Texas Capital Gains Tax Rate 2025

As we embark on the year 2025, it's important for residents and businesses in Texas to understand the state's tax landscape, particularly when it comes to capital gains. Capital gains taxes are an essential component of a state's revenue, and Texas, known for its business-friendly environment, has its own unique approach to this form of taxation. This article aims to provide an in-depth analysis of the Texas capital gains tax rate for the year 2025, offering insights into its implications, calculations, and potential future developments.

Understanding the Texas Capital Gains Tax

The Texas tax system operates under a unique structure, primarily due to the state’s lack of a personal income tax. Instead, Texas relies heavily on sales tax, property tax, and other types of levies to generate revenue. While the absence of a personal income tax is often seen as a significant advantage for businesses and individuals, it also means that capital gains tax becomes a critical component of the state’s fiscal strategy.

In Texas, capital gains tax is applied to the profits made from the sale of capital assets, which include investments, real estate, collectibles, and certain business assets. The state's approach to capital gains taxation is designed to encourage economic growth and investment, while also ensuring a stable revenue stream for essential state services.

Tax Rates and Calculations

As of 2025, the Texas capital gains tax rate stands at 7.5%, which is applicable to most types of capital gains. This rate is uniform across the state and is imposed on the net capital gain, which is calculated by subtracting the cost basis (the original investment amount) from the selling price.

For instance, if an individual purchases a piece of real estate for $500,000 and sells it for $700,000 after a few years, the capital gain would be $200,000. The capital gains tax would then be calculated as 7.5% of $200,000, resulting in a tax liability of $15,000.

| Capital Gain Amount | Texas Capital Gains Tax |

|---|---|

| $100,000 | $7,500 |

| $500,000 | $37,500 |

| $1,000,000 | $75,000 |

It's important to note that Texas does not differentiate between short-term and long-term capital gains, unlike some other states and the federal government. This means that the 7.5% tax rate applies regardless of how long the asset was held, making it a straightforward and predictable tax structure.

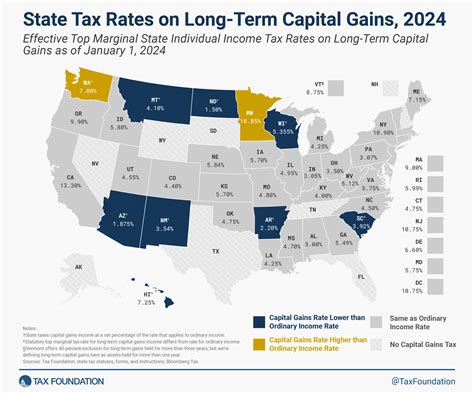

Comparative Analysis: Texas vs. Other States

When compared to other states, Texas’s capital gains tax rate is relatively moderate. Some states, especially those with a high cost of living, impose significantly higher rates, while others, like Texas’s neighboring state New Mexico, do not have a state-level capital gains tax.

For instance, California, a state known for its high taxes, imposes a maximum capital gains tax rate of 13.3%, which is more than double the Texas rate. On the other hand, Florida, another popular state for businesses and individuals, also does not have a state-level capital gains tax, similar to Texas's strategy.

| State | Capital Gains Tax Rate |

|---|---|

| Texas | 7.5% |

| California | 13.3% |

| Florida | 0% |

| New York | varies (up to 13.3%) |

The absence of a personal income tax and a moderate capital gains tax rate makes Texas an attractive destination for businesses and high-net-worth individuals seeking to minimize their tax liabilities. This has contributed to the state's robust economic growth and its reputation as a business-friendly haven.

Implications for Businesses and Individuals

For businesses, especially those involved in real estate, venture capital, and other asset-intensive industries, the Texas capital gains tax rate can significantly impact their bottom line. While the 7.5% rate is competitive, it’s essential for businesses to carefully plan their investments and sales strategies to optimize their tax position.

Individuals, particularly those with significant investment portfolios, should also be mindful of the capital gains tax implications. Proper tax planning, including the use of tax-efficient investment strategies and the consideration of long-term holding periods, can help individuals minimize their tax liabilities and maximize their returns.

Future Outlook and Potential Changes

As we look ahead, the future of the Texas capital gains tax rate remains largely stable. With a robust economy and a business-centric approach, it’s unlikely that the state will make significant changes to its tax structure in the short term. However, as the economic landscape evolves, particularly with the potential impact of federal tax reforms, Texas may need to adapt its tax policies to remain competitive.

One potential area of change could be the introduction of differentiated tax rates for long-term and short-term capital gains. While this would add complexity to the tax system, it could also provide incentives for long-term investment and stability. Additionally, as the state's population and economic profile continue to evolve, the tax landscape may need to be adjusted to ensure it remains equitable and sustainable.

Furthermore, with the increasing focus on environmental sustainability and green initiatives, there could be a shift towards tax incentives for environmentally friendly investments. Texas, with its strong energy sector, could potentially explore tax breaks for green energy investments, encouraging a transition towards a more sustainable economy.

Conclusion

In conclusion, the Texas capital gains tax rate for 2025 stands at 7.5%, offering a competitive and predictable tax environment for businesses and individuals. The state’s unique approach, characterized by the absence of a personal income tax, has contributed to its reputation as a business-friendly hub. While the current tax structure is stable, the future holds potential for evolutionary changes, ensuring Texas remains adaptable and responsive to economic and environmental developments.

Frequently Asked Questions

How does Texas compare to other states in terms of capital gains tax rates?

+

Texas’s capital gains tax rate of 7.5% is relatively moderate compared to some other states. States like California impose much higher rates, while others like Florida have no state-level capital gains tax. This makes Texas an attractive destination for businesses and individuals seeking tax efficiency.

Are there any exceptions or special considerations for certain types of capital gains in Texas?

+

As of 2025, there are no specific exceptions or special considerations for certain types of capital gains in Texas. The 7.5% tax rate applies uniformly to most capital gains, including those from real estate, investments, and collectibles.

How does Texas’s lack of personal income tax impact its capital gains tax structure?

+

Texas’s absence of a personal income tax means that capital gains tax becomes a critical component of the state’s revenue. It encourages economic growth and investment while ensuring a stable income stream for the state. This unique tax structure has contributed to Texas’s reputation as a business-friendly state.