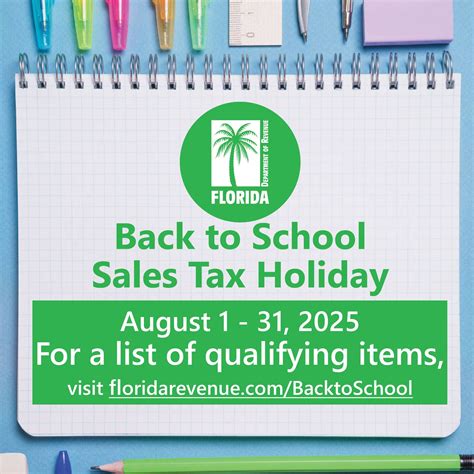

Florida Tax Free 2025

The Florida Tax Free period is an annual event that offers a much-anticipated break from sales tax for residents of the Sunshine State. For a limited time, shoppers can take advantage of tax savings on a variety of essential items, making it an ideal time to stock up on back-to-school supplies, clothing, and more. In this article, we delve into the specifics of the Florida Tax Free 2025 event, exploring its dates, eligible items, and the potential savings it presents for Floridians.

Understanding Florida’s Tax Free Event

Florida’s Tax Free period is a strategic initiative by the state government to stimulate local economies and provide financial relief to residents. During this event, sales tax is temporarily waived on certain items, making them more affordable and accessible to consumers. This annual occurrence has become a staple for Floridians, offering a unique opportunity to save on essential purchases.

Dates to Remember: Florida Tax Free 2025

The Florida Tax Free period for 2025 is scheduled to take place from August 1st to August 7th. This week-long event is a prime opportunity for shoppers to plan their purchases and take advantage of the tax-free benefits. Mark your calendars, as this is a limited-time offer and a great chance to save on your shopping.

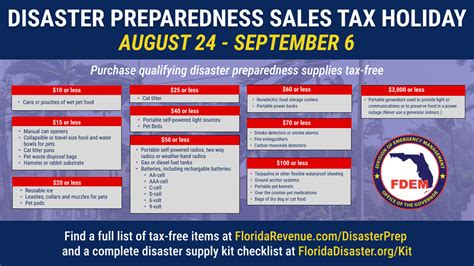

Eligible Items: What’s Covered in Florida’s Tax Free Event

The Florida Tax Free event covers a wide range of items that are considered essential for daily life. Here’s a breakdown of the categories and specific items that are eligible for tax-free purchases during the 2025 event:

- Clothing and Accessories: Clothing items, including shirts, pants, dresses, jackets, and footwear, are exempt from sales tax. This category also covers accessories like hats, belts, and scarves.

- Back-to-School Supplies: School essentials such as notebooks, pens, pencils, calculators, and backpacks are included in the tax-free offerings. This category is particularly beneficial for parents preparing their children for the upcoming academic year.

- Books: Whether you're a student, a bookworm, or a collector, books of all kinds are eligible for tax-free purchases during this event. This includes textbooks, novels, reference books, and even e-books.

- Computers and Related Equipment: Florida's Tax Free event extends to computers and computer-related items. This category covers laptops, desktops, tablets, printers, and other computer accessories.

- Sports and Recreational Equipment: Sports enthusiasts can rejoice, as sports equipment, including items like bicycles, basketballs, soccer balls, and tennis rackets, are also tax-free during this period.

It's important to note that there are some exclusions and limitations to the eligible items. For instance, clothing items priced over $100 per item are not covered by the tax-free benefit. Additionally, certain categories, such as jewelry, watches, and certain electronics, are not included in the event.

Estimated Savings: How Much Can You Save During Florida Tax Free 2025

The potential savings during the Florida Tax Free event can be significant, especially for those planning to make substantial purchases. Let’s take a look at some estimated savings based on different scenarios:

| Scenario | Estimated Savings |

|---|---|

| Back-to-School Shopping for a Family | Up to $75-$100 |

| Clothing Haul for a Single Individual | Around $50-$70 |

| Technology Upgrade (Laptop and Accessories) | Up to $150 |

| Sports Equipment for a Team | Varies based on team size and equipment, potentially hundreds of dollars |

These estimates provide a rough idea of the savings one can expect during the Florida Tax Free event. It's worth noting that the actual savings will depend on individual purchasing habits and the specific items chosen.

Tips for Maximizing Your Tax-Free Shopping Experience

To make the most of the Florida Tax Free event, consider the following tips:

- Create a shopping list: Plan your purchases in advance to ensure you cover all your needs and maximize your savings.

- Compare prices: Take advantage of online resources and compare prices to find the best deals and ensure you're getting the most value for your money.

- Shop early: Some popular items may sell out quickly, so consider shopping at the beginning of the event to have a wider selection of products.

- Consider bulk purchases: If you're stocking up on essentials, buying in bulk can provide additional savings and ensure you're prepared for the year ahead.

The Impact and Benefits of Florida’s Tax Free Event

Florida’s Tax Free event has a significant impact on both consumers and businesses. For consumers, it offers an opportunity to save money on essential items, making their purchasing power go further. This event can be particularly beneficial for families with children, as it eases the financial burden of back-to-school shopping.

From a business perspective, the Tax Free period can drive increased sales and foot traffic. Retailers often promote their tax-free deals, attracting customers and boosting their revenue. This event can also create a sense of urgency, encouraging shoppers to make purchases during the designated period.

Future Implications and Potential Changes

As with any initiative, there are ongoing discussions and potential changes to the Florida Tax Free event. While the 2025 event is set to follow the traditional format, there may be proposals for expanding the eligible categories or extending the duration of the event in the future.

Some proponents argue that broadening the eligible items could further benefit consumers and stimulate the economy. However, it's important to strike a balance to ensure the event remains focused on providing relief for essential purchases.

Additionally, there are considerations for making the event more inclusive and accessible to all Floridians. Proposals for extending the event duration or introducing additional tax-free days could be on the horizon to accommodate a wider range of shopping needs.

Are there any income restrictions for participating in the Florida Tax Free event?

+

No, the Florida Tax Free event is open to all residents, regardless of income. It’s a universal benefit aimed at providing financial relief to all Floridians.

Can I purchase gift cards during the Tax Free period?

+

No, gift cards are generally not eligible for tax-free purchases during this event. The focus is on tangible items and essential purchases.

Are there any online retailers participating in the Florida Tax Free event?

+

Yes, many online retailers offer tax-free purchases during this period. However, it’s essential to check the retailer’s policies and ensure they are participating in the event.

Can I combine the Tax Free savings with other discounts or promotions?

+

Yes, you can combine the Tax Free savings with other discounts and promotions offered by retailers. This can further enhance your savings during the event.

Are there any restrictions on the quantity of items I can purchase tax-free?

+

Generally, there are no quantity restrictions. However, some retailers may have their own policies, so it’s advisable to check with individual stores for any specific limitations.