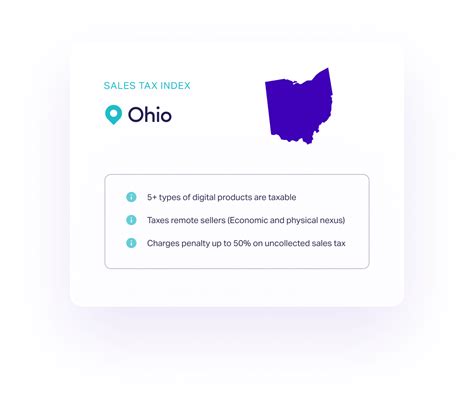

Ohio Sales Tax

Ohio, a vibrant state in the Midwest region of the United States, boasts a diverse economy and a robust sales tax system. Understanding the intricacies of Ohio sales tax is crucial for businesses and consumers alike, as it directly impacts their financial obligations and planning. This comprehensive guide aims to delve into the specifics of Ohio sales tax, covering its rates, applicability, exemptions, and the processes involved in compliance.

Understanding Ohio Sales Tax Rates

Ohio’s sales tax structure is a combination of state and local taxes, with each county and municipality having the authority to impose additional taxes. The state sales tax rate stands at 5.75%, effective since March 1, 2023. This state-level tax is applied uniformly across Ohio, serving as a foundation for the overall sales tax calculation.

However, the total sales tax an individual pays can vary significantly depending on their location within the state. Local sales tax rates in Ohio range from 0% to 2.5%, with an average rate of 1.27%. These local taxes are determined by the specific county and city where the purchase is made. For instance, the city of Columbus levies a local sales tax of 1.25%, while Cincinnati has a higher rate of 1.5%. These variations can have a notable impact on the final price of goods and services, especially for businesses with operations spanning multiple counties.

| County | Local Sales Tax Rate |

|---|---|

| Adams County | 1.25% |

| Athens County | 1.5% |

| Belmont County | 1.25% |

| ... (Remaining Counties) | ... |

| State Average | 1.27% |

Sales Tax Exemptions in Ohio

Ohio’s sales tax system is not applicable to all goods and services. Several categories are exempt from sales tax, providing financial relief to consumers and businesses. Understanding these exemptions is crucial for accurate tax planning and compliance.

Food and Grocery Exemptions

One of the most notable exemptions in Ohio’s sales tax system is for unprepared food items. Grocery staples like bread, milk, eggs, and produce are not subject to sales tax, making them more affordable for consumers. However, this exemption does not extend to prepared foods, which are taxed at the standard rate.

Additionally, Ohio provides a sales tax exemption for baby food, ensuring that essential items for infants are more accessible to families. This exemption covers a wide range of baby food products, including ready-to-eat cereals, infant formulas, and baby food jars.

Prescription Drugs and Medical Devices

Ohio’s sales tax laws also exempt prescription drugs and certain medical devices from taxation. This includes a broad range of items, from common medications to more specialized equipment. For instance, insulin, hearing aids, and even prosthetic limbs are all exempt from sales tax, providing financial relief to those with medical needs.

Clothing and Footwear

Ohio offers a sales tax exemption for certain clothing and footwear items, particularly those that are essential and of low value. Items such as children’s clothing, school uniforms, and certain types of footwear are exempt, making back-to-school shopping more affordable for families.

| Exempt Item | Tax Exemption Details |

|---|---|

| Unprepared Food | Exempt, including staples like bread, milk, and produce |

| Baby Food | Exempt, covering a range of infant food products |

| Prescription Drugs | Exempt, including common and specialized medications |

| Medical Devices | Exempt, encompassing various equipment and aids |

| Children's Clothing | Exempt, providing relief for families |

Ohio Sales Tax Compliance and Collection

Compliance with Ohio’s sales tax regulations is a critical aspect for businesses, ensuring they meet their tax obligations and avoid penalties. The Ohio Department of Taxation provides comprehensive guidelines and resources to assist businesses in this process.

Registering for a Sales Tax Permit

Businesses operating in Ohio are required to register for a sales tax permit with the Ohio Department of Taxation. This permit authorizes them to collect and remit sales tax on behalf of the state. The application process is straightforward and can be completed online through the department’s website. It’s crucial for businesses to obtain this permit before initiating sales to ensure compliance.

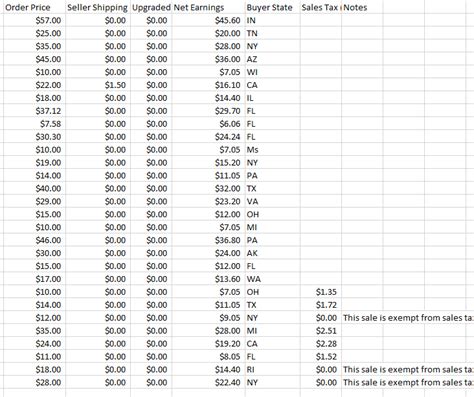

Sales Tax Calculation and Remittance

Calculating sales tax accurately is essential for businesses to ensure they collect the correct amount from customers. The total sales tax due is the sum of the state sales tax rate (5.75%) and the applicable local sales tax rate. Businesses must maintain records of these calculations and the corresponding tax collections.

Remitting sales tax to the Ohio Department of Taxation is typically done on a monthly or quarterly basis, depending on the business's sales volume. The department provides a secure online portal for businesses to file their tax returns and make payments.

Sales Tax Audits and Penalties

The Ohio Department of Taxation conducts regular audits to ensure businesses are compliant with sales tax regulations. These audits involve a review of sales records, tax calculations, and remittances. Businesses found to be non-compliant may face penalties, including fines and interest charges. It’s crucial for businesses to maintain accurate records and ensure timely tax filings to avoid these penalties.

The Impact of Ohio Sales Tax on Businesses

Ohio’s sales tax system has a significant impact on businesses operating within the state. Understanding these implications can help businesses make informed decisions and adapt their strategies accordingly.

Price Strategies and Consumer Behavior

The varying sales tax rates across Ohio can influence consumer behavior and pricing strategies. Businesses operating in counties with higher local sales tax rates may need to adjust their pricing to remain competitive. Additionally, understanding consumer preferences and the impact of sales tax on purchasing decisions can help businesses tailor their marketing and sales approaches.

Tax Compliance and Operational Costs

Compliance with Ohio’s sales tax regulations requires businesses to invest in robust systems and processes. This includes implementing sales tax software, training staff on tax calculations, and maintaining accurate records. These compliance efforts can add to a business’s operational costs, particularly for those with a broad geographic reach within the state.

Strategic Planning for Exemptions

Ohio’s sales tax exemptions can provide strategic opportunities for businesses. For instance, businesses specializing in exempt items like groceries or medical supplies may have a competitive advantage due to the lower prices they can offer. Understanding these exemptions can help businesses position themselves effectively in the market.

Frequently Asked Questions

What is the current state sales tax rate in Ohio?

+The current state sales tax rate in Ohio is 5.75%, effective since March 1, 2023.

Are there any counties in Ohio with a 0% local sales tax rate?

+Yes, there are counties in Ohio with a 0% local sales tax rate. This means that the total sales tax in these counties is just the state sales tax rate.

What items are exempt from sales tax in Ohio?

+In Ohio, several items are exempt from sales tax, including unprepared food, baby food, prescription drugs, medical devices, and certain clothing and footwear items.

How often do businesses need to remit sales tax to the Ohio Department of Taxation?

+Businesses in Ohio typically remit sales tax on a monthly or quarterly basis, depending on their sales volume. The Ohio Department of Taxation provides a secure online portal for this purpose.

What happens if a business is found to be non-compliant with Ohio sales tax regulations?

+Non-compliance with Ohio sales tax regulations can result in penalties, including fines and interest charges. The Ohio Department of Taxation conducts regular audits to ensure compliance.