Ga Sales Tax Rate

Welcome to this in-depth exploration of the Georgia Sales Tax Rate, a critical aspect of the state's revenue generation and economic policy. The sales tax is a vital component of Georgia's financial framework, impacting businesses, consumers, and the overall economy. Understanding the intricacies of this tax system is essential for both residents and businesses operating within the state.

Understanding the Georgia Sales Tax Rate

Georgia’s sales tax is a consumption tax levied on the sale of goods and certain services. It is a percentage of the sale price that is collected by the retailer and remitted to the Georgia Department of Revenue. This tax is a significant revenue source for the state, funding various public services and infrastructure projects.

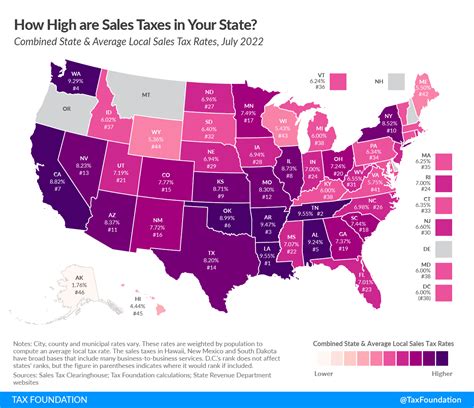

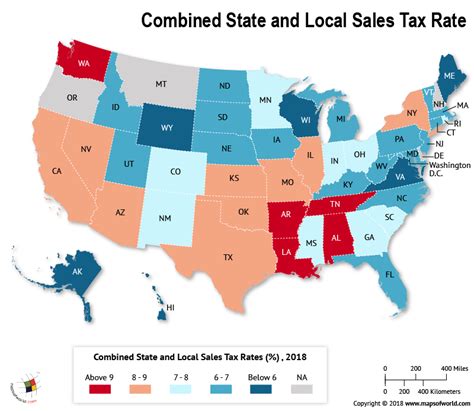

The state sales tax rate in Georgia is set at 4%, which is applied to most retail sales across the state. However, it's important to note that local governments in Georgia are also authorized to levy their own local sales taxes, creating a combined sales tax rate that varies across different counties and municipalities.

Local Sales Tax Variations

In addition to the state sales tax, local governments in Georgia have the authority to impose a local-option sales tax, often referred to as a Special Purpose Local Option Sales Tax (SPLOST). These taxes are used to fund specific projects or initiatives, such as infrastructure improvements, school construction, or public safety enhancements.

| County | State Sales Tax | Local Sales Tax | Total Sales Tax |

|---|---|---|---|

| Fulton County | 4% | 1% | 5% |

| Cobb County | 4% | 1% | 5% |

| Gwinnett County | 4% | 1% | 5% |

| Dekalb County | 4% | 1% | 5% |

| Cherokee County | 4% | 1% | 5% |

| ... | ... | ... | ... |

As the table illustrates, several counties in Georgia have a total sales tax rate of 5% due to the addition of the local-option sales tax. It's crucial for businesses and consumers to be aware of these variations, as they can significantly impact the final price of goods and services.

Sales Tax Exemptions and Special Considerations

While the sales tax is applied to a broad range of goods and services, there are certain categories that are exempt from this tax. These exemptions are designed to promote specific economic or social policies, such as encouraging agricultural production or supporting education.

Agricultural Sales Tax Exemption

Georgia offers a sales tax exemption for agricultural producers and related businesses. This exemption covers a wide range of agricultural inputs, including farm equipment, livestock, seeds, fertilizers, and other agricultural supplies. By exempting these items from sales tax, the state aims to support the agricultural industry and promote economic growth in this sector.

Educational Materials Sales Tax Exemption

To encourage educational pursuits, Georgia also provides a sales tax exemption for certain educational materials. This includes textbooks, instructional materials, and computer software used in educational institutions. By reducing the cost of these essential resources, the state aims to make education more accessible and affordable for students and educational institutions.

Special Events and Tourism

Georgia often utilizes sales tax as a tool to promote special events and tourism. For instance, some counties may temporarily reduce or eliminate the sales tax during specific festivals or sporting events to attract visitors and boost local economies. These strategies are carefully planned to ensure a balance between revenue generation and tourism promotion.

Sales Tax Compliance and Enforcement

Ensuring compliance with the sales tax regulations is a critical responsibility for both businesses and the state. The Georgia Department of Revenue employs various strategies to enforce sales tax compliance, including audits, inspections, and educational initiatives.

Sales Tax Audits and Inspections

The Department of Revenue conducts regular audits and inspections to verify that businesses are accurately collecting and remitting sales tax. These audits involve a thorough examination of sales records, tax returns, and other financial documents. Non-compliance can result in penalties, interest charges, and even criminal prosecution in severe cases.

Educational Initiatives

To promote compliance and understanding, the Department of Revenue offers a range of educational resources and workshops for businesses. These initiatives aim to simplify the sales tax process, clarify regulations, and provide practical guidance on tax collection and reporting.

Impact of Sales Tax on the Economy

The sales tax plays a pivotal role in Georgia’s economy, influencing consumer behavior, business operations, and the overall fiscal health of the state. Understanding these impacts is crucial for policymakers, businesses, and consumers alike.

Consumer Behavior and Price Sensitivity

Sales tax directly affects consumer purchasing decisions. Higher sales tax rates can discourage spending, particularly on discretionary items, leading to a potential decline in retail sales. On the other hand, lower sales tax rates can stimulate consumer demand and boost economic activity.

Business Operations and Pricing Strategies

For businesses, sales tax is a critical factor in pricing strategies. Companies must carefully consider the impact of sales tax on their products or services to ensure competitive pricing. Moreover, businesses with operations across multiple counties or states face the challenge of managing varying sales tax rates and compliance requirements.

Revenue Generation and Fiscal Health

The sales tax is a significant source of revenue for Georgia, funding essential public services and infrastructure projects. The state’s ability to maintain a stable and predictable tax environment is crucial for attracting businesses and promoting economic growth. A well-managed sales tax system ensures the state can meet its financial obligations and invest in critical areas such as education, healthcare, and infrastructure.

Looking Ahead: The Future of Sales Tax in Georgia

As Georgia’s economy continues to evolve, so too will its sales tax system. The state must adapt to changing economic conditions, technological advancements, and consumer preferences. Here are some potential future developments and considerations.

E-Commerce and Online Sales

The rapid growth of e-commerce presents unique challenges and opportunities for sales tax collection. Georgia, like many other states, is exploring ways to ensure that online sales are subject to the appropriate sales tax. This includes navigating complex issues such as nexus laws, economic nexus thresholds, and the collection of sales tax for online marketplaces.

Simplifying Tax Codes and Compliance

To reduce the administrative burden on businesses, there is a growing trend towards simplifying tax codes and improving compliance processes. This may involve streamlining tax forms, providing digital tools for tax filing and payment, and enhancing educational resources to make compliance easier and more efficient.

Expanding Sales Tax Base

As the economy evolves, so too does the nature of goods and services subject to sales tax. Georgia may consider expanding the sales tax base to include new sectors or services, ensuring that the tax system remains fair and sustainable. This could involve reevaluating existing exemptions or introducing new ones to support emerging industries or social initiatives.

Conclusion

The Georgia Sales Tax Rate is a complex and dynamic component of the state’s economic landscape. It influences consumer behavior, shapes business operations, and plays a critical role in revenue generation. As Georgia navigates the challenges and opportunities of a changing economy, the sales tax system will continue to evolve, ensuring the state remains fiscally healthy and competitive.

What is the current state sales tax rate in Georgia?

+The current state sales tax rate in Georgia is 4%.

Are there any counties with a higher sales tax rate than the state rate?

+Yes, several counties in Georgia have a higher sales tax rate due to the addition of local-option sales taxes. These counties typically have a total sales tax rate of 5%.

What is the purpose of local-option sales taxes in Georgia?

+Local-option sales taxes, also known as Special Purpose Local Option Sales Taxes (SPLOST), are used to fund specific projects or initiatives at the local level, such as infrastructure improvements or school construction.

Are there any sales tax exemptions in Georgia?

+Yes, Georgia offers sales tax exemptions for certain categories, such as agricultural producers and educational materials. These exemptions are designed to promote specific economic or social policies.

How does the sales tax impact consumer behavior in Georgia?

+Sales tax can influence consumer purchasing decisions. Higher sales tax rates may discourage spending, particularly on discretionary items, while lower rates can stimulate demand and boost economic activity.