might be allowed to remit quarterly or annually. This ensures a steady flow of revenue for the city and state governments.

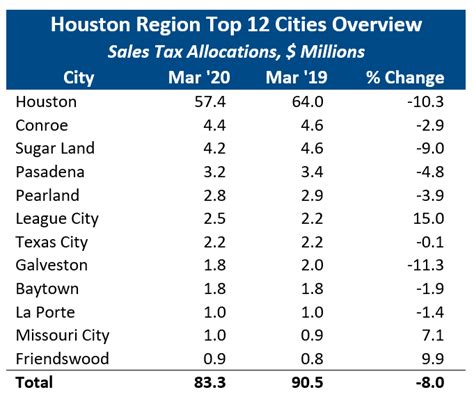

Impact of Sales Tax on Houston’s Economy

Sales tax plays a pivotal role in Houston’s economic landscape, contributing significantly to the city’s overall revenue. The funds generated through sales tax are allocated towards essential services and infrastructure development, ensuring the city’s continued growth and prosperity.

Funding Essential Services

A substantial portion of the sales tax revenue is dedicated to funding critical services that directly impact the lives of Houston residents. These include:

- Public Safety: Sales tax revenue supports the city's police and fire departments, ensuring the safety and security of its citizens.

- Education: A significant chunk of the tax revenue is allocated to public schools, helping to provide quality education to Houston's youth.

- Infrastructure Development: Sales tax funds contribute to the maintenance and improvement of Houston's roads, bridges, and public transportation systems.

- Social Services: The tax revenue also supports social welfare programs, ensuring that the city's most vulnerable populations have access to necessary resources.

Encouraging Business Growth

The sales tax structure in Houston is designed to encourage business growth and investment. By offering certain exemptions and maintaining a competitive tax rate, the city creates an attractive environment for businesses to thrive.

Additionally, the city's commitment to infrastructure development, funded in part by sales tax revenue, enhances Houston's appeal as a business destination. Well-maintained roads, efficient public transportation, and a robust utility network all contribute to a positive business environment.

Compliance and Penalties

Ensuring compliance with sales tax regulations is a critical responsibility for businesses operating in Houston. Failure to comply can result in significant penalties and legal consequences.

Common Compliance Issues

Some of the most common compliance issues include:

- Incorrect Tax Calculation: Miscalculating the applicable tax rate or failing to apply the correct exemptions can lead to under-collection of tax.

- Late Remittance: Businesses that fail to remit sales tax on time may face penalties and interest charges.

- Non-Compliance with Registration: Operating a business without obtaining the necessary sales tax permit can result in severe penalties.

To avoid these pitfalls, businesses should stay informed about the latest tax regulations and seek professional advice when needed.

Penalties and Legal Consequences

The Texas Comptroller’s office takes a firm stance on sales tax compliance, and penalties for non-compliance can be substantial. These may include:

- Interest Charges: Late payment of sales tax may incur interest charges, which accumulate over time.

- Penalties: Depending on the severity of the violation, businesses may face penalties of up to [insert percentage]% of the unpaid tax.

- Criminal Charges: In cases of intentional non-compliance or tax evasion, businesses and individuals may face criminal charges and even jail time.

It is always in a business's best interest to prioritize compliance and seek professional guidance to navigate the complex world of sales tax regulations.

Sales Tax for Online Businesses in Houston

With the rise of e-commerce, online businesses in Houston must also navigate the complexities of sales tax. The rules for online sales tax are slightly different and often depend on the business’s physical presence and the destination of the sale.

Nexus and Sales Tax Obligations

Online businesses with a nexus in Houston, meaning they have a physical presence in the city, are generally required to collect and remit sales tax on transactions with Houston residents. This physical presence can include a warehouse, office, or even a remote employee working from home.

However, for online businesses without a nexus in Houston, the rules are less clear-cut. The Wayfair decision, a landmark Supreme Court ruling, allows states to require out-of-state sellers to collect sales tax if they have a certain level of economic presence in the state. This has led to increased scrutiny on online businesses, and many are now required to collect sales tax even without a physical presence in Houston.

Sales Tax for Online Marketplace Sellers

Online marketplace sellers, such as those on Amazon or eBay, face unique challenges when it comes to sales tax. These platforms often have their own sales tax rules and requirements, which can be complex and vary based on the seller’s location and the destination of the sale.

To ensure compliance, online marketplace sellers should carefully review the sales tax guidelines provided by the marketplace and seek professional advice if needed. Missteps in this area can lead to significant penalties and legal issues.

Future Implications and Trends

The world of sales tax is ever-evolving, and Houston is no exception. As the city continues to grow and adapt, so too will its sales tax landscape. Here are some key trends and future implications to watch out for:

Increasing Digital Presence

With more businesses embracing digital platforms, the sales tax rules for online transactions will continue to evolve. Houston, like many other cities, may implement more stringent regulations to ensure that online businesses contribute their fair share to the city’s revenue stream.

Expanding Tax Base

As Houston’s economy diversifies, the city may consider expanding its tax base to include new types of transactions. This could mean introducing sales tax on previously untaxed services or products, ensuring a more stable revenue stream for the city.

Simplification of Exemptions

The current sales tax exemption system can be complex and difficult to navigate. In the future, Houston may simplify its exemption structure, making it easier for businesses to understand and comply with the regulations. This could involve consolidating exemptions or providing clearer guidelines for businesses.

Increased Use of Technology

Technology is already playing a significant role in sales tax collection and compliance. In the future, Houston may invest more in technological solutions, such as automated tax calculation and remittance systems, to enhance efficiency and accuracy.

Conclusion

Sales tax in Houston, TX, is a complex but critical component of the city’s economic ecosystem. By understanding the intricacies of the tax structure, exemptions, and compliance requirements, businesses can navigate this landscape with confidence. This guide has provided a comprehensive overview, but it’s important to remember that the world of sales tax is ever-evolving, and staying updated with the latest regulations is essential for success.

FAQ

What is the current sales tax rate in Houston, TX?

+

As of [insert date], the total sales tax rate in Houston is [insert total percentage]%, including the state and local sales tax rates.

Are there any upcoming changes to the sales tax rates in Houston?

+

While there are no immediate changes announced, sales tax rates are subject to periodic reviews and adjustments. It’s advisable to stay updated with official sources for any future changes.

How often do businesses need to remit sales tax in Houston?

+

The frequency of sales tax remittance depends on the business’s tax liability. Larger businesses may be required to remit monthly, while smaller businesses might remit quarterly or annually.

What happens if a business fails to comply with sales tax regulations in Houston?

+

Non-compliance can result in penalties, interest charges, and even criminal charges in severe cases. It’s crucial for businesses to prioritize compliance to avoid these consequences.

How can online businesses determine their sales tax obligations in Houston?

+

Online businesses should consult the Texas Comptroller’s website and guidelines, as well as the specific rules set by online marketplaces. Seeking professional advice is recommended to ensure accurate compliance.