Where Do I Pay My Property Taxes

Understanding where and how to pay your property taxes is an essential aspect of responsible homeownership. The process can vary depending on your location, but we've compiled a comprehensive guide to help you navigate this essential financial obligation. This article will provide you with the necessary information to ensure a smooth and timely payment of your property taxes, covering various aspects such as online payment portals, tax assessor offices, and the importance of timely payments.

The Role of Tax Assessor Offices

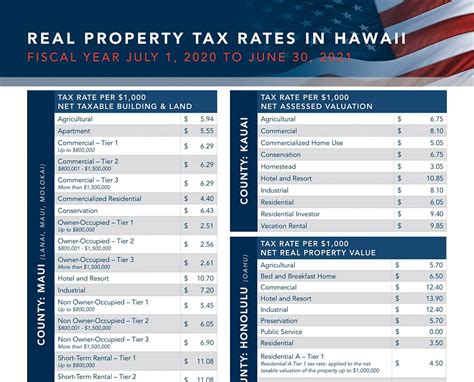

In most jurisdictions, the primary responsibility for collecting property taxes lies with the local government, often overseen by a tax assessor or assessor’s office. These offices are typically responsible for evaluating the value of properties within their jurisdiction, determining the applicable tax rates, and issuing tax bills to property owners.

The tax assessor's office plays a crucial role in ensuring that property taxes are assessed fairly and accurately. They consider various factors such as the property's location, size, improvements, and recent sales of comparable properties to arrive at a fair market value. This value is then used to calculate the property tax amount.

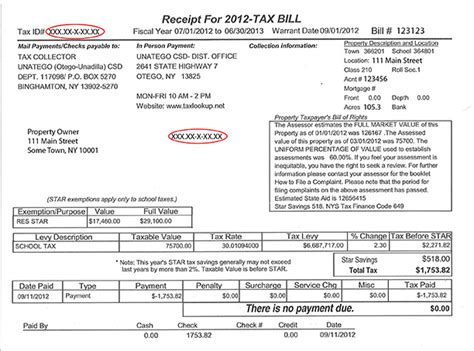

Once the tax assessment is complete, the assessor's office will send a tax bill to the property owner, outlining the amount due, the due date, and payment options. It is important to carefully review this bill to ensure the accuracy of the assessed value and the calculated tax amount. If you have any concerns or believe there may be an error, it is advisable to contact the assessor's office promptly.

Locating Your Local Tax Assessor Office

Identifying your local tax assessor office is the first step in understanding where to pay your property taxes. These offices are typically associated with the county or municipality where your property is located. You can find the contact details for your local tax assessor office by visiting the official website of your county or city government.

Alternatively, you can use online resources such as property tax search databases or real estate websites that provide information on local tax assessor offices. These platforms often allow you to search for your property by address or parcel number, providing details about your tax assessment, including the contact information for the relevant tax assessor office.

Once you have identified your local tax assessor office, it is recommended to contact them directly to inquire about their preferred payment methods and any specific instructions for remitting your property taxes. Some offices may accept payments in person, while others may offer online payment portals or accept payments by mail.

Online Payment Portals: A Convenient Option

In today’s digital age, many tax assessor offices have embraced technology to offer convenient online payment portals. These portals provide a secure and efficient way to pay your property taxes without the need to visit the office in person.

To utilize an online payment portal, you will typically need to create an account using your property details, such as the address or parcel number. Once your account is set up, you can access it anytime to view your tax bill, make payments, and track the status of your transactions. Online payment portals often accept various payment methods, including credit cards, debit cards, and electronic fund transfers.

The convenience of online payment portals extends beyond the initial payment. Many portals offer features such as automatic payment scheduling, allowing you to set up recurring payments to ensure timely remittance without the hassle of manual reminders. Additionally, these portals often provide detailed payment histories, enabling you to easily track and manage your property tax payments over time.

Security and Privacy Concerns with Online Payment Portals

While online payment portals offer convenience, it is essential to prioritize security and privacy when using these platforms. Tax assessor offices typically employ robust security measures to protect your personal and financial information. However, it is always advisable to verify the legitimacy of the portal before entering sensitive data.

Look for indicators of a secure connection, such as a padlock icon in your browser's address bar or "https" in the website's URL. These signs indicate that the connection is encrypted, making it more difficult for unauthorized individuals to intercept your data. Additionally, check for any security certifications or seals displayed on the payment portal to further assure its legitimacy.

When creating an account on an online payment portal, choose a strong and unique password to protect your account. Avoid using easily guessable information such as your birthdate or common phrases. It is also recommended to enable two-factor authentication (2FA) if available, adding an extra layer of security to your account.

Alternative Payment Methods: Mail and In-Person

While online payment portals have become increasingly popular, traditional payment methods such as mail and in-person payments still remain valid options for paying your property taxes.

Mail Payments

If you prefer a more traditional approach, you can mail your property tax payment to the tax assessor’s office. The tax bill you receive will typically include instructions on how to remit your payment by mail. It is important to ensure that you send your payment in a timely manner to avoid late fees or penalties.

When mailing your payment, use a secure and trackable method such as certified mail or a courier service. This allows you to verify that your payment has been received by the tax assessor's office, providing peace of mind and reducing the risk of lost or delayed payments.

It is recommended to include a copy of your tax bill or at least your property tax account number with your payment to ensure proper processing. Additionally, keep a record of your payment, including the payment method, amount, and date, for your personal records and as proof of payment if needed.

In-Person Payments

For those who prefer a more direct approach, many tax assessor offices still accept in-person payments. Visiting the tax assessor’s office allows you to interact directly with staff, ask questions, and receive immediate assistance if needed.

Before heading to the office, it is advisable to check their website or contact them to confirm their operating hours and any specific requirements for in-person payments. Some offices may have designated payment windows or counters, while others may require appointments for certain services.

When making an in-person payment, bring the necessary documentation, such as your tax bill and a form of payment. Common forms of payment accepted by tax assessor offices include cash, checks, money orders, and sometimes even credit or debit cards. Be prepared to provide valid identification, such as a driver's license or state-issued ID, to complete the payment process.

The Importance of Timely Payments

Paying your property taxes on time is crucial to avoid late fees, penalties, and potential legal consequences. Most jurisdictions impose strict deadlines for property tax payments, and failure to meet these deadlines can result in significant financial penalties.

Late payments often incur interest charges, which can quickly accumulate and add up to a substantial amount. Additionally, some jurisdictions may impose additional penalties, such as late payment fees or interest on the unpaid balance. In extreme cases, non-payment of property taxes can lead to legal action, including tax liens on your property or even foreclosure proceedings.

To avoid these pitfalls, it is essential to stay organized and mark important tax payment deadlines on your calendar. Many tax assessor offices provide reminders or notifications for upcoming due dates, but it is ultimately your responsibility to ensure timely payment. Consider setting up automatic payments or reminders to avoid any missed payments.

Consequences of Late or Unpaid Property Taxes

The consequences of late or unpaid property taxes can be severe and far-reaching. Beyond the immediate financial penalties, such as interest and late fees, there are several other potential implications to consider.

First and foremost, your credit score may be adversely affected. Property tax delinquency is typically reported to credit bureaus, which can result in a negative impact on your credit report. This can make it more challenging to obtain loans, mortgages, or other forms of credit in the future.

Furthermore, prolonged non-payment of property taxes can lead to tax liens being placed on your property. A tax lien is a legal claim against your property by the government for unpaid taxes. This lien remains attached to your property until the taxes are paid in full, and it can affect your ability to sell or refinance your home.

In extreme cases, the government may initiate foreclosure proceedings to recover the unpaid taxes. Foreclosure can result in the loss of your property and significant financial strain. It is important to note that each jurisdiction may have its own specific laws and procedures regarding tax liens and foreclosures, so it is crucial to familiarize yourself with the local regulations.

Conclusion: Stay Informed and Organized

Understanding where and how to pay your property taxes is an essential aspect of responsible property ownership. By familiarizing yourself with the local tax assessor office, exploring online payment portals, and considering alternative payment methods, you can ensure a smooth and timely payment process.

Remember to stay organized and mark important tax payment deadlines on your calendar. Set up reminders or automatic payments to avoid late fees and penalties. Keeping accurate records of your property tax payments and staying informed about any changes in tax laws or procedures can help you maintain a good standing with your local government and avoid potential legal consequences.

Property taxes are an important responsibility, and by staying informed and organized, you can ensure a positive relationship with your local tax assessor's office and maintain the financial stability of your property.

What happens if I pay my property taxes late?

+Late payment of property taxes typically incurs interest charges and penalties. The specific consequences can vary depending on the jurisdiction, but it’s important to avoid late payments to prevent financial penalties and potential legal actions.

Can I make partial payments for my property taxes?

+Partial payments are generally not accepted for property taxes. Most jurisdictions require the full amount to be paid by the due date. However, it’s advisable to contact your local tax assessor’s office to inquire about any specific arrangements or payment plans they may offer.

Are there any tax breaks or exemptions for property owners?

+Many jurisdictions offer tax breaks, exemptions, or discounts for certain types of property owners, such as seniors, veterans, or individuals with disabilities. It’s worth researching and understanding the specific tax incentives available in your area to take advantage of any applicable benefits.