Vehicle Sales Tax Virginia

Vehicle sales tax in Virginia is an important consideration for anyone purchasing a new or used car in the state. Understanding the tax implications can help car buyers plan their budgets effectively and ensure they are aware of the costs associated with their vehicle purchase. In this comprehensive guide, we will delve into the specifics of vehicle sales tax in Virginia, covering the rates, exemptions, and the process of calculating and paying this tax.

Understanding Vehicle Sales Tax in Virginia

The Commonwealth of Virginia imposes a sales and use tax on the purchase of vehicles, including cars, trucks, motorcycles, and recreational vehicles. This tax is designed to generate revenue for the state and ensure a fair contribution from vehicle owners. The sales tax is applicable to both new and used vehicle sales, making it an essential aspect of the car-buying process in Virginia.

Sales Tax Rates

The sales tax rate in Virginia varies depending on the jurisdiction in which the vehicle is purchased. The base state sales tax rate is 4.3%, but local jurisdictions have the authority to add their own sales tax rates on top of this. As a result, the total sales tax rate can vary across different counties and cities within the state.

To illustrate, let’s consider an example. If you are purchasing a vehicle in the city of Richmond, the sales tax rate consists of the state base rate of 4.3% plus a local rate of 1.5%, resulting in a total sales tax rate of 5.8% for that particular jurisdiction.

| Jurisdiction | Local Sales Tax Rate | Total Sales Tax Rate |

|---|---|---|

| City of Richmond | 1.5% | 5.8% |

| Fairfax County | 0.75% | 5.05% |

| Arlington County | 0.25% | 4.55% |

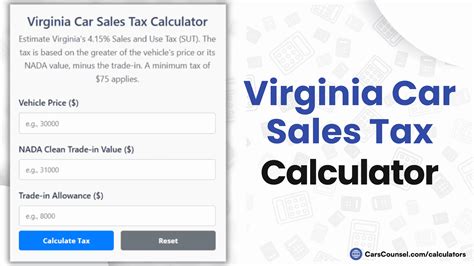

Vehicle Sales Tax Calculation

The sales tax owed on a vehicle purchase in Virginia is calculated based on the purchase price of the vehicle. This includes the base price, any applicable fees, and the cost of any optional equipment or accessories added to the vehicle. To illustrate, consider the following example:

Suppose you are purchasing a new car with a base price of $30,000. The dealership adds $1,500 worth of optional equipment, and there are $700 in fees associated with the purchase. The total purchase price of the vehicle would be $32,200.

Now, let's assume the applicable sales tax rate for your jurisdiction is 5.8%. The sales tax calculation would be as follows:

Sales Tax = Total Purchase Price x Sales Tax Rate

Sales Tax = $32,200 x 0.058

Sales Tax = $1,864.40

In this example, the sales tax owed on the vehicle purchase would be $1,864.40.

Exemptions and Special Considerations

While most vehicle purchases in Virginia are subject to sales tax, there are certain exemptions and special considerations to be aware of. These include:

- Vehicle Trade-Ins: When trading in a vehicle as part of a purchase, the trade-in value is deducted from the purchase price of the new vehicle. This can reduce the overall sales tax liability.

- Military Exemptions: Active-duty military personnel stationed in Virginia may be eligible for sales tax exemptions on vehicle purchases. These exemptions are subject to specific criteria and documentation.

- Disability Exemptions: Individuals with disabilities may qualify for sales tax exemptions on the purchase of certain vehicles or vehicle modifications. These exemptions are granted based on specific disability-related criteria.

- Leased Vehicles: Vehicles leased through a dealership or leasing company are typically subject to a different tax calculation. The tax is based on the lease payments rather than the purchase price.

It's important for car buyers to understand these exemptions and consider whether they may be eligible for any of them. Consulting with a tax professional or the Virginia Department of Taxation can provide further guidance on these specific scenarios.

Payment and Reporting Process

The process of paying vehicle sales tax in Virginia involves several steps. Here’s a breakdown of the key steps involved:

Step 1: Obtaining a Temporary Registration Permit

After purchasing a vehicle, the buyer must obtain a temporary registration permit to legally operate the vehicle on public roads. This permit is typically valid for a limited period, allowing the buyer time to complete the necessary paperwork and pay the sales tax.

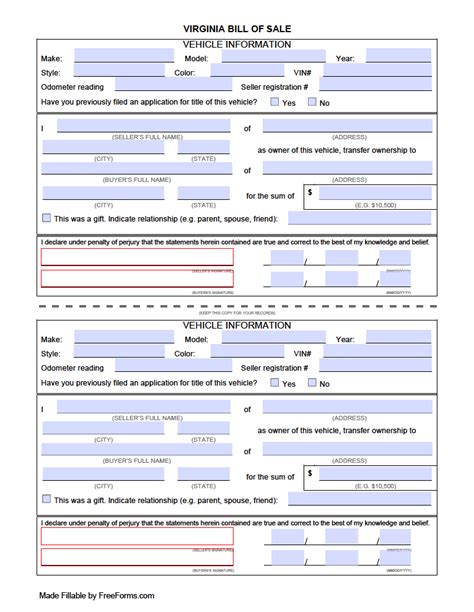

Step 2: Completing the Virginia Vehicle Sales and Use Tax Return

The buyer is responsible for completing the Virginia Vehicle Sales and Use Tax Return (Form ST-5). This form requires detailed information about the vehicle purchase, including the purchase price, any trade-in value, and the applicable sales tax rate. The form can be obtained from the Virginia Department of Taxation’s website or at local tax offices.

Step 3: Paying the Sales Tax

The sales tax owed on the vehicle purchase must be paid to the Virginia Department of Taxation. The payment can be made online, by mail, or in person at designated tax offices. It’s important to ensure the payment is made before the temporary registration permit expires to avoid penalties and additional fees.

Step 4: Registering the Vehicle

Once the sales tax has been paid, the buyer can proceed with registering the vehicle. This involves submitting the necessary documentation, including the Vehicle Sales and Use Tax Return, to the Virginia Department of Motor Vehicles (DMV). The DMV will then issue the vehicle’s permanent registration and license plates.

Penalties and Interest

Failure to pay the vehicle sales tax in a timely manner can result in penalties and interest charges. The Virginia Department of Taxation enforces these penalties to ensure compliance with tax regulations. It’s crucial for buyers to stay informed about the deadlines and requirements to avoid unnecessary financial burdens.

Vehicle Sales Tax and the Used Car Market

The sales tax implications extend to the used car market in Virginia as well. When purchasing a used vehicle, the sales tax is typically calculated based on the purchase price agreed upon by the buyer and seller. This can include private sales, dealership purchases, or auctions.

In the case of private sales, the buyer and seller must ensure the sales tax is accurately calculated and paid. The buyer is responsible for obtaining the necessary documentation and completing the required tax forms. It's essential to follow the same steps as outlined above for new vehicle purchases to ensure compliance with Virginia's tax regulations.

The Future of Vehicle Sales Tax in Virginia

The landscape of vehicle sales tax in Virginia is subject to potential changes and updates. As technology advances and the automotive industry evolves, the state may consider adjustments to its tax policies. For instance, the increasing popularity of electric vehicles and autonomous driving technologies could prompt discussions about tax incentives or adjustments to support these emerging trends.

Additionally, the ongoing development of Virginia's infrastructure and transportation systems may influence the state's tax policies. As the state invests in roads, public transit, and sustainable transportation options, the vehicle sales tax could play a crucial role in funding these initiatives. Staying informed about any proposed changes or updates to the vehicle sales tax is essential for car buyers and industry professionals alike.

Conclusion

Understanding the intricacies of vehicle sales tax in Virginia is vital for anyone considering a vehicle purchase in the state. From calculating the applicable sales tax rate to navigating the payment and registration process, this comprehensive guide has provided a detailed overview of the key aspects. By staying informed and aware of the tax implications, car buyers can make informed decisions and ensure a seamless and compliant vehicle purchase experience in Virginia.

What happens if I don’t pay the vehicle sales tax in Virginia on time?

+

Failure to pay the vehicle sales tax in Virginia on time can result in penalties and interest charges. The Virginia Department of Taxation enforces these penalties to ensure compliance with tax regulations. It’s important to stay informed about the deadlines and requirements to avoid additional financial burdens.

Are there any sales tax exemptions for electric vehicles in Virginia?

+

Yes, Virginia offers a sales tax exemption for the purchase of electric vehicles. This exemption is available to encourage the adoption of environmentally friendly transportation options. To qualify, the vehicle must meet specific criteria related to its electric drive system and energy efficiency.

Can I transfer my vehicle sales tax liability if I move out of Virginia?

+

If you move out of Virginia after purchasing a vehicle, you may be able to transfer your sales tax liability to your new state of residence. This process involves providing proof of your move and complying with the tax regulations of your new state. It’s important to consult with the tax authorities in both Virginia and your new state to ensure a smooth transition.