Greenville County Property Tax

Property taxes are an essential part of the financial landscape for homeowners and investors, and understanding their intricacies is crucial for effective financial planning. In Greenville County, South Carolina, the property tax system is a key revenue source for the local government, impacting both residents and businesses. This comprehensive guide aims to shed light on the workings of Greenville County property taxes, offering insights into how they are calculated, the factors that influence them, and the steps individuals can take to navigate the process effectively.

Understanding Greenville County Property Taxes

Property taxes in Greenville County are determined through a meticulous assessment process that considers various factors, including the property’s value, location, and the specific tax rates applicable in the area. This system ensures that property owners contribute to the county’s revenue stream, which, in turn, funds essential services and infrastructure projects.

Assessment Methodology

The Greenville County Assessor’s Office plays a pivotal role in establishing the property’s assessed value, which forms the basis for tax calculations. This value is derived through a comprehensive evaluation process, taking into account recent sales of comparable properties, the property’s physical condition, and any improvements or additions made over time. The assessor’s office maintains detailed records and utilizes specialized software to ensure accuracy and fairness in the assessment process.

For instance, consider a residential property located in downtown Greenville. The assessor would examine recent sales of similar properties in the area, considering factors such as square footage, number of bedrooms and bathrooms, age of the structure, and any unique features. This data-driven approach ensures that the assessed value aligns with the property's true market value, providing a fair and equitable basis for taxation.

Tax Rates and Mil Rates

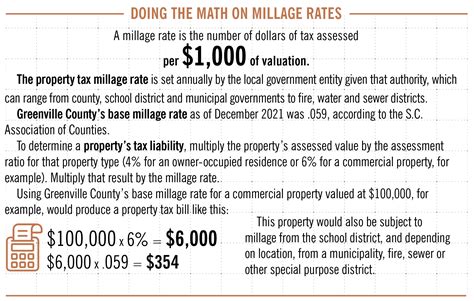

Greenville County, like many other jurisdictions, employs a mil rate system to determine the property tax rate. A mil, often referred to as a millage rate, represents one-tenth of a percent, or 0.1%. The county’s tax rate is expressed in mills and is applied to the assessed value of the property to calculate the annual tax liability.

| Taxing Authority | Mil Rate |

|---|---|

| Greenville County | 210 mills |

| School District | 178 mills |

| Municipality (e.g., City of Greenville) | 100 mills |

In the above example, the total mil rate for a property located within the City of Greenville and the Greenville County School District would be 488 mills (210 + 178 + 100). This rate is applied to the assessed value to determine the annual property tax bill.

Factors Influencing Property Taxes

Property taxes in Greenville County are influenced by a range of factors, each playing a unique role in determining the final tax liability. Understanding these factors can empower homeowners and investors to make informed decisions and potentially reduce their tax burden.

Property Value

The assessed value of the property is a primary determinant of the property tax. As mentioned earlier, the Greenville County Assessor’s Office employs a rigorous assessment process to determine this value. It’s important to note that property values can fluctuate over time due to market conditions, improvements made to the property, or changes in the surrounding area. Regular monitoring of property values and staying informed about local real estate trends can help property owners anticipate potential changes in their tax liability.

Location and Zoning

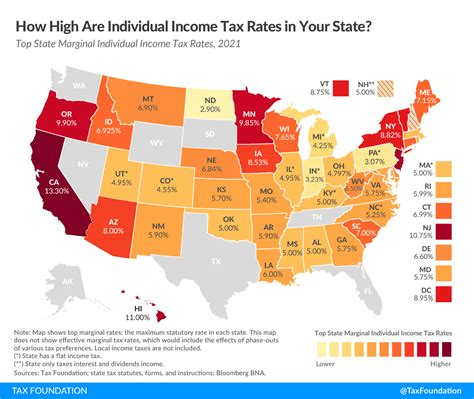

The location of the property within Greenville County can significantly impact the tax liability. Different areas of the county may have varying tax rates, and properties located in high-demand neighborhoods or close to amenities might be subject to higher assessments. Additionally, zoning regulations can influence property taxes. For instance, properties zoned for commercial use may have different tax rates and assessments compared to residential properties.

Improvements and Renovations

Any improvements or renovations made to the property can affect its assessed value. Adding a new wing, renovating the kitchen, or installing energy-efficient upgrades may increase the property’s value, leading to a higher tax assessment. It’s crucial for property owners to understand how these improvements impact their tax liability and to explore potential tax benefits associated with certain types of improvements, such as those related to energy efficiency or accessibility.

Exemptions and Discounts

Greenville County offers various exemptions and discounts that can reduce the property tax burden for eligible individuals. These may include homestead exemptions, veterans’ exemptions, and discounts for senior citizens or persons with disabilities. Understanding the eligibility criteria and applying for these benefits can significantly lower the tax liability. It’s essential to stay informed about the available exemptions and consult with the Greenville County Treasurer’s Office to ensure you are taking advantage of all applicable benefits.

The Property Tax Payment Process

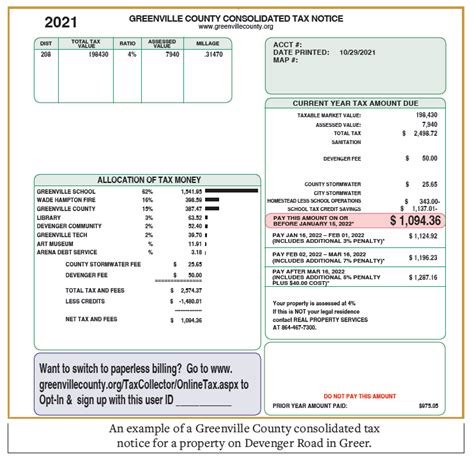

Understanding the property tax payment process is essential for property owners to ensure timely and accurate payments. Greenville County provides a user-friendly system that offers multiple payment options to cater to various preferences and needs.

Online Payment Portal

The Greenville County Treasurer’s Office offers a secure online payment portal that allows property owners to make payments conveniently from the comfort of their homes. This portal provides real-time account information, including the current balance and payment history. Property owners can set up automatic payments or make one-time payments using a credit or debit card, electronic check, or bank account transfer. The online system also sends email notifications to remind property owners of upcoming deadlines, ensuring timely payments and avoiding penalties.

In-Person Payments

For those who prefer in-person interactions, Greenville County provides multiple payment locations across the county. Property owners can visit the Treasurer’s Office or authorized payment centers to make payments in person. These locations accept various forms of payment, including cash, checks, and money orders. It’s important to note that payment hours may vary, so checking the county’s official website for the most up-to-date information is advisable.

Payment Plans and Installment Options

Recognizing that property taxes can be a significant financial burden, Greenville County offers payment plans and installment options to ease the financial strain. Property owners can set up a payment plan to spread the tax liability over multiple installments, making it more manageable. The county typically requires a down payment and subsequent payments at regular intervals, ensuring that the tax liability is covered in full by the due date. This option provides flexibility and helps property owners budget effectively for their tax obligations.

Challenging Your Property Tax Assessment

If you believe that your property’s assessed value is inaccurate or if you have concerns about the fairness of your tax assessment, Greenville County provides a process for appealing the assessment. This section will guide you through the steps to challenge your property tax assessment effectively.

Gathering Evidence

Before initiating an appeal, it’s crucial to gather evidence that supports your case. This may include recent sales data of similar properties in your neighborhood, appraisals, or any documentation that demonstrates the property’s actual value. Comparative market analysis, performed by a licensed real estate professional or appraiser, can provide valuable insights into the property’s fair market value.

Filing an Appeal

The first step in the appeal process is to file a formal request with the Greenville County Assessor’s Office. This request should clearly state the reasons for the appeal and provide supporting documentation. It’s important to carefully review the assessment notice you received and identify any discrepancies or errors. The appeal form typically requires detailed information about the property, including its address, assessed value, and the reasons for the appeal.

When filing the appeal, it's advisable to include a concise and well-organized package of evidence. This may include a cover letter summarizing your arguments, supporting documentation, and any expert opinions or reports. It's essential to meet all deadlines and provide complete and accurate information to strengthen your case.

Informal Review

After submitting your appeal, the Assessor’s Office will review your case and may schedule an informal review meeting. This meeting provides an opportunity to discuss your concerns directly with the assessor or their representative. It’s a chance to present your evidence, clarify any misunderstandings, and reach a mutually satisfactory resolution. Being prepared with a clear presentation of your case and any additional supporting documentation can enhance the likelihood of a favorable outcome.

Formal Hearing

If the informal review does not lead to a resolution, the next step is to request a formal hearing before the Greenville County Board of Assessment Appeals. This board is an independent body responsible for reviewing and deciding on property tax appeals. The hearing provides a platform to present your case, cross-examine witnesses, and argue your position before the board members.

To prepare for the formal hearing, it's beneficial to consult with a tax professional or attorney who specializes in property tax appeals. They can provide valuable guidance on presenting your case effectively, addressing legal considerations, and ensuring compliance with the hearing procedures. Being well-prepared and presenting a strong argument can increase your chances of a successful appeal.

Strategies for Reducing Property Taxes

While property taxes are a necessary contribution to the community’s infrastructure and services, there are strategies that property owners can employ to potentially reduce their tax liability. This section outlines some effective approaches to consider.

Appeal the Assessment

As mentioned earlier, appealing your property’s assessed value is a crucial step in potentially reducing your tax burden. By gathering evidence, filing a well-prepared appeal, and presenting your case effectively, you can challenge an unfair or inaccurate assessment. A successful appeal can lead to a lower assessed value, resulting in reduced property taxes.

Explore Exemptions and Discounts

Greenville County offers various exemptions and discounts that can significantly lower your property tax liability. These may include homestead exemptions, veterans’ exemptions, and discounts for senior citizens or persons with disabilities. Understanding the eligibility criteria and applying for these benefits can provide substantial savings. It’s important to stay informed about the available options and consult with the Greenville County Treasurer’s Office to ensure you are taking advantage of all applicable exemptions.

Utilize Tax Incentive Programs

Greenville County, along with the state of South Carolina, offers tax incentive programs designed to promote economic development and encourage specific types of investments. These programs may provide tax credits, abatements, or other benefits for eligible properties. For instance, the South Carolina Investment Tax Credit Program offers tax credits for qualified investments in manufacturing facilities or certain types of real estate projects. Exploring these programs and determining your eligibility can lead to significant tax savings.

Consider Rental Property Options

If you own multiple properties or are considering purchasing additional properties, exploring rental options can be a strategic way to offset your property tax liability. By renting out your properties, you can generate income that can be used to cover a portion of your property taxes. Additionally, rental properties may qualify for different tax treatments, such as depreciation, which can provide tax benefits. Consulting with a tax professional can help you navigate the complexities of rental property taxation and maximize your savings.

Conclusion: Empowering Property Owners

Understanding Greenville County property taxes is a crucial aspect of financial planning for homeowners and investors. By comprehending the assessment process, factors influencing tax liability, and the available strategies for reduction, property owners can take control of their financial obligations and make informed decisions. Whether it’s appealing an assessment, exploring exemptions, or utilizing tax incentive programs, the key lies in staying informed, seeking professional advice when needed, and actively managing your property tax obligations.

How often are property taxes assessed in Greenville County?

+

Property taxes in Greenville County are assessed annually. The assessment process involves evaluating the property’s value based on various factors, including recent sales data and improvements made to the property. The assessed value is then used to calculate the property tax liability for the upcoming year.

What is the timeline for paying property taxes in Greenville County?

+

Property taxes in Greenville County are typically due in two installments. The first installment is due by January 15th, and the second installment is due by June 15th. However, it’s important to note that these dates may be subject to change, so it’s advisable to consult the Greenville County Treasurer’s Office for the most up-to-date information.

Are there any penalties for late property tax payments in Greenville County?

+

Yes, Greenville County imposes penalties for late property tax payments. A penalty of 1.5% is applied for each month (or part of a month) that the payment is overdue. It’s crucial to make timely payments to avoid these penalties and maintain a good standing with the county.