What Are Pre Tax Deductions

Understanding pre-tax deductions is crucial for anyone looking to optimize their financial planning and minimize their tax liability. These deductions play a significant role in determining the amount of tax an individual or business owes to the government. In this comprehensive guide, we will delve into the world of pre-tax deductions, exploring their definition, types, benefits, and how they impact your overall financial strategy.

Unraveling the Concept of Pre-Tax Deductions

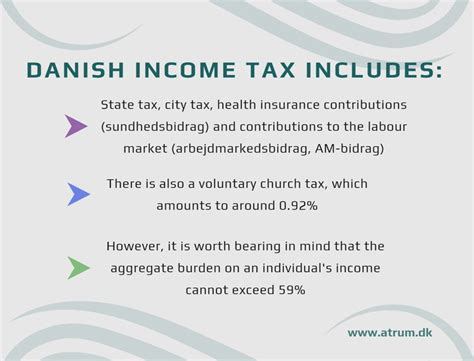

Pre-tax deductions refer to specific expenses or contributions that are deducted from an individual’s income before calculating their taxable income. These deductions are a powerful tool for reducing the amount of income subject to taxation, thereby lowering the overall tax burden. By understanding and strategically utilizing pre-tax deductions, individuals and businesses can maximize their financial savings and plan their finances more efficiently.

The concept of pre-tax deductions is deeply rooted in the principle of tax efficiency. It allows individuals to set aside a portion of their income for various purposes while enjoying the benefit of reduced taxable income. This mechanism not only helps in managing personal finances but also encourages individuals to invest in their future through retirement savings and healthcare expenses, among other things.

Types of Pre-Tax Deductions

Pre-tax deductions come in various forms, each catering to different financial needs and goals. Here’s a breakdown of some common types of pre-tax deductions:

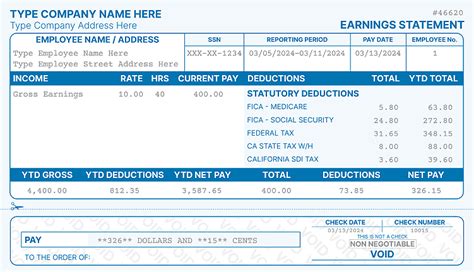

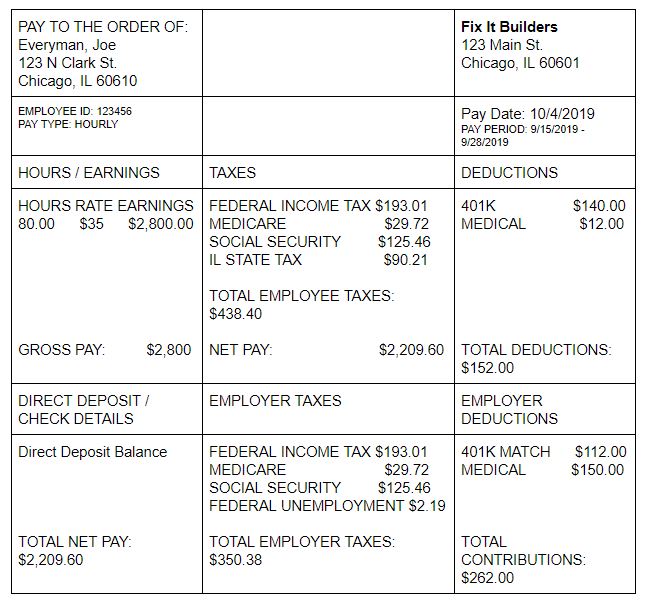

Retirement Contributions

One of the most well-known pre-tax deductions is related to retirement savings. Individuals can contribute to retirement plans such as 401(k)s, Traditional IRAs, or Roth IRAs on a pre-tax basis. These contributions reduce taxable income immediately, providing an instant tax benefit. For instance, contributing 5,000 to a 401(k) plan could save an individual up to 1,500 in taxes, depending on their tax bracket.

Healthcare Costs

Healthcare expenses are another significant category of pre-tax deductions. Employees can enroll in pre-tax healthcare plans, such as Health Savings Accounts (HSAs) or Flexible Spending Accounts (FSAs), which allow them to set aside money for medical, dental, and vision expenses. By contributing to these accounts, individuals can reduce their taxable income and gain tax advantages when paying for qualified healthcare costs.

Transportation and Parking Benefits

Some employers offer pre-tax transportation benefits, allowing employees to deduct a portion of their commuting costs. This includes expenses for public transportation, vanpooling, or even parking fees. By taking advantage of these benefits, employees can lower their taxable income and save on transportation-related expenses.

Childcare and Education Expenses

Parents can benefit from pre-tax deductions for childcare and education-related expenses. Qualified childcare expenses can be deducted through the Dependent Care Flexible Spending Account (DCFSA), which reduces taxable income. Additionally, certain education-related expenses, such as tuition and fees, can be deducted or claimed as tax credits, further easing the financial burden.

| Deduction Type | Description |

|---|---|

| Retirement Contributions | Contributions to 401(k), IRA, and Roth IRA plans reduce taxable income. |

| Healthcare Costs | HSAs and FSAs allow pre-tax deductions for medical expenses. |

| Transportation Benefits | Pre-tax deductions for commuting costs like public transport or parking. |

| Childcare and Education | DCFSA for childcare expenses and tax credits for education costs. |

Benefits and Impact on Financial Planning

The advantages of pre-tax deductions extend far beyond the immediate tax savings. By contributing to pre-tax accounts, individuals can:

- Lower their taxable income, resulting in reduced tax liability.

- Build a substantial retirement fund over time, as pre-tax contributions grow tax-deferred.

- Gain flexibility in managing healthcare expenses, especially with FSAs and HSAs.

- Save for childcare and education expenses without a significant impact on taxable income.

- Improve overall financial stability and security by planning for future needs.

Financial Planning Strategies

Incorporating pre-tax deductions into your financial plan requires careful consideration and strategic thinking. Here are some key strategies to maximize the benefits:

- Maximize Retirement Contributions: Contribute the maximum allowed to retirement plans like 401(k)s and IRAs to take full advantage of pre-tax benefits.

- Utilize Healthcare Benefits: Explore pre-tax healthcare plans and consider setting aside funds for qualified medical expenses.

- Evaluate Transportation Options: Assess your commuting costs and take advantage of pre-tax transportation benefits if available.

- Plan for Childcare and Education: Research and utilize DCFSAs and education tax credits to ease the financial burden of raising a family.

- Review and Adjust Annually: Regularly review your financial situation and adjust your pre-tax deductions to align with your goals and changing circumstances.

Conclusion

Pre-tax deductions are a powerful tool in the financial planning arsenal, offering individuals and businesses a way to optimize their finances and reduce their tax burden. By understanding the various types of pre-tax deductions and strategically incorporating them into their financial strategies, individuals can achieve greater financial security and plan for a more prosperous future. Remember, every financial decision, including pre-tax deductions, should be made with careful consideration and professional advice to ensure optimal results.

Can I contribute to multiple pre-tax retirement plans simultaneously?

+

Yes, you can contribute to both a 401(k) and an IRA simultaneously. However, there are annual contribution limits for each type of plan, so it’s important to stay within those limits to avoid penalties.

Are there any disadvantages to using pre-tax deductions?

+

One potential disadvantage is that pre-tax deductions may reduce your eligibility for certain tax credits or deductions. Additionally, some pre-tax deductions may have strict rules and penalties for early withdrawal or non-qualified expenses.

Can businesses benefit from pre-tax deductions?

+

Absolutely! Businesses can offer pre-tax benefits to their employees, such as retirement plans and healthcare benefits. This not only helps attract and retain talent but also provides tax advantages for both the business and its employees.