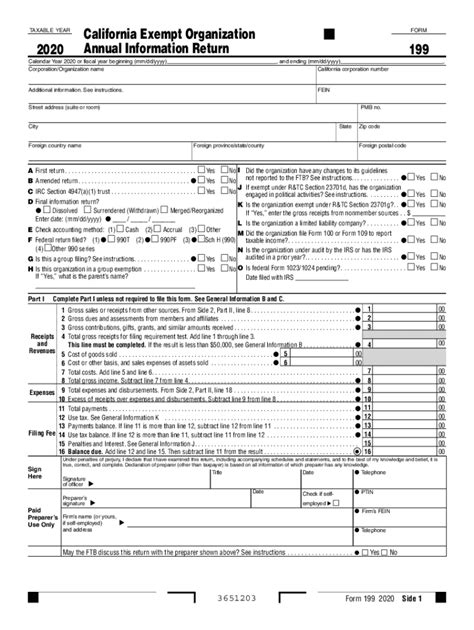

State Of California Tax Form

The State of California tax system is an intricate process, encompassing various forms and regulations. One of the most crucial elements of this system is the California Tax Form, a document that plays a pivotal role in the state's revenue collection. This comprehensive guide aims to unravel the complexities of the California Tax Form, providing an in-depth analysis for both residents and businesses operating within the state.

Understanding the California Tax Form: An Overview

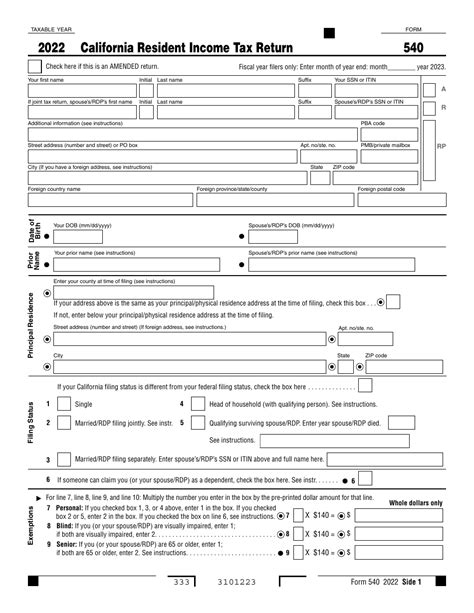

The California Tax Form, officially known as Form 540, is the primary vehicle through which individuals and entities report their income, deductions, and credits to the Franchise Tax Board (FTB) of California. This form is an essential tool for the state’s fiscal operations, as it ensures compliance with tax laws and facilitates the efficient collection of revenue.

For individuals, the Form 540 serves as a detailed record of their annual earnings, including wages, salaries, tips, and other forms of income. It also allows taxpayers to claim deductions and credits, which can reduce their overall tax liability. Similarly, for businesses, the form captures the entity's income, expenses, and other relevant financial data, helping to determine the business's tax obligations.

The complexity of the California Tax Form can vary significantly based on the taxpayer's circumstances. For instance, individuals with straightforward financial situations may find the form relatively simple, while those with multiple sources of income, investments, or business ventures may require more intricate calculations and documentation.

Key Sections of the California Tax Form

The Form 540 is divided into several sections, each designed to capture specific aspects of a taxpayer’s financial profile.

- Personal Information: This section collects basic details about the taxpayer, including name, address, and social security number. It also includes spaces for dependents, which can impact the taxpayer's deductions and credits.

- Income: Here, taxpayers report their earnings from various sources, such as wages, self-employment income, interest, dividends, and capital gains. Each source of income may have its own unique reporting requirements.

- Deductions and Credits: Taxpayers can reduce their taxable income by claiming deductions and credits. Deductions include expenses like mortgage interest, state taxes paid, and charitable contributions. Credits, on the other hand, are direct reductions of the taxpayer's liability and can include incentives like the Child Tax Credit or the Earned Income Tax Credit.

- Tax Calculation: This section guides taxpayers through the process of calculating their total tax liability, taking into account their income, deductions, and credits. The result is the amount of tax owed to the state.

- Payments and Refunds: Taxpayers use this section to indicate any payments they have already made towards their tax liability, and to request a refund if they believe they have overpaid.

- Signatures and Verification: The final section requires taxpayers to sign and date the form, verifying the accuracy of the information provided. This section also includes spaces for preparers, such as tax professionals, to sign and provide their information.

Navigating the California Tax Form: A Step-by-Step Guide

Completing the California Tax Form can be a daunting task, especially for first-time filers or those with complex financial situations. Here’s a detailed, step-by-step guide to help simplify the process.

Step 1: Gather Your Documents

Before you begin filling out the Form 540, it’s essential to have all the necessary documents at hand. This includes:

- Wage and income statements (e.g., W-2 forms, 1099 forms)

- Records of interest, dividends, and capital gains

- Receipts or records of deductions (e.g., mortgage interest, medical expenses)

- Information about dependents

- Any relevant tax documents from the previous year

Organizing these documents beforehand will make the process of completing the form much smoother.

Step 2: Understanding Your Tax Status

The first step in completing the form is to determine your tax status. This refers to your marital status and whether you are filing as an individual or as part of a couple. Your tax status can impact your tax rate and the deductions and credits you are eligible for.

Step 3: Enter Your Personal Information

The Form 540 begins with a section for personal details. Ensure you provide accurate information, including your full name, address, and social security number. If you are filing jointly with a spouse, you will need to provide their information as well.

Step 4: Report Your Income

This is one of the most critical sections of the form. Here, you will need to report all sources of income, including wages, salaries, tips, self-employment income, and any other earnings. Ensure you have the necessary documentation to back up your claims.

Step 5: Claim Your Deductions and Credits

Deductions and credits can significantly reduce your tax liability. Some common deductions include mortgage interest, state taxes paid, and charitable contributions. Credits, such as the Child Tax Credit or the Earned Income Tax Credit, can provide direct reductions to your tax bill. Be sure to research and understand which deductions and credits you are eligible for.

Step 6: Calculate Your Tax

The California Tax Form provides a detailed guide to help you calculate your total tax liability. This involves adding up your income, subtracting your deductions, and applying any credits. The result is the amount of tax you owe to the state.

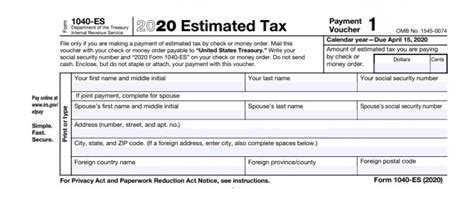

Step 7: Payments and Refunds

If you have already made payments towards your tax liability, you will need to indicate this on the form. If you believe you have overpaid, you can request a refund. Ensure you have the necessary documentation to support your claims.

Step 8: Sign and Verify

The final step is to sign and date the form, verifying the accuracy of the information provided. If you have used a tax preparer, they will also need to sign and provide their information.

California Tax Form: A Case Study

To illustrate the intricacies of the California Tax Form, let’s consider a hypothetical case study of a taxpayer, Jane Smith.

Jane is a single individual with no dependents. She works as an employee for a tech company, earning an annual salary of $70,000. In addition to her salary, she also receives interest income of $1,000 from a savings account and capital gains of $2,000 from a stock investment. She has paid $5,000 in state taxes and has made charitable contributions of $1,500.

When filling out her Form 540, Jane would start by reporting her salary, interest income, and capital gains. She would then claim deductions for her state taxes paid and charitable contributions. Based on her income and deductions, she calculates her tax liability to be $8,500. Since she has already paid $5,000 in taxes, she requests a refund of $3,500.

| Income | Amount |

|---|---|

| Salary | $70,000 |

| Interest Income | $1,000 |

| Capital Gains | $2,000 |

| Total Income | $73,000 |

| Deductions | Amount |

|---|---|

| State Taxes Paid | $5,000 |

| Charitable Contributions | $1,500 |

| Total Deductions | $6,500 |

Jane's tax liability is calculated as follows: $73,000 (total income) - $6,500 (total deductions) = $66,500 (taxable income). Using the California tax rates, her tax liability is determined to be $8,500. Since she has already paid $5,000, she requests a refund of $3,500.

Common Mistakes to Avoid on the California Tax Form

Filling out the California Tax Form can be complex, and it’s easy to make mistakes. Here are some common errors to watch out for:

- Incorrect Personal Information: Double-check your name, address, and social security number to ensure accuracy.

- Miscalculating Income or Deductions: Ensure you have all the necessary documentation to accurately report your income and claim your deductions.

- Forgetting to Sign: The form is not considered valid unless it is signed and dated by the taxpayer.

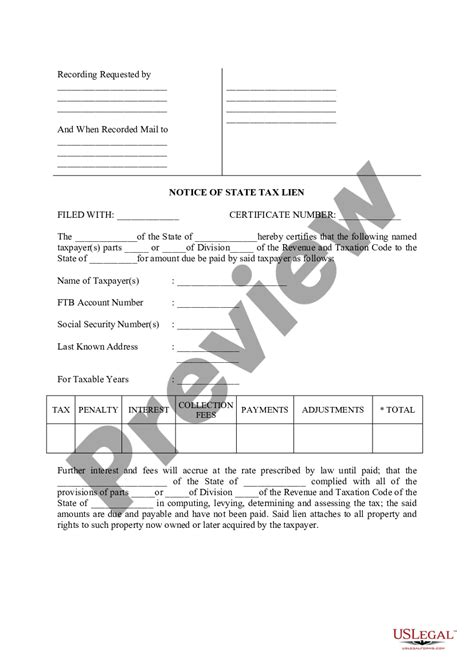

- Filing Late: Be aware of the filing deadlines to avoid penalties and interest charges.

- Not Updating Your Information: If your personal circumstances have changed, such as a new address or marital status, ensure you update your information on the form.

The Future of California’s Tax System: Trends and Innovations

The California tax system is continually evolving to meet the changing needs of its residents and businesses. Here are some trends and innovations that are shaping the future of tax filing in the state.

Online Filing and Payment

The Franchise Tax Board (FTB) is increasingly encouraging taxpayers to file their returns and make payments online. This not only simplifies the process for taxpayers but also reduces administrative costs for the state. Online filing also allows for real-time tracking of the status of your return, providing greater transparency.

Electronic Documentation

With the rise of digital technology, the FTB is moving towards a more paperless system. Taxpayers are encouraged to keep electronic records of their income, deductions, and other relevant documents. This not only saves physical storage space but also makes it easier to access and organize financial information.

Data Analytics and Machine Learning

The FTB is leveraging advanced technologies, such as data analytics and machine learning, to improve tax compliance and enforcement. These tools can help identify potential fraud, detect errors, and provide insights for policy decisions. As these technologies evolve, they are expected to play an even larger role in the future of tax administration.

Simplification of Tax Forms

The complexity of tax forms is a common source of frustration for taxpayers. The FTB is exploring ways to simplify the Form 540 and other tax forms, making them more user-friendly and easier to understand. This could involve consolidating sections, providing clearer instructions, and offering more online guidance.

Conclusion: Embracing the Complexity of California’s Tax System

The California Tax Form, or Form 540, is a crucial component of the state’s tax system, playing a vital role in revenue collection and fiscal management. While the form can be complex, understanding its intricacies is essential for taxpayers to fulfill their obligations accurately and efficiently.

This guide has provided an in-depth analysis of the California Tax Form, offering a step-by-step approach to completion and highlighting common pitfalls to avoid. It has also explored the future of the state's tax system, showcasing how technological advancements and data-driven approaches are shaping the landscape of tax administration.

As California continues to lead the way in innovation and fiscal management, it is essential for taxpayers to stay informed and engaged with the evolving tax landscape. By understanding the California Tax Form and keeping abreast of the latest trends and innovations, taxpayers can navigate the system with confidence and ensure compliance with the state's tax laws.

How often do I need to file the California Tax Form?

+Typically, you need to file a California tax return if you meet certain income thresholds or if you had California source income. The filing requirements can vary based on your tax status and income level. It’s always a good idea to consult the Franchise Tax Board’s guidelines or seek professional advice to ensure you are meeting your filing obligations.

What happens if I file my California Tax Form late or make a mistake?

+Filing your tax return late or making mistakes can result in penalties and interest charges. The amount of the penalty depends on various factors, including the severity of the mistake and the timeliness of your filing. If you realize you’ve made a mistake, it’s best to file an amended return as soon as possible. The Franchise Tax Board provides guidance on how to correct errors and avoid penalties.

Can I e-file my California Tax Form, and what are the benefits?

+Yes, you can e-file your California tax return through the Franchise Tax Board’s website or authorized e-file providers. E-filing offers several benefits, including faster processing times, reduced errors, and the ability to track the status of your return online. It’s a convenient and secure way to file your taxes and receive your refund, if applicable.

What if I need help with my California Tax Form? Are there any resources available?

+The Franchise Tax Board provides extensive resources to assist taxpayers with their tax obligations. This includes online guides, instructional videos, and interactive tools. Additionally, you can seek the assistance of tax professionals or use tax preparation software to ensure your tax return is completed accurately and efficiently.