Chandler Sales Tax

Chandler, Arizona, a vibrant city known for its thriving technology sector and growing business community, has a unique sales tax structure that impacts both residents and businesses. Understanding the intricacies of this tax system is essential for anyone looking to navigate the financial landscape of this bustling city. Let's delve into the specifics of Chandler's sales tax and explore how it operates, affects various sectors, and influences the overall economic climate.

Understanding Chandler’s Sales Tax: A Comprehensive Overview

Chandler’s sales tax is a consumption tax levied on the sale of goods and services within the city limits. It is a crucial component of the city’s revenue stream, contributing significantly to the funding of essential public services and infrastructure development. The tax rate is comprised of both state and local components, with specific rates applicable to different types of transactions.

State and Local Sales Tax Rates

The state of Arizona imposes a base sales tax rate of 5.6%, which is applicable to most retail sales. Additionally, the city of Chandler adds a local sales tax of 1.5%, bringing the total sales tax rate to 7.1% for most transactions within the city.

| Tax Component | Rate |

|---|---|

| Arizona State Sales Tax | 5.6% |

| Chandler Local Sales Tax | 1.5% |

| Total Sales Tax Rate in Chandler | 7.1% |

However, it's important to note that certain categories of goods and services may be subject to different tax rates. For instance, the sale of unprepared food items often carries a reduced tax rate, while specific services like restaurant meals and hotel accommodations may have additional taxes levied by the city.

Tax Exemptions and Special Considerations

Chandler, like many other jurisdictions, provides exemptions from sales tax for certain goods and services. These exemptions are typically designed to encourage economic activity or support specific sectors. For instance, the sale of certain agricultural products, prescription medications, and select manufacturing equipment may be exempt from sales tax.

Additionally, Chandler offers tax incentives and programs to attract businesses and promote economic growth. These initiatives can include tax breaks for new businesses, reduced tax rates for specific industries, or incentives for companies relocating to the city. Such measures are strategically designed to stimulate economic development and create a competitive business environment.

Impact on Businesses and Consumers

Chandler’s sales tax structure has a direct impact on both businesses and consumers. For businesses, the tax is a cost of doing business in the city and can influence pricing strategies, especially for companies operating on thin margins. It also affects the competitiveness of local businesses compared to online retailers or those located in neighboring jurisdictions with lower tax rates.

For consumers, the sales tax adds to the cost of goods and services purchased within Chandler. While this may seem like a mere inconvenience, it can significantly impact household budgets, especially for lower-income residents or those making large purchases. Understanding these costs is crucial for consumers to make informed financial decisions.

The Role of Sales Tax in Chandler’s Economy

Chandler’s sales tax is a vital component of the city’s fiscal framework, providing a stable source of revenue for essential public services and infrastructure projects. It is a key tool for the city’s economic development strategy, allowing for the funding of initiatives that enhance the quality of life for residents and attract new businesses.

Funding Public Services and Infrastructure

A significant portion of the revenue generated from Chandler’s sales tax is allocated to funding public services, including education, public safety, and social services. This ensures that the city can provide high-quality services to its residents and maintain a safe and healthy community.

Moreover, sales tax revenue is instrumental in financing infrastructure projects. From road improvements and public transportation systems to the development of recreational facilities, these projects not only enhance the city's appeal but also create job opportunities and stimulate economic growth.

Economic Development and Business Climate

Chandler’s sales tax plays a pivotal role in shaping the city’s business climate. The tax revenue is utilized to support initiatives that promote economic development, such as business incentives, workforce training programs, and the development of business parks and incubators.

By investing in these areas, Chandler aims to create an environment that fosters business growth and innovation. This, in turn, attracts new businesses and creates job opportunities, contributing to the city's overall economic prosperity.

Comparative Analysis: Chandler vs. Neighboring Jurisdictions

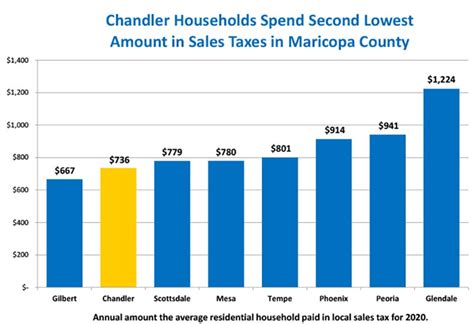

When comparing Chandler’s sales tax to that of neighboring cities and towns, it becomes evident that the city’s tax rate is relatively competitive. While the total sales tax rate of 7.1% may seem high, it is important to consider the specific exemptions and incentives offered by the city.

For instance, Phoenix, Arizona's largest city, has a slightly higher total sales tax rate of 8.1%, while smaller towns like Gilbert and Mesa have rates of 7.8% and 7.7%, respectively. This comparative analysis highlights that Chandler's tax structure is well-positioned to attract businesses and consumers while still generating sufficient revenue for essential public services.

Future Implications and Potential Reforms

As Chandler continues to grow and evolve, its sales tax structure will remain a critical aspect of the city’s fiscal planning. The city’s leadership and stakeholders must carefully consider potential reforms to ensure the tax system remains fair, efficient, and conducive to economic growth.

Potential Reforms and Adjustments

One potential reform could involve revisiting the tax rate structure to make it more competitive with neighboring jurisdictions. This could involve reducing the local sales tax rate or introducing targeted incentives for specific industries or business sectors.

Additionally, the city could explore the possibility of offering tax breaks or incentives for businesses that create a significant number of jobs or invest in sustainable practices. Such measures would not only attract new businesses but also promote a more environmentally conscious and socially responsible business community.

Impact on Long-Term Economic Development

Any reforms to Chandler’s sales tax system would have a significant impact on the city’s long-term economic development. A well-designed tax system can enhance the city’s appeal to businesses and investors, leading to increased economic activity, job creation, and improved quality of life for residents.

On the other hand, if the tax system becomes too complex or burdensome, it could deter businesses from locating in Chandler, hindering economic growth and development. Thus, striking the right balance between generating sufficient revenue and creating a competitive business environment is crucial for the city's future prosperity.

Public Perception and Engagement

Public perception of the sales tax system is another critical aspect to consider. Chandler’s residents and businesses must feel that the tax system is fair, transparent, and beneficial to the community. Engaging with the public through town hall meetings, surveys, and other outreach initiatives can help shape the tax system to better serve the needs and interests of the community.

Conclusion: Navigating Chandler’s Sales Tax Landscape

Chandler’s sales tax is a complex yet essential component of the city’s economic fabric. Understanding its intricacies, from the specific tax rates to the exemptions and incentives offered, is crucial for both businesses and consumers operating within the city.

As Chandler continues to evolve and grow, its sales tax system will remain a key tool for economic development and public service funding. By staying informed and engaged with the city's fiscal policies, residents and businesses can actively participate in shaping a sustainable and prosperous future for Chandler.

How often are sales tax rates reviewed and adjusted in Chandler, Arizona?

+Sales tax rates in Chandler, like many other jurisdictions, are typically reviewed and adjusted periodically. This process often involves assessing the city’s financial needs, economic trends, and comparative tax rates in neighboring areas. While there is no set timeline for these reviews, they are generally conducted every few years to ensure the tax system remains fair and effective.

Are there any plans to reduce the sales tax rate in Chandler to attract more businesses?

+While reducing the sales tax rate is a strategy often considered by cities to attract businesses, Chandler’s leadership typically takes a holistic approach to economic development. This may involve a combination of tax incentives, infrastructure improvements, and business support programs. So, while a rate reduction is possible, it is just one of many tools the city might use to foster economic growth.

How does Chandler’s sales tax compare to other major cities in Arizona?

+Chandler’s total sales tax rate of 7.1% is relatively competitive compared to other major cities in Arizona. For instance, Phoenix has a higher rate of 8.1%, while Mesa and Gilbert have rates of 7.7% and 7.8%, respectively. This competitive tax rate, coupled with Chandler’s thriving business environment and quality of life, makes it an attractive location for businesses and residents alike.