Dc Property Tax

The District of Columbia, often referred to as Washington, D.C., has a unique property tax system that impacts its residents and businesses. With a diverse range of properties, from historic landmarks to modern developments, understanding the ins and outs of property taxation is crucial for anyone navigating the D.C. real estate landscape. In this comprehensive guide, we will delve into the specifics of D.C. property tax, covering everything from assessment processes to payment schedules and relief programs.

Unraveling the D.C. Property Tax System

Property taxes in the District of Columbia are an essential component of the city’s revenue stream, contributing significantly to the funding of local services and infrastructure. The process begins with the assessment of each property, which determines its taxable value. This value is then used to calculate the property tax liability for the owner.

Assessment Process: A Step-by-Step Breakdown

The Office of Tax and Revenue (OTR) is responsible for assessing properties in D.C. Here’s a detailed look at the assessment process:

- Data Collection: OTR gathers information about properties, including size, location, and recent sales data. This data is used to create a comprehensive database of property characteristics.

- Physical Inspections: Assessors from OTR conduct on-site visits to verify the data and ensure accuracy. These visits are crucial for identifying any changes or improvements made to the property since the last assessment.

- Value Estimation: Using a combination of sales comparison, cost, and income approaches, OTR estimates the market value of each property. This value is then adjusted to reflect any exemptions or special considerations.

- Notice of Assessment: Property owners receive a notice of their assessed value, along with the estimated tax liability. This notice provides an opportunity for property owners to review and appeal the assessment if they believe it is inaccurate.

The assessment process aims to ensure fairness and accuracy in property taxation, with regular reassessments to account for market fluctuations and property improvements.

Tax Rates and Calculations: Understanding the Formula

D.C. property taxes are calculated based on the assessed value of the property and the applicable tax rate. The tax rate varies depending on the type of property and its use. Here’s a simplified breakdown:

- Residential Properties: The current tax rate for owner-occupied residential properties is 0.85% of the assessed value. For rental properties, the rate is 1.45%.

- Commercial Properties: Commercial properties, including offices, retail spaces, and warehouses, are taxed at a rate of 1.85% of their assessed value.

- Vacant Land: Vacant land is taxed at a rate of 1.85%, which is the same as commercial properties.

It's important to note that these tax rates are subject to change and may be influenced by local budget considerations and economic factors.

Payment Schedules: When and How to Pay

D.C. property taxes are typically due in two installments, with the first half due by September 15th and the second half by March 31st of the following year. Property owners can choose from several payment methods, including online payments, mail-in checks, and in-person payments at designated OTR offices.

Late payments incur interest and penalties, so it's essential to stay informed about the payment deadlines and take advantage of the available payment options.

Navigating Property Tax Relief Programs

The District of Columbia recognizes the financial burden that property taxes can place on certain segments of its population. As such, it offers a range of tax relief programs to assist eligible homeowners and businesses.

Homestead Deduction: A Boost for Homeowners

The Homestead Deduction program provides a tax deduction for homeowners who occupy their properties as their primary residence. This deduction reduces the assessed value of the property for tax purposes, resulting in a lower tax liability. To qualify, homeowners must meet specific income and residency criteria.

| Income Limit | Deduction Amount |

|---|---|

| Up to $75,000 | $73,500 |

| $75,001 - $100,000 | $70,500 |

| $100,001 and above | $51,000 |

The deduction amount varies based on the homeowner's income, as shown in the table above. This program aims to make homeownership more affordable and encourage long-term residency in the District.

Senior Citizen and Disabled Tax Relief

D.C. also offers tax relief to senior citizens and individuals with disabilities. The Senior Citizen Real Property Tax Relief program provides a full or partial exemption from property taxes for eligible seniors. To qualify, individuals must be 65 years or older, occupy the property as their primary residence, and meet certain income requirements.

Similarly, the Disabled Real Property Tax Relief program offers a full or partial exemption to individuals with disabilities who meet specific criteria, including residency and income limitations.

Other Tax Relief Programs

The District of Columbia has additional tax relief programs, such as the Circuit Breaker Tax Credit, which provides a credit to low-income homeowners and renters based on their income and property taxes paid. There are also programs specifically designed for veterans, low-income seniors, and homeowners affected by natural disasters.

Property Tax Appeals: Ensuring Fair Assessment

If a property owner believes that their assessed value is incorrect or unfair, they have the right to appeal the assessment. The District of Columbia offers a comprehensive appeals process to address such concerns.

The Appeals Process: Step by Step

Here’s a simplified guide to the appeals process in D.C.:

- Review the Notice of Assessment: When you receive your notice, carefully review the assessed value and compare it to recent sales data and other properties in your area. Look for discrepancies or errors.

- File an Appeal: If you believe your assessment is incorrect, you can file an appeal with the Office of Tax and Revenue. The appeal must be filed within a specified timeframe, typically 60 days from the assessment notice.

- Provide Evidence: During the appeal process, you’ll have the opportunity to present evidence supporting your claim. This may include recent appraisals, sales data, or expert opinions.

- Hearing: Your appeal may be heard by an independent hearing officer or a board of review. You can present your case and provide additional information at this hearing.

- Decision: The hearing officer or board will issue a decision, either upholding the original assessment or adjusting it based on the evidence presented. You will receive a written notice of the decision.

It's important to gather all the necessary documentation and seek professional advice if needed to strengthen your appeal.

The Impact of Property Taxes on the D.C. Real Estate Market

Property taxes play a significant role in the real estate market dynamics of the District of Columbia. They influence investment decisions, property values, and the overall economic health of the city.

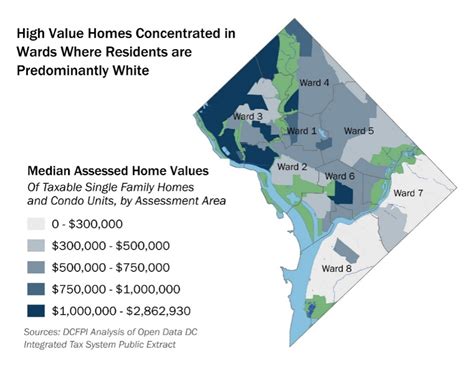

Property Values and Market Trends

The assessed value of properties, which forms the basis for property taxes, is closely tied to market values. When property values rise, so do the tax liabilities for owners. This can impact the affordability of homes and the investment potential of commercial properties.

The District's unique status as a federal district with a diverse economy and a high concentration of government-related jobs influences property values and tax revenues. The presence of federal agencies and diplomatic missions can drive up property values in certain areas, impacting the tax base.

Economic Considerations

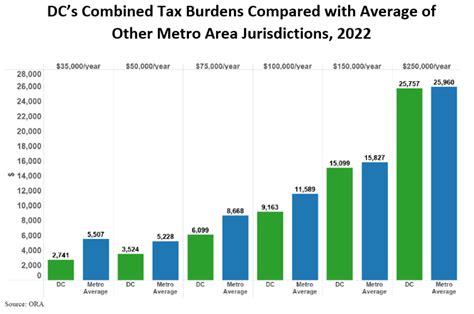

Property taxes are a significant source of revenue for the District, contributing to the funding of essential services like education, public safety, and infrastructure development. The tax system aims to balance the need for revenue with the financial realities of property owners.

Economic factors, such as the local job market, income levels, and the overall economic health of the District, can influence tax rates and the effectiveness of tax relief programs. The District's leaders must carefully consider these factors to ensure a sustainable and equitable tax system.

Conclusion: A Comprehensive Guide to D.C. Property Taxes

Understanding the intricacies of D.C. property taxes is crucial for anyone investing in or residing in the District of Columbia. From the assessment process to tax relief programs and appeals, this guide has provided a comprehensive overview of the key aspects of D.C. property taxation.

By staying informed about the property tax system and taking advantage of available resources, property owners can navigate the process with confidence. Whether it's ensuring an accurate assessment, exploring tax relief options, or understanding the market implications, knowledge is key to making informed decisions about property ownership in the District.

What happens if I miss the property tax payment deadline in D.C.?

+Late payments in D.C. incur interest and penalties. The interest rate is currently set at 14% per annum, and penalties are applied after 30 days of delinquency. It’s important to stay on top of payment deadlines to avoid these additional charges.

How often are properties reassessed in D.C.?

+Properties in D.C. are typically reassessed every four years. However, if significant changes or improvements are made to a property, it may be reassessed sooner. This ensures that property taxes reflect the current value of the property.

Can I appeal my property tax assessment if I disagree with it?

+Yes, you have the right to appeal your property tax assessment if you believe it is incorrect or unfair. The District of Columbia provides a formal appeals process, which we’ve outlined in this guide. It’s important to act promptly and gather relevant evidence to support your appeal.

Are there any tax incentives for green or energy-efficient properties in D.C.?

+Yes, D.C. offers tax incentives for properties that meet certain energy efficiency standards. The Green Building Tax Abatement Program provides a partial or full exemption from property taxes for a specified period. This program aims to encourage sustainable development and reduce environmental impact.

How can I stay informed about changes to D.C.’s property tax system and relief programs?

+Staying informed is crucial to ensure you’re aware of any changes or updates to the property tax system. You can subscribe to newsletters or follow official websites like the Office of Tax and Revenue (OTR) and the Department of Consumer and Regulatory Affairs (DCRA) for the latest information. Additionally, local news outlets and community organizations often provide updates on tax-related matters.