North Carolina Car Sales Tax

The North Carolina car sales tax is an important aspect of vehicle purchasing in the state, as it can significantly impact the overall cost of acquiring a new or used car. Understanding the sales tax regulations and how they apply to different types of vehicle sales is crucial for both buyers and sellers.

In this comprehensive guide, we will delve into the intricacies of the North Carolina car sales tax, covering its rates, exemptions, and the various factors that influence the tax amount. We will also provide real-world examples and insights to help you navigate this essential aspect of car buying in the Tar Heel State.

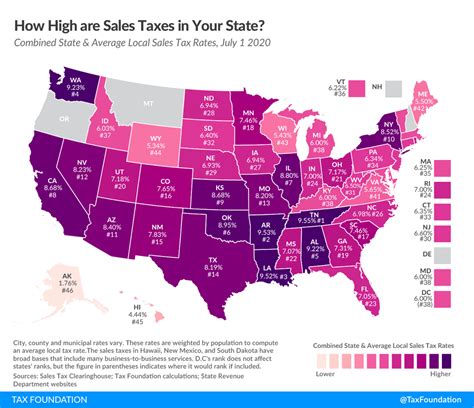

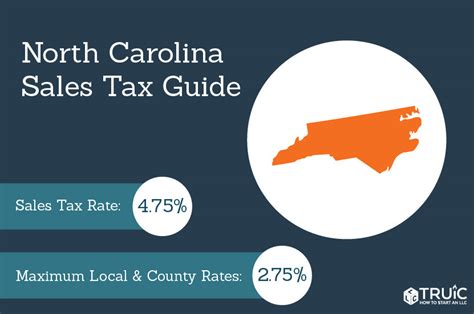

Understanding North Carolina's Sales Tax Structure

North Carolina imposes a sales tax on the purchase of tangible personal property, including vehicles. The state sales tax rate is 4.75%, which applies uniformly across the state. However, local governments can also levy their own additional sales taxes, creating a combined sales tax rate that varies by location.

For instance, in the city of Charlotte, the combined sales tax rate is 7.25%, with an additional 2.5% levied by the city government. This means that when buying a car in Charlotte, you would pay a sales tax of 7.25% on the vehicle's purchase price.

Here's a breakdown of the sales tax rates in some major cities in North Carolina:

| City | Combined Sales Tax Rate |

|---|---|

| Charlotte | 7.25% |

| Raleigh | 8.00% |

| Durham | 7.75% |

| Greensboro | 7.25% |

| Winston-Salem | 7.50% |

It's essential to check the specific sales tax rate for your county or city before making a vehicle purchase, as these rates can vary significantly and impact the overall cost.

Calculating Car Sales Tax in North Carolina

To calculate the sales tax on a vehicle purchase in North Carolina, you multiply the purchase price by the applicable sales tax rate. For instance, if you're buying a car for $25,000 in a location with a 7.25% combined sales tax rate, the sales tax amount would be:

Sales Tax Amount = Purchase Price x Sales Tax Rate

Sales Tax Amount = $25,000 x 0.0725 = $1,812.50

So, in this example, the sales tax due on the vehicle purchase would be $1,812.50.

Example: Car Sales Tax Calculation

Let's consider a real-world example to illustrate the car sales tax calculation in North Carolina.

Imagine you're purchasing a used car in Raleigh, where the combined sales tax rate is 8.00%. The car's purchase price is $18,000. To calculate the sales tax due:

Sales Tax Amount = $18,000 x 0.08 = $1,440

Therefore, in this scenario, the sales tax on the used car purchase would amount to $1,440.

Exemptions and Special Considerations

While most vehicle purchases in North Carolina are subject to sales tax, there are certain exemptions and special considerations to be aware of:

- Trade-Ins: If you trade in your old vehicle as part of the purchase of a new one, the sales tax is typically calculated based on the difference in value between the two vehicles. So, if your old car's trade-in value is $8,000 and the new car costs $22,000, the sales tax would apply to the $14,000 difference.

- Leased Vehicles: When leasing a vehicle, the sales tax is usually calculated based on the monthly lease payments. The tax is included in the lease payments, and the exact calculation can vary depending on the lease term and other factors.

- Military Exemptions: Active-duty military personnel stationed in North Carolina may be eligible for sales tax exemptions on certain vehicle purchases. This exemption applies to the full purchase price, including any accessories or options.

- Taxable Value of Vehicles: The sales tax in North Carolina is calculated based on the taxable value of the vehicle, which is often different from the purchase price. The taxable value can be affected by factors like the vehicle's age, mileage, and condition. It's essential to understand how this value is determined for accurate tax calculations.

Registration and Title Fees

In addition to sales tax, vehicle buyers in North Carolina must also consider registration and title fees. These fees are separate from the sales tax and are paid to the North Carolina Division of Motor Vehicles (DMV) to officially register and title the vehicle.

Registration fees in North Carolina vary based on the vehicle's weight and type. For passenger cars, the registration fee is typically $40 for a two-year registration period. However, other vehicle types, such as trucks, motorcycles, and trailers, have different registration fee structures.

Title fees are also applicable when purchasing a vehicle in North Carolina. The title fee is $50 for the initial title, and $25 for each additional title if there are multiple owners. These fees are in addition to the sales tax and registration fees.

Example: Registration and Title Fees

Let's continue with our previous example of purchasing a used car in Raleigh for $18,000. In this scenario, the registration and title fees would be as follows:

- Registration Fee: $40 for a two-year registration period.

- Title Fee: $50 for the initial title.

So, in addition to the $1,440 in sales tax, the buyer would also need to pay $90 in registration and title fees, bringing the total tax and fees to $1,530.

The Future of North Carolina's Car Sales Tax

As the automotive industry evolves and electric vehicles (EVs) become more prevalent, it's essential to consider how these changes may impact the car sales tax landscape in North Carolina.

North Carolina has been proactive in promoting the adoption of electric vehicles by offering various incentives, including tax credits and rebates. These incentives can significantly reduce the overall cost of purchasing an EV and may also impact the sales tax calculation. For instance, if an EV qualifies for a tax credit, the sales tax would be calculated based on the post-credit purchase price.

Additionally, as the state's sales tax structure is tied to the value of the vehicle, the evolving automotive market, particularly with the introduction of autonomous vehicles and new mobility options, may lead to adjustments in how sales tax is assessed and collected. It's crucial for buyers and sellers to stay informed about these potential changes to ensure compliance with evolving tax regulations.

FAQ

Are there any online resources to help me calculate car sales tax in North Carolina?

+Yes, there are online sales tax calculators available that can assist with estimating the sales tax on a vehicle purchase in North Carolina. These calculators typically require you to input the purchase price and the applicable sales tax rate for your location. It’s a good idea to use these calculators as a starting point, but be sure to verify the final tax amount with a tax professional or the North Carolina Department of Revenue.

How do I know if my vehicle purchase qualifies for any sales tax exemptions in North Carolina?

+Determining sales tax exemptions can be complex and depends on various factors, including the nature of the purchase, your eligibility for specific exemptions, and the type of vehicle. It’s best to consult with a tax professional or refer to the North Carolina Department of Revenue’s website for detailed information on sales tax exemptions and qualifications.

Can I negotiate the sales tax amount on a vehicle purchase in North Carolina?

+No, the sales tax is a mandatory charge determined by the state and local governments. It’s not typically negotiable, and attempting to negotiate the sales tax amount may raise concerns about tax compliance. Instead, focus your negotiations on the vehicle’s purchase price and any applicable dealer fees.

What happens if I don’t pay the sales tax on my vehicle purchase in North Carolina?

+Failing to pay the required sales tax on a vehicle purchase can lead to serious consequences, including fines, penalties, and even legal action. It’s crucial to ensure that all applicable taxes and fees are paid in full and on time to avoid these issues. If you have concerns about paying the sales tax, it’s best to seek guidance from a tax professional or the North Carolina Department of Revenue.