Utah Car Sales Tax

In the state of Utah, vehicle sales and purchases are subject to a range of taxes and fees, with the sales tax being one of the most notable. This tax applies to the purchase of new and used vehicles, and understanding its intricacies is crucial for both consumers and businesses operating within the state's automotive industry.

Understanding the Utah Car Sales Tax

The car sales tax in Utah is a percentage-based tax levied on the purchase price of a vehicle. It is an essential revenue source for the state government, contributing to various public services and infrastructure development. The tax rate and its application can vary depending on the type of vehicle and the location of the sale.

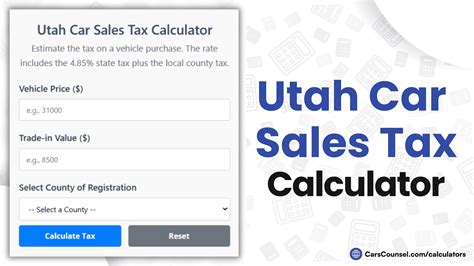

Tax Rate and Calculation

As of [current year], the standard sales tax rate for vehicles in Utah is 4.70%. This rate is applicable statewide and is added to the purchase price of the vehicle. For instance, if you purchase a car priced at 20,000, the sales tax due would be <strong>940 (4.70% of $20,000). However, it’s important to note that this is not the only tax applicable to vehicle purchases in Utah.

Additional Taxes and Fees

Utah imposes a Title Transfer Fee of $7.25, which is charged per vehicle title transfer. This fee is separate from the sales tax and is payable to the Utah Department of Motor Vehicles (DMV). Additionally, there may be other fees and surcharges depending on the specific location of the vehicle sale. For example, some counties in Utah impose an additional Vehicle Surcharge to support local transportation projects.

Exemptions and Special Cases

Certain vehicles and situations may qualify for tax exemptions or reduced tax rates. For instance, active-duty military personnel and their spouses are eligible for a reduced sales tax rate of 3.50% when purchasing a vehicle in Utah. Additionally, some counties offer tax exemptions or rebates for electric vehicles (EVs) or other environmentally friendly cars to encourage their adoption.

Vehicle Registration and Licensing Fees

In addition to sales tax, vehicle owners in Utah are subject to registration and licensing fees. These fees vary depending on the type of vehicle, its weight, and the county of registration. For example, a standard passenger car registration in Utah typically costs around 55, while a heavy truck registration can range from 70 to $250.

| Vehicle Type | Registration Fee (approx.) |

|---|---|

| Passenger Car | $55 |

| Light Truck | $70 |

| Motorcycle | $32 |

| Heavy Truck | $70 - $250 |

Tax Collection and Remittance

The responsibility for collecting and remitting the sales tax lies with the seller. Sellers are required to register with the Utah State Tax Commission and obtain a Sales and Use Tax Permit. They must then collect the applicable sales tax from the buyer and remit it to the state on a regular basis, usually quarterly or monthly, depending on their sales volume.

Online Sales and Out-of-State Purchases

Utah has specific regulations for online vehicle sales and purchases made out of state. If you purchase a vehicle online or from a dealer in another state, you are still required to pay Utah sales tax. The dealer or seller is responsible for collecting and remitting this tax to Utah. However, if the seller does not collect the tax, it becomes the buyer’s responsibility to self-report and pay the tax to the Utah Tax Commission.

Tax Audits and Compliance

The Utah State Tax Commission conducts audits to ensure compliance with sales tax laws. Audits may be triggered by various factors, including suspicious sales patterns, tips from informants, or random selection. Non-compliance can result in penalties, interest charges, and legal consequences.

The Impact of Car Sales Tax on the Automotive Industry

The car sales tax in Utah has a significant impact on the state’s automotive industry, influencing consumer behavior, dealer operations, and overall market dynamics.

Consumer Perspective

From a consumer standpoint, the sales tax adds a substantial cost to the purchase price of a vehicle. This additional expense can influence buying decisions, with some consumers opting for lower-priced vehicles or delaying their purchase to save for the tax. Others may choose to purchase from out of state to avoid Utah’s sales tax, especially if they live near state borders.

Dealer Operations and Strategies

For dealerships, the sales tax is a critical consideration in their pricing and sales strategies. Dealers must factor in the tax when setting their vehicle prices to ensure competitiveness in the market. They also play a vital role in educating consumers about the tax, especially when it comes to explaining additional fees and potential exemptions.

Market Dynamics and Economic Impact

The sales tax on vehicles contributes significantly to Utah’s economy, funding various public services and infrastructure projects. It also influences the overall vehicle market in the state. For instance, the availability of tax exemptions for certain vehicles can encourage the adoption of environmentally friendly cars, while additional surcharges may impact the sales of larger vehicles.

Future Implications and Potential Changes

The landscape of car sales tax in Utah, like in many other states, is subject to change. Potential future developments include the following:

- Changes in Tax Rates: The state government may adjust the sales tax rate based on economic conditions or budgetary needs. While a higher rate could provide more revenue for the state, it may also discourage vehicle purchases.

- Exemption Expansions: With the growing focus on environmental sustainability, Utah may expand tax exemptions for electric and hybrid vehicles to encourage their adoption.

- Online Sales Regulation: As online vehicle sales continue to rise, the state may implement more stringent regulations to ensure proper tax collection and compliance.

- Local Initiatives: Individual counties or cities within Utah may propose their own vehicle tax initiatives to fund specific local projects or services.

Conclusion

Understanding the intricacies of Utah’s car sales tax is crucial for both consumers and businesses in the automotive industry. From the standard sales tax rate to additional fees and exemptions, every aspect plays a role in shaping the vehicle purchasing experience and the state’s automotive market. As the industry evolves, so too will the regulations and tax structures, making it essential to stay informed about these changes.

Are there any ways to reduce the sales tax burden when purchasing a vehicle in Utah?

+Yes, there are a few strategies. First, active-duty military personnel and their spouses are eligible for a reduced sales tax rate. Additionally, some counties offer tax exemptions or rebates for electric vehicles (EVs) to encourage their adoption. Finally, if you’re purchasing a vehicle from a private seller, the sales tax may be lower compared to buying from a dealership.

How often do sales tax rates change in Utah?

+Sales tax rates can change annually, typically as part of the state’s budget process. However, significant changes are relatively rare and often tied to specific initiatives or economic conditions.

Are there any plans to eliminate the sales tax on vehicles in Utah?

+Currently, there are no active proposals to eliminate the sales tax on vehicles in Utah. However, the state regularly reviews its tax structure, and changes can occur based on economic needs and public sentiment.