Durham Real Estate Tax

Welcome to our in-depth exploration of the Durham Real Estate Tax landscape, a topic of great interest to both current and prospective property owners in the vibrant city of Durham, North Carolina. As we delve into the intricacies of this essential aspect of homeownership, we aim to provide you with a comprehensive understanding of the tax obligations and strategies associated with real estate in Durham.

The city of Durham, often referred to as the "Bull City," boasts a thriving culture, a robust economy, and a diverse range of residential options. With its reputation for innovation, a thriving arts scene, and a rapidly growing tech sector, Durham has become an attractive destination for many. However, as with any thriving real estate market, understanding the tax implications is crucial for both investors and homeowners.

Understanding the Durham Real Estate Tax Structure

The real estate tax in Durham, like in many other localities, serves as a significant source of revenue for the city, funding essential services and infrastructure projects. This tax is levied on the assessed value of properties, which includes both the land and any structures on it.

The tax rate in Durham is determined annually by the city's Board of Commissioners and is expressed as a percentage of the property's assessed value. This rate can vary from year to year, influenced by factors such as the city's budgetary needs, inflation, and economic trends. For the current fiscal year, the tax rate stands at 0.5817 per $100 of assessed value, which is a slight decrease from the previous year's rate.

The assessed value of a property is typically determined by a professional appraisal conducted by the Durham County Tax Office. This appraisal takes into account various factors, including the property's size, location, condition, and recent sales data of comparable properties in the area. It's important to note that the assessed value may not always reflect the market value of the property.

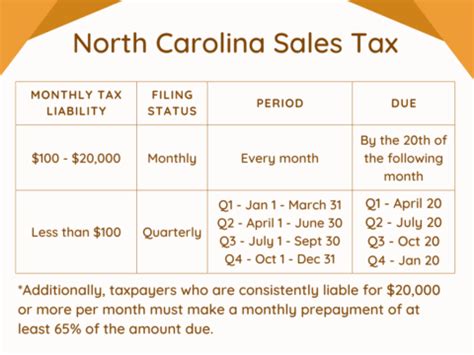

Tax Due Dates and Payment Options

Real estate taxes in Durham are billed semi-annually, with bills issued in June and December. The due dates for these payments are typically in July and January of the following year. Property owners have the flexibility to choose from several payment methods, including online payments, direct debit, and traditional mail-in checks.

For those who prefer automatic payments, the Durham County Tax Office offers a convenient direct debit program. Enrolling in this program ensures that your tax payments are made on time without the need for manual reminders. It's a popular choice for busy homeowners and investors who value convenience and peace of mind.

Tax Relief Programs and Exemptions

Recognizing the diversity of its residents, Durham offers several tax relief programs and exemptions designed to support specific groups within the community. These initiatives aim to make homeownership more accessible and affordable for eligible individuals and families.

| Program/Exemption | Eligibility Criteria |

|---|---|

| Homestead Exemption | Primary residence owned and occupied by the taxpayer. Offers a reduction in the assessed value of up to $25,000. |

| Disabled Veterans Exemption | Veterans with service-connected disabilities. Provides a reduction in assessed value based on the level of disability. |

| Senior Citizen Exemption | Homeowners aged 65 or older with limited income. Reduces the taxable value of the property. |

| Low-Income Housing Tax Credit | Developers of affordable housing projects. Provides tax credits for creating and maintaining affordable housing units. |

These programs and exemptions demonstrate Durham's commitment to supporting its residents and fostering a thriving, inclusive community. It's important for property owners to explore these opportunities and understand their eligibility to take advantage of the available benefits.

Tax Strategies for Durham Real Estate Investors

For real estate investors in Durham, understanding the tax implications of their investments is crucial for optimizing returns and managing cash flow effectively. Here are some strategies to consider:

Capitalize on Tax Deductions

Real estate investors can benefit from a range of tax deductions associated with their properties. These deductions can significantly reduce the tax liability and improve cash flow. Some common deductions include:

- Mortgage Interest: Investors can deduct the interest paid on mortgages for investment properties.

- Property Taxes: The real estate taxes paid on the investment property are fully deductible.

- Maintenance and Repairs: Costs incurred for routine maintenance and repairs are tax-deductible.

- Depreciation: Investors can claim depreciation on the building's structure and certain improvements over time, reducing their taxable income.

Utilize Tax-Advantaged Accounts

Consider investing in real estate using tax-advantaged accounts such as Self-Directed IRAs or 401(k) plans. These accounts allow investors to grow their real estate holdings tax-free or on a tax-deferred basis, depending on the account type. It’s a strategic way to build wealth and minimize tax obligations.

Take Advantage of Cost Segregation

Cost segregation is a strategy that involves separating the cost of a property’s various components into shorter and longer depreciation periods. By doing so, investors can accelerate depreciation deductions, reducing their taxable income in the early years of ownership. This strategy requires a detailed engineering study, but it can provide significant tax benefits.

Explore 1031 Exchanges

A 1031 exchange, also known as a like-kind exchange, allows investors to defer capital gains taxes when selling an investment property by reinvesting the proceeds into a similar property. This strategy can be particularly beneficial for those looking to grow their real estate portfolio without incurring immediate tax obligations.

The Impact of Real Estate Taxes on Durham’s Property Market

Real estate taxes play a significant role in shaping the dynamics of Durham’s property market. They influence investment decisions, property values, and the overall attractiveness of the market for buyers and investors.

Taxes and Property Values

The relationship between real estate taxes and property values is complex. While higher taxes can sometimes be a disincentive for potential buyers, they can also indicate a well-funded community with access to quality services and infrastructure. In Durham, the relatively moderate tax rates, coupled with the city’s reputation for excellence in education, healthcare, and cultural amenities, contribute to a positive perception of the local property market.

Attracting Investors and Driving Growth

Durham’s real estate market has seen substantial growth in recent years, attracting investors and homeowners alike. The city’s commitment to offering tax relief programs and exemptions, as well as its overall business-friendly environment, has played a significant role in this growth. Investors are drawn to the potential for capital appreciation and the opportunity to leverage tax-efficient strategies.

Future Implications and Outlook

Looking ahead, Durham’s real estate tax landscape is expected to remain stable, with the city continuing to prioritize its residents’ needs and the sustainable growth of the community. The city’s proactive approach to managing tax rates and offering tax relief initiatives will likely contribute to the ongoing attractiveness of the Durham real estate market for investors and homeowners.

In conclusion, understanding the Durham Real Estate Tax structure and its implications is essential for both homeowners and investors. By staying informed about tax rates, relief programs, and strategic tax planning, individuals can make more informed decisions about their real estate investments and ownership in this vibrant city.

What is the current tax rate for real estate in Durham, North Carolina?

+The current tax rate for real estate in Durham is 0.5817 per $100 of assessed value for the fiscal year.

Are there any tax relief programs available in Durham for homeowners?

+Yes, Durham offers several tax relief programs, including the Homestead Exemption, Disabled Veterans Exemption, and Senior Citizen Exemption. These programs provide tax benefits to eligible homeowners.

How often are real estate taxes billed in Durham?

+Real estate taxes in Durham are billed semi-annually, with bills issued in June and December. Payments are due in July and January of the following year.

What payment options are available for real estate taxes in Durham?

+Durham offers various payment options, including online payments, direct debit, and traditional mail-in checks. The direct debit program is a popular choice for automatic payments.