Jimmy Carr Tax

In recent years, the topic of tax avoidance and evasion has gained significant public attention, especially when high-profile individuals or celebrities are involved. One such instance that sparked widespread controversy and ethical debates is the case of British comedian Jimmy Carr's involvement with the K2 tax avoidance scheme.

This article aims to delve into the intricacies of this tax controversy, examining the scheme's mechanics, its impact on Carr's reputation and the wider public perception of tax avoidance, as well as exploring the legal and ethical implications that arise from such practices.

The K2 Tax Avoidance Scheme

The K2 tax avoidance scheme, masterminded by the financial services firm Spearpoint Group, gained notoriety in the early 2010s for its aggressive and complex strategy to reduce tax liabilities for high-net-worth individuals. The scheme operated through a network of trusts and companies based in Jersey, a well-known tax haven, with the ultimate aim of diverting profits from UK-based activities to these offshore entities, thereby minimizing tax payments.

The K2 scheme offered a seemingly attractive proposition to its clients, promising to reduce their tax liabilities to as little as 1%. This was achieved by structuring their earnings as loans rather than income, thus bypassing the standard income tax rates. While such schemes are not illegal per se, they often exploit loopholes in the tax system, leading to significant revenue losses for governments and contributing to a sense of unfairness among taxpayers who cannot access such intricate avoidance methods.

How the K2 Scheme Worked

At its core, the K2 scheme involved the creation of a complex web of offshore entities, each with specific roles and connections to the client. Here's a simplified breakdown of how it functioned:

- A UK-based company would pay a significant portion of its profits to an offshore company controlled by the client.

- This offshore company would then pay a "loan" to a second offshore company, owned by the first.

- The second company would use these "loan" funds to purchase shares in a trust, with the client being the beneficiary of this trust.

- The trust would then pay out the profits to the client as a "loan repayment," thus avoiding income tax on these profits.

While this structure might seem convoluted, it effectively allowed individuals like Jimmy Carr to sidestep the UK's income tax laws, potentially saving them millions in tax payments.

Jimmy Carr's Involvement

Jimmy Carr, a highly successful and well-known comedian, found himself at the center of this tax controversy in 2012 when his involvement in the K2 scheme was publicly revealed. According to reports, Carr had been participating in the scheme since 2006, during which time he allegedly saved millions of pounds in taxes by routing his earnings through this intricate offshore network.

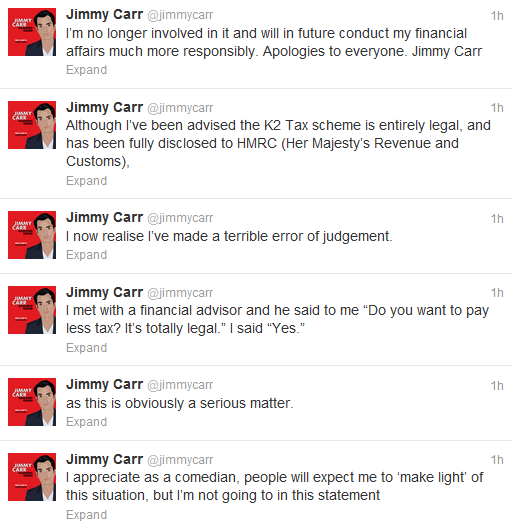

The revelation of Carr's tax arrangements sparked a media frenzy, with the public and political figures alike expressing outrage at what was perceived as an unethical and immoral practice. The backlash was so intense that Carr was even forced to issue a public apology, stating that he had made a "terrible error of judgment" and would be ending his involvement with the scheme.

Impact on Public Perception and Ethics

The Jimmy Carr tax controversy had a significant impact on public perception of tax avoidance and evasion. It brought to the forefront the complex issue of ethical boundaries in tax planning, especially for high-profile individuals who often serve as role models for the public.

Public outrage over Carr's tax arrangements was fueled by a sense of injustice and the perception that the wealthy were not paying their fair share of taxes. This sentiment was further exacerbated by the fact that Carr's participation in the scheme was revealed at a time when the UK was implementing austerity measures, which included cuts to public services and benefits.

Ethical and Legal Implications

From an ethical standpoint, the K2 scheme and Carr's involvement raise several important questions. One key issue is the concept of tax morality. While tax avoidance is not illegal, the moral implications of using complex schemes to minimize tax payments, especially when the individual in question is already wealthy, are often questioned.

Additionally, the use of tax havens like Jersey in the K2 scheme highlights the broader issue of offshore financial centers and their role in facilitating tax avoidance and evasion. These jurisdictions often have lower tax rates or even offer zero taxation, making them attractive destinations for those seeking to reduce their tax liabilities. The existence of such tax havens has led to a global debate on tax fairness and the need for international cooperation to combat tax avoidance.

Legally, the K2 scheme did not break any laws. However, the public backlash and political pressure following the Jimmy Carr controversy led to significant changes in UK tax legislation. The government introduced measures to close the loopholes exploited by such schemes, including the introduction of the Diverted Profits Tax (also known as the "Google Tax") in 2015, which targeted multinational corporations that shifted profits offshore to avoid UK taxes.

The Future of Tax Avoidance

The Jimmy Carr tax controversy is just one example of the ongoing battle between taxpayers and tax authorities. As tax avoidance schemes become increasingly sophisticated, tax authorities are also enhancing their capabilities to detect and deter such practices. The use of data analytics and artificial intelligence is revolutionizing tax enforcement, allowing authorities to identify patterns and anomalies that might indicate tax avoidance.

Furthermore, there is a growing global movement towards greater tax transparency and cooperation among nations. Initiatives like the Common Reporting Standard (CRS) and the Base Erosion and Profit Shifting (BEPS) project are aimed at combating tax avoidance and ensuring that multinational corporations and wealthy individuals pay their fair share of taxes. These efforts are crucial in promoting a more equitable global tax system.

| Metric | Value |

|---|---|

| Estimated Tax Savings (Carr's case) | £3.3 million per year |

| Number of Participants (K2 scheme) | Over 1,000 individuals |

| Amount Recovered by HMRC (from K2 participants) | £300 million |

What is the difference between tax avoidance and tax evasion?

+Tax avoidance is the legal practice of minimizing tax liabilities through various strategies and loopholes in the tax system. Tax evasion, on the other hand, is the illegal practice of not paying taxes owed, often by deliberately misrepresenting or hiding income or assets.

Are there any legal consequences for tax avoidance schemes like the K2 scheme?

+While tax avoidance schemes like the K2 scheme are not illegal per se, they can face legal consequences if they are found to be abusive or artificial. The UK government has introduced measures to combat such schemes, and participants may be required to pay back the taxes avoided, along with penalties and interest.

How can individuals avoid getting involved in controversial tax schemes like the K2 scheme?

+Individuals should exercise caution when considering any tax planning strategy, especially those that involve complex offshore structures. It’s crucial to seek advice from reputable tax professionals who can provide ethical and legal guidance. Additionally, being transparent with tax authorities and paying the correct amount of taxes due is essential to avoid potential legal and reputational risks.