Oklahoma State Tax Refund Status

Welcome to our comprehensive guide on the Oklahoma State Tax Refund Status. In this expert-driven article, we will delve into the intricacies of tracking and understanding your tax refund process in Oklahoma. Whether you're a resident or a non-resident, we'll provide you with the necessary information and insights to navigate the refund journey smoothly.

Understanding the Oklahoma Tax Refund Process

The Oklahoma Tax Commission is responsible for administering state taxes and ensuring taxpayers receive their refunds accurately and timely. Let's explore the key aspects of the refund process:

Tax Refund Timeline

Oklahoma aims to process individual income tax returns and issue refunds within 30 days from the date of filing. However, several factors can impact the refund timeline, such as:

- The complexity of the tax return

- Errors or discrepancies in the submitted information

- Additional reviews or audits required

- Payment methods and banking processes

It's essential to note that the processing time can vary, especially during peak tax seasons. Therefore, it's advisable to plan and file your taxes early to avoid potential delays.

Refund Payment Methods

Oklahoma offers taxpayers the flexibility to receive their refunds through various payment methods:

- Direct Deposit: The fastest and most convenient way to receive your refund. You can provide your bank account details, and the refund will be deposited directly into your account.

- Check: If you prefer a traditional method, you can opt for a refund check, which will be mailed to your address on record.

- Debit Card: Oklahoma also provides the option of receiving your refund on a prepaid debit card, which can be convenient for those without a bank account.

During the tax filing process, you'll have the opportunity to choose your preferred refund payment method.

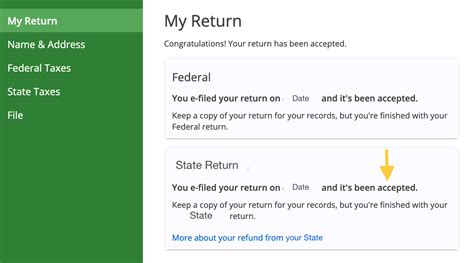

Tracking Your Refund

The Oklahoma Tax Commission provides taxpayers with multiple ways to track the status of their refund:

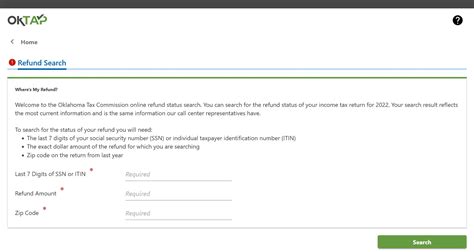

Online Refund Status Tool

You can utilize the Oklahoma Tax Refund Status Lookup tool on the official website of the Oklahoma Tax Commission. This tool allows you to enter your Social Security Number, Tax Year, and Date of Birth to access real-time refund information.

Refund Hotline

For those who prefer a direct line of communication, the Oklahoma Tax Commission offers a Refund Hotline at (405) 521-3162. You can call this number to speak with a representative and receive updates on your refund status.

Refund Inquiry Form

If you encounter any issues or require further assistance, you can submit an online Refund Inquiry Form on the Oklahoma Tax Commission website. This form allows you to provide detailed information about your refund, and a representative will respond to your inquiry.

Frequently Asked Questions (FAQs)

How long does it take to receive my Oklahoma state tax refund?

+Oklahoma aims to process individual income tax returns and issue refunds within 30 days. However, various factors can influence the timeline, and it may take longer during peak tax seasons.

Can I check my refund status online?

+Absolutely! The Oklahoma Tax Commission provides an online refund status lookup tool on its official website. You can access this tool by entering your Social Security Number, Tax Year, and Date of Birth.

What if I don't receive my refund within the estimated timeframe?

+If you have not received your refund within the estimated timeframe, you can contact the Oklahoma Tax Commission's Refund Hotline at (405) 521-3162. They will assist you in tracking your refund and resolving any potential issues.

Are there any alternative methods to receive my refund if direct deposit is not an option?

+Yes, Oklahoma offers refund checks and prepaid debit cards as alternative payment methods. You can choose your preferred method during the tax filing process.

Can I change my refund payment method after filing my taxes?

+Unfortunately, once you have filed your taxes, it is not possible to change your refund payment method. It is advisable to choose your preferred method carefully when filing your return.

We hope this guide has provided you with valuable insights into the Oklahoma State Tax Refund Status. If you have further questions or require additional assistance, feel free to reach out to the Oklahoma Tax Commission or consult a tax professional.