What Is Sales Tax In Nc

Sales tax in North Carolina is a vital component of the state's revenue system, contributing significantly to the funding of essential public services and infrastructure. This tax, imposed on the sale of goods and certain services, plays a crucial role in the state's economic landscape. Understanding the intricacies of North Carolina's sales tax is essential for businesses and consumers alike, as it directly impacts their financial obligations and strategies.

Sales Tax Basics in North Carolina

The sales tax in North Carolina is a percentage-based tax levied on the purchase price of taxable goods and services. As of my last update in January 2023, the state sales tax rate stands at 4.75%. However, it’s important to note that this is just the base rate, and local governments have the authority to impose additional sales taxes, leading to varying rates across the state.

Local Sales Tax Variations

North Carolina’s sales tax structure allows for local option taxes, which are additional sales taxes levied by counties and municipalities. These local taxes can be as high as 2.5%, resulting in a maximum combined sales tax rate of 7.25%. For instance, the city of Asheville imposes a local sales tax of 2%, bringing the total sales tax rate to 6.75% for shoppers in that area. These local variations create a complex sales tax landscape, with rates differing significantly from one region to another.

| County | Local Sales Tax Rate |

|---|---|

| Asheville | 2% |

| Raleigh | 1.5% |

| Charlotte | 2.25% |

| Durham | 1.75% |

Taxable and Exempt Items

Not all goods and services are subject to North Carolina’s sales tax. Certain items are considered tax-exempt, including:

- Prescription drugs

- Groceries and unprepared foods

- Non-prepared food sold at farmers’ markets

- Clothing and footwear (with some exceptions)

- School supplies and textbooks

- Certain medical devices

However, it's important to note that while these items are exempt from state sales tax, local jurisdictions may impose their own taxes on some of these categories. Additionally, some counties have specific exemptions, such as the exemption of firewood and lumber in certain counties.

Online Sales and Sales Tax

With the rise of e-commerce, North Carolina has implemented rules for online sales. Online retailers are required to collect sales tax if they have a physical presence (also known as a nexus) in the state. This could be in the form of a warehouse, distribution center, or even a remote worker based in North Carolina. If a business has a nexus in the state, it must collect sales tax based on the location of the customer and the applicable sales tax rate for that area.

Sales Tax Compliance and Registration

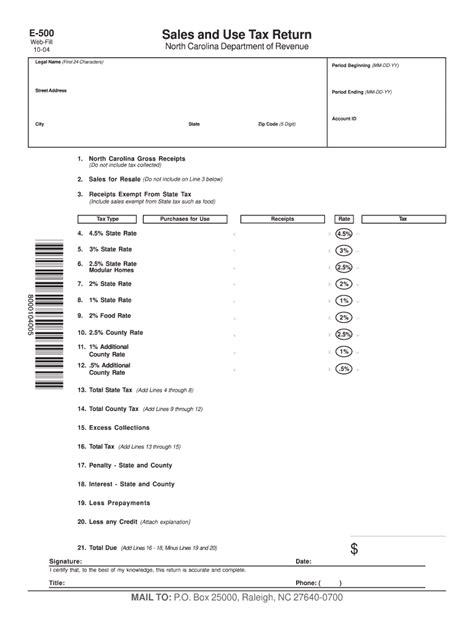

Businesses operating in North Carolina must obtain a Sales and Use Tax Permit from the North Carolina Department of Revenue. This permit allows businesses to collect and remit sales tax to the state. Failure to register and collect sales tax can result in penalties and interest charges.

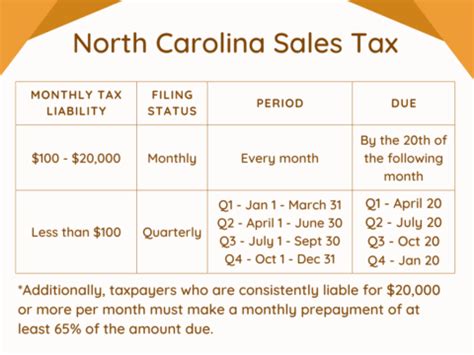

Businesses are required to file sales tax returns periodically, usually on a monthly, quarterly, or annual basis, depending on their sales volume. These returns must be filed by the 20th day of the month following the reporting period, and the sales tax collected must be remitted to the state by the same deadline.

Sales Tax Audits and Enforcement

The North Carolina Department of Revenue conducts sales tax audits to ensure compliance. These audits can be triggered by various factors, including random selection, discrepancies in tax returns, or tips received by the department. During an audit, the department will review a business’s records to ensure accurate sales tax collection and remittance.

If a business is found to be non-compliant, it may face penalties, interest charges, and even criminal prosecution in severe cases. Therefore, it's crucial for businesses to maintain accurate records and ensure timely sales tax filings.

Future Implications and Changes

North Carolina’s sales tax landscape is subject to change, and businesses and consumers should stay informed about any updates. The state periodically reviews its tax structure, and changes can occur to rates, exemptions, or tax collection rules. Additionally, with the ongoing evolution of e-commerce and remote work, the definition of a nexus may continue to evolve, impacting the sales tax obligations of online businesses.

Furthermore, as sustainability and environmental concerns gain prominence, there may be discussions around the taxability of certain goods and services, such as implementing a carbon tax or incentivizing the sale of eco-friendly products through tax exemptions.

How often do sales tax rates change in North Carolina?

+Sales tax rates in North Carolina can change periodically, but major revisions are relatively rare. The state legislature sets the rates, and any changes must be approved through the legislative process. Typically, rate changes are implemented with careful consideration to ensure stability for businesses and consumers.

Are there any sales tax holidays in North Carolina?

+Yes, North Carolina does have sales tax holidays. These are specific periods, usually a few days, during which certain categories of items are exempt from sales tax. Common categories include school supplies, clothing, and energy-efficient appliances. These holidays are designed to provide temporary tax relief for consumers.

What happens if a business fails to collect sales tax in North Carolina?

+If a business fails to collect and remit sales tax in North Carolina, it may face significant penalties and interest charges. In some cases, the business could also be subject to criminal prosecution. It’s crucial for businesses to understand their sales tax obligations and ensure compliance to avoid such consequences.