Whats Tax Evasion

Tax evasion, a critical topic in the realm of finance and law, refers to the illegal practice of intentionally avoiding or underreporting one's tax obligations to the government. It is a serious offense that undermines the integrity of the tax system and can have significant legal and financial consequences.

Understanding Tax Evasion

Tax evasion occurs when individuals, businesses, or organizations deliberately misrepresent their financial situation to reduce their tax liability. This can take various forms, ranging from simple underreporting of income to complex schemes designed to conceal assets and transactions.

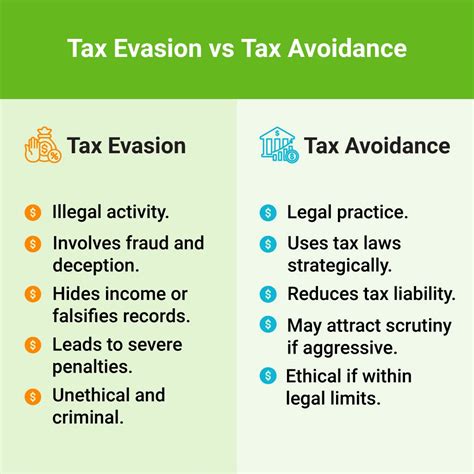

The motivation behind tax evasion often stems from a desire to minimize tax payments, either to increase personal or corporate profits or to avoid financial difficulties. However, it is important to distinguish tax evasion from tax avoidance, which is the legal practice of minimizing tax liabilities through legitimate means such as taking advantage of tax credits, deductions, or loopholes in the tax code.

Methods of Tax Evasion

Tax evaders employ a range of strategies to conceal their true financial circumstances. Here are some common methods used:

Underreporting Income

One of the most prevalent forms of tax evasion is underreporting income. This involves intentionally failing to report all sources of income, such as business profits, rental income, or investment gains. Taxpayers may omit certain income streams or underestimate the value of their earnings to reduce their taxable income.

False or Misleading Records

Tax evaders often maintain false or misleading financial records to distort their true financial position. This can involve falsifying invoices, receipts, or other documentation to overstate expenses or understate income. By manipulating records, taxpayers can create the appearance of lower profits or higher losses, thus reducing their tax liability.

Concealing Assets

Another common tactic is the concealment of assets. Taxpayers may transfer assets to offshore accounts, shell companies, or trusts to hide their true ownership and value. By doing so, they aim to avoid taxation on these assets and keep them out of the reach of tax authorities.

Unreported Cash Transactions

Businesses, particularly those in cash-based industries, may engage in unreported cash transactions to evade taxes. By accepting cash payments without issuing receipts or recording sales, they can underreport their income and avoid paying taxes on those transactions.

Illegal Tax Shelters

Some tax evaders participate in illegal tax shelters, which are complex schemes designed to reduce tax liabilities through fraudulent means. These shelters often involve the misuse of tax laws, tax treaties, or loopholes to artificially reduce taxable income or create tax deductions that are not legally justified.

Consequences of Tax Evasion

Tax evasion is a serious offense with significant legal and financial repercussions. Tax authorities around the world have stringent measures in place to detect and prosecute tax evaders.

If caught, individuals or businesses may face civil and criminal penalties, including fines, penalties, and even imprisonment. The severity of the penalties depends on various factors, such as the amount of tax evaded, the intent of the taxpayer, and the jurisdiction in which the offense occurred.

Moreover, tax evaders may also suffer reputational damage, as their actions can lead to negative public perception and loss of trust from stakeholders, investors, and clients. In some cases, tax evasion can result in the dissolution of businesses or the loss of professional licenses.

Prevention and Compliance

To combat tax evasion, governments and tax authorities have implemented various measures to enhance tax compliance. These include:

- Enhanced Tax Reporting Requirements: Governments often introduce stricter reporting obligations, such as requiring more detailed financial disclosures or implementing automatic information exchange agreements between countries to facilitate cross-border tax compliance.

- Improved Tax Enforcement: Tax authorities invest in advanced technology and analytics to detect suspicious transactions and identify potential tax evaders. They also collaborate with law enforcement agencies to investigate and prosecute tax crimes.

- Taxpayer Education: Governments and tax agencies focus on educating taxpayers about their rights and responsibilities, promoting voluntary compliance, and clarifying tax laws to reduce the likelihood of accidental errors or misunderstandings.

- International Cooperation: Tax authorities collaborate internationally to share information and coordinate efforts in combating tax evasion. This includes agreements like the Common Reporting Standard (CRS) and the Base Erosion and Profit Shifting (BEPS) project, which aim to prevent tax avoidance and evasion on a global scale.

Additionally, tax professionals play a crucial role in helping individuals and businesses navigate the complex tax landscape while remaining compliant. They provide advice on tax planning, ensure accurate record-keeping, and assist in voluntary disclosures to correct past mistakes.

Conclusion

Tax evasion is a significant issue that threatens the integrity of tax systems worldwide. By understanding the methods and consequences of tax evasion, individuals and businesses can make informed decisions to comply with tax laws and avoid the pitfalls of illegal tax practices. Governments and tax authorities continue to strengthen their efforts to combat tax evasion, ensuring a fair and transparent tax environment for all.

Frequently Asked Questions

What is the difference between tax evasion and tax avoidance?

+Tax evasion is the illegal practice of deliberately avoiding or underreporting taxes, often through fraudulent means. In contrast, tax avoidance is the legal use of tax planning strategies to minimize tax liabilities within the bounds of the law.

How can individuals and businesses ensure tax compliance?

+To ensure tax compliance, individuals and businesses should keep accurate financial records, report all income and expenses honestly, and seek professional tax advice. Staying informed about tax laws and regulations is also crucial to avoid unintentional errors.

What are the potential consequences of tax evasion?

+Tax evaders may face severe consequences, including hefty fines, penalties, and even imprisonment. Additionally, they may suffer reputational damage, loss of business opportunities, and the risk of having their assets seized.

How do tax authorities detect tax evasion?

+Tax authorities employ various methods to detect tax evasion, such as data analytics, information sharing agreements, and whistleblower programs. They also investigate suspicious transactions, compare reported income with third-party data, and analyze spending patterns to identify potential tax evaders.