Inheritance Tax Calculator

Welcome to the ultimate guide on understanding and managing inheritance tax. In this comprehensive article, we will delve into the intricacies of inheritance tax, also known as estate tax, providing you with the knowledge and tools to navigate this complex financial landscape. Whether you're an individual planning for the future or a professional advisor seeking expert insights, this guide will equip you with valuable information and practical strategies.

Unraveling the Inheritance Tax Landscape

Inheritance tax is a critical aspect of financial planning, impacting individuals and families worldwide. It is a tax levied on the transfer of an individual’s assets upon their death, often a significant concern for those with substantial estates. Understanding the nuances of inheritance tax is crucial for effective estate planning, ensuring that your loved ones receive the maximum benefit from your assets.

In this section, we will explore the fundamental concepts of inheritance tax, including its definition, purpose, and how it differs from other taxes. We will also discuss the various factors that influence the calculation of inheritance tax, such as the value of the estate, the relationship between the deceased and the beneficiaries, and the applicable tax rates.

The Basics of Inheritance Tax

Inheritance tax, in its simplest form, is a tax imposed on the transfer of property, assets, and wealth from one generation to another. It is a mechanism designed to ensure that individuals pay their fair share of taxes on the assets they accumulate during their lifetime. The tax is typically levied on the net value of the estate, which is calculated by subtracting any applicable deductions and exemptions from the gross estate value.

The purpose of inheritance tax is twofold. Firstly, it serves as a means to raise revenue for governments, contributing to the overall tax base. Secondly, it plays a role in wealth redistribution, ensuring that the concentration of wealth remains balanced across society. By imposing a tax on inherited assets, governments aim to promote economic equality and prevent the excessive accumulation of wealth in a few hands.

It's important to note that inheritance tax is distinct from other taxes, such as income tax and gift tax. Income tax is levied on the earnings or profits generated during an individual's lifetime, while gift tax applies to transfers made during an individual's lifetime. Inheritance tax, on the other hand, specifically targets the transfer of assets upon death, making it a unique and critical component of estate planning.

| Tax Type | Purpose | Timing |

|---|---|---|

| Inheritance Tax | Raising revenue and wealth redistribution | Levied upon death |

| Income Tax | Taxation of earnings and profits | Based on annual income |

| Gift Tax | Taxation of transfers during lifetime | Applicable to large gifts |

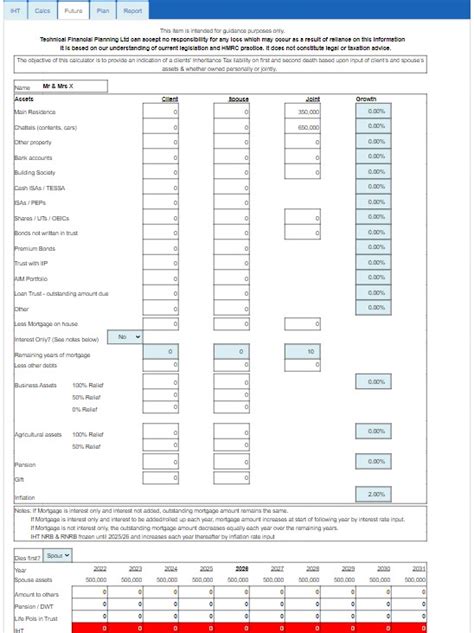

Factors Influencing Inheritance Tax Calculation

The calculation of inheritance tax is influenced by several key factors, each playing a crucial role in determining the final tax liability. Understanding these factors is essential for accurate tax planning and minimizing the tax burden on your estate.

- Value of the Estate: The primary factor in inheritance tax calculation is the value of the estate. This includes all assets owned by the deceased, such as real estate, investments, cash, personal property, and business interests. The higher the value of the estate, the greater the potential tax liability.

- Relationship between the Deceased and Beneficiaries: The relationship between the deceased and the beneficiaries can significantly impact the tax rate applied. Typically, inheritance tax rates are lower for transfers to spouses or civil partners and immediate family members, such as children or grandchildren. Transfers to distant relatives or unrelated individuals may face higher tax rates.

- Applicable Tax Rates: Inheritance tax rates vary depending on the jurisdiction and the value of the estate. In some countries, there are progressive tax rates, where the tax rate increases as the estate value rises. Other jurisdictions may have flat tax rates or exemptions for certain thresholds. Understanding the applicable tax rates is crucial for accurate tax planning.

- Deductions and Exemptions: Various deductions and exemptions can reduce the taxable value of an estate. These may include funeral expenses, outstanding debts, charitable donations, and specific allowances for certain assets. By maximizing deductions and exemptions, individuals can minimize their inheritance tax liability.

Let's consider an example to illustrate the impact of these factors on inheritance tax calculation. Imagine a scenario where an individual, John, passes away leaving behind an estate valued at $2 million. John is survived by his spouse, Mary, and they have two adult children, Sarah and David. In this case, the applicable factors would be as follows:

- Value of the Estate: $2 million

- Relationship between Deceased and Beneficiaries: Spouse (Mary), Children (Sarah and David)

- Applicable Tax Rates: Progressive tax rate structure with thresholds of $1 million and $2 million

- Deductions and Exemptions: Funeral expenses ($20,000), Outstanding debts ($50,000), and Charitable donation ($100,000)

By applying these factors and considering the applicable tax rates, we can estimate the inheritance tax liability for John's estate. This example highlights the importance of understanding the specific tax laws and regulations in your jurisdiction to ensure accurate tax planning.

Maximizing Exemptions and Deductions

One of the key strategies in minimizing inheritance tax liability is maximizing the use of exemptions and deductions. These provisions allow individuals to reduce the taxable value of their estate, resulting in lower tax obligations. In this section, we will explore the various exemptions and deductions available and provide practical tips on how to make the most of these tax-saving opportunities.

Understanding Exemptions

Exemptions are specific provisions in tax laws that allow certain assets or transfers to be excluded from the calculation of inheritance tax. These exemptions can significantly reduce the taxable value of an estate, making them an essential tool in estate planning. Common types of exemptions include:

- Spousal Exemptions: Many jurisdictions provide exemptions for transfers made to a surviving spouse. These exemptions can be substantial, allowing spouses to pass on a significant portion of their estate to each other without incurring inheritance tax. This ensures that the surviving spouse has financial security and can continue to enjoy the benefits of the deceased's assets.

- Charitable Exemptions: Donations made to registered charities or charitable organizations are often exempt from inheritance tax. By making charitable contributions, individuals can not only support causes they care about but also reduce their tax liability. This dual benefit makes charitable exemptions an attractive option for many individuals.

- Business Relief Exemptions: For individuals with business interests, business relief exemptions can provide significant tax savings. These exemptions apply to transfers of business assets, such as shares in a family-owned company, and can reduce the taxable value of the estate. Business relief exemptions are particularly beneficial for entrepreneurs and business owners, allowing them to pass on their businesses to the next generation with reduced tax obligations.

Maximizing Deductions

In addition to exemptions, deductions can also play a crucial role in reducing inheritance tax liability. Deductions are expenses or losses that can be subtracted from the gross estate value, thereby lowering the taxable amount. Here are some key deductions to consider:

- Funeral and Administration Expenses: The costs associated with the funeral, such as burial or cremation expenses, can be deducted from the estate. Additionally, administrative expenses related to the settlement of the estate, such as legal fees and accounting costs, are also deductible. By carefully managing these expenses, individuals can maximize the deductions and reduce their tax burden.

- Outstanding Debts and Liabilities: Any outstanding debts or liabilities owed by the deceased, such as mortgages, loans, or credit card balances, can be deducted from the estate. This includes both secured and unsecured debts. By ensuring that these debts are settled promptly, individuals can effectively reduce the taxable value of their estate.

- Gift Deductions: Transfers made during an individual's lifetime, known as gifts, may be eligible for deductions. Many jurisdictions allow individuals to make annual gift exemptions or utilize gift-splitting provisions to reduce the taxable value of their estate. By strategically planning and utilizing these gift deductions, individuals can minimize the impact of inheritance tax.

Let's continue with our previous example of John's estate. By maximizing the available exemptions and deductions, we can further reduce the taxable value of his estate. Here's how it could look:

- Spousal Exemption: John's estate benefits from a spousal exemption, reducing the taxable value by a substantial amount.

- Charitable Exemption: John made a significant charitable donation of $100,000, which is exempt from inheritance tax.

- Funeral and Administration Expenses: The funeral expenses of $20,000 and administrative costs of $5,000 are deducted from the estate.

- Outstanding Debts: John had an outstanding mortgage of $80,000, which is deducted from the estate value.

- Gift Deductions: John made annual gifts to his children, utilizing the gift exemption, reducing the taxable value further.

By maximizing these exemptions and deductions, John's estate can significantly lower its inheritance tax liability, ensuring that more of his assets are passed on to his loved ones.

Advanced Estate Planning Strategies

While maximizing exemptions and deductions is an essential step in minimizing inheritance tax liability, advanced estate planning strategies can further optimize the transfer of assets to your beneficiaries. These strategies involve a deeper understanding of tax laws, trust structures, and financial planning. In this section, we will explore some advanced techniques to enhance your estate planning and maximize the benefits for your loved ones.

Trusts and Estate Planning

Trusts are powerful tools in estate planning, offering a range of benefits, including asset protection, tax efficiency, and flexibility in the distribution of assets. By establishing a trust, individuals can ensure that their assets are managed and distributed according to their wishes, even after their death. Trusts can be tailored to meet specific goals and provide tax advantages.

One common type of trust used in estate planning is the irrevocable trust. This type of trust is designed to remove assets from the individual's estate, reducing the taxable value. Once assets are transferred to an irrevocable trust, they are no longer owned by the individual, and the trust becomes a separate legal entity. This strategy can be particularly beneficial for individuals with substantial estates, as it allows them to pass on assets to their beneficiaries with reduced tax obligations.

Another trust structure to consider is the life insurance trust. This type of trust is specifically designed to hold life insurance policies. By transferring ownership of the policy to the trust, the proceeds of the policy become part of the trust's assets rather than the individual's estate. This strategy can be effective in minimizing inheritance tax liability, as life insurance proceeds are typically exempt from estate tax. Additionally, life insurance trusts can provide liquidity to the estate, ensuring that beneficiaries receive the benefits promptly.

Asset Transfer Strategies

Efficient asset transfer strategies can further reduce the impact of inheritance tax. By carefully planning the timing and method of asset transfers, individuals can minimize tax obligations and maximize the value received by their beneficiaries.

- Gifting Assets: Making gifts during an individual's lifetime can be an effective strategy to reduce the taxable value of the estate. By utilizing annual gift exemptions or gift-splitting provisions, individuals can transfer assets to their beneficiaries while minimizing tax implications. This strategy is particularly beneficial for individuals with substantial estates, as it allows them to distribute wealth gradually and reduce the overall tax burden.

- Selling Assets: In some cases, selling assets before death can be a viable strategy to minimize inheritance tax. By realizing capital gains during an individual's lifetime, they can utilize applicable tax exemptions or offsets. Additionally, the proceeds from the sale can be used to fund other financial goals or investments, providing flexibility and tax efficiency.

- Asset Titling: The way assets are titled can impact their treatment for inheritance tax purposes. By carefully considering the ownership structure of assets, individuals can optimize their tax position. For example, joint ownership with rights of survivorship can ensure that assets pass directly to the surviving owner, avoiding probate and potentially reducing tax obligations.

Let's apply these advanced estate planning strategies to our ongoing example of John's estate. By utilizing trusts and asset transfer strategies, John can further optimize the distribution of his assets and minimize inheritance tax liability.

- Irrevocable Trust: John establishes an irrevocable trust to hold a significant portion of his assets. This trust ensures that the assets are managed according to his wishes and reduces the taxable value of his estate.

- Life Insurance Trust: John transfers ownership of his life insurance policy to a life insurance trust. This strategy ensures that the proceeds of the policy are exempt from estate tax and provides liquidity to the estate, benefiting his beneficiaries.

- Gifting Assets: John makes annual gifts to his children, utilizing the gift exemption, and gradually transfers wealth to them during his lifetime.

- Asset Titling: John reviews the titling of his assets, ensuring that they are structured to minimize tax obligations. For example, he may consider joint ownership with his spouse for certain assets to avoid probate and ensure a seamless transfer upon his death.

By implementing these advanced estate planning strategies, John can maximize the benefits for his loved ones and ensure that his assets are distributed efficiently and with minimal tax implications.

The Role of Professional Advisors

Navigating the complexities of inheritance tax and estate planning can be challenging, and seeking the guidance of professional advisors is often essential. Financial planners, tax advisors, and legal professionals bring valuable expertise and insights to ensure that your estate planning is comprehensive and aligned with your goals. In this section, we will explore the benefits of working with professional advisors and provide guidance on selecting the right team for your needs.

Benefits of Professional Guidance

Engaging professional advisors can bring numerous benefits to your estate planning process. These experts have in-depth knowledge of tax laws, regulations, and best practices, ensuring that your estate planning strategies are compliant and optimized. They can provide personalized advice tailored to your specific circumstances, taking into account factors such as your financial goals, family dynamics, and tax obligations.

Financial planners, in particular, play a crucial role in helping you understand the impact of inheritance tax on your overall financial plan. They can assist in maximizing exemptions, deductions, and tax-efficient strategies to minimize your tax liability. By working closely with a financial planner, you can ensure that your estate planning aligns with your long-term financial goals and provides the desired outcomes for your beneficiaries.

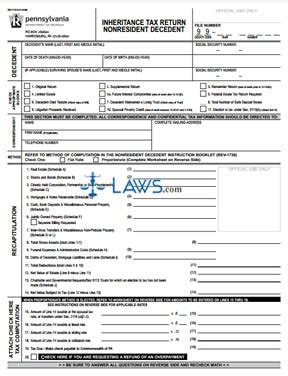

Tax advisors, on the other hand, specialize in tax laws and regulations. They can provide expert guidance on the complex rules surrounding inheritance tax, including the applicable rates, thresholds, and exemptions. Tax advisors can also assist in preparing and filing the necessary tax returns, ensuring accuracy and compliance. Their expertise can help you navigate the intricacies of tax laws and make informed decisions to minimize your tax obligations.

Legal professionals, such as estate planning attorneys, bring a wealth of knowledge in creating legally binding documents and ensuring that your wishes are accurately reflected in your estate plan. They can assist in drafting wills, trusts, and other legal instruments to ensure that your assets are distributed according to your intentions. Legal professionals also play a vital role in resolving any disputes or challenges that may arise during the estate administration process.

Selecting the Right Professional Advisors

When selecting professional advisors for your estate planning needs, it’s essential to choose individuals or firms with expertise in inheritance tax and estate planning. Look for advisors who have a proven track record of success and a strong reputation in the industry. Consider their experience, qualifications, and specialization in tax and estate planning matters.

It's beneficial to seek advisors who have a holistic approach to your financial planning. They should understand your overall financial situation, including your assets, liabilities, income, and goals. This comprehensive understanding allows them to provide tailored advice and ensure that your estate planning aligns with your financial strategy.

Additionally, consider the communication style and accessibility of the advisors. You want professionals who are responsive, approachable, and willing to answer your questions and address your concerns. Building a strong relationship with your advisors is crucial for effective collaboration and ensuring that your estate planning is well-aligned with your wishes.

In our ongoing example, John recognizes the value of professional guidance and seeks the expertise of a financial planner, a tax advisor, and an estate planning attorney. By working with these professionals, John can ensure that his estate planning is comprehensive, compliant, and optimized to achieve his goals. The advisors provide personalized advice, assist in maximizing tax-efficient strategies, and ensure that John's wishes are accurately reflected in his estate plan.

Conclusion: Empowering Your Estate Planning Journey

Inheritance tax is a complex but critical aspect of financial planning. By understanding the fundamentals, maximizing exemptions and deductions, employing advanced estate planning strategies, and seeking professional guidance, you can navigate the inheritance tax landscape with confidence. This comprehensive guide has provided you with the knowledge and tools to make informed decisions and