Polestar 2 Tax Credit

In the ever-evolving landscape of electric vehicles (EVs), the Polestar 2 has emerged as a prominent player, offering a sleek and sustainable alternative to traditional combustion engine cars. As the world embraces a greener future, governments and automotive industries are collaborating to incentivize the adoption of electric mobility. One such incentive is the tax credit, a financial reward that can significantly reduce the cost of purchasing an EV like the Polestar 2. In this comprehensive guide, we delve into the intricacies of the Polestar 2 tax credit, exploring its potential benefits, eligibility criteria, and the overall impact it can have on the transition to electric driving.

Understanding the Polestar 2 Tax Credit

The Polestar 2 tax credit is a government-issued incentive aimed at encouraging the purchase of environmentally friendly vehicles, specifically the Polestar 2 electric car. It serves as a rebate or deduction on the taxes owed by individuals who opt for this eco-conscious choice. This credit not only makes the Polestar 2 more affordable but also contributes to the broader goal of reducing carbon emissions and promoting sustainable transportation.

The credit amount can vary depending on several factors, including the region and the specific policies in place. Typically, it is calculated as a percentage of the vehicle's purchase price or a flat rate, whichever results in the greater savings for the buyer. For instance, in the United States, the federal tax credit for electric vehicles like the Polestar 2 can be up to $7,500, providing a significant reduction in the overall cost of ownership.

Key Benefits of the Tax Credit

- Cost Savings: The tax credit directly reduces the upfront cost of the Polestar 2, making it more accessible to a wider range of buyers. This incentive can be especially beneficial for those who are considering making the switch to electric but are concerned about the initial investment.

- Environmental Impact: By incentivizing the purchase of electric vehicles, the tax credit promotes a greener transportation system. It encourages consumers to choose environmentally friendly options, thereby reducing carbon emissions and contributing to a more sustainable future.

- Government Support: Governments around the world recognize the importance of transitioning to electric mobility. The tax credit is a testament to their commitment to supporting the EV industry and encouraging the adoption of cleaner technologies.

Eligibility and Criteria

While the Polestar 2 tax credit is an attractive proposition, it is important to understand the eligibility criteria to determine if you qualify for this incentive. The requirements can vary based on the region and the specific policies implemented.

Vehicle Requirements

In most cases, the tax credit is applicable to new electric vehicles only. This means that purchasing a used Polestar 2 may not qualify for the credit. Additionally, the vehicle must meet certain criteria regarding its battery capacity, range, and emissions standards. The Polestar 2, with its impressive range and zero-emission performance, easily satisfies these requirements.

Income and Tax Liability

The tax credit is typically available to individuals or businesses with a certain level of tax liability. This means that the credit can offset a portion of the taxes owed, but it is not a refundable credit. If your tax liability is lower than the credit amount, the remaining balance may not be refunded.

Regional Variations

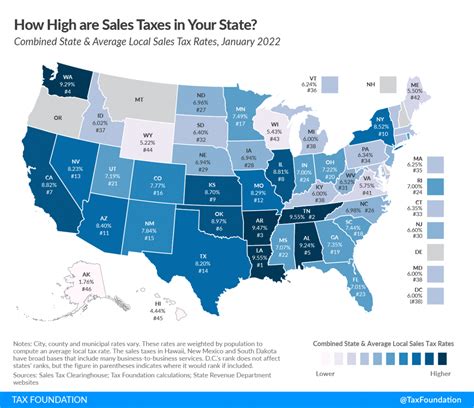

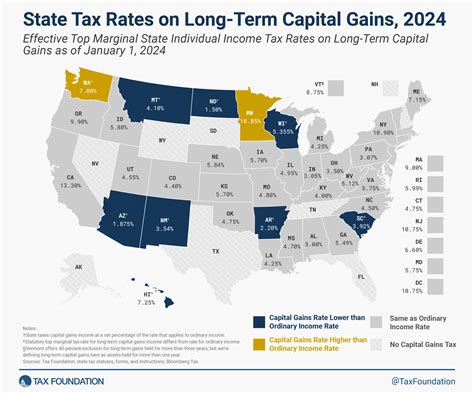

It is crucial to note that tax credit policies can differ significantly between countries, states, or provinces. Some regions may offer additional incentives or have unique eligibility criteria. For instance, certain states in the US provide their own EV tax credits, which can be combined with the federal credit, further reducing the cost of purchasing a Polestar 2.

Maximizing the Benefits

To ensure you maximize the advantages of the Polestar 2 tax credit, it is essential to plan your purchase strategically. Here are some tips to make the most of this incentive:

Timing Your Purchase

Tax credits for electric vehicles are often subject to change or may have expiration dates. Keeping yourself informed about the latest policies and deadlines is crucial. Planning your purchase to align with these timelines can ensure you don’t miss out on the benefits.

Research and Comparison

Before making a decision, research and compare the tax credit policies in your region. Different states or countries may offer varying incentives, so understanding these differences can help you choose the most advantageous option. Additionally, compare the Polestar 2 with other EV models to determine its value and ensure you are getting the best deal.

Utilizing Additional Incentives

In addition to tax credits, there may be other incentives available, such as rebates, grants, or low-interest loans specifically for electric vehicle purchases. These can further reduce the overall cost of ownership. Stay informed about these opportunities and explore all potential avenues to maximize your savings.

Performance and Specifications

Now that we’ve explored the tax credit, let’s delve into the heart of the Polestar 2: its performance and specifications. This section will provide an in-depth look at what makes the Polestar 2 a compelling choice for environmentally conscious drivers.

Power and Efficiency

The Polestar 2 boasts an impressive electric powertrain, delivering exceptional performance without compromising efficiency. With a range of up to 295 miles on a single charge, it offers the freedom to explore without range anxiety. The dual-motor setup provides an exhilarating driving experience, with rapid acceleration and precise handling, rivaling many traditional sports cars.

Advanced Technology

Polestar has incorporated cutting-edge technology into the 2, enhancing both the driving experience and overall safety. The Android Automotive OS provides a seamless infotainment system, offering a wide range of apps and services right at your fingertips. Additionally, the vehicle is equipped with advanced driver-assistance systems (ADAS), ensuring a safer and more confident driving experience.

| Specification | Details |

|---|---|

| Battery Capacity | 78 kWh |

| Range (Single Charge) | Up to 295 miles |

| 0-60 mph | 4.4 seconds |

| Charging Time (DC Fast Charging) | 0-80% in approximately 40 minutes |

Real-World Performance Analysis

To truly understand the Polestar 2’s capabilities, let’s explore some real-world performance data and user experiences. These insights will provide a comprehensive view of how the vehicle performs in various scenarios.

Efficiency and Range

Polestar 2 owners have reported impressive real-world range, often exceeding the official estimates. This is particularly beneficial for long-distance travel, as it reduces the need for frequent charging stops. The efficient use of energy and the vehicle’s regenerative braking system contribute to an overall eco-friendly driving experience.

Charging Infrastructure

With the growing popularity of electric vehicles, charging infrastructure has become more widespread. Polestar 2 owners have access to a vast network of charging stations, ensuring convenient and efficient charging experiences. The vehicle’s fast-charging capability further reduces the time spent at charging stations, making it a practical choice for daily commuting and long journeys alike.

User Feedback and Reviews

Polestar 2 has received positive feedback from owners and automotive experts alike. Users praise its sleek design, comfortable interior, and impressive performance. The seamless integration of technology and the intuitive driving experience have been highlighted as key strengths. Overall, the Polestar 2 has proven to be a reliable and enjoyable electric vehicle, offering a smooth transition to sustainable mobility.

Future Implications and Outlook

As the world moves towards a more sustainable future, the role of electric vehicles like the Polestar 2 becomes increasingly significant. Here, we explore the potential impact and future prospects of the Polestar 2 and the EV industry as a whole.

Market Growth and Adoption

The electric vehicle market is experiencing rapid growth, and the Polestar 2 is a key player in this transformation. With its impressive performance and innovative features, the Polestar 2 is contributing to the mainstream adoption of electric mobility. As more consumers opt for EVs, the market is expected to expand, leading to further advancements in technology and infrastructure.

Environmental Impact and Sustainability

The transition to electric vehicles has a profound impact on the environment. By reducing carbon emissions and relying on cleaner energy sources, EVs like the Polestar 2 play a crucial role in mitigating climate change. As the Polestar 2 and other EVs continue to gain popularity, we can expect a significant reduction in air pollution and a more sustainable transportation system.

Industry Collaboration and Innovation

The success of the Polestar 2 and other EVs is a result of collaboration between automotive manufacturers, technology companies, and governments. This partnership fosters innovation and drives the development of cutting-edge technologies. As the industry continues to evolve, we can anticipate even more advanced features, improved efficiency, and enhanced sustainability practices.

Conclusion

The Polestar 2 tax credit is a powerful incentive that encourages the adoption of electric vehicles and contributes to a greener future. By understanding the eligibility criteria and maximizing the benefits, individuals can make informed decisions when considering the Polestar 2 as their next vehicle. With its impressive performance, advanced technology, and environmental benefits, the Polestar 2 is a compelling choice for those seeking a sustainable and exciting driving experience.

Frequently Asked Questions

Can I combine the federal tax credit with state or local incentives for the Polestar 2?

+

Yes, in many cases, you can combine the federal tax credit with state or local incentives. This can result in even greater savings when purchasing the Polestar 2. It’s important to research and understand the specific policies and eligibility criteria for each incentive to maximize your benefits.

How long does it typically take to receive the tax credit after purchasing the Polestar 2?

+

The timeframe for receiving the tax credit can vary depending on the region and the tax filing process. In some cases, it may be applied directly to your tax liability when filing your tax return. Others may require additional documentation and processing time. It’s advisable to consult with a tax professional to understand the specific timeline for your situation.

Are there any restrictions on using the tax credit for leasing the Polestar 2 instead of purchasing it?

+

The eligibility for tax credits may vary depending on whether you purchase or lease the Polestar 2. Some regions offer tax credits specifically for purchasing new EVs, while others may provide incentives for leasing as well. It’s essential to review the specific policies and consult with a tax advisor to understand the applicability of the credit in your leasing scenario.

Can I transfer the tax credit to someone else if I decide not to use it for my Polestar 2 purchase?

+

The transferability of the tax credit depends on the specific policies and regulations in your region. In some cases, the credit may be non-transferable and applicable only to the original purchaser. However, certain jurisdictions allow for the transfer of credits under specific circumstances. It’s crucial to consult with a tax professional to understand the transferability rules and ensure compliance.

What happens if the tax credit amount exceeds my tax liability for the year?

+

If the tax credit amount exceeds your tax liability, the remaining balance may or may not be refundable, depending on the specific policies in your region. In some cases, the excess credit can be carried over to future tax years, allowing you to apply it against future tax liabilities. It’s important to review the guidelines and consult with a tax advisor to understand the treatment of excess credits in your situation.