Az State Tax Payment

Understanding the intricacies of state tax payments is crucial, especially when navigating the complex tax systems of different states. Arizona, with its unique tax landscape, presents specific requirements and procedures that taxpayers need to be aware of. This comprehensive guide aims to delve into the process of making AZ state tax payments, providing clarity and practical insights for individuals and businesses alike.

The Basics of AZ State Tax Payment

Arizona, or the "Grand Canyon State," is known for its diverse landscapes and vibrant economy. When it comes to taxes, Arizona operates under a system that includes both state and local taxes. For individuals and businesses, comprehending the state tax payment process is essential to ensure compliance and avoid potential penalties.

The Arizona Department of Revenue (ADOR) is the primary authority overseeing tax administration in the state. It is responsible for collecting various taxes, including income tax, transaction privilege tax (TPT), property tax, and more. Understanding the specific taxes applicable to your situation is the first step in navigating the AZ state tax payment process.

Income Tax Payment

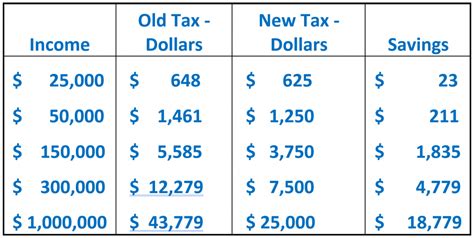

Arizona imposes an income tax on individuals and businesses. The income tax rates vary depending on the taxpayer's filing status and income bracket. For individuals, the state offers a graduated tax rate structure, ranging from 2.59% to 4.50%. Businesses, on the other hand, are subject to a flat rate of 4.9% on their taxable income.

To make income tax payments, taxpayers typically have two options. They can either make payments throughout the year through payroll deductions or estimated tax payments, or they can make a lump-sum payment when filing their annual tax return. The choice depends on the taxpayer's financial situation and preferences.

| Taxpayer Type | Payment Options |

|---|---|

| Individuals | Payroll Deductions, Estimated Tax Payments, or Lump-Sum Payment |

| Businesses | Estimated Tax Payments or Lump-Sum Payment |

Transaction Privilege Tax (TPT) and Use Tax

Arizona also imposes a Transaction Privilege Tax (TPT), commonly known as a sales tax, on the sale or lease of tangible personal property and certain services. The TPT rate varies depending on the location of the transaction and the type of business. For instance, the state TPT rate is 5.6%, but local jurisdictions may add additional taxes, resulting in a combined rate that can exceed 10% in some areas.

In addition to TPT, Arizona also has a use tax, which applies to purchases made outside the state but used within Arizona. This tax ensures that all purchases are taxed fairly, regardless of where they are made. Businesses and individuals engaging in taxable activities must register with ADOR to obtain a TPT license and comply with the associated tax obligations.

Payment Methods and Deadlines

AZ state tax payments can be made through various methods, each with its own advantages and considerations. Understanding these methods and their associated deadlines is vital to ensure timely and accurate payments.

Online Payment Options

The ADOR offers a convenient online payment system, allowing taxpayers to make payments directly from their bank accounts or using credit/debit cards. This method is secure, efficient, and often preferred for its simplicity. To utilize this option, taxpayers need to access the ADOR's website and follow the step-by-step process for online payments.

Online payments can be made for various taxes, including income tax, TPT, and use tax. The system provides real-time updates, allowing taxpayers to track their payment status and ensure timely submission.

Paper Filing and Payment

For those who prefer traditional methods, paper filing and payment are also available. Taxpayers can download the appropriate tax forms from the ADOR website, fill them out, and mail them along with their payment to the designated address. This method may take longer and requires careful attention to ensure accuracy.

Paper filing is suitable for taxpayers who prefer a physical record of their tax returns and payments. However, it is essential to note that this method may have slightly longer processing times compared to online payments.

Payment Deadlines and Penalties

Timely payment of AZ state taxes is crucial to avoid penalties and interest charges. The deadlines for tax payments vary depending on the type of tax and the taxpayer's filing status.

For income tax, the deadline for filing and paying is typically April 15th of the following year. However, if this date falls on a weekend or holiday, the deadline is extended to the next business day. It's important to note that estimated tax payments have their own deadlines, usually quarterly.

TPT and use tax payments also have specific deadlines. Businesses are generally required to make monthly or quarterly payments, depending on their tax liability. Failure to meet these deadlines can result in penalties and interest charges, which can quickly accumulate.

| Tax Type | Payment Deadlines |

|---|---|

| Income Tax | April 15th (or the next business day if it falls on a weekend or holiday) |

| TPT and Use Tax | Monthly or Quarterly, depending on tax liability |

Tax Payment Assistance and Resources

Navigating the complexities of AZ state tax payments can be challenging, especially for those new to the state or those with unique tax situations. Fortunately, the ADOR provides various resources and assistance programs to help taxpayers understand their obligations and comply with state tax laws.

ADOR Taxpayer Assistance Programs

The Arizona Department of Revenue offers a range of taxpayer assistance programs to provide guidance and support. These programs include:

- Taxpayer Advocate Services: This program helps resolve tax issues and provides assistance to taxpayers experiencing financial difficulties.

- Taxpayer Assistance Centers: ADOR operates physical locations where taxpayers can receive in-person assistance with tax-related matters.

- Taxpayer Education: The department provides educational resources, workshops, and webinars to help taxpayers understand their rights and responsibilities.

These programs aim to ensure that taxpayers have the necessary support to navigate the tax system effectively and resolve any issues they may encounter.

Online Resources and Tools

In addition to the assistance programs, the ADOR website offers a wealth of online resources and tools to assist taxpayers. These resources include:

- Tax Forms and Publications: A comprehensive library of tax forms and publications, providing detailed information on various tax topics.

- Tax Calculator: An online tool that helps taxpayers estimate their tax liability and understand their payment obligations.

- Payment Plan Options: Information on setting up payment plans for those who cannot pay their taxes in full by the deadline.

Utilizing these online resources can greatly simplify the tax payment process and provide taxpayers with the confidence to navigate their obligations effectively.

Tax Professional Services

For individuals and businesses with complex tax situations or those seeking expert guidance, engaging the services of a tax professional can be beneficial. Tax professionals, such as certified public accountants (CPAs) and enrolled agents, have extensive knowledge of tax laws and can provide personalized advice and assistance.

Tax professionals can help with tax planning, preparation, and filing, ensuring that taxpayers meet their obligations while maximizing their tax benefits. They can also represent taxpayers before the ADOR, providing an added layer of support and expertise.

FAQs: Common Questions about AZ State Tax Payment

What happens if I miss the state tax payment deadline?

+Missing a state tax payment deadline can result in penalties and interest charges. The specific penalties vary depending on the tax type and the extent of the delay. It's important to contact the ADOR as soon as possible to discuss your options and potential penalty relief.

Can I make partial payments for my state taxes?

+Yes, the ADOR allows partial payments for state taxes. This option is particularly useful for taxpayers who cannot afford to pay their entire tax liability in one go. However, it's important to note that penalties and interest may still apply to the outstanding balance.

How can I check my state tax payment status?

+You can check your state tax payment status by logging into your ADOR online account or by contacting the department directly. Online accounts provide real-time updates on payment status, while phone or in-person inquiries may require some processing time.

Are there any tax relief programs available in Arizona?

+Yes, Arizona offers various tax relief programs to assist taxpayers facing financial hardships. These programs include the Property Tax Relief Program, the Senior Citizen and Disabled Persons Property Tax Reduction Program, and more. Eligibility criteria and application processes vary, so it's advisable to check the ADOR website for detailed information.

Can I pay my state taxes with a credit card?

+Yes, the ADOR accepts credit card payments for state taxes. However, it's important to note that there may be convenience fees associated with this payment method. These fees are typically charged by the third-party payment processor and are not retained by the state.

Making AZ state tax payments is a critical aspect of financial responsibility for individuals and businesses in Arizona. By understanding the tax payment process, deadlines, and available resources, taxpayers can ensure compliance and avoid potential penalties. This guide aims to provide a comprehensive overview, but it’s always advisable to consult the ADOR website or a tax professional for the most up-to-date and personalized guidance.