City Of Boston Real Estate Tax

The City of Boston, Massachusetts, is renowned for its vibrant culture, historic landmarks, and dynamic real estate market. When it comes to property ownership, one of the key considerations for residents and investors alike is the real estate tax landscape. Understanding the intricacies of Boston's real estate tax system is essential for making informed decisions and managing one's financial obligations effectively.

Unraveling the Boston Real Estate Tax Landscape

The City of Boston employs a comprehensive property tax system, encompassing various types of real estate, including residential, commercial, and industrial properties. This tax structure plays a pivotal role in funding essential public services and infrastructure development across the city. Delving into the specifics of Boston’s real estate tax reveals a nuanced and detailed process that shapes the financial landscape for property owners.

Tax Assessment Process: A Deep Dive

At the heart of Boston’s real estate tax system lies a meticulous assessment process. The city’s Department of Revenue undertakes a comprehensive evaluation of each property, considering factors such as location, size, improvements, and market value. This assessment is a crucial determinant of the tax liability for each property owner. The process is designed to ensure fairness and accuracy, taking into account the unique characteristics of each property.

One notable aspect of Boston's assessment process is its reliance on a triennial revaluation cycle. Every three years, the city undertakes a comprehensive review of property values, ensuring that tax assessments remain current and reflective of the dynamic real estate market. This approach helps maintain equity among property owners and prevents disparities that may arise over time.

To illustrate, consider the case of a residential property located in the historic Back Bay neighborhood. The assessment process would involve an in-depth analysis of the property's features, such as its architectural style, square footage, and recent renovations. Additionally, the assessor would consider the property's proximity to amenities, transportation hubs, and other factors that influence its market value. This comprehensive evaluation forms the basis for determining the property's assessed value and, subsequently, its tax liability.

| Property Type | Assessment Cycle |

|---|---|

| Residential | Triennial Revaluation |

| Commercial | Annual Review |

| Industrial | Triennial with Annual Adjustments |

Tax Rates and Calculations: A Step-by-Step Guide

Once the assessed value of a property is determined, the city applies a tax rate to calculate the property tax liability. The tax rate, expressed as a percentage, is established by the Boston City Council and may vary based on the property’s classification. This rate is a critical factor in determining the overall tax burden for property owners.

For instance, residential properties in Boston are subject to a tax rate of 1.078% for the fiscal year 2023. This means that for every $1,000 of assessed value, the property owner would be responsible for paying $10.78 in property taxes. However, it's important to note that the tax rate can fluctuate from year to year, influenced by factors such as budget requirements and the need to fund specific initiatives or projects.

To provide a practical example, let's consider a single-family home in Boston with an assessed value of $500,000. Using the tax rate for residential properties, the property owner would calculate their tax liability as follows: $500,000 (assessed value) x 1.078% (tax rate) = $5,390. This calculation illustrates the tangible impact of the tax rate on a property owner's financial obligations.

| Property Classification | Tax Rate (FY 2023) |

|---|---|

| Residential | 1.078% |

| Commercial | 1.534% |

| Industrial | 1.327% |

Tax Exemptions and Abatements: Navigating Relief Opportunities

Boston’s real estate tax system also offers a range of exemptions and abatements aimed at providing relief to certain property owners. These provisions are designed to support specific groups, such as senior citizens, veterans, and individuals with disabilities, by reducing their tax burden. Exploring these exemptions and abatements is essential for property owners seeking to optimize their financial position.

One notable exemption available in Boston is the Senior Citizen Tax Exemption. This provision allows eligible senior citizens to receive a partial or full exemption from their real estate taxes, based on their income level and property value. To qualify, individuals must meet certain age and residency requirements, and their income must fall below a specified threshold. This exemption provides much-needed financial relief for older residents, enabling them to maintain their property ownership without the strain of excessive tax obligations.

Additionally, Boston offers abatements for certain circumstances, such as property damage or improvements made to enhance energy efficiency. These abatements provide temporary reductions in property taxes, allowing property owners to offset the costs associated with necessary repairs or environmentally conscious upgrades. By incentivizing these actions, the city promotes both property maintenance and sustainability efforts.

To illustrate the impact of these exemptions and abatements, consider a hypothetical scenario where a veteran with a service-connected disability owns a residential property in Boston. If eligible, this veteran could receive a partial exemption from their real estate taxes, reducing their financial burden and providing much-needed support. Such provisions demonstrate the city's commitment to supporting vulnerable populations and fostering a more equitable tax landscape.

| Exemption/Abatement | Eligibility Criteria |

|---|---|

| Senior Citizen Tax Exemption | Age 65+, Boston residency, income limits |

| Veteran's Exemption | Honorable discharge, Boston residency, disability rating |

| Property Damage Abatement | Damage due to natural disaster or fire |

Tax Payment Options and Deadlines: A Comprehensive Overview

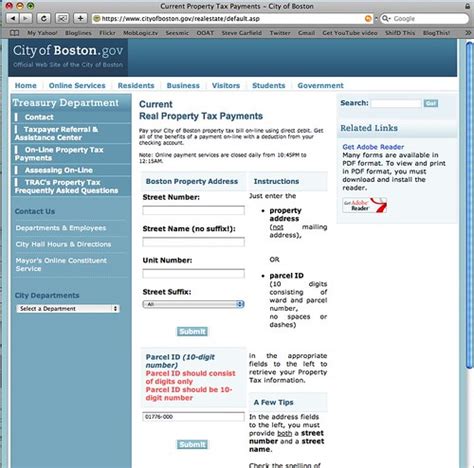

Once property owners have calculated their tax liability, it’s essential to understand the available payment options and associated deadlines. Boston offers a range of payment methods to accommodate different preferences and circumstances. From traditional mail-in payments to online options and automated billing, property owners have flexibility in choosing the most convenient and efficient approach.

To ensure timely payment, Boston provides a structured schedule of deadlines for real estate tax payments. These deadlines are typically aligned with the city's fiscal year, with multiple payment due dates throughout the year. Property owners are encouraged to stay informed about these deadlines to avoid penalties and late fees. The city's website and official communication channels provide detailed information on payment options and due dates, ensuring transparency and accessibility for taxpayers.

For instance, Boston typically offers four quarterly payment deadlines for real estate taxes. These deadlines are strategically spaced throughout the fiscal year, allowing property owners to plan and budget accordingly. Failure to meet these deadlines may result in additional charges and administrative fees, emphasizing the importance of timely payment.

To enhance convenience and streamline the payment process, Boston has implemented an online payment system. Property owners can access their account information, view their tax bills, and make secure payments through the city's official website. This digital platform provides real-time updates, enabling taxpayers to monitor their payment history and ensure compliance with their financial obligations.

| Payment Method | Description |

|---|---|

| Mail-in Payment | Send check or money order to designated address |

| Online Payment | Secure payment through city's website |

| Automated Billing | Setup automatic payments for convenience |

Challenging Tax Assessments: A Step-by-Step Guide

In certain circumstances, property owners may feel that their tax assessment is inaccurate or unfair. Boston provides a formal process for challenging assessments, allowing property owners to seek a review and potential adjustment. Understanding this process is vital for individuals seeking to rectify any discrepancies and ensure fairness in their tax obligations.

The first step in challenging a tax assessment is to carefully review the assessment notice received from the city. This notice outlines the assessed value, tax rate, and other pertinent information. Property owners should scrutinize this document for any potential errors or discrepancies. Common reasons for challenging an assessment include significant changes in the property's condition, recent sales of comparable properties at lower values, or discrepancies in the assessment process itself.

If a property owner identifies grounds for a challenge, the next step is to gather supporting documentation. This may include recent property appraisals, photographs, repair estimates, or evidence of comparable property sales. Having a well-documented case is crucial for a successful challenge.

Once the documentation is gathered, the property owner should contact the Boston Assessing Department to initiate the formal challenge process. This typically involves submitting a written request for review, along with the supporting documentation. The Assessing Department will then review the case and may request additional information or schedule an inspection of the property.

During the review process, property owners should maintain open communication with the Assessing Department. They can expect a thorough examination of their case, including a detailed analysis of the property's characteristics and market trends. The department aims to ensure fairness and accuracy in the assessment process, taking into account the unique circumstances of each property.

If the challenge is successful, the Assessing Department will adjust the property's assessed value, resulting in a reduced tax liability. This adjustment may be retroactive, providing relief for past tax years as well. However, it's important to note that not all challenges will result in a favorable outcome. In such cases, property owners have the option to appeal the decision through the Boston Assessment Board of Appeals, which provides an additional layer of review and potential resolution.

Navigating the process of challenging tax assessments requires patience, thorough documentation, and a willingness to engage with the city's tax authorities. By understanding the steps involved and presenting a well-supported case, property owners can ensure that their tax obligations are fair and accurate, contributing to a more equitable real estate tax landscape in Boston.

Real-World Examples: Case Studies in Boston’s Real Estate Tax Landscape

Exploring real-world examples and case studies provides valuable insights into the practical application of Boston’s real estate tax system. By examining the experiences of property owners, investors, and developers, we can gain a deeper understanding of the complexities and opportunities within this dynamic landscape.

One notable case study involves a prominent developer's recent acquisition of a commercial property in Boston's Seaport District. The developer, known for their innovative mixed-use projects, aimed to transform the acquired property into a vibrant hub for technology startups and creative industries. However, the real estate tax implications of this venture were a key consideration in the overall financial planning.

Upon acquiring the property, the developer engaged in a thorough analysis of the tax landscape. They calculated the tax liability based on the assessed value of the property, taking into account the commercial tax rate and any applicable exemptions or abatements. This analysis formed the foundation for their financial strategy, influencing decisions related to project timelines, rental rates, and overall profitability.

Another case study highlights the experience of a first-time homebuyer in Boston's vibrant South End neighborhood. This individual, a young professional, sought to navigate the complexities of real estate taxes as they embarked on their property ownership journey. Through careful research and consultation with tax professionals, they gained a comprehensive understanding of the assessment process, tax rates, and available exemptions.

The homebuyer's due diligence paid off when they successfully secured a partial exemption for first-time homebuyers. This exemption, coupled with their diligent tax planning, resulted in significant savings on their real estate tax obligations. By staying informed and proactive, they were able to manage their financial responsibilities effectively, contributing to a positive and sustainable homeownership experience.

These real-world examples illustrate the tangible impact of Boston's real estate tax system on the decisions and experiences of property owners and developers. By understanding the intricacies of assessments, tax rates, and available relief opportunities, individuals and businesses can navigate the landscape with confidence, making informed choices that align with their financial goals and aspirations.

Future Implications and Trends: Shaping Boston’s Real Estate Tax Landscape

Looking ahead, the future of Boston’s real estate tax landscape is poised for evolution and innovation. As the city continues to grow and evolve, several key trends and factors are likely to shape the tax system and its impact on property owners.

One significant trend is the increasing focus on sustainability and environmental considerations. Boston, known for its commitment to green initiatives, is likely to incorporate eco-friendly practices and incentives into its real estate tax structure. This may include tax breaks for energy-efficient upgrades, solar panel installations, or other environmentally conscious improvements. By incentivizing sustainable practices, the city can promote a greener future while providing financial relief to property owners who embrace these initiatives.

Additionally, the continued development of Boston's technology sector is expected to influence real estate tax policies. As the city attracts tech startups and established companies, the demand for commercial real estate is likely to rise. This trend may prompt adjustments in commercial tax rates and assessment methodologies to accommodate the evolving needs of the tech industry. By fostering a supportive tax environment for tech-focused businesses, Boston can enhance its position as a hub for innovation and economic growth.

Furthermore, the evolving dynamics of the housing market, particularly in response to changing demographics and preferences, are likely to impact real estate taxes. As Boston experiences shifts in population, such as an influx of young professionals or a growing demand for affordable housing, the city may introduce targeted tax initiatives to address these needs. This could include incentives for developers building affordable housing units or adjustments in tax rates to support specific demographic groups.

Another crucial factor shaping the future of Boston's real estate tax landscape is the ongoing commitment to equity and fairness. The city's efforts to ensure that tax assessments remain fair and accurate will continue to be a priority. This includes ongoing triennial revaluations, rigorous assessment processes, and a focus on transparency and accessibility in tax administration. By maintaining a fair and equitable tax system, Boston can foster a positive environment for property ownership and investment.

As Boston navigates these trends and adapts to the evolving needs of its residents and businesses, the real estate tax landscape is likely to become even more dynamic and responsive. Property owners, investors, and developers can anticipate a tax system that supports sustainable practices, embraces technological advancements, and prioritizes equity. By staying informed and engaged with these evolving trends, individuals can proactively navigate the tax landscape and make informed decisions that contribute to their financial success and the city's overall prosperity.

What are the key factors influencing real estate tax assessments in Boston?

+Real estate tax assessments in Boston are influenced by various factors, including property location, size, improvements, and market value. The city’s assessment process takes into account these unique characteristics to determine the assessed value, which forms the basis for tax liability.

How often are real estate tax rates reviewed and adjusted in Boston?

+Real estate tax rates in Boston are reviewed and adjusted annually by the Boston City Council. These adjustments take into account factors such as budget requirements and the need to fund specific initiatives or projects. Property owners should stay informed about any changes to the tax rate to accurately calculate their tax liability.

Are there any exemptions or abatements available to reduce real estate tax obligations in Boston?

+Yes, Boston offers a range of exemptions and abatements to provide relief to certain property owners. These provisions include the Senior Citizen Tax Exemption, Veteran’s Exemption, and abatements for property damage or energy-efficient improvements. Exploring these opportunities can lead to significant savings for eligible property owners.