Prince William County Taxes

Located in the heart of Northern Virginia, Prince William County is a vibrant and rapidly growing community. As one of the largest counties in the state, it boasts a diverse economy, a rich historical heritage, and a high quality of life. However, with growth comes the responsibility of managing the county's finances, and taxation is a key component of that management. This article aims to delve into the intricacies of Prince William County's taxation system, exploring its structure, rates, and the impact it has on the local economy and residents.

Understanding the Tax Landscape of Prince William County

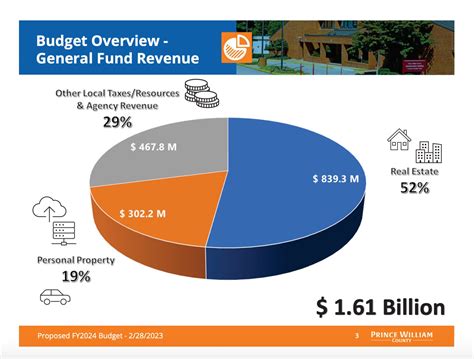

Prince William County, like many other localities in Virginia, relies heavily on property taxes as its primary source of revenue. These taxes are an essential part of the county’s fiscal framework, funding a wide range of services and infrastructure projects. Understanding the tax landscape is crucial for both residents and businesses operating within the county, as it directly influences their financial obligations and the overall economic health of the region.

The taxation system in Prince William County is governed by a combination of state and local laws, with the Board of County Supervisors playing a pivotal role in setting tax rates and policies. This board, elected by the residents, is responsible for balancing the need for revenue with the economic realities and aspirations of the community.

Property Taxes: The Backbone of County Revenue

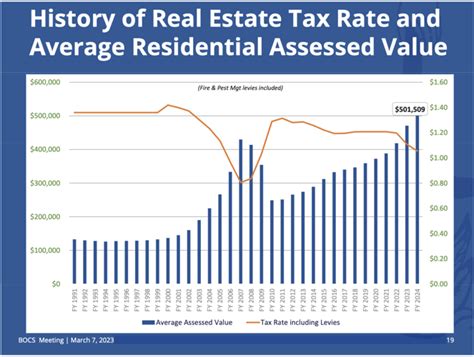

Property taxes form the backbone of Prince William County’s revenue stream. These taxes are levied on both real estate and personal property, with the rates varying depending on the type of property and its assessed value. The assessment process, conducted by the County’s Department of Finance, is a comprehensive evaluation of property values, taking into account factors such as location, size, improvements, and recent sales data.

| Property Type | Tax Rate (per $100 of Assessed Value) |

|---|---|

| Residential | 0.99 |

| Commercial | 1.16 |

| Agricultural | 0.82 |

| Personal Property | Varies by Type |

The current tax rates for the 2023-2024 fiscal year reflect a commitment to maintaining a competitive tax environment while supporting essential services. For residential properties, the rate stands at $0.99 per $100 of assessed value, a rate that has been carefully calibrated to provide adequate funding for schools, public safety, and other vital services without placing an undue burden on homeowners.

Business Taxes: Fostering Economic Growth

In addition to property taxes, Prince William County also collects taxes from businesses operating within its borders. These taxes are crucial for supporting economic development initiatives, infrastructure improvements, and other projects that contribute to the county’s long-term prosperity.

The county levies a business, professional, and occupational license tax (BPOL tax) on businesses based on their gross receipts. This tax is designed to encourage economic growth while ensuring that businesses contribute fairly to the county's financial health. The rates for the BPOL tax vary depending on the business's industry and gross receipts, with the lowest rate being 0.12% and the highest rate being 0.22%.

Prince William County also imposes a machinery and tools tax, which applies to tangible personal property used in a business. This tax further contributes to the county's revenue, helping to fund essential services and infrastructure projects.

Special Taxes and Assessments

Beyond the standard property and business taxes, Prince William County also utilizes special taxes and assessments to fund specific projects and initiatives. These mechanisms allow the county to address unique needs and challenges while ensuring transparency and accountability.

One such example is the Northern Virginia Transportation Authority (NVTA) Tax, which is levied on real estate to support transportation projects in the region. This tax is a crucial component of the county's efforts to improve mobility and connectivity, enhancing the overall quality of life for residents and businesses alike.

Additionally, the county may impose special assessments on certain properties to fund infrastructure improvements that benefit specific neighborhoods or developments. These assessments are tailored to the unique needs of the community and are designed to ensure that the benefits of these projects are shared by those who contribute to their funding.

The Impact of Taxation on the Local Economy

The taxation policies and rates in Prince William County have a profound impact on the local economy. A well-managed tax system can foster economic growth, attract investment, and support the development of a vibrant business community. Conversely, poorly structured or excessive taxation can hinder economic activity and drive away potential investors and businesses.

By carefully calibrating tax rates and offering targeted tax relief programs, Prince William County strives to create an environment that is conducive to business growth and prosperity. This approach has contributed to the county's reputation as a desirable location for businesses, with a thriving economic ecosystem that includes a diverse mix of industries and startups.

The impact of taxation is not limited to businesses alone. Residents also feel the effects of tax policies, particularly through their property taxes. A balanced and equitable taxation system ensures that residents are able to afford the cost of living in the county while still receiving high-quality public services. This balance is essential for maintaining a stable and satisfied community, which in turn attracts further investment and development.

Comparative Analysis: Prince William County vs. Surrounding Areas

Comparing Prince William County’s taxation system with those of its neighboring counties provides valuable insights into the effectiveness and competitiveness of its tax policies. While each locality has unique needs and challenges, a comparative analysis can highlight areas where Prince William County excels and areas where it may need to adapt to remain competitive.

For instance, when compared to Fairfax County, a neighboring locality with a similar economic profile, Prince William County's property tax rates are generally lower. This difference can make Prince William County more attractive to homeowners and businesses seeking a more affordable tax environment. However, it is important to consider other factors, such as the quality of services and infrastructure, which may also influence the decision-making process of residents and businesses.

Furthermore, a comparison with more rural counties in Virginia can reveal the challenges and opportunities that come with different economic profiles. While these counties may have lower tax rates due to a smaller tax base, they may also face limitations in funding essential services and infrastructure projects. Prince William County, with its diverse economy and robust tax base, has the advantage of being able to support a broader range of initiatives while maintaining competitive tax rates.

Future Outlook and Opportunities

As Prince William County continues to grow and evolve, its taxation system will play a pivotal role in shaping its future. The county’s leadership and residents face the ongoing challenge of balancing the need for revenue with the desire to maintain a competitive and attractive tax environment. This delicate balance is essential for sustaining economic growth, ensuring fiscal responsibility, and providing high-quality services to residents.

Looking ahead, there are several key opportunities and challenges that the county may encounter. One potential opportunity lies in exploring innovative financing mechanisms, such as public-private partnerships, to fund large-scale infrastructure projects without placing an undue burden on taxpayers. Additionally, the county could consider further refining its tax relief programs to better support vulnerable populations and promote economic equity.

However, challenges also exist. As the county's population continues to grow, the demand for services and infrastructure will likely increase, placing pressure on the tax base. Managing this growth sustainably while maintaining a competitive tax environment will require careful planning, collaboration, and a deep understanding of the community's needs and aspirations.

Conclusion

Prince William County’s taxation system is a complex yet crucial component of its economic landscape. By understanding the intricacies of this system, residents and businesses can make informed decisions about their financial obligations and the role they play in the county’s prosperity. The county’s leadership, through careful planning and thoughtful policy-making, has the opportunity to shape a tax environment that fosters growth, supports its residents, and positions Prince William County as a leader in economic vitality and quality of life.

How often are property tax rates adjusted in Prince William County?

+Property tax rates are typically adjusted annually to align with the fiscal year, which runs from July 1 to June 30. The Board of County Supervisors reviews and sets the tax rates based on the county’s budget requirements and economic considerations.

Are there any tax incentives for businesses in Prince William County?

+Yes, Prince William County offers various tax incentives and programs to attract and support businesses. These include Enterprise Zones, which offer reduced tax rates for qualifying businesses, and the Virginia Enterprise Zone Grant, which provides financial assistance for business relocation and expansion. Additionally, the county’s Economic Development Authority (EDA) offers customized incentive packages to eligible businesses.

How can I estimate my property taxes in Prince William County?

+To estimate your property taxes, you can use the County’s online property tax calculator. This tool allows you to input your property’s assessed value and the applicable tax rate to get an estimate of your annual tax liability. It’s important to note that this estimate is based on current tax rates and may not reflect any changes made during the fiscal year.