How Much Is Sales Tax In Texas

The sales tax landscape in the United States is intricate, with varying rates and regulations across different states and even within counties and cities. Texas, with its diverse economic landscape, presents a unique case when it comes to sales tax regulations. Understanding the intricacies of sales tax in Texas is crucial for both businesses and consumers, as it directly impacts the cost of goods and services and the revenue generated for the state.

The Texas Sales Tax System

Texas, known for its business-friendly environment and diverse industries, has a robust sales tax system in place. The state’s sales tax structure is a combination of state and local taxes, which can make it complex for those unfamiliar with the system.

State Sales Tax Rate

As of [most recent update], the state-wide sales tax rate in Texas stands at 6.25%. This rate is applied uniformly across the state and is a crucial component of the state’s revenue generation.

| State Sales Tax Rate | Value |

|---|---|

| Texas Statewide Sales Tax | 6.25% |

Local Sales Taxes

In addition to the state sales tax, Texas allows local jurisdictions, including counties and cities, to impose their own sales tax rates. These local sales taxes can vary significantly, adding an extra layer of complexity to the overall sales tax structure.

For instance, major cities like Houston and Dallas often have higher sales tax rates due to additional local taxes. These local taxes are typically used to fund specific initiatives or infrastructure projects in the respective cities.

| City | Local Sales Tax Rate |

|---|---|

| Houston | 2.00% |

| Dallas | 2.50% |

| Austin | 1.25% |

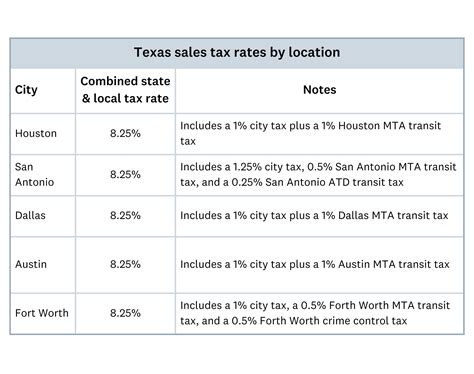

Combined Sales Tax Rates

When you combine the state sales tax with the local sales tax, you get the total sales tax rate applicable in a particular area. For example, in Houston, the total sales tax rate would be 8.25% (6.25% state tax + 2.00% local tax). This rate can vary significantly across different parts of Texas.

| City | Total Sales Tax Rate |

|---|---|

| Houston | 8.25% |

| Dallas | 8.75% |

| Austin | 7.50% |

Exemptions and Special Considerations

Like many other states, Texas has a range of sales tax exemptions and special considerations that can impact the overall sales tax burden on businesses and consumers.

Food and Groceries

One notable exemption in Texas is for certain food items and groceries. The sales tax rate on unprepared food items is 0%, which means essential groceries are tax-free. This exemption can significantly reduce the cost of living for residents, especially those with lower incomes.

| Food Category | Sales Tax Rate |

|---|---|

| Unprepared Food | 0% |

| Prepared Food (e.g., restaurant meals) | Varies by locality |

Special Events and Exemptions

Texas also offers sales tax holidays for specific events or categories of goods. For instance, the state may waive sales tax on certain items during back-to-school shopping or energy-efficient appliance purchases. These holidays provide a temporary relief from sales tax and encourage consumer spending.

Remote Sellers and Nexus Laws

Texas, like many states, has implemented sales tax nexus laws that require remote sellers (online retailers) to collect sales tax from Texas residents if they meet certain thresholds. This has become particularly important with the rise of e-commerce, ensuring that online purchases are not exempt from sales tax obligations.

Compliance and Enforcement

Ensuring compliance with sales tax regulations is crucial for businesses operating in Texas. The state has dedicated agencies and departments to oversee sales tax collection and enforcement.

Registration and Permits

Businesses, whether physical stores or online retailers, are required to obtain the necessary permits and register with the Texas Comptroller of Public Accounts to collect and remit sales tax. Failure to do so can result in penalties and legal consequences.

Audits and Penalties

The state conducts regular sales tax audits to ensure compliance. Audits can be random or targeted based on various factors. Non-compliance can lead to substantial penalties, interest charges, and even legal action. It is crucial for businesses to maintain accurate records and ensure timely sales tax remittance.

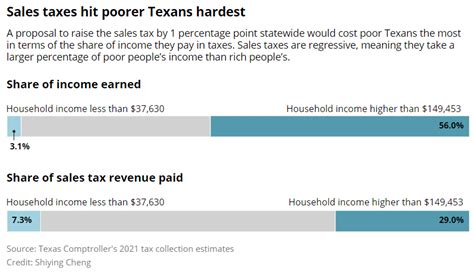

The Impact of Sales Tax on the Texas Economy

The sales tax system in Texas plays a significant role in the state’s economy. It is a major source of revenue for the state and local governments, funding essential services and infrastructure projects.

Revenue Generation

In [year], Texas generated approximately $28.5 billion in sales tax revenue, making it a substantial contributor to the state’s overall budget. This revenue is used to fund education, healthcare, transportation, and other vital services.

Economic Impact on Businesses

For businesses, the sales tax structure can impact pricing strategies and overall competitiveness. Companies need to carefully consider sales tax rates when setting their prices, especially when competing with online retailers or businesses in other states with lower sales tax rates.

Consumer Behavior and Spending

The sales tax rate can also influence consumer behavior. Higher sales tax rates may discourage spending, especially for discretionary items, while exemptions and sales tax holidays can stimulate consumer demand.

Looking Ahead: The Future of Sales Tax in Texas

As the economic landscape continues to evolve, so too will the sales tax system in Texas. With the rise of e-commerce and changing consumer preferences, the state may need to adapt its sales tax regulations to keep pace with these trends.

Potential Changes and Challenges

One potential challenge is ensuring equitable sales tax collection from online retailers. As more shopping moves online, states like Texas may need to enhance their nexus laws and enforcement mechanisms to capture sales tax revenue from these sources.

Additionally, with the increasing focus on sustainability and environmental initiatives, there may be discussions around sales tax exemptions or incentives for green products or services.

The Role of Technology

Technology will likely play a pivotal role in the future of sales tax administration in Texas. Advanced software and automation can streamline sales tax compliance, making it easier for businesses to manage their sales tax obligations and for the state to enforce and collect sales tax efficiently.

Conclusion

Understanding the sales tax landscape in Texas is essential for both businesses and consumers. The state’s sales tax system, with its state and local components, can be complex, but it plays a crucial role in funding vital services and shaping the economy. As Texas continues to evolve, so too will its sales tax regulations, ensuring a dynamic and responsive approach to revenue generation and economic development.

Are there any special considerations for out-of-state businesses selling to Texas residents?

+Yes, out-of-state businesses with significant sales in Texas may be required to register and collect sales tax under the state’s nexus laws. Failure to comply can result in penalties.

How often do sales tax rates change in Texas?

+While the state-wide sales tax rate remains stable, local sales tax rates can change annually based on local government decisions. It’s essential to stay updated on these changes to ensure compliance.

Are there any online resources to help businesses calculate and manage sales tax obligations in Texas?

+Yes, the Texas Comptroller of Public Accounts provides a comprehensive sales tax guide and calculator to assist businesses in managing their sales tax obligations. It’s a valuable resource for compliance and accuracy.

What happens if a business undercharges or overcharges sales tax?

+If a business undercharges sales tax, it must remit the difference to the state, along with any applicable penalties. Overcharging, on the other hand, may require a refund to the customer, depending on the circumstances.

How can businesses stay informed about sales tax changes and compliance requirements in Texas?

+Businesses can subscribe to alerts and newsletters from the Texas Comptroller’s office, which provides regular updates on sales tax changes and compliance news. Staying informed is crucial for maintaining compliance.