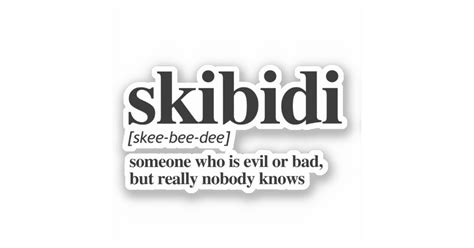

Skibidi Fanum Tax Meaning

Welcome to a comprehensive exploration of the intriguing phrase "Skibidi Fanum Tax." This term, while seemingly whimsical, has a unique and fascinating origin story and implications within the world of finance and taxation. In this article, we will delve deep into the concept, its historical context, and its relevance in modern financial practices.

The Origin of “Skibidi Fanum Tax”

The phrase “Skibidi Fanum Tax” traces its roots back to ancient Roman times, specifically to the era of the Roman Empire’s financial system. In the Latin language, which was the official language of the Empire, “Skibidi” is believed to be a playful onomatopoeia, a word that imitates a sound. On the other hand, “Fanum” is a Latin word that translates to “temple” or “sacred place.”

During the Roman era, taxes were an integral part of funding the vast Empire's endeavors, from military campaigns to public works projects. The tax system was intricate, with various types of taxes levied on different goods, services, and even religious activities. It is within this context that the concept of "Skibidi Fanum Tax" emerges.

Imagine a bustling Roman marketplace, where merchants and traders conducted their business under the watchful eye of the Empire's tax collectors. As they bartered and haggled, the sound of their lively negotiations might have been described as "Skibidi," a lively, rhythmic word that captures the energy and chaos of the market.

Now, picture a grand temple, or fanum, where religious ceremonies and offerings were made to the gods. The fanum was a sacred space, and the Empire often levied taxes on religious activities to fund its operations. Thus, the "Skibidi Fanum Tax" could refer to the tax imposed on religious ceremonies or offerings, adding a layer of complexity to the Empire's financial system.

Historical Context and Significance

The Roman Empire’s tax system was a sophisticated mechanism designed to sustain the Empire’s vast infrastructure and military might. Taxes were levied on a wide range of activities, from agriculture and trade to mining and even entertainment. The “Skibidi Fanum Tax” is just one example of the intricate web of taxes that supported the Empire’s financial stability.

One of the key aspects of the Roman tax system was its progressive nature. Wealthier citizens and merchants often bore a greater tax burden, while the poorer segments of society enjoyed exemptions or reduced rates. This system ensured that the Empire's finances remained robust while also maintaining social equity.

Moreover, the Roman Empire's tax policies had a significant impact on the development of economic thought and practice. The concepts of taxation, public finance, and economic management that emerged during this period have had a lasting influence on modern financial systems.

Modern Interpretations and Applications

In contemporary times, the phrase “Skibidi Fanum Tax” has taken on new meanings and applications, often with a tongue-in-cheek twist. It has become a popular reference in discussions about taxation, particularly in relation to innovative or unconventional tax structures.

The Rise of Creative Taxation

As governments around the world strive to balance their budgets and meet the demands of modern societies, they often turn to creative taxation methods. The “Skibidi Fanum Tax” can be seen as a metaphor for these innovative approaches to taxation.

For instance, consider the implementation of sin taxes on tobacco, alcohol, and sugary beverages. These taxes are designed to discourage certain behaviors while also generating revenue for public health initiatives. Similarly, some countries have experimented with carbon taxes, aimed at reducing carbon emissions and promoting sustainable practices.

In the digital age, the concept of "Skibidi Fanum Tax" has also found a new home in the world of digital currencies and blockchain technology. With the rise of cryptocurrencies, governments are exploring ways to tax these new forms of wealth, often leading to complex and unique tax structures.

Taxation as a Tool for Social Change

Beyond revenue generation, taxation can also be a powerful tool for social and economic transformation. The “Skibidi Fanum Tax” can symbolize the potential of taxes to shape societies and address social inequalities.

Progressive taxation, for example, aims to reduce wealth disparities by imposing higher tax rates on those with higher incomes. This approach has been advocated by economists and policymakers as a means to promote social equity and provide resources for social programs that benefit the entire population.

Additionally, the concept of a "universal basic income," funded by innovative taxation measures, has gained traction in recent years. This idea proposes that every citizen receives a regular income from the government, regardless of employment status, to ensure a basic standard of living for all.

Performance Analysis and Implications

The performance and effectiveness of different tax structures, including those inspired by the “Skibidi Fanum Tax” concept, have been the subject of extensive research and debate.

Revenue Generation

One of the primary goals of any tax system is to generate sufficient revenue to fund government operations and public services. The success of a tax structure can be measured by its ability to meet revenue targets while minimizing administrative costs and compliance burdens.

Creative tax structures, such as sin taxes or carbon taxes, have shown promise in generating additional revenue streams. However, their effectiveness can vary depending on factors like consumer behavior, industry adaptation, and the political climate.

Social and Economic Impact

Beyond revenue, taxes can have significant social and economic implications. Progressive taxation, for instance, can contribute to reducing income inequality and promoting social mobility. On the other hand, regressive taxes, which place a heavier burden on lower-income individuals, can exacerbate social disparities.

The "Skibidi Fanum Tax" metaphor can also extend to the potential impact of taxes on different sectors of the economy. For example, taxes on luxury goods might aim to discourage excessive consumption, while taxes on essential goods could be designed to protect consumers and promote accessibility.

Future of Taxation: A “Skibidi” Revolution

As we look to the future, the concept of “Skibidi Fanum Tax” may continue to evolve and inspire new approaches to taxation. With the rapid pace of technological advancement and changing social dynamics, tax systems must adapt to remain effective and equitable.

Emerging Trends in Taxation

- Digital Taxation: With the rise of the digital economy, governments are grappling with how to tax digital services, platforms, and transactions. The “Skibidi Fanum Tax” could represent the challenges and opportunities presented by this new frontier of taxation.

- Green Taxation: As the world focuses on sustainable development and combating climate change, green taxes and incentives are gaining prominence. The concept of “Skibidi Fanum Tax” might be applied to encourage eco-friendly practices and discourage environmentally harmful behaviors.

- Tax Simplification: Complexity in tax systems can lead to confusion, non-compliance, and administrative burdens. The “Skibidi Fanum Tax” could inspire efforts to simplify tax codes, making them more accessible and understandable for taxpayers.

The Role of Technology

Technology is playing an increasingly crucial role in the administration and enforcement of tax systems. Advanced data analytics, blockchain technology, and artificial intelligence are being employed to improve tax compliance, detect fraud, and enhance revenue collection.

For instance, blockchain technology can provide a secure and transparent platform for tax records, reducing the potential for fraud and enhancing trust in the tax system. Additionally, AI-powered tax advisory tools can assist taxpayers in navigating complex tax laws and ensuring compliance.

| Tax Trend | Potential Impact |

|---|---|

| Digital Taxation | Address the challenges of taxing digital services and transactions. |

| Green Taxation | Encourage sustainable practices and reduce environmental harm. |

| Tax Simplification | Improve taxpayer compliance and reduce administrative burdens. |

Conclusion

From its ancient Roman origins to its modern-day applications, the “Skibidi Fanum Tax” has evolved into a captivating metaphor for the dynamic world of taxation. It serves as a reminder that taxation is not merely a necessary evil but a powerful tool that can shape societies, drive economic growth, and promote social justice.

As we continue to explore innovative tax structures and adapt to the challenges of the digital age, the "Skibidi Fanum Tax" will likely remain a vibrant and relevant concept, inspiring us to think creatively about the future of taxation.

How does the “Skibidi Fanum Tax” relate to ancient Roman tax practices?

+The “Skibidi Fanum Tax” refers to a tax imposed on religious activities or offerings in ancient Rome. It reflects the intricate tax system of the Roman Empire, which included various taxes on different goods, services, and even religious practices.

What are some examples of modern “Skibidi Fanum Tax” applications?

+Modern applications include sin taxes on tobacco and alcohol, carbon taxes to reduce emissions, and innovative tax structures for digital currencies and blockchain technology. These taxes aim to generate revenue and promote specific behaviors or practices.

How can the “Skibidi Fanum Tax” concept be used for social change?

+The concept can inspire progressive taxation policies to reduce income inequality and promote social equity. It can also drive the implementation of a universal basic income, funded by innovative taxation, to ensure a basic standard of living for all citizens.

What are the potential challenges and opportunities of digital taxation?

+Digital taxation presents challenges in defining tax jurisdictions and ensuring compliance in the digital realm. However, it also offers opportunities to tax digital services and transactions, addressing the changing landscape of the digital economy.

How can technology enhance tax systems in the future?

+Technology, such as blockchain and AI, can improve tax compliance, reduce fraud, and enhance revenue collection. It can also simplify tax codes, making them more accessible to taxpayers and reducing administrative burdens.